I previously had a Hold rating on Hexcel Corporation (NYSE:HXL), which was primarily driven by the lack of upside in 2023. However, Hexcel is one of those stocks that should be assessed on the long-term potential. Moreover, with the introduction of the evoX Stock Screener available to subscribers, I have introduced a rating system that incorporates risk and longer-term reward. With that in mind, I am revisiting the stock and aim to discuss the long term growth drivers as well as the risks for Hexcel and revise my rating if there is need for it.

What Does Hexcel Do?

Hexcel Corporation is engaged in providing advanced lightweight composites technology. The Company’s product range includes carbon fiber, specialty reinforcements, prepregs and other fiber-reinforced matrix materials, honeycomb, resins, engineered core, and composite structures for use in commercial aerospace, space and defense, and industrial applications.

The Company operates through two segments: Composite Materials and Engineered Products. The Composite Materials segment is comprised of its carbon fiber, specialty reinforcements, resin systems, prepregs and other fiber-reinforced matrix materials, and honeycomb core product lines and pultruded profiles. The Engineered Products segment is comprised of lightweight high-strength composite structures, radio frequency/electromagnetic interference (RF/EMI) and microwave absorbing materials, engineered core, and specialty machined honeycomb products with added functionality and thermoplastic additive manufacturing.

Long-Term Growth Driver #1: Commercial Aerospace Production

Hexcel

One obvious growth driver for Hexcel will be the increase of production on key programs. 2019 should have been a year of solid growth for Hexcel in the commercial aerospace segment. However, due to the Boeing 737 MAX crisis production for the MAX was dialed back and even went to 0 in 2020 while other programs were subsequently affected by the rise of the pandemic while a combination of quality issues and supply chain constraints have provided downward pressure on the ability for OEMs to increase production.

For Hexcel, it has been a years-long path to get its commercial aerospace revenue back to where it previously was. The company fully depends on the production plans of Airbus (OTCPK:EADSF) and Boeing (BA) to get back to where it wants to go, as these two OEMs account for 87% of the commercial aerospace sales, which provides the bulk of the revenues in any undisturbed year. The remaining 13% percent goes to regional and business jets.

The Airbus A350 is the airplane with the highest shipset value, but it should be noted that while single aisle jets only have a shipset value of around 10% measured against the A350 a significant portion of the lower value is offset by the higher production volumes. The goal for Hexcel’s Commercial Aerospace business is to get back to 2019 revenue levels, which stood at roughly $1.6 billion, and as I said that has been a challenging path. I did some calculations that includes all key Boeing and Airbus programs for Hexcel, and that calculations does show that by 2024 Hexcel will not yet be at the previous levels of 2019, but by 2025 this could most definitely be the case by 2026 when its Boeing and Airbus related revenues could exceed the total revenues for commercial aerospace activities in 2019.

Key to improving revenues for Hexcel will be a ramp-up in production on wide body as well single aisle jets, with modest additions expected from higher production on regional and large business jets. Airbus and Boeing are known to be looking at significantly higher production rates for their single aisle jets and higher production rates on wide body programs are also targeted, so we are not looking at unrealistic growth expectations for commercial programs.

Long-Term Growth Driver #2: Commercial Aerospace Program Launches

Boeing

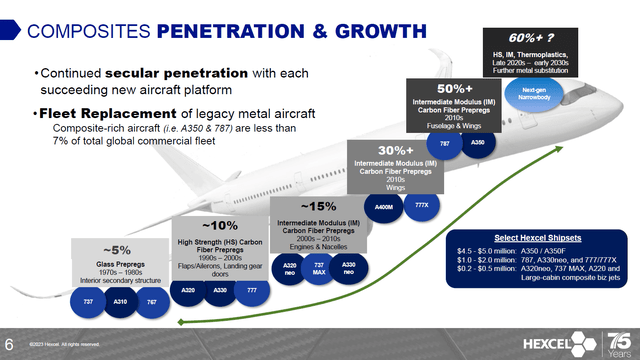

Another source of growing revenues for Hexcel is the launch of new airplane programs. With each new generation airplane whether it is an all-new program or an evolutionary update, we have seen the shipset value of Hexcel materials increase. An all-new design allows for broader application of advanced materials and Hexcel is the composite material specialist of the aerospace industry.

Long-Term Growth Driver #3: Space & Defense Momentum

Also in the defense industry, there is momentum that could drive sales higher. The company is active on major defense platforms such as the F-35, CH-53K, Rafale, A400M, Black Hawk and V-22. Some of these programs require replacements, but some are also programs on which production has yet to go up. With defense budgets increasing globally, there likely will also be higher demand for advanced materials while space enjoys momentum in the commercial segment as well as the space-based segment and new weapon capability developments such as hypersonics also provide opportunities for Hexcel.

What Are The Risks for Hexcel?

Hexcel enjoys some solid momentum in its key end markets. There are, however, also risks that mostly center on timing. For production ramp-ups we have been seeing that Boeing and Airbus have not been able to execute ramp-ups as desired due to significant strains in the aerospace supply chain, and the risk is that even when Hexcel is ready to deliver, other aerospace suppliers might not, which can result in production ramp-ups being delayed.

Furthermore, while the opportunity of an all-new aircraft program is huge, there is no definite timeline. It is clear that new aircraft development is required, but when an aircraft program will be launched is unknown. Aircraft development costs billions of dollars so making a launch decision does not happen overnight. Boeing previously envisioned the launch of a new mid-size airplane, but with the window closing on aircraft replacement and the dire financial and development situation at Boeing that plan has been shelved. So, while the opportunity is there for Hexcel we simply don’t know when Airbus or Boeing will pull the trigger and launch a new jet. This is more of a remote risk rather than an immediate risk as a new airplane program would basically add a sub stream of revenues that currently is not present and with development phases lasting 5-8 years, a launch today would only start significantly adding to revenues around 7-10 years from now.

The other risk is the downturn in Industrial revenues. While revenue declines in the segment have tapered, the loss of a significant portion of wind energy business has shaved off around a third of the revenues. The company is pivoting away from wind energy to other markets such as consumer electronics, marine, and automotive, but we are not given any kind of insights on how well they are progressing. Without insights or any signs that new business is won in excess of lost business, we don’t know when the business will start seeing growth again and we certainly don’t know whether the company will ever see Industrials revenues back in line with 2019 levels.

Is Hexcel Stock A Buy?

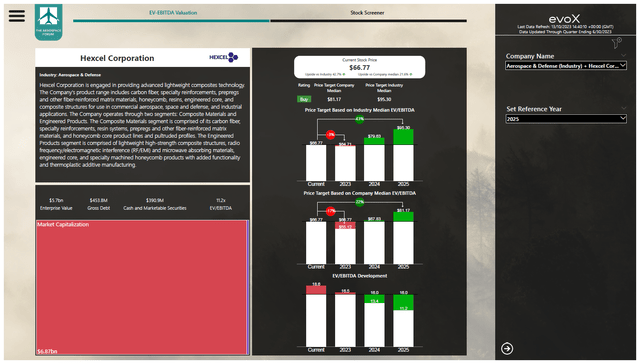

Hexcel stock price valuation (The Aerospace Forum)

Whether you consider Hexcel a buy or a hold is actually very much dependent on your investment horizon. As I noted in my previous article, Hexcel stock is slightly overvalued with 2023 earnings in mind, and compared to 2024 earnings there is little upside, but that is against a company EV/EBITDA multiple that is lower compared that of peers. With Hexcel being a unique company with advanced material knowledge, having the company trade at a discount to peers might not make sense. So, Hexcel is currently more a hold than a buy, but I assess aerospace companies based on their potential in the future, in which case I see around 43% upside towards 2025 and my price target for Hexcel currently would be around $80 per share representing 19% upside.

Conclusion: Hexcel Flashes Buy Rating

Hexcel offers a lot of potential to capitalize on combined upward potential for commercial airplane production as well as higher defense revenues. What still stands is that the company is somewhat overvalued at current prices when considering 2023 and possibly 2024 earnings.

However, Hexcel could be one of those companies for which buying at a discount is a rarity and over the longer term this is actually a solid buy. With my new rating system, Hexcel has shown to be a buy rather than a Hold, so I am upgrading accordingly with the notion that the company is not trading at a discount but still offers significant value ahead.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply