Every weekday the CNBC Investing Club with Jim Cramer holds a Morning Meeting livestream at 10:20 a.m. ET. Here’s a recap of Tuesday’s key moments. 1. U.S. stocks ticked up slightly Tuesday morning, with the S & P 500 up 0.15% and the Nasdaq Composite up 0.25%. The modest gains come after the Labor Department’s monthly consumer price index showed inflation slowed to a 3.1% annual rate in November, largely in line with Wall Street’s expectations. At the same time, the Federal Reserve is beginning a two-day policy meeting Tuesday, with investors widely expecting the central bank will hold interest rates steady at an announcement Wednesday. Bond yields were mainly flat, with that of the 10-year Treasury hovering above 4.2%. And oil prices tumbled more than 3%, as West Texas Intermediate crude broke below $70 a barrel. 2. Earlier Tuesday, we exited our entire position in software firm Oracle after another disappointing quarter . Total cloud revenues grew 24% in constant currency in the quarter, missing management’s guidance of 28% growth, while cloud-infrastructure revenue growth of 52% was a step down from 66% in the prior quarter. The miss is largely tied to a lack of capacity, as Oracle can’t build out data centers fast enough. However, all the investment in building out data centers is great for Club name Eaton , given the power management’s largest end-market by sales is in data centers and distributed IT. And AI -focused data centers require triple the electric content. So, that could be one company in which we redeploy our cash from the Oracle sale. 3. Shares of Club holding Eli Lilly closed down more than 2% Monday on the back of a new study on the company’s weight-loss drug Zepbound . The data showed 20.9% weight loss through 36 weeks in obese people without type 2 diabetes, while those who continued on the medicine lost an incremental 5.5% of weight from weeks 36 through 88. But those who went off the drug regained roughly half the weight. While the market hammered the stock on that point, the news is actually good news – it means that people who take this drug will need to stay on it to keep the weight off. Shares of Lilly were down 0.34% Tuesday morning, at $582 apiece. (Jim Cramer’s Charitable Trust is long ETN, LLY. See here for a full list of the stocks.) As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust’s portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade. THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY , TOGETHER WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.

Read the full article here

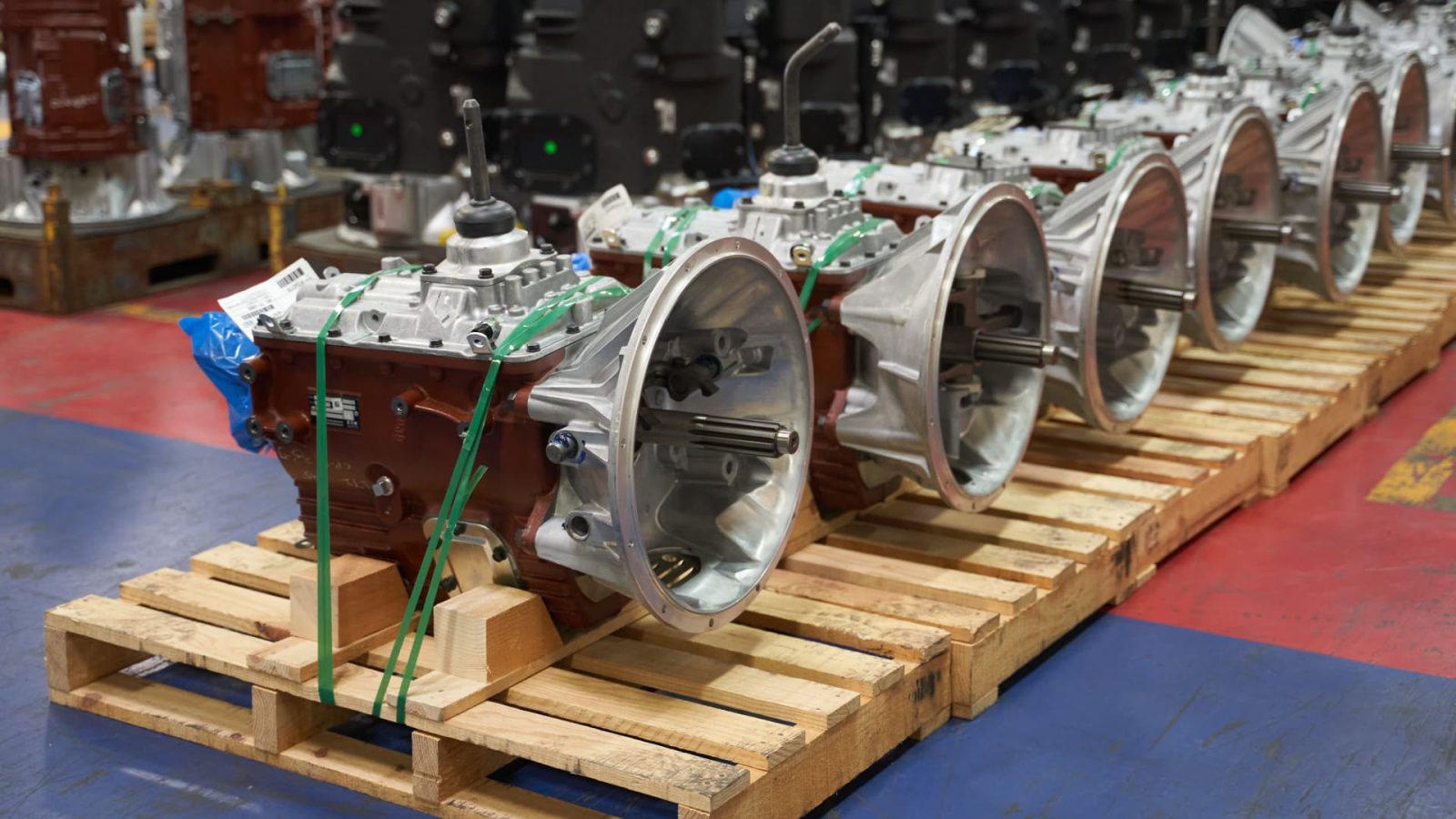

Leave a Reply