Investment Thesis

HireQuest Inc. (NASDAQ:HQI) has recently dropped on the earnings report and hasn’t recovered since. I wanted to take a look at its financial health to see if this has created an opportunity to jump in. The financial health is very strong in my opinion; however, the acquisition of MRI came with very sticky costs, which may persist for a little while longer, coupled with subpar revenue growth, I believe the volatility in the share price is going to continue and we will see further drops. I rate the company a hold until we get a more stabilized expense outlook.

Briefly on the Company

HireQuest is a staffing company that specializes in temporary staffing services for skilled and semi-skilled construction and industrial personnel. The company also provides some permanent staffing services and specializes in commercial and noncommercial driver license -drivers. The company is active in recycling, warehousing, logistics, hospitality, and retail industries.

The company has 2 reportable segments, one of which makes up over 95% of revenues, which is franchise royalties, and the other is service revenue.

Outlook

The company saw a huge share price decline since the latest quarterly report, which missed EPS by $0.12 and a slight miss on revenues. The decline can be attributed to the ballooning of expenses from the acquisition of certain assets of MRI Network. SG&A was $5.6m, which was an increase of 74.5% from the same period last year. The expenses seem to be very sticky, and it will take a long time for them to stabilize, which will weigh on the company’s earnings for a little while longer. I am not sure how much longer, but I wouldn’t be surprised if these costs persist into the next year.

I also believe that the Fed is going to keep interest rates higher for longer or even raise a little more given what we have been seeing from the economy in the recent weeks. There are recent scares of inflation coming back up again which may mean the Fed will raise interest rates once more. The Fed held out from raising interest rates in July, and it looks like they won’t raise them in August, however, with the economy still adding 150k new jobs per month, which exceeds the number of workers entering the labor force, the economy seems to be going hot still.

On top of this, the management is seeing softness in their temporary staffing services and does not see a recovery until at least the end of the year, which is also just speculation and will depend on what the Fed is going to do going forward and how the economy develops in the next 3-6 months. I’m not very hopeful here that everything’s going to start to improve.

Financials

All graphs in this section will be as of FY22 because q/q numbers tend to fluctuate more and do not show the full picture of where the company is heading due to the seasonality of the business.

As of Q2 ’23, HireQuest had around $2m in cash against zero long-term debt and $16m in short-term credit facility loans, which isn’t a problem in my opinion. Debt helps the company finance its operations and facilitate growth through further acquisitions, as long as the interest expenses are manageable. In the case of HQI, I believe it is manageable. So far, the company’s interest expense has been around $854k while EBIT stood at around $6m, which means that the interest coverage ratio is 7x, meaning EBIT can cover interest expenses 7 times over.

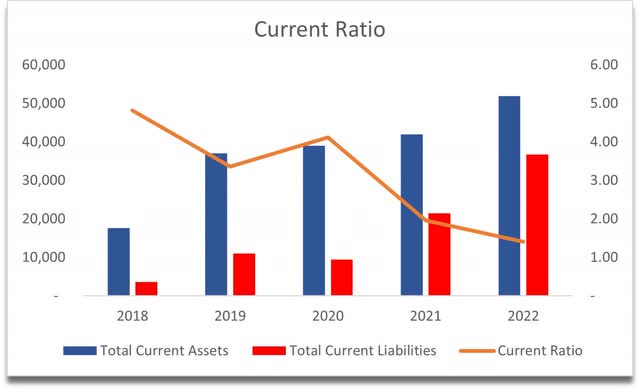

HQI’s historical current ratio has been very high and has dropped to a more efficient ratio of around 1.4 by the end of FY22 and Q2 ’23. This tells me that it is being efficient with its assets and still able to pay off its short-term obligations. The company has no liquidity issues. One concern would be if the ratio kept dropping as we have been seeing quite a downtrend in the last 5 years. I would like it to stabilize around these levels.

Current Ratio (Author)

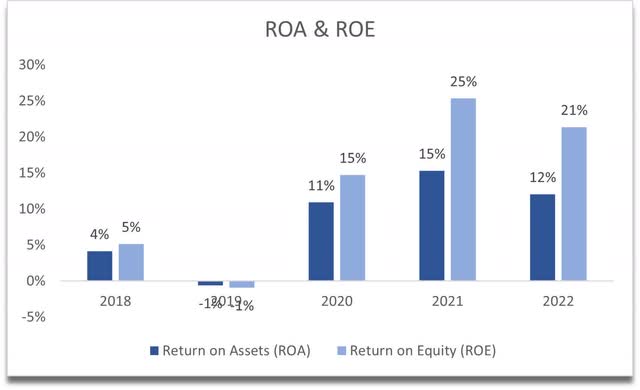

In terms of efficiency and profitability, ROA and ROE have been outstanding in the last few years, which are well above my minimums of 5% for ROA and 10% for ROE. A slight dip in FY22, and I’m also expecting further dips in FY23. After that, I would expect a rebound in FY24. What these metrics tell me is that the management is very efficient with the company’s assets and shareholder capital.

ROA and ROE (Author)

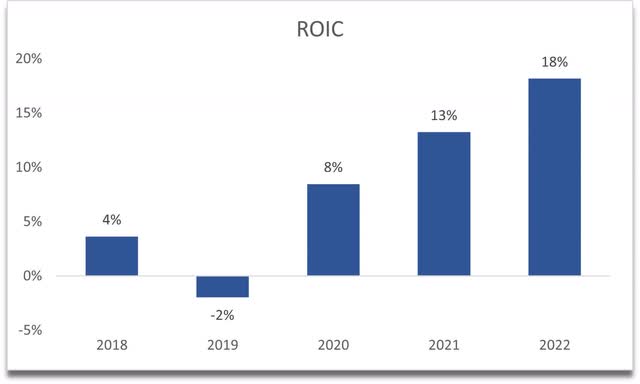

I am also very impressed with how the company’s return on invested capital has developed over the years. I am looking for around 10% ROIC as a minimum, and here the company had around 18% by the end of FY22, however, I would expect some declines going forward but not too much. This tells me the company still has a competitive advantage in the market and a decent moat.

ROIC (Author)

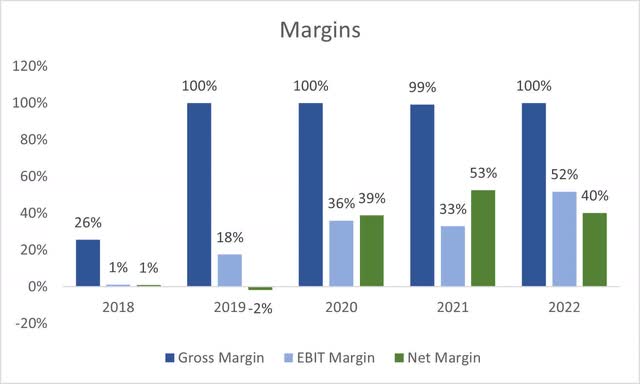

In terms of margins, these have been good until FY22, however, in the most recent report, operating margins have come down to around 32% due to the MRI acquisition. The costs seem to be much stickier than anticipated, but over time, I believe these will improve.

Margins (Author)

Overall, there is a lot of good in the financials. Some worries in the short term are the downtrends in efficiency and profitability ratios and margins, however, with time, these will improve. The company still has a decent competitive edge and a moat that will deteriorate a little bit more, which tells me that there may be more volatility ahead for the company, and the share price may continue to fall.

Valuation

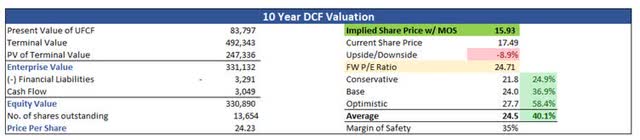

In the last 2 years, the company grew revenues by 63% and 37.5%. Analysts estimate the growth to be around 19% for FY23. For my base case, I decided to grow revenues by around 8% CAGR for the next decade to be on the conservative side. For my optimistic case, I went with 11.5% CAGR, while for the conservative case, I went with 5.7% CAGR to give me a range of possible outcomes.

I believe that margins will play the biggest role in deciding the company’s valuation. As I mentioned earlier, the sticky costs of MRI acquisition have been weighing down on the company’s operating margins, which leads me to go with around 35% operating margins for FY23, which is still a little higher than what the first half of the year is showing us, however, I’m assuming the company manages to decrease these costs in the 2nd half of the year which will improve the margins. For FY24, I modeled further improvements in margins by another 500bps, which will bring them to 40%. Then, I decided to keep improving them to the margins the company saw at the end of FY22, which could be slightly optimistic, but, not out of the realm of possibility. Profit margins will return to around 39% by FY32.

On top of these estimates, I will add a 35% margin of safety. The reason being is that the company is quite small, with very little daily average volume, which means it is not as liquid and may have a lot of fluctuations daily. I am also not sure how well the company can improve operating margins going forward and what the revenue growth will be in the upcoming quarters. With that said, HireQuest’s intrinsic value is $15.93, implying around 9% downside from current valuations.

Intrinsic Value (Author)

Closing Comments

I rate the company a hold for now until it manages to resolve the high costs associated with one of the largest acquisitions to date that will weigh down on the company’s future earnings quite a bit as I project around $0.71 a share of earnings in FY23. That means the company is trading at around 25x forward earnings, which I think is slightly expensive given the uncertainties of the company’s revenue growth.

I would be willing to pay around $15 to take on the risks but right now I’ll be waiting for the next couple of quarter results to see how the cost-cutting measures worked and whether the company is back to better profitability and revenue growth. If we see much better margins at the beginning of next year and if we see that the revenue growth is improving, then I will adjust my revenue assumptions and reassess.

Read the full article here

Leave a Reply