Dear readers,

Few companies are as storied, as qualitative, or as interesting as LVMH (OTCPK:LVMUY). In an environment like this, we need to be careful about every premium we accept for a company. However, I believe I am not alone when I say that LVMH is one company that I have no issue premiumizing to some degree.

LVMH is Moet Hennessy Louis Vuitton SE – and it was one of the very first companies I covered for iREIT® on Alpha when I became a contributor. I bought a significant stake at an average cost basis of below €600/share, that’s for the native French MC ticker in Paris. The company then obviously went up significantly – my RoR at one time was almost 70% in less than a year. I could have sold – but I don’t sell quality stocks like that easily, and the company never climbed above €900/share in a significant way.

Instead, and surprisingly, we’ve seen the company drop down to almost below €700/share, which is when it becomes interesting for me.

Why?

Let me show you.

Louis Vuitton – World-leading luxury with double-digit EPS growth

This is an international conglomerate specializing in luxury goods.

LVMH in its current operational specifics is younger than I am (and many readers here) – founded, or merged in 1987. The brands it represents, however, are many of them older than the United States of America if we go by the Declaration of Independence in 1776. We’re talking about brands like Moët, like Les Clos Des Lambrays, which come at staggering 300-700 year histories for some of the vineyards and brands that the company holds.

The idea to form a conglomerate with a focus on luxury goods was one by French multi-billionaire, art collector, investor, and businessman Bernard Jean Étienne Arnault, the richest person in Europe and the Chairman and CEO of LVMH.

The company represents a staggering amount of popular brands, and here are some of the more prominent ones.

- Christian Dior

- Louis Vuitton

- Fendi

- Marc Jacobs

- Kenzo

- TAG Heuer

- Bulgari

- Dom Perignon

- Zenith

- Sephora

These are called “maisons” by the way, if you want to be nitpicky. Fundamentals for this company are beyond rock-solid.

What makes me say this?

AA-credit for one. Very few companies manage this. The yield is only 1.77% here as I am writing the article, but it’s still a good yield for what the company offers, even in this environment.

The sponsored ADR of the company which we’ll look at here, LVMUY, represents 0.2X of one ordinary share – so keep that in mind.

I would, however, as always, give you the option that you should look into the native listing, which is the Parisian MC-ticker.

This is one of the very few companies where I pretty much just “add more”. This is not just about myself being a consumer/user of many of the company’s Maisons, it has to do with the position and status these brands have. 196,000 employees and 5,664 stores make this company a great business, and the company manages annual revenues of almost €80B with an operating margin of 26.6%, one of the best in the entire business and sector.

In fact, so much of the company is “the best in the business”, that I am choosing to share a snapshot here.

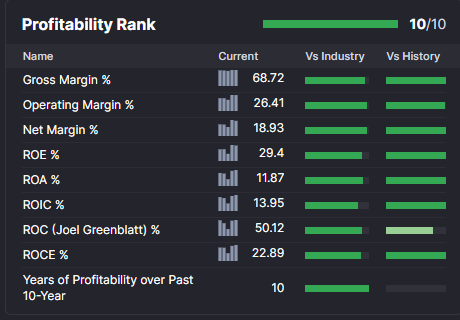

GuruFocus, LVMH Profitability (GuruFocus)

The green represents the degree of outperformance relative to the deciles in its sector. In this case, dark green represents the company being in the 90th+ percentile in the said variable. As you can see, not only does LVMH outperform the sector, the degree of outperformance is increasing.

Why is this?

Scale and maison strength.

LVMH has one of the world’s best business models in the retail industry. What I am talking about here is less than 32% COGS and less than 42% operating expenses, leading to that 17%+ net margin that you see above. It’s an absolutely insane margin when you compare it to any other company in clothing, jewelry, or other ancillary sectors.

This is what LVMH does. It premiumizes luxury – and people are willing to pay that premium.

Just how has this played out during 1H23?

17% revenue growth, which on a run-rate basis puts the company above €80B for the year, 13% profit increase with an operating margin of above 27%, almost €2B of FCF, and a gearing level of less than 22%.

Everything grew by double digits except wines/spirits and not a single segment is down significantly.

