Investment Thesis

I wanted to take a look at Honeywell’s (NASDAQ:HON) financials to see how it has been doing over the years and to see whether the long-term trend warrants an investment. The underwhelming growth in revenues and EPS makes the company slightly overpriced right now and is not a good time to buy some shares, as risk/reward is not enticing at these prices, therefore, I give it a hold rating until we see better growth in EPS or revenue growth picks up substantially.

Outlook

As you will see in the next section, the revenue growth isn’t particularly great for HON. Most of the segments saw positive results in the latest quarter, however, the Safety and Productivity Solutions saw a whopping 17% decline in sales, which brought down the company’s growth to around 4% in the 6 months ended June ’23.

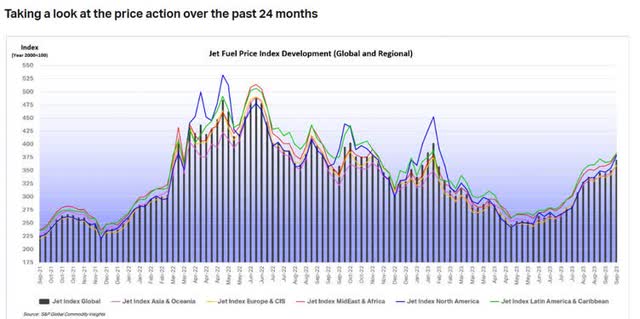

The aerospace segment saw very good results, going up over 14% y/y and this segment to me seems to be the most promising. Travel hours have been great since the lockdowns have been lifted and the demand for air travel has certainly increased. This is very positive for the company as over 35% of its revenues come from the aerospace industry. What I don’t like to see is the demand come back down in the near future as jet fuel prices are coming back up, which may lead to an increase in fare prices and a decrease in air travel. Jet fuel prices seemed to have bottomed out in May ’23 and are back on the rise again. In the next quarter report, I will be eager to see what the outlook for the segment looks like going into ’24.

Jet fuel Prices on the rise (IATA)

Of course, it will also depend on how elastic air travel demand is to an increase in prices in the short run. Usually, consumers are very price elastic, meaning a small change in prices will lead to a larger drop in demand, however, I believe that after such a long break from flying because of the pandemic, the consumers became slightly less picky about the prices available and will be booking their trips. However, it has been quite a bit of time since the lockdowns ended, and such a rapid increase in jet fuel prices may lead to the demand for air travel subsiding until it all stabilizes once again.

Financials

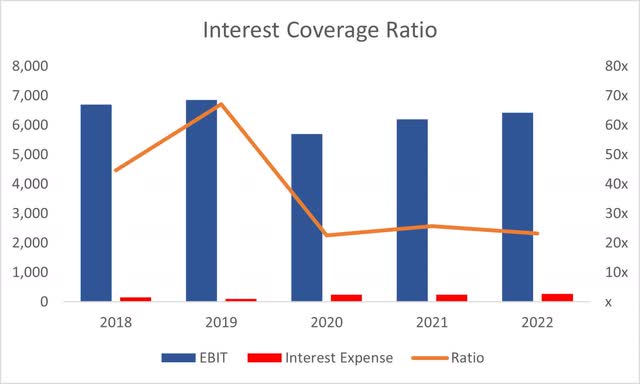

As of Q2 23, the company had $8.7B in liquidity, against $17.6B in long-term debt. That is not a bad position to be in, I believe. The interest expense on debt is easily managed by the company. The interest coverage ratio has been around 23x as of FY22, meaning EBIT can cover the interest expense 23 times over. I am usually looking for companies that can cover the interest 5 times over, while many analysts suggest 2x is plenty already, so it is safe to say the company is at no risk of insolvency any time soon. With an average of over $6B in cash from operations, the company can easily take on more debt if it wants to complement its operations and do some more expansion.

