Investment Thesis

The healthcare sector is in the midst of a post-pandemic recovery. COVID increased costs with extra precautions and nursing shortages, and it reduced some profitable procedures as patients avoided hospitals. On a secular basis, an aging population is driving demand. In the United States, this demographic shift is driving growth in the Medicare Advantage (Part C) market, which is estimated to grow to be the largest revenue source for healthcare providers. Healthcare is recession-resistant, especially now that Medicare is the largest single payor.

HCA Healthcare (NYSE:HCA) stands to capitalize on this demographic shift, with year-over-year growth in Medicare Advantage already reaching 11.3%. The HCA Network targets comprehensive coverage of the healthcare spectrum in localized areas. Across 182 hospitals and 2,300 care sites, HCA has 37.2 million patient encounters per year. HCA is the largest private hospital network in the world, with a 27.2% domestic market share by enterprise value.

Aging Population

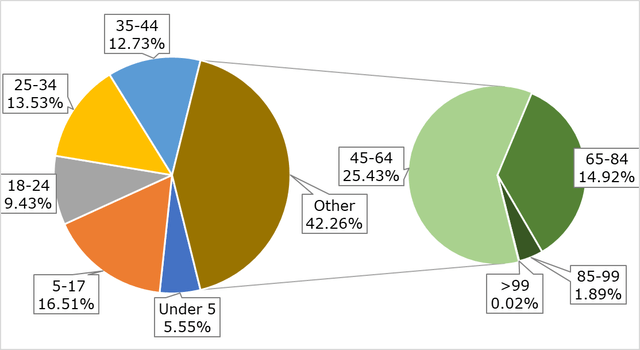

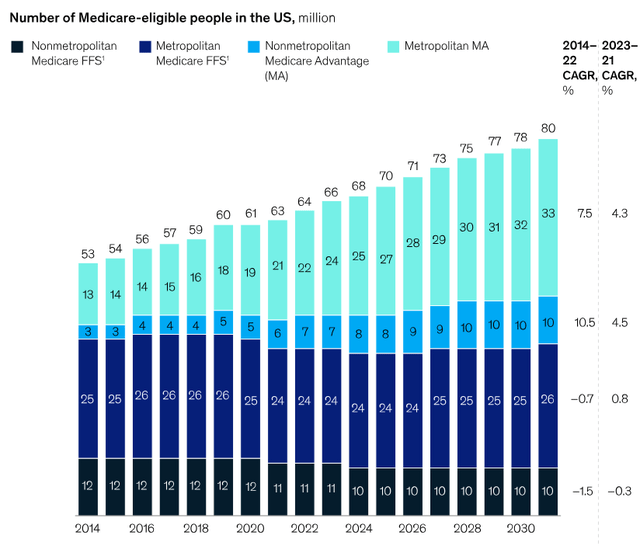

Census, BuildingBenjamins

The US population is aging rapidly. The United States life expectancy has risen steadily since the 1960s, reaching a record 79 years old in 2019. By 2040, this number is expected to climb to 85 years old. The number of Americans 65 and older will double within the next 40 years, reaching an estimated 80 million in retirement age by 2040. A sharp increase in life expectancy, with the largest share of the population aging out of paying into social security and Medicare, will put immense fiscal pressure on government and private healthcare spending.

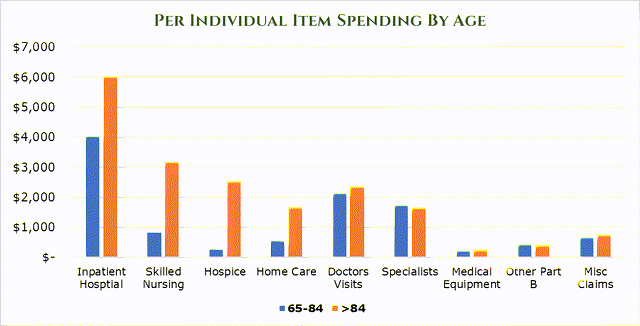

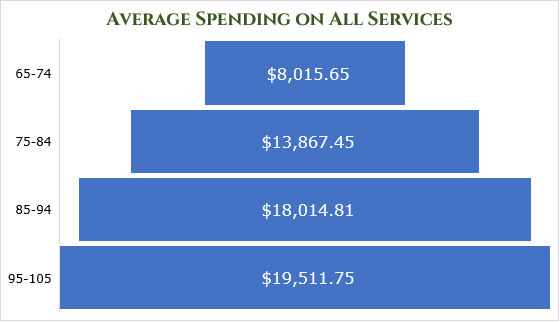

CMS, BuildingBenjamins

As age ramps up, the per-individual spending on items increases drastically, particularly in acute-care areas. By age 85, the average spend on healthcare is $18,014.81 per year per person.

CMS, BuildingBenjamins

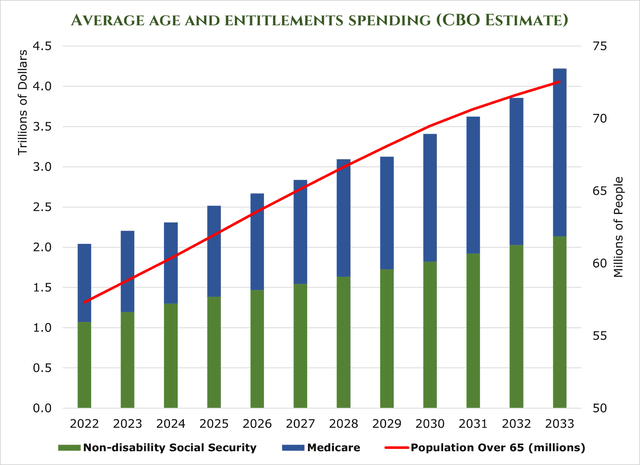

The CBO estimates that by the end of the decade, non-disability social security and Medicare spending will grow to $3.5 trillion per year, a $1.5 trillion increase.

CBO, BuildingBenjamins

US Spending on healthcare has traditionally matched GDP, as hikes in prices above GDP generally bring the ire of the government and insurance payors. However, persistently high inflation, clinical staff shortages, and massive demand from an aging population have put upward pressure on healthcare prices. McKinsey estimates that US spending on healthcare will grow at a 7.1% 5-year CAGR – outpacing GDP by an estimated 240bps.

Medicare Advantage (Part C)

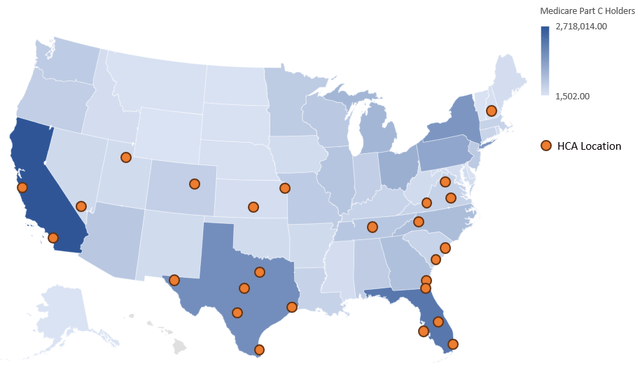

Medicare Advantage (also called Part C or Managed Medicare) plans provide both the government part of Medicare (Parts A and B) and additional benefits to the payee. Payers pay premiums like a normal insurance plan, but usually pay a heavily discounted rate as the government covers what Parts A and B would normally. What separates Medicare Advantage from the remaining Medicare programs is it works more like a traditional insurance plan. Medicare recipients tend to be service-location agnostic – all medical facilities are required to accept Medicare. However, Medicare Advantage plans operate within affiliate HMO Networks to provide benefits (Health Maintenance Organization), much like a traditional insurance plan. This means that Medicare Advantage plan holders must stay in-network.

McKinsey

Medicare Advantage is projected to grow to be the largest source of revenue for healthcare providers by 2026. It is estimated that membership is growing at about 8% year-over-year, and it will reach around 52% penetration of Medicare recipients by 2026. This large sequential year-over-year increase will increase the addressable market significantly, with government estimates putting the Medicare Advantage total addressable market at $75 billion by 2026. Short-term pressures come from postponed elective or low-priority surgeries that were not conducted during COVID 2020-22.

Challenges

Inflation, coupled with COVID-19, had an intensely negative impact on the balance sheets of healthcare firms. Due to the cyclical and long-term nature of insurance and government contracts, healthcare firms are hard-pressed to pass down increased costs, which has eaten at the industry’s margins. McKinsey estimates that inflation and COVID-19-related expenses have reduced the EBITDA margins of the healthcare industry by 600bps. However, there is some relief in sight. Based on rate increase filings, insurance companies are seeking a median of 10% rate increases. Healthcare companies are beginning to pass on this cost to insurers.

An estimated shortage of 200,000 nurses and 50,000 doctors by 2025 will increase costs and limit the availability of services. As a result of short-sighted policies, there is not much relief on this front. Historically, Physicians Associations and Nurses’ Associations have strongly opposed increasing the number of Doctors and Nurses allowed to enter the workforce. The problem is self-compounding, as doctors and nurses burn out in record numbers as their patient counts continue to increase. Hospital systems are turning to traveling nurses and other specialized temporary clinical staff to fill these gaps. In Massachusetts alone, temporary clinical staff expenses have grown 150% since before COVID-19. In 2023 is estimated that $248 billion in additional cost will be realized due to inflation in labor costs alone.