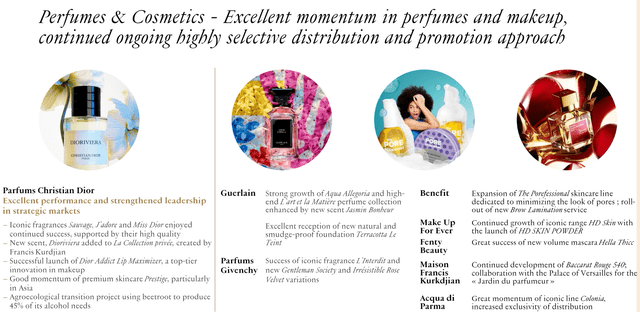

We’re talking double-digit growth in leather, jewelry, champagne, fashion, watches, perfume, makeup, and in Sephora. We’re talking about strong European and Asian business trends. The issue for Wines/Spirits specifically was due to a weak demand in the USA for cognacs and spirits, as well as recovery in China. Inventories were high in early 2023, and COVID-19 recovery was not yet finished.

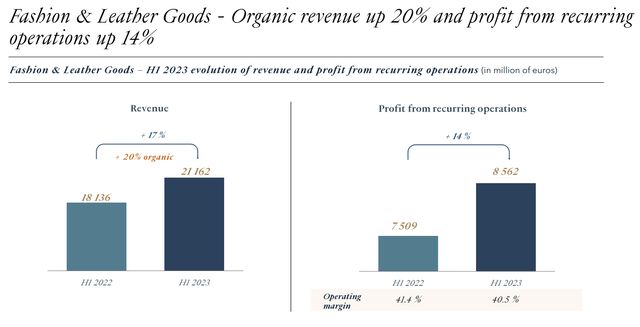

Fashion and leather goods were the stars of the show, as it typically tends to be, being the major sales driver here.

LVMH IR (LVMH IR)

But the performance this year was even better than we usually expect from the company in these segments. Christian Dior especially, saw remarkable growth in all product categories. The company’s perfume segment, however, also saw remarkable growth here.

LVMH IR (LVMH IR)

Overall, the company’s operations are growing very strongly in all key areas both geographically and in terms of operations. I already wrote the following in one of my previous articles on LVMH.

Once China normalization comes more into play, it’s likely we’ll see further advance and improvements both to the top and the bottom line, and it’s hard to argue with trends like these, with profit from recurring operations over €21B, up 23% on a YoY full-year basis.

(Source: LVMH article, January 2023)

And those normalization trends have now come into full play. Despite a significant downturn here for LVMH in a relatively short period of time, I am still up significantly as things stand, and continue to view the company as a superb investment – even better now than in my previous article.

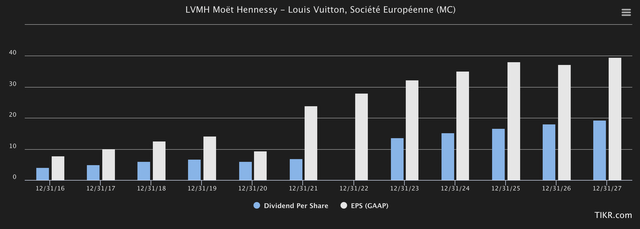

Here, if you need a reminder, are the estimates for where the company is likely to go in terms of earnings and overall upside.

LVMH Estimates (TIKR.com)

This would imply a 2027E yield of well over 2%, with my own YoC fairly close to 2.8% – which for this company is insane. To be clear, LVMH isn’t an income investment. It’s dividend won’t make you rich. That is not the point of this investment. But you could easily, over time, double your money in a relatively short period of time if this growth and these valuation levels persist.

The risks for the company remain as they have been previously – commoditization of its products, which is something LVMH needs to avoid. The entire idea of the brand is that it’s an exclusive product that most people do not have access to easily, but rather work their way up to.

If the company starts undermining this to increase revenue, we may see a similar decline in premiumization as we’ve seen in brands like Maserati (through cars), and to some extent, I’d argue Jaguar and Lamborghini (though the latter isn’t that bad yet and is still a premium brand).

With that, I’m going to show you what I view as the likely and justified valuation for the company here.