Coverage Ratio (Author)

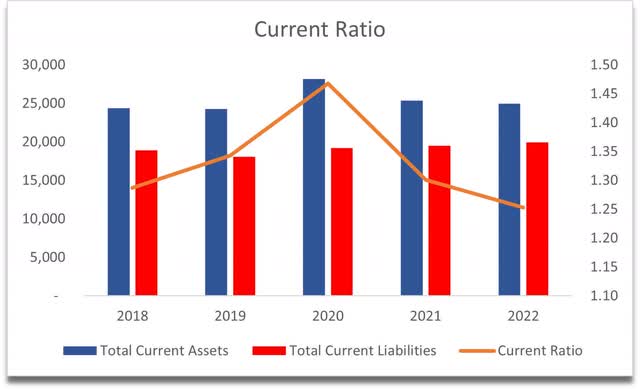

Honeywell’s current ratio has been relatively stable at over 1.3 for many years now. This is decent; however, I would like to see 1.5-2.0, but as long as the company’s able to pay off its short-term obligations, the company has no liquidity issues.

Current Ratio (Author)

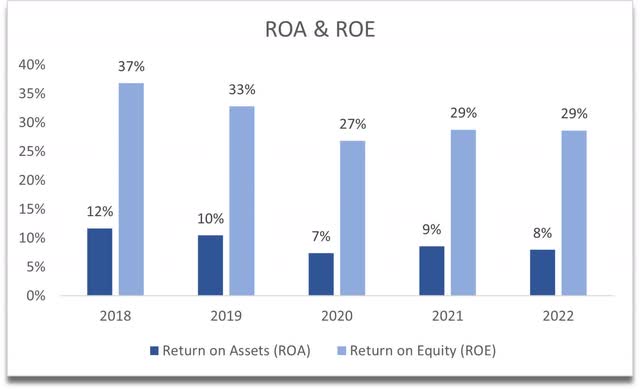

The company’s ROA and ROE are decent also. ROA has been above my minimum of 5% and ROE above 10% for a while now. This tells me that the company is efficient at utilizing its assets and shareholder capital.

ROA and ROE (Author)

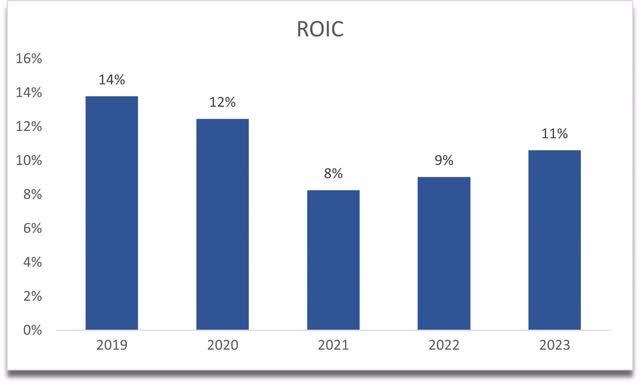

The company’s return on invested capital has also been quite decent over the years and above my minimum of 10%, which tells me that the company has a competitive advantage and a moat in the industry. A couple of years ago, the ROIC was better, so I would like to see it starting to come back up to those numbers in the future.

ROIC (Author)

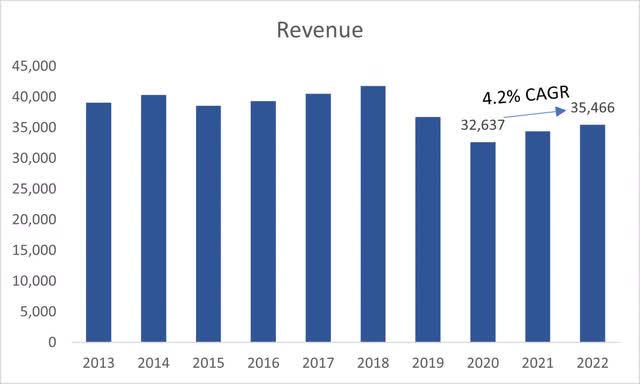

In terms of revenue, I am quite disappointed overall, as over the last decade, the company managed to lose around 1% per year, while showing a little growth of around 4.2% per year in the last 3 years. Can we trust the growth is going to remain going forward? Analysts think that it will remain at around that rate for the next 3 years at least. This lack of growth is going to be my anchor for revenue assumptions, as I am not expecting any catalysts that will propel growth to new levels.

Revenue Growth (Author)

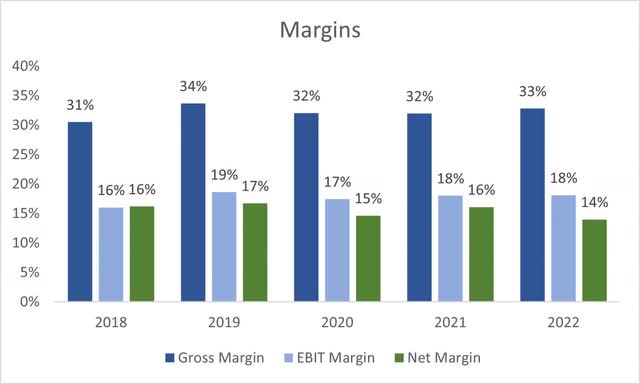

So, if the company has no revenue growth, another way a company can improve its position is through improvements in margins. Honeywell seems to have kept their margins relatively stable, which turned out to be lower net margins overall in the latest financial year and that is not good in my opinion. I would like to see some cost-cutting measures implemented to combat the slow revenue growth in the future.

Margins (Author)

Overall, nothing too impressive, which is not surprising given the company’s size and age. It is chugging along just fine, with some sort of competitive advantage in place and a moat. I would like to see improvements in margins going forward if the company isn’t able to grow its revenues at a decent rate because the growth in earnings seems to be relatively low, which I don’t think warrants the company’s FW PE ratio of 21 according to analysts and my analysis.

Valuation

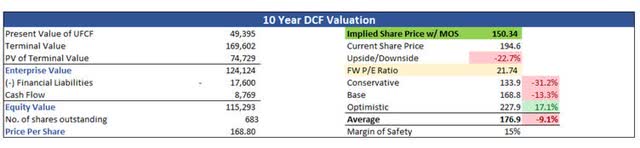

I’m not going to be too optimistic about the company’s revenue prospects, however, I am going to make them positive for the base case, because in recent years it has picked up. So, for my base case, I went with a 3.5% CAGR for the next decade. For my optimistic case, I went with a 5.5% CAGR, while for the conservative case, I went with a 1.5% CAGR for the next 10 years to round out the possible outcomes.

In terms of margins, I went with around 700bps or 7% improvement in gross margins over the next decade, which is around 40bps of margin improvement per year from FY25 onward. For operating margins, I went with around 9bps of improvement per year until FY32. These changes in efficiency will lead to net margins going from around 14% in FY22 to around 21% by FY32, which seems reasonable to me, while EPS will grow at a steady 6% per year, which is slightly on the conservative side because analysts are assuming a much higher EPS growth for the next couple of years, but it’s subjective as these estimates tend to change with more information available from the company, so I will rather be on the safer side.

On top of these estimates, I decided to add a 15% margin of safety as I believe this is more than enough. The company isn’t very volatile as the company’s beta is around 1. With that said, Honeywell’s intrinsic value is $155 a share, implying that the company is currently trading around 22% premium to its fair value in my opinion and therefore it’s not a good idea to start a position right now.

Intrinsic Value (Author)

Closing Comments

With an FW PE ratio of around 22 according to my estimates, the company is slightly overpriced in my opinion. Risk/reward is not very enticing at this price level, and I would like to see a pullback, which may be a lot to ask considering I’m looking for a 22% decline, however, it can happen if we see some more economic uncertainties that will bring in a lot of volatility back in the markets. If it doesn’t come back to the PT, I would be looking for the company’s ability to increase its EPS growth considerably, which would improve its valuation further and will change my PT in the long run if that happens.

As of right now, the company’s slow revenue and EPS growth are not very enticing, and for me to take on a position in the company, I would like it to be at a much lower price than what it is trading at right now as I don’t find this valuation cheap. A Forward PE ratio of 17 would be where I would be looking to start a position, but the company hasn’t seen that sort of valuation since around July ’20.

It is a great company overall, but I’m sure I’ll find something that is at my risk/reward profile, with better growth potential.

Read the full article here

Leave a Reply