Investment Rundown

Hawkins Inc (NASDAQ:HWKN) is engaging in the chemicals market and this is a market that is notorious for quite a lot of volatility this right now has played out in the favour of HWKN as the bottom line grew in the last quarter YoY. But there are of course risks associated with this type of volatility, and I don’t think it’s properly baked in and accounted for in the share price of HWKN right now. I would prefer a lower entry point before making a purchase or adding to a position.

However, I have to admit that the growth prospect of the company still looks quite appealing and in the long-term HWKN should do very well if they can capitalize on times like this with improved prices and acquire more business. As I want more margin of safety though I will be rating HWKN a hold for now.

Company Segments

HWKN stands out as a premier specialty chemical and ingredient manufacturer, catering to a diverse clientele spanning industrial, water treatment, and health & nutrition sectors. With a rich history and a commitment to delivering top-tier chemical products, HWKN has firmly established itself as a key player in the industry. The company’s extensive portfolio encompasses a wide array of chemical solutions, each meticulously crafted to meet the unique needs of its industrial partners. From supporting essential industrial processes to enhancing water treatment capabilities, HWKN provides critical ingredients that underpin various sectors, ensuring operational efficiency and product quality.

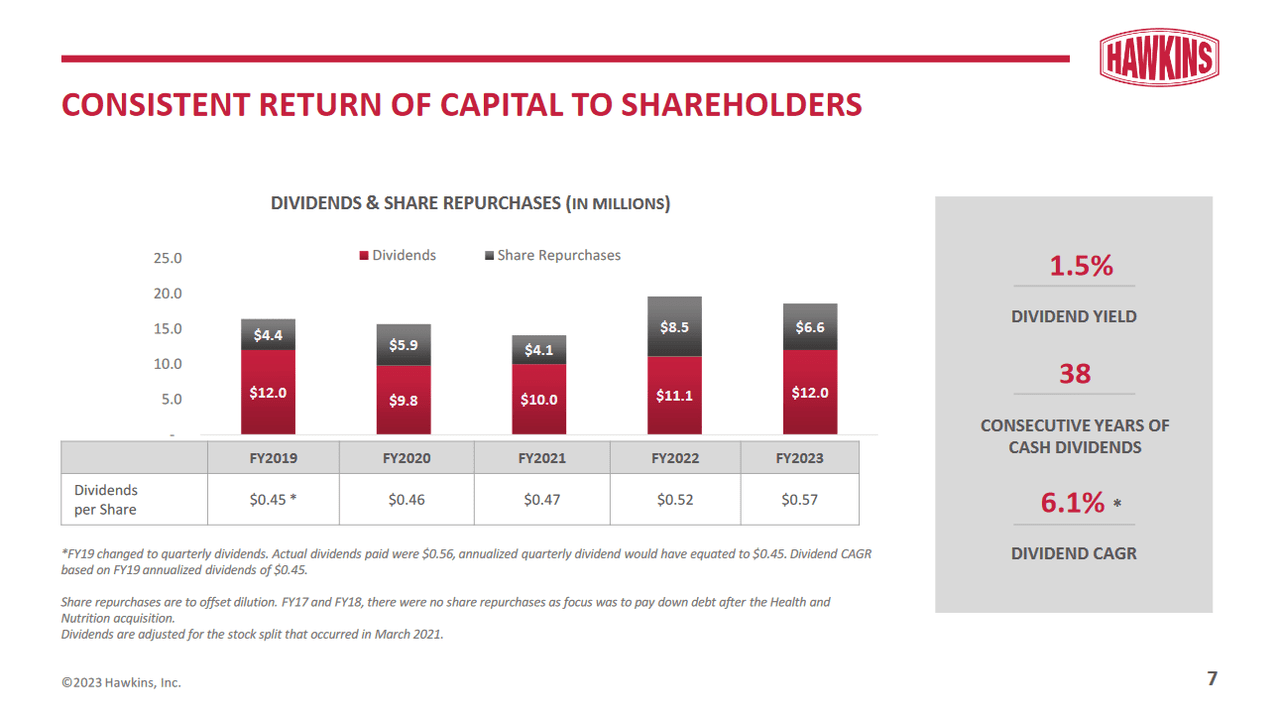

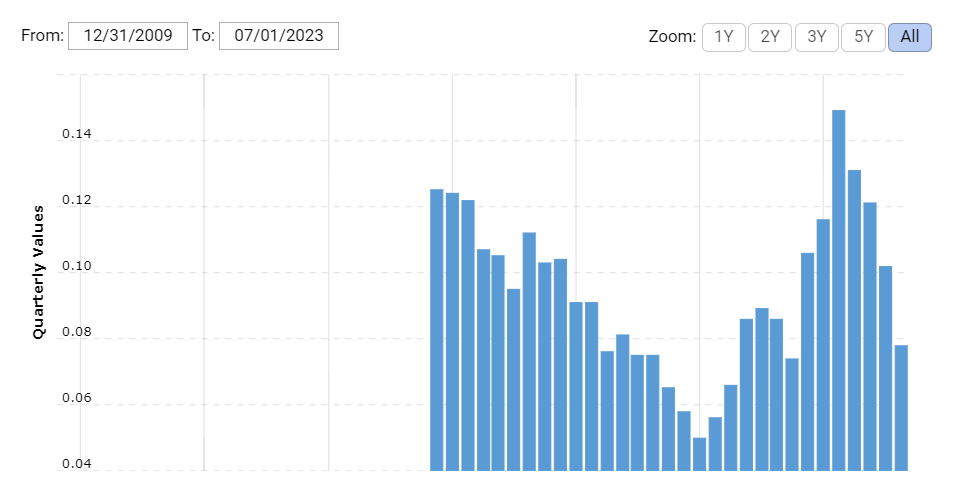

Shareholder Returns (Investor Presentation)

One of the key drivers behind the growth of the share price in the last few quarters seems to be the significant amount of returns that shareholders are getting from the company. Over the last couple of years, the dividend has grown at a CAGR of 6.1%. This is building upon the 38 years of consecutive cash dividends being issued by the company. In 2022 the share price was quite a bit lower than where it is right now and this set of HWKN greatly boosted the share buyback program. From 2021 to 2022 it more than doubled to $8.5 million.

Earnings Highlights

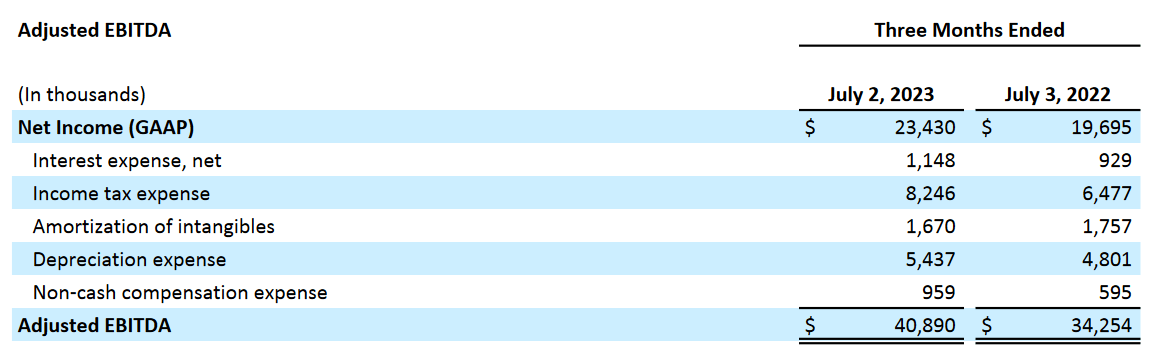

Net Income (Earnings Report)

The last quarter for HWKN continued to show a lot of strength in my opinion. The company managed to grow the bottom line by double digits to $23 million, up from $19 million the year prior.

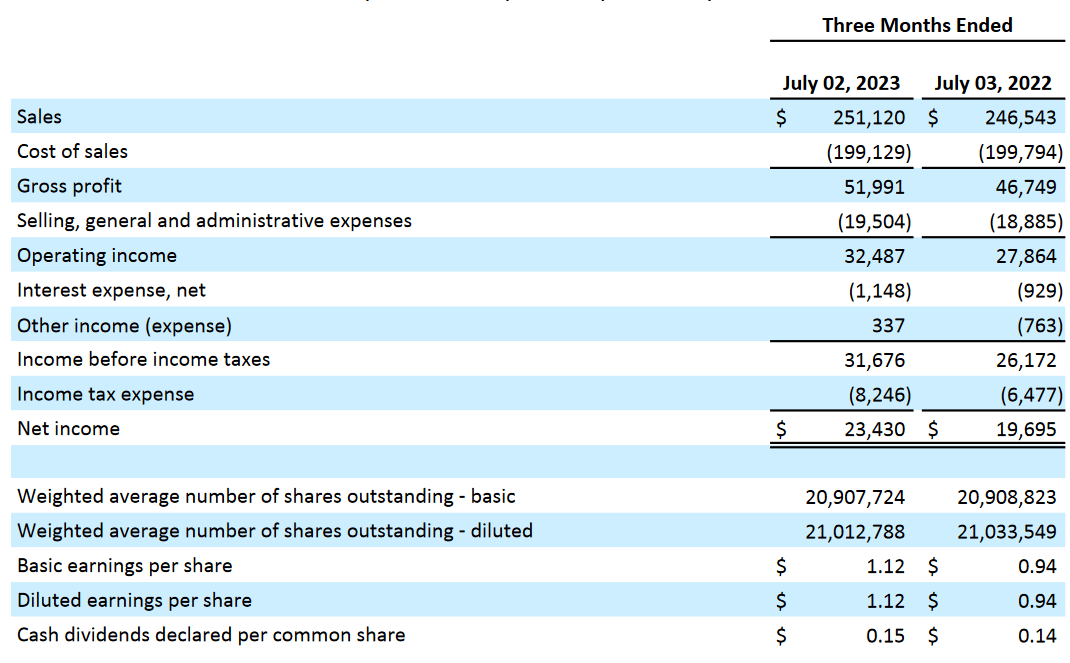

Income Statement (Earnings Report)

Attributed to this solid set of growth has been the steadiness of the cost of sales for the company, actually showcasing a decline YoY even whilst the total sales grew to $251 million. This trickled down the line and netted HWKN with a strong set of net income growth. Buybacks did take a slight break though as they more or less sat at the same level as last year. However, I think that if HWKN manages to maintain the margins and the pricing conditions improve even more, then the management may see it fit to buy back more shares, this could further add some fuel to the share price for the short term.

Risks

In its historical performance, the company has encountered substantial pricing pressure from its competitors. When industry-wide demand experiences a decline, the company grapples with the challenge of preserving its profit margins. It’s important to note that the current surge in profits can be largely attributed to robust pricing for its chemicals. However, the sustainability of such favorable pricing conditions may come into question in the upcoming year, potentially resulting in more modest returns for shareholders.

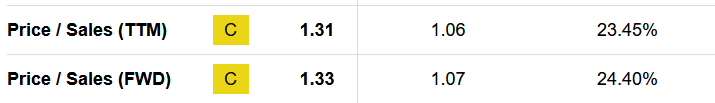

p/s (Seeking Alpha)

Early signs of this will be margin contraction, which could send the share price down quite a lot given that the p/e of the business is over 17 right now on an FWD basis. Given that 17 is above the sector median of 13 it leaves a significant downside risk as a correction could send it down to where the rest of the sector and peers are at. Lacking margin expansion does not suggest that HWKN is necessarily able to outperform peers and competitors, therefore a significant correction may be due.

Debt (macrotrends)

In light of recent acquisitions (it completed acquisition of EcoTech Enterprises in July), HWKN has seen a notable uptick in its long-term debt, which now stands at approximately $130 million. While strategic expansions can be instrumental in driving growth, it’s crucial to consider the implications of such endeavors on the company’s financial structure. Should HWKN continue to pursue further expansion initiatives, there’s a potential for a substantial increase in debt levels. This prospect, while not uncommon in the business world, raises valid concerns among shareholders. The additional leverage assumed by the company may elicit apprehension and prompt investors to reevaluate their positions.