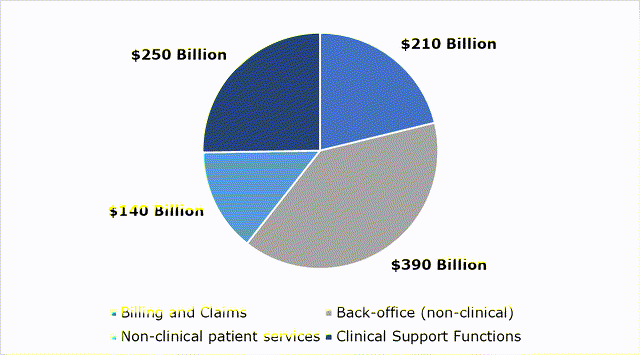

An endemic problem within the healthcare system is ‘administrative creep.’ Almost 25% of all costs are incurred in administration – or about $1 trillion annually. These costs vary, with non-clinical support functions eating up the lion’s share of administrative spending. It is estimated that between $285-570 billion of this administrative figure is unneeded.

McKinsey

Tying it Together

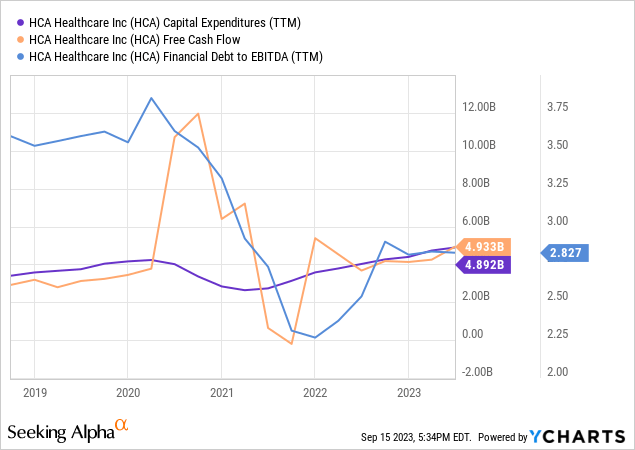

With the worst of COVID-19 over, heavier capital deployment is again back on the table. Of the $4.6 billion in capital investments for 2023, $4.4 will go toward internal growth. Short-term growth has 1,563 clinical beds in the 2023-24 pipeline and 664 ER beds. Additionally, HCA acquired a controlling share (90%) of its JV with Envision. HCA utilizes the JV company, Valesco, as a contract-labor finder. HCA estimates this will add $1 billion in revenue, but will likely not contribute meaningfully to EBITDA. On top of this, HCA has reduced its debt load substantially, allowing for more aggressive expansion.

HCA Pays out a small dividend with a 0.97% Yield. HCA engages in a significant share buy-back program, repurchasing $915 million in 2Q23. This is part of a larger share repurchase program amounting to $11 billion.

YCHARTS CMS, HCA, BuildingBenjamins

HCA Stands to benefit significantly from the localized nature of Medicare Advantage. For example, in the Dallas-Fort Worth area, HCA has 4,100 medical staff across 239 care locations covering the entire healthcare spectrum. This allows for significant geographic capture of private insurance providers and Medicare Advantage.

Revenue increased 7% year over year in 2Q23, attributed to a 3% increase in revenue per visit, and a 4% increase in admissions. Pent-up demand from procedure postponements during the height of the pandemic are beginning to be realized. Additionally, turnover on in-house nurses has decreased to 17%, with hiring increasing by 9% year over year. HCA turnover is below average, which sat at 22.5% in 2022. This decrease in turnover and increasing hiring has helped HCA reduce its contract labor cost by 20% yearly.

|

HCA 1H23 Results |

||

|

Area |

Ratio (As a percentage of total revenue) |

Year over Year Change in Revenue Compared to 1H22 |

|

Medicare |

16.9% |

1.6% |

|

Medicare Advantage |

16.2% |

11.3% |

|

Medicaid |

4.7% |

24.1% |

|

Managed Medicaid |

5.7% |

-12.5% |

|

Private Insurer |

49.2% |

8.1% |

|

Other |

7.3% |

-4.2% |

Conclusion

Despite facing industry-wide challenges such as staffing shortages and inflation, HCA has the chance for substantial growth. Its vast network, the largest in the United States, and robust year-over-year growth demonstrate the demographic tailwinds have already begun. Financial stability is reflected in HCA’s revenue increase, reduced debt, and lowered staff turnover. HCA is a leader in healthcare, and is a stable investment for those looking to capitalize on these demographic changes.

Read the full article here

Leave a Reply