LVMH – Valuation calls for a significant upside

In my previous article on LVMH, I specified a share price target of €800/share. As of this article, I’m not moving from this target and continue to view it as a valid one.

LVMH is a very strongly-growing business, with an average growth rate of over 17% on average for the past 5 and future 3 years included. 2023E is expected at 17% growth, followed by high-single-digit growth for the next few years after.

The company does require you to consider it at a premium. But my PT of €800/share is fairly short-term. If this growth materializes, then €800/share is less than 21.2x P/E, and the company is currently at 22.3x, with a typical premium at around 27x P/E. Long-term, I’d say around €900/share if this earnings growth materializes, but for now I forecast the company at around 24-25x P/E.

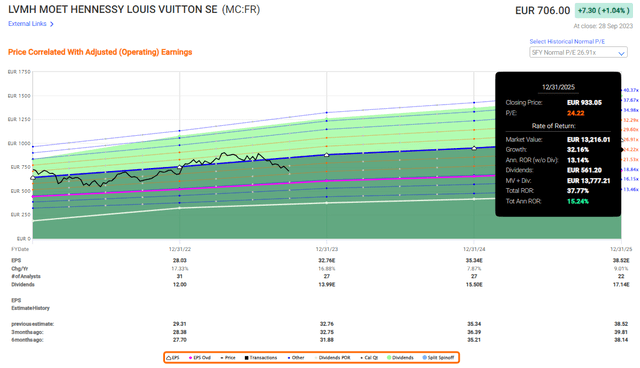

That 24-25x P/E typically gives us double-digit or high single-digit RoR annualized. Thanks to the recent drop in share price, we now have annualized RoR of 15.24% per year at 24.2x, to 37% in 3 years for this company.

This may not impress many of you, but it needs to be taken in context of what you usually get, and where this company tends to trade.

F.A.S.T Graphs MC upside (F.A.S.T Graphs)

While this may not be the most exciting and rich-making idea out there, I’m a firm believer in the strategy of diversification. Diversification into the world’s best luxury company at a double-digit, market-beating upside, is something I can live with even if it doesn’t come at market-beating sort of yields.

Analyst targets for this specific company? They’re fairly generous, much like my own targets. 26 analysts follow the company – over 20 of them are at “BUY” or equivalent here. They consider the company a “BUY” with a range from €640 on the low side to €1,020 on the high side with an average of €906.

This is one of the only companies where I accept a massive premium, but it’s one where I with very high confidence would accept and purchase the company at this sort of valuation, or even slightly above. At anything below €800/share, this company becomes buyable. That’s why I recently added a small position of shares both in my commercial and my private portfolio.

So, this is more of an update on a long-term thesis on this above-quality company – and I will clearly state to you that I view this as a good investment at this time. I hope it drops more. I hope we see levels below €600/share, but I doubt that we will easily see this. The way that I invest is that I release “portions” of cash at certain levels, and with this company, I’ve now allocated a full “portion” (around 0.1% of my cash) in investing at this valuation. However, I retain at this time over 14.9% of my portfolio in cash.

Here is my thesis for the company.

Thesis

-

LVMH is the best luxury investment potential on earth, at the right price. The company’s mix of segments, maisons, ownership, and potential for growth is unrivaled across its peers, and I view it with great confidence, which is why it’s my largest luxury position, despite the fact that I don’t much invest in consumer discretionary otherwise.

-

The company has been on a good ride, returning over 35% in 2022 if bought at overall appealing prices, and also bumped the dividend. I expect more good results and more dividend bumps coming in the next few years.

-

Despite the company essentially at my share price target of €800/share, I still consider LVMH a “BUY” until it goes clearly above here, with a conservative RoR potential of 9-10% annually until 2025E.

Remember, I’m all about:

-

Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

-

If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

-

If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

-

I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

-

This company is overall qualitative.

-

This company is fundamentally safe/conservative & well-run.

-

This company pays a well-covered dividend.

-

This company is currently cheap.

-

This company has a realistic upside that is high enough, based on earnings growth or multiple expansion/reversion.

The only issue is that LVMH is not cheap – other than that, it’s a rock-solid investment here.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply