We are very bullish on gold (GLD)(IAU) right now and – based on history – believe it could be set to triple over the next several years. Here are three reasons why we think gold is likely headed higher:

#1. Very Aggressive Central Bank Buying

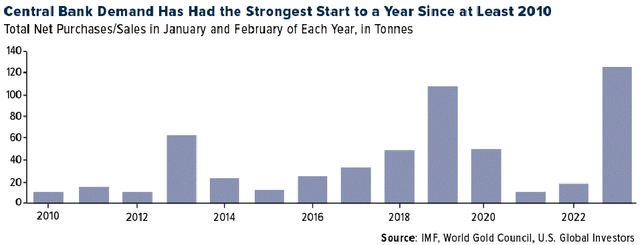

One of the biggest reasons why we are bullish on gold right now is because central banks across the world have engaged in an aggressive gold-buying spree in recent years. In fact, in 2023 they have been acquiring gold at the fastest pace on record since they became net buyers in 2010. In the first two months of the year alone, central banks collectively have purchased a whopping net 125 tonnes of gold, led by significant purchases from the central banks in Singapore, Turkey, China, Russia, and India.

Forbes.com

This surge in gold demand reflects broader economic trends, including the rise of the BRICS nations (Brazil, Russia, India, China, and South Africa) and their increased economic weight relative to the G7 countries. Central banks in these countries are diversifying their reserves away from the U.S. dollar and towards gold to support their currencies and move towards a potential alternative global payments system. This all bodes well for gold prices moving forward given that it means that incremental demand for Dollars is declining while incremental demand for gold is increasing.

#2. Major Geopolitical & Macroeconomic Tailwinds

Another big reason why we think the risk-reward outlook for gold is very favorable right now is due to the fact that geopolitical tensions and risks are soaring right now. Current and potential future conflicts in Eastern Europe, the Middle East, and the Far East are all simmering right now. In particular, the potential for conflict in the Korean Peninsula, the Taiwan Straits, and a war between Iran and Israel remains elevated. In particular, a crisis around Taiwan embroiling the United States and China as well as a potential escalation of the ongoing war in Ukraine that could involve NATO going to war with Russia should concern everyone. Should such a war break out, gold appears highly likely to benefit given its proven status as a safe haven.

#3. The Federal Reserve Is Likely Finished Raising Interest Rates

The biggest reason why we are bullish on gold prices right now is that the Federal Reserve is likely done raising interest rates, with the consensus among economists being that the federal funds rate will remain steady through most of the first half of the next year. With the current rate set at an elevated level of 5.25%-5.50%, the Fed has signaled that it is going to be careful about any further increases moving forward. Moreover, financial conditions have also loosened a little bit given the recent pullback in Treasury yields leading to the belief that the aggressive tightening cycle has ended.

While no immediate rate cuts are expected, the majority of economists predict one by the middle of 2024. Moreover, economic growth is forecasted to slow and unemployment may rise modestly, which should further incentivize interest rate cuts by the Federal Reserve moving forward.

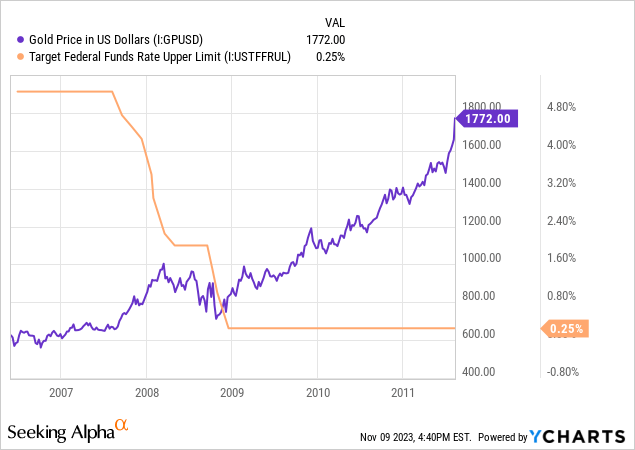

The reason why this is such a bullish indicator for gold prices is that they have historically soared after the Federal Reserve finished hiking interest rates. This pattern suggests that gold becomes a more enticing investment post-rate hikes as investors seek stability and hedge against the economic uncertainty brought on by the rapid rise in interest rates as well as the fact that interest rates often get cut to levels that fall below the Fed’s long-term inflation target, thereby resulting in negative real interest rates.

As a result, we believe that the gold price has a very bullish set-up right now. Here is the epic gold bull market from 2006-2011, where it increased by ~3x:

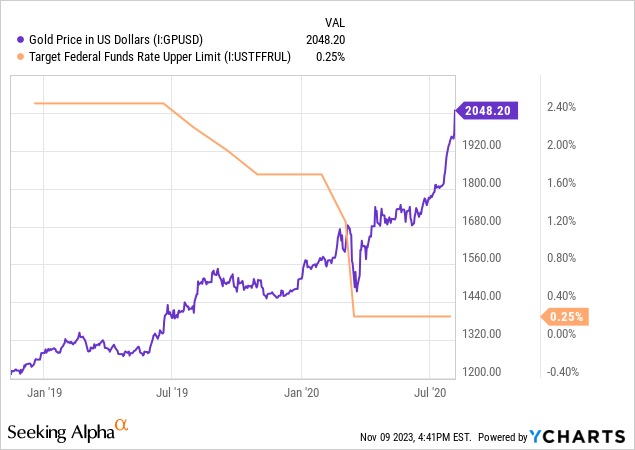

Here is the next epic gold bull market from 2018-2020 where gold prices increased by ~60%:

If history is any guide, gold is likely on the cusp of another major breakout higher, which – if it reaches the same levels as it did earlier this century – could result in a tripling of the price of gold in a matter of a few years.

Investor Takeaway

The combination of aggressive central bank gold purchases, intensifying global geopolitical and macroeconomic headwinds, and the Federal Reserve’s potential completion of its rate hiking cycle and an impending pivot towards interest rate cuts provides a compelling case for a new gold bull market and a massive increase in the price of gold.

Given these tailwinds, we are buying gold hand-over-fist right now in the form of investing in miners (GDX) such as Barrick Gold (GOLD) and Newmont Corp (NEM), selling put options via the highly liquid ETF GLD, and investing directly in physical gold bullion through a variety of products. Overall, we believe that the yellow metal may be the best risk-adjusted buy in the current environment.

Read the full article here

Leave a Reply