Co-authored by Treading Softly

It’s not an infrequent question for me to be asked where I see the prime opportunities for investment today. Having been a presence on Seeking Alpha for nearly a decade, as well as operating the largest investment group on Seeking Alpha, it’s not uncommon that I get daily direct messages seeking free advice.

Today, I want to take a moment and answer one of the direct questions that I get often – where would I invest if I had $1,000,000 in cash to invest today? When it comes to deciding where you want to invest, one of the key questions you must ask is, what is your goal for investing? If you’re a growth investor, my thoughts on where to invest $1,000,000 may not be applicable to you simply because I invest through the perspective or the lens of an income investor. I have been operating my unique Income Method for decades, leveraging massive amounts of income from the market into my account month after month, quarter after quarter. This allows me to be a net buyer of the market in almost any environment. With a million dollars, I could generate $90,000 to $100,000 annually from just the holdings that are in my personal portfolio. The question is not what’s in my portfolio now, but where would I start focusing my investing dollars if I had $1,000,000 to invest in the market at this moment.

Key Considerations – 42 and 25

Before jumping into the specific sectors or areas that I would start pouring this money into, I first have two key considerations that I want to remind my readers about. I have a strong set of rules within my portfolio that guide everything that I do. These are the rules that are foundational to my Income Method as it is a guiding philosophy as well as a perspective on investing and on life itself.

One of those rules is the Rule of 42. I aim to have at least 42 unique or different investments in my portfolio. To touch on a common question I received, I consider an ETF or a CEF to be a single position because even though it holds many other possibly commonly traded equities, it’s under the management of one manager. The same as I consider a BDC that has a portfolio of hundreds of loans to only be a single position and not 100 different fixed income positions; my Rule of 42 simply allows that if one of the holdings in my portfolio fails, it does not cause my entire portfolio to collapse.

The second key rule that I have in my portfolio is the Rule of 25. I aim to reinvest at least 25%, at a minimum, of all dividends received into my portfolio back into that portfolio to create organic growth simply from the income coming in. This is extremely important, especially if you’re investing in fixed-income investments that pay a fixed rate as they will never rise on its own. You have to then create your own income or dividend growth through reinvestment.

With these two key thoughts in mind, let’s dive into the two sectors that I would be pouring my million dollars into today.

Fixed Rate Fixed Income

For a couple of years, prior to the rapid rate hikes that we saw in the last few years, I was strongly encouraging income investors to start investing in floating rate or rate reset preferred securities. The reason that we were doing this was because I knew that interest rates could not stay low forever and that they were going to rise rapidly. I wanted holdings that were trading at a discount to par because people were living in the present instead of thinking about the future. I was able to buy multiple different preferred securities that are now going to reset to exceptionally high yields, and we are now also sitting on large capital gains because of the rise of interest rates. With this in mind, you must understand that now we are likely at a peak point in interest rates. There isn’t much higher that the Federal Reserve is likely to raise them. So now the horizon is not one of higher interest rates but one where interest rates are going to be forced to be cut. Because you’re now in the inverse of the prior situation, if you are taking money to invest in the market, I would not tell you to focus on floating rate for securities; I would instead be buying up trading at a heavy discount, fixed rate, preferred securities, or other fixed-income investments like baby bonds and bonds.

If we look at regional banking preferreds or other financial sector preferreds that have a par yield within the 3% to 4% range, we can see that they are trading at massive double-digit discounts to their par value. They’re yielding 6-7% all the way down here, which means that once rates start being cut, they will start moving upwards in value rapidly, all while you’ve locked in this higher yield for a long time due to the fact that it is unlikely to be called. As an income investor, I want to lock in sustainable, reliable income, and preferred securities that do not cost the bank or other financial sector company large amounts of money to pay are also the ones that are less likely to be called. Consider the few hand-selected preferred securities below that are trading at a sharp discount and a decently high yield.

Regions Financial Corp., Series E, 4.45% Dep Shares Non-Cumulative Preferred Stock (RF.PR.E) – yield 7.2%

Bank OZK, Series A, 4.625% Non-Cumulative Perpetual Preferred Stock (OZKAP) – yield 7.9%

Bank of America Corp., Series PP, 4.125% Depositary Shares Non-Cumulative Preferred Stock (BAC.PR.P) – yield 6.5%

Utilities

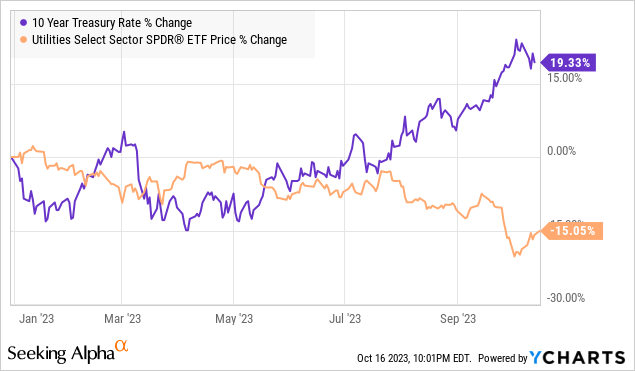

This pick is likely not one that’s going to be popular. The utility sector has had a terrible 2023, with it being down over 20% year-to-date. To understand what’s driving utilities, which are historically considered to be extremely safe and stable investments for both income and capital gains, to be down over 20% year-to-date, you need to understand its direct relationship with Treasury rates. Below, you will see a chart that compares the 10-year Treasury rate with the utility sector percent of change.

The utility sector will move in an inverse relationship historically with the 10-year Treasury rate. It’s not a one-for-one movement as there can be delays – the market is not efficient. What this means though is that as treasury rates float higher, utilities become less attractive. Why would you buy a 3 to 5% yielding utility when you can lock in a 5% rate for ten years at risk-free? For most of us, you wouldn’t.

However, as an ardent believer in “buying low and selling high,” I am happy to buy things when they are not in their cyclical prime. Utilities at this point are heavily beaten down and continue to be beaten down. Their premiums are getting smaller, and there is a chance that if the 10-year rate moves higher, they will fall even further, but I also know that I invested not just for a one to two-year perspective and that interest rates just like those mentioned above, are not going to stay elevated forever. As interest rates start being cut, the 10-year rate will fall, and as it falls, Utilities will recover. I will be sitting, not only on higher yields than others when they come flooding back to the sector but also on strong capital gains that I can then lock in if I sell and move to a new opportunity. You might notice between both of these recommendations that I am looking forward years into the future and buying what is going to be popular then instead of what is going to be popular now. This is because I have a multi-decade perspective – to buy things that are yielding higher than normal to lock in that income for the long run, but also to give me the opportunity to recycle my capital effectively and to continue to see my income grow.

Below are a few utilities that I currently find attractive and considered oversold and am willing to buy, even if their yields are below my typical target of 6%.

NextEra Energy Partners (NEP) – yield 15%

NextEra Energy (NEE) – Yield 3.4%

Duke Energy (DUK) – yield 4.6%

ATCO Ltd. (OTCPK:ACLLF) – yield 5.4%

Conclusion

Today, we reviewed where I would be investing $1,000,000 if I had that in cash. There are many different ways that we end up being able to generate cash to invest, whether selling a business, getting an inheritance, getting a bonus from work, or tax return. But for me and so many other income investors, we continually have cash to invest in the market because the market continually pays us for participating. I don’t need to sell holdings to raise cash. I don’t need to sell options to raise cash. I just need to stand still, and the market will pay me over and over again. What I don’t need to live on or pay my bills, I can reinvest in the market to unlock even more income for the future.

So, where would you invest $1,000,000 if you had it? I’ve told you where I would be focusing on. Why don’t you share where you might be focusing on? If your portfolio isn’t providing you with cash to be able to reinvest on a daily or monthly basis. Perhaps you need to change your focus and perspective.

When it comes to retirement, you’re not going to have your business’s check in the mail every two weeks as an employee or owner. You’re going to need to find a replacement for that. I strongly encourage you to consider the fact that selling off your investments or dwindling your life savings is not a long-term, sustainable method unless you have a massive stockpile or plan to take a massive cut to your lifestyle. Instead, let the market pay you and pay your way so that way you can spend your days just enjoying your hobbies or spending it with loved ones.

That’s the beauty of my Income Method. That’s the beauty of income investing.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply