Henkel (OTCPK:HENKY)(OTCPK:HENOY)(OTCPK:HELKF) has outperformed our expectations. We were alright with the adhesive exposures in our last coverage, but we expected more pressure from consumers trading down, meaning shifting from Henkel’s brands to competing supermarket labels or less premium brands.

Instead, while volume effects were more pronounced and negative for the consumer business, there was scope for pricing and the segment performed well in organic sales, indicating that this wasn’t such a big issue on balance. The recovery of electronics markets for Henkel’s adhesive businesses supported performance, and this has translated into upward revisions of guidance. Multiples look decent, even relative to peers. But with relatively high PEs at 15x, the absolute case isn’t good enough, and the value isn’t deep enough for us to be interested.

Latest Earnings

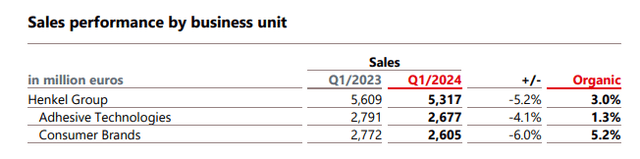

There were fewer disposals in the adhesives business, which is higher margin. The unadjusted growth numbers were therefore stronger in adhesives and helped support the headline operating margin. Adhesives’ organic growth lagged that of the consumer area, where these figures are adjusted for comparability after disposals, which were undertaken by Henkel as part of their “portfolio valorisation” plan. There were more disposals in consumer. Adhesives has around 50% higher margins than the consumer business.

Segments (Q1 PR)

Half of the consumer business declines were on account of disposals, but there were also negative currency effects from being present in regions with weaker currencies, such as Turkey and places in Africa.

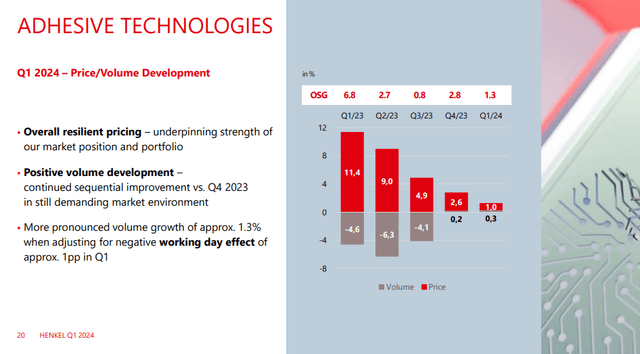

Within adhesives, electronics started to bottom out. Electronics has been generally a weak market, even in retail. Henkel’s electronics markets are with manufacturers, which have also been slowed down and were awaiting a recovery after the semiconductor shortage followed by the glut. The recovery has evidently begun a little, with expectations for an electronics recovery being shared by other industrial companies.

Pricing and Volume in adhesives (Q1 Pres)

In general, performance has been better in adhesives in terms of volumes, which gelled with our previous expectation that adhesives would have to drive and offset poorer performance in consumer.

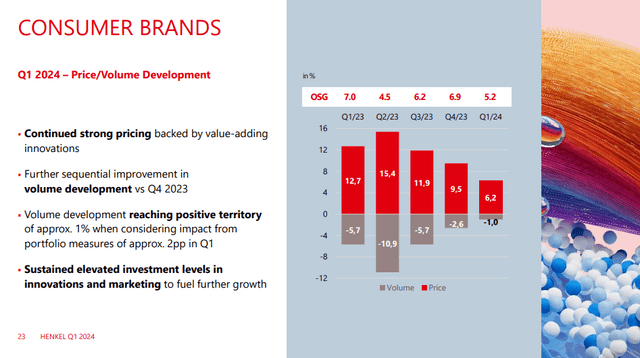

Pricing and volume (Q1 Pres)

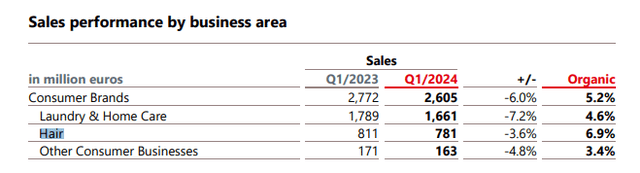

For consumer brands there was more volume pressure, likely due to some trading down, but certain segments have been performing very well. While there are ongoing optimisations of the portfolio, hair was a standout in terms of organic and organic results, performing better than laundry and home care and the other consumer businesses.

Consumer Segment Breakdown (Q1 PR)

Hair had a good margin contribution and helped along results. Pricing was the primary sales lever in consumer, and it was encouraging to see that it was available to Henkel despite an environment in which consumers have become more careful about savings, which is a testament to brand power in their portfolio. Downtrading pressures didn’t preclude price hiking.

Bottom Line

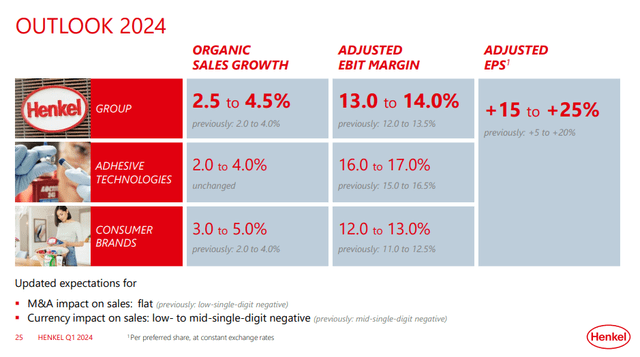

IMEA growth looked great on paper but was modest in terms of organic growth, but organic growth still reflects the general success in pricing strategy. The outlook has improved, particularly on the margin side as adhesives sees renewed support from electronics, supporting the high margin adhesives’ presence in the mix in the forecast, and therefore allowing for a strong expected EPS performance.

Margins are also improving in hair, which is the subject of the company’s focus in consumer – also because there were probably fewer consumers trading down in hair products. Altogether, but mainly because of the electronics turnaround within adhesives, the outlook for the coming year has improved again.

Outlook (Q1 Pres)

Using SA’s spreads, Henkel is cheaper than the average consumer staple play, with their multiple discounted around 20%. It’s also generally lower multiple than other household products stocks. However, 60% of the EBITDA is adhesives, which is more B2B facing. A company like 3M (MMM), which could be chosen as a possible comp, has a more similar B2B and B2C mix. At above 10x EV/EBITDA FWD compared to Henkel’s less than 9x, it also points to a somewhat attractive value proposition.

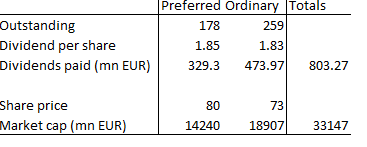

Note that Henkel has prominent preferred shares in the capital stack. However, for some reason, within the EV, the value of these preferreds is automatically included in the screener EV. You can know that by seeing that the market caps of the preferreds and the commons add up to the provided figure of around 32 billion EUR, which is the market cap reported in the screeners. Generally, preferreds should be treated as a senior element in the capital stack to common shares, almost like debt since it basically is a hybrid debt-equity instrument, and not pure equity. We would not aggregate them into market cap, but maybe there’s something we’re missing. Either way, the screener multiples are fine.

Preferreds and common (VTS)

In all, Henkel has some billionaire brands that account for the bulk of their sales, like Schwarzkopf in hair. They’re a solid consumer staples company, and are driven by established adhesive products for manufacturing. While the industrial outlook in the West is generally not that great, some turnarounds in weaker areas like electronics should keep the ship on an even keel. Henkel is not a bad pick, but not deep enough value for us as a high profile consumer staples pick.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply