HighPeak Energy (NASDAQ:HPK) has successfully refinanced its debt, pushing its next debt maturity (based on the springing maturity of its existing credit facility) out by around three years with a new $1.2 billion term loan.

This gives HighPeak some breathing room, although at a cost. The term loan comes with an interest rate that is close to 3% higher than HighPeak’s existing debt. As well, there are various restrictions around the number of active rigs that HighPeak can have, so it will probably see its production decline at least a bit in early to mid 2024.

The rig restrictions do have the benefit of forcing HighPeak to spend less on capex and focus on generating more free cash flow, which it should be able to do decently with $80s oil.

I believe HighPeak is roughly fairly priced for long-term $80 oil now, although I estimate its value at around $14 per share with long-term $75 oil. This is up slightly from my previous estimate of HighPeak’s value, due to improved near-term oil prices plus a more stable financial situation.

Debt Refinancing

HighPeak successfully refinanced its debt by entering into a term loan agreement with a $1.2 billion commitment capacity. This term loan matures in September 2026 and carries an interest rate of SOFR + 7.5%. The term loan has a first-lien security interest in substantially all of HighPeak’s assets.

With SOFR at around 5.3%, the term loan’s current interest rate would be 12.8%, which is quite high for first-lien debt.

HighPeak is using the proceeds from the term loan to repay its 10% unsecured notes due February 2024, its 10.625% unsecured notes due November 2024 and its existing credit facility borrowings (maturing in June 2024, but with a springing maturity to October 2023).

At the end of Q2 2023, HighPeak had $970 million in net debt, although with no working capital deficit its net debt would be closer to $1.25 billion. Proforma for its July equity offering, its net debt with no working capital deficit would be approximately $1.1 billion.

HighPeak will likely continue to carry at least some working capital deficit and it mentioned that it is now generating positive free cash flow, so its $1.2 billion term loan should give it sufficient (albeit limited) liquidity, given that the term loan also imposes restrictions on how many active drilling rigs it can have.

HighPeak is also allowed to enter into a super senior revolving credit facility for up to $100 million.

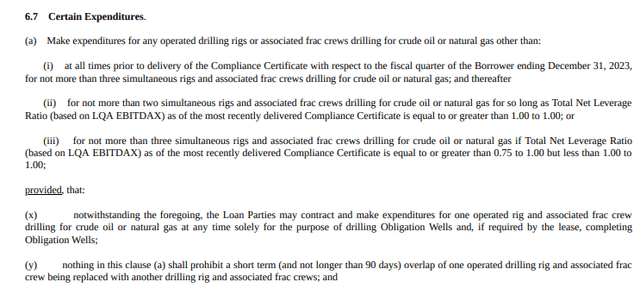

Drilling Restrictions

HighPeak mentioned that it was adding a third drilling rig to take advantage of strong oil prices, but it will soon (in 2024) be limited to no more than two drilling rigs (outside of obligation wells) as long as its net leverage is 1.0x or higher. If its net leverage is between 0.75x to 1.0x, then it is allowed to have three drilling rigs.

HighPeak’s Capex Restrictions (highpeakenergy.com)

At current strip, HighPeak seems likely to be restricted to two drilling rigs into mid-to-late 2024, but should get its net leverage below 1.0x during 2H 2024. It may be able to get its net leverage below 0.75x by the end of 2024 at current strip, potentially allowing it to increase its rig count above three.

Potential 2024 Outlook

I’ve modeled a scenario below where HighPeak runs a two-rig drilling program through most of 2024 and spends $600 million on capex. In this scenario HighPeak will likely see its production fall a bit from its 2023 exit rate (with guidance midpoint currently at 57,000 BOEPD).

Thus I am currently modeling HighPeak’s 2024 production at 53,000 BOEPD (83% oil) with the belief that it will exit 2024 with around 50,000 BOEPD in production if it continues with a two-rig drilling program. However, there is significant uncertainty around HighPeak’s production levels due to its large number of recent wells and currently high base decline rate.

At the current strip of $82 WTI oil for 2024, HighPeak may generate $1.382 billion in oil and gas revenues before hedges.

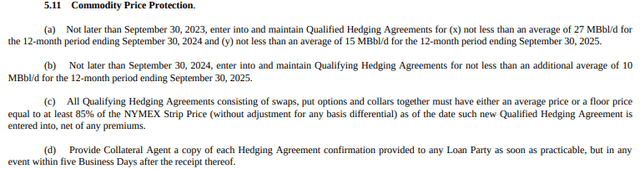

HighPeak’s Hedging Requirements (highpeakenergy.com)

HighPeak’s 2024 hedges (from the end of Q2 2023) have approximately negative $14 million in value. This doesn’t include the new hedges that HighPeak will add soon (if it hasn’t done so already).

As shown above, HighPeak is now required (as part of its term loan agreement) to enter into oil hedges covering at least 27,000 barrels per day in oil production for the twelve month period ending September 2024, with a floor price that is at least 85% of strip.

| Type | Barrels/Mcf | $ Per Barrel/Mcf | $ Million |

| Oil | 16,056,350 | $81.50 | $1,309 |

| NGLs | 1,741,050 | $24.75 | $43 |

| Natural Gas | 9,285,600 | $2.40 | $22 |

| Hedge Value | -$14 | ||

| Total | $1,360 |

I am modeling HighPeak’s 2024 lease operating expenses (including workover expense) at $9.00 per BOE at 53,000 BOEPD in average production. HighPeak’s cash interest costs may end up at around $146 million if it only makes its $30 million per quarter in scheduled repayments. It may be able to reduce its interest costs with accelerated repayments.

| Expenses | $ Million |

| Lease Operating Expense And Workovers | $174 |

| Production And Ad Valorem Taxes | $76 |

| Cash G&A | $10 |

| Cash Interest | $146 |

| Capital Expenditures | $600 |

| Total Expenditures | $1,006 |

This results in a projection of $354 million in 2024 free cash flow at low-$80s WTI oil and modest production declines.

HighPeak also has $13 million in annual dividend payments at its current quarterly dividend of $0.025 per share. It is also required to make $120 million per year in term loan repayments.

Note Refinancing And Estimated Valuation

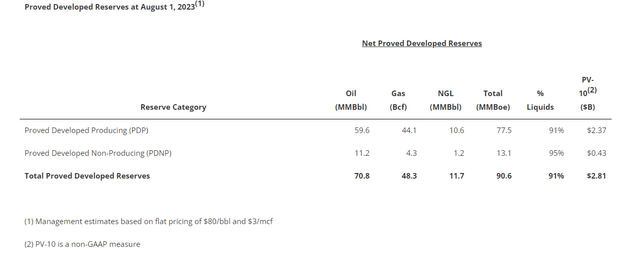

HighPeak estimated that its proved developed reserves had a PV-10 of $2.81 billion at $80 oil. This was based on estimated reserves from the beginning of August 2023.

HighPeak’s Reserves (highpeakenergy.com)

At $16.75 per share, HighPeak’s market cap would be approximately $2.5 billion assuming that its outstanding options and warrants were exercised. It would have approximately 149 million shares outstanding along with $850 million in net debt. This $3.35 billion combined total is nearly 1.2x HighPeak’s proved developed PV-10 at $80 oil. At $80s oil, HighPeak should be able to increase its proved developed reserves while also reducing its debt.

I previously estimated HighPeak’s value at $13 per share in a long-term $75 oil and $3.75 gas scenario. I’ve increased its estimated value to $14 per share with long-term (after 2024) $75 WTI oil. This increase is due to higher near-term oil prices as well as the improved stability of HighPeak’s finances.

At long-term $80 WTI oil instead, I’d consider HighPeak’s current share price of around $16.75 per share to be roughly fair. HighPeak’s insiders have recently purchased shares at around its current share price, but I tend to take a more conservative view towards longer-term oil prices.

Conclusion

HighPeak Energy successfully refinanced its debt and it now has three years until its new $1.2 billion term loan matures. It is paying close to 13% interest on that term loan though, and is also required to make $120 million per year in term loan repayments.

At $80s oil, HighPeak should be able to make significant progress in reducing its net debt and leverage though. It will be restricted in terms of the number of active drilling rigs it can have until it reduces its leverage below 0.75x.

I believe that HighPeak is currently fairly valued for a long-term $80 WTI oil scenario and is worth approximately $14 per share at long-term $75 WTI oil instead.

Read the full article here

Leave a Reply