Investment action

Based on my current outlook and analysis of HashiCorp (NASDAQ:HCP), I recommend a buy rating. I expect HCP growth to reaccelerate once we get past FY24, as I expect the economy to recover by then, thereby removing all the negative headwinds that are driving a weak outlook for FY24. The long-term trend remains intact, and HCP is well positioned to benefit from it.

Basic Info

HCP offers open-source resources and paid offerings that empower developers, operators, and security experts to set up, safeguard, manage, and interconnect cloud computing infrastructure. HCP has a few key products:

- Terraform: In contrast to traditional deployment methods, which rely on time-consuming and error-prone graphical user interfaces or laborious manual ticketing systems, Terraform is an infrastructure as code that enables DevOps to provision, configure, and manage the entire lifecycle of their application deployments with declarative, easy-to-read configuration files.

- Vault: A solution for managing and protecting sensitive information in the cloud, such as tokens, passwords, certificates, and encryption keys.

- Consul: Consul is a networking platform that works across multiple clouds and offers a single control plane for managing hybrid and disjoint cloud infrastructures. By providing a central registry and discovery mechanism for services, it grants administrators oversight and management of distributed resources.

- Nomad: Developers can use this system to orchestrate the delivery and management of containerized and non-containerized application workloads in an easy and scalable manner.

Of the 4 key products above, Terraform is the flagship product that I see as the key growth driver for the business. The company generates income from a worldwide customer base, with the majority located in the United States, contributing to approximately 73% of its FY23 revenue.

Review

HCP’s revenue for 2Q24 came in at $143.2 million, which was higher than the $138.1 million consensus had predicted (26% growth vs. 21%). Pro-forma operating loss decreased to -$35.1 million, which is better than the -$43.9 million that was estimated by consensus. There were also encouraging signs of growth, as 2FQ24 cRPO increased to $420 million. I think HCP’s results are especially impressive given the shaky state of demand. Management has noted that while the demand environment has been relatively stable recently, it remains fraught with difficulties as the company undergoes an optimization cycle. Customers are being more frugal in their spending, expansion and extension cycles are getting longer, budgets are being scrutinized more closely, and initial contract values are getting smaller. Although these pieces of news may seem discouraging at first glance, I do not believe they are indicative of any fundamental flaws in the HCP business model. I think the fact that HCP grew by 26% despite these challenges is compelling evidence of demand. Hence, I believe the slowdown implied in HCP guidance for 3Q24 and the remainder of the year, while a material deceleration, should not be extrapolated into the medium term as growth should reaccelerate. In particular, I want to call attention to management’s comments that front-end demand signals have remained stable and that contract activity was stronger in FQ2 than in the traditionally slow 1Q24.

The right way to view HCP businesses is to focus on the long-term secular growth trends of multi-cloud and AI. If there is just one area to focus for the 2Q24 earnings transcript, it should this part where a comment made by management that shows that HCP is well positioned to take advantage of this trend.

“I wanted to ask you, we noticed at Google Next that your announcement that the Google provider for Terraform had been downloaded 350 million times and I just looked and it’s climbed at 370 million. So, it looks like it’s kind of shockingly active (question by sellside analyst)

Yes, no, I think, certainly, I think we continue to be impressed as those download counts cross new thresholds to your point, I think Google hit an impressive milestone. I think AWS recently crossed the 2 billion download mark as well. (reply by management). 2Q24 call

In my view, this serves as evidence that the ongoing trend of multi-cloud adoption, a crucial element in HCP’s achievements, is maintaining its momentum. Additionally, management elaborates that the growing popularity of multi-cloud approaches can be attributed to investments in generative AI. Customers who were previously reliant on a single cloud service provider are now actively seeking the most optimal generative AI tools and services available. Ultimately, this is expected to boost HCP’s ARPU as it enhances the importance of HCP’s portfolio (which enables customer to efficiently management of multi-cloud environments)

The negative press (debate around open source) that the company has gotten for its move from HCP to the Business Source License [BSL] framework should be discredited by these earnings call. The earnings call confirmed what I already suspected: there is a lot of misunderstanding about Mozilla’s decision to switch from the Mozilla Public License [MPL] to the BSD license for its source code. Management clarifies that the move is not intended to affect the company’s users and partners. Instead, it would negatively impact product clones that have been able to flourish thanks to the old MPL license. The goal of the shift is to ensure that HCP can keep innovating freely within the open-source community over the long term. This adjustment, in my opinion, is essential for the company’s long-term operations.

Valuation

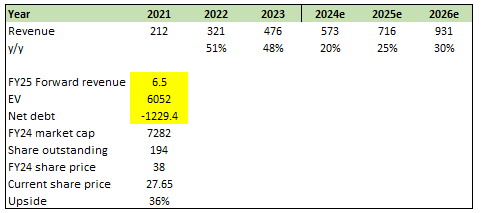

Author’s work

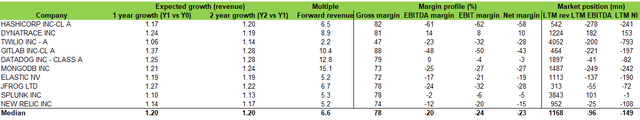

I believe HCP will see growth accelerate as the year progresses given that the slowdown in FY24 (as per guidance) is mainly macro-driven, which should recover as the long-term secular trend remains intact. To some extent, my growth assumptions might underestimate the growth ability of HCP, as the business has historically grown at >40%. Even in 4Q23, which is arguably a worse economic situation than today given the higher inflation rate (more need to drive up rates to keep inflation down), the business still grew by 40.7%. With my growth expectation in mind, I compare HCP against other infrastructure software peers and believe that HCP should trade in line with them given that it is growing at similar rates. As HCP grows and improves its margin profile, I expect multiples to rerate higher.

Author’s work

Risk and final thoughts

The potential investment concern for HCP is that future growth may experience a sustained deceleration due to its already elevated revenue level, along with a reduced rate of public cloud adoption and the fulfillment of enterprise multi-cloud strategies taking longer than expected. In conclusion, I recommend a buy rating for HCP. I anticipate that HCP’s growth will regain momentum in FY25 as the economy recovers, eliminating the negative headwinds affecting FY24. The company’s long-term prospects remain favorable. It’s crucial to focus on HCP’s alignment with long-term secular trends, such as multi-cloud adoption and AI. These trends, as evidenced by download counts and management’s insights, suggest continued momentum in HCP’s success. Regarding valuation, HCP’s growth prospects align with peers, but I believe there is potential for higher multiples as the company improves its margin profile.

Read the full article here

Leave a Reply