Financials

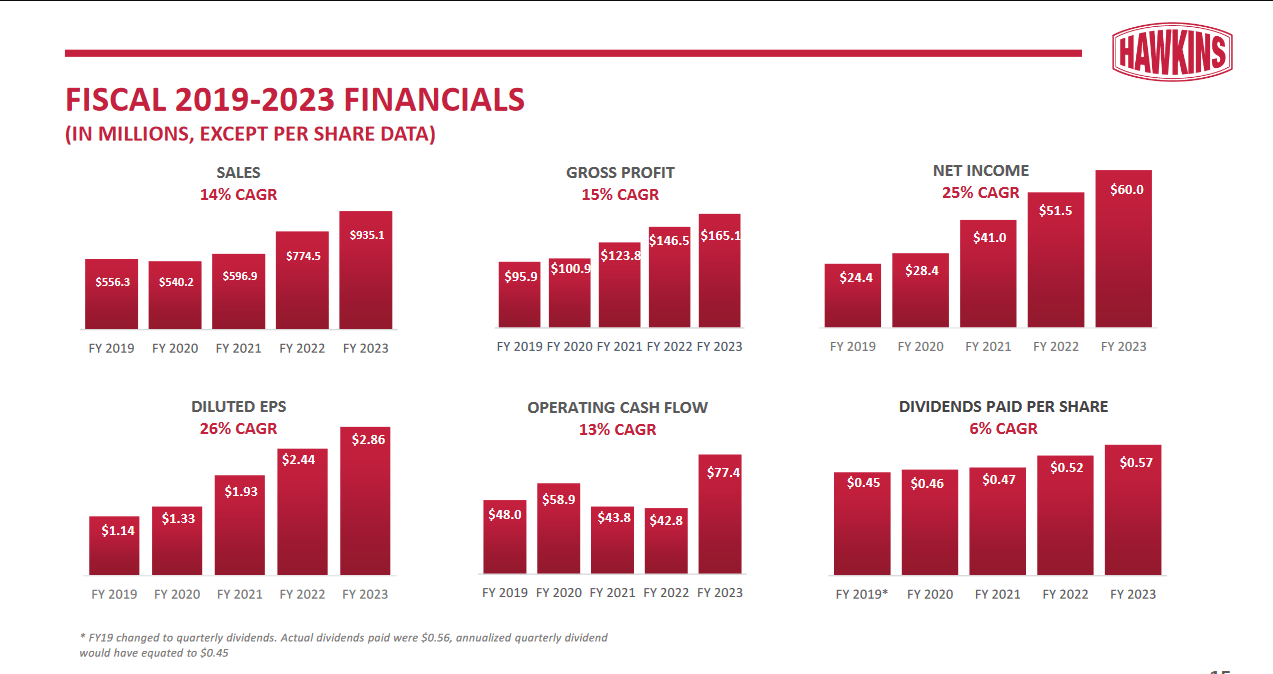

Historical Results (Investor Presentation)

Looking at the financials of the company I think they have improved very well over just the last couple of years. If this continues then HWKN could potentially be able to justify the slight premium it has for the p/b for example. On a TTM p/b, it’s over 3, far above the sector median of 1.57. But with this in mind, it has just led to HWKN having quite a low debt level generally. Even though I had it as a risk, which it is, HWKN has done a good job at not overleveraging itself too much over the years and this I think will just lead to the company trading at a premium. Going into the next few quarters though, I would like to see more and more capital devoted to improving the cash position as that would both deleverage the company and potentially lead to a higher valuation too, and potentially make my hold rating a buy instead.

Final Words

The chemicals industry is quite volatile as the pricing conditions are heavily made up of supply and demand. Right now it has been in the favor of HWKN but I think that still the price is quite high to have to pay for the business. There is a halt in buybacks of the business which is both good and bad. Less capital is returned to shareholders, but the management seems to also realize that they may be paying a high premium right now, indicating that they see some potential downside risk. I like the long-term outlook though and will issue a hold for HWKN.

Read the full article here

Leave a Reply