Thesis

Harmony Gold (NYSE:HMY) is a senior gold producer with a diversified mix of underground/open-pit primarily gold mining assets in South Africa, Papua New Guinea, and Australia. HMY derives a dominant portion of its gold production from South Africa and is prone to the South African risk factor (discussed later).

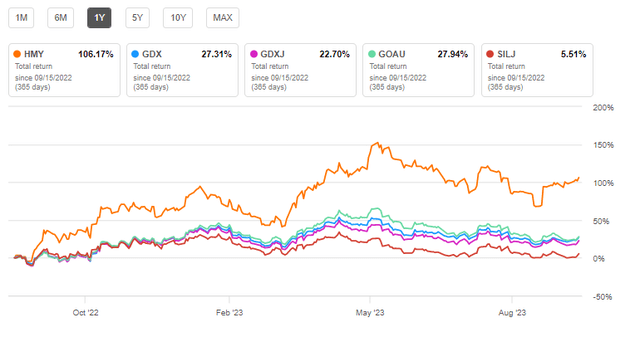

The company has a primary listing in South Africa, but its secondary NYSE listing, HMY, forms part of multiple prominent gold/silver miners’ ETFs (we’d call them the benchmark ETFs). For reference, HMY constitutes 1.20% (~0.79 MM shares), 1.84% (~16.76 MM shares), 3.06% (~0.64 MM shares), and 4.31% (~6.4 MM shares) of VanEck Gold Miners ETF (GDX), VanEck Junior Gold Miners ETF (GDXJ), U.S. Global Go Gold and Precious Metal Miners ETF (GOAU), and ETFMG Prime Junior Miners ETF (SILJ) respectively. Despite its secondary listing status, HMY provides adequate liquidity, as witnessed by the daily trading volumes averaging ~2 million shares. At the time of writing, HMY last traded at $4.31, way above the mid-point (at $3.685) of its 52-week range (between $1.94-$5.43). Interestingly, the stock’s 1-year total returns have significantly outperformed its benchmark ETFs. As such, I believe the growth element is primarily factored in the current share price, indicating that the stock is fairly priced.

1-Year Total Returns HMY v/s benchmark ETFs (Figure 1) Source: Seeking Alpha

In this article, we discuss HMY’s FY 2023 results, which were impressive. We also discuss the South African risk factor, which weighs on HMY’s 2024 growth outlook and impacts its apparently low valuation. Finally, we discuss HMY’s diversification strategy to expand its product/geographical footprint beyond South Africa. Let’s get into the details.

FY 2023 Review – Results and Expectations

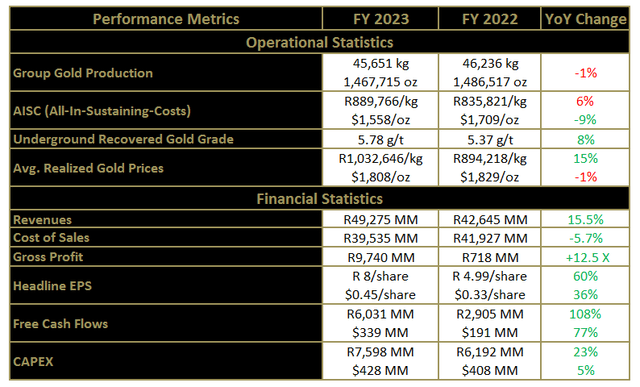

Let’s start with the headline numbers. Look at the table below (which compares HMY’s key 2023 operational/financial statistics with FY 2022) and my following commentary.

Harmony Gold’s FY 2023 Headline Statistics (Table 1) – Source: Author

1) Group Gold Production: On a consolidated basis, gold production remained flat during FY 2023, with a negligible YoY decline of only 1%. The decrease was partially attributable to the closure of the Bambanani mine in FY 2022 (nil production in 2023). Absent the impact of the Bambanani mine’s output, HMY’s YoY gold production increased by 2% (or 848 kg) during 2023.

FY 2024 production is expected to be within the range of 1,380,000-1,480,000 ounces. Assuming HMY’s 2024 gold production at the mid-point of the 2024 guidance range (at ~1,430,000 ounces), we might witness a YoY production decline of ~2.5%. However, strong gold recovery grades within the 5.60-5.75 g/t range will augment FY 2024 gold production, which could reasonably be expected to lie at the higher end of the guidance range.

2) Cost Performance: During 2023, HMY’s Rand-based AISC (All-In-Sustaining-Costs) increased by 6% YoY (from R835,821/kg to R889,766/kg). However, the revaluation of the USD against the Rand led to a YoY improvement in 2023 AISC (AISC declined from $1,709/oz to $1,558/oz). Interestingly, the Rand has considerably weakened against the USD during the past two years (check the chart below), implying that FY 2024’s increased AISC guidance of R975,000/kg would spell little trouble for HMY’s cost profile (USD terms).

ZAR/USD 2-Year Chart (Figure 2) – Source: XE

Besides the devaluation of the Rand, I believe HMY’s Phase II of the decarbonization program will favorably impact its production costs over the near-to-medium term. During Phase I, HMY commissioned 30 Megawatt renewable energy production at the Tshepong North/South Operations. This output amounted to ~20% of peak Free State daytime operational demand and ~6% of the daytime operational demand of HMY’s South African operations. Under Phase II, HMY plans to construct another 137 Megawatt of renewable energy (100 MW will be built using a Rand 1.5 billion green loan, while another 37 MW will be executed through a Power Purchase Agreement).

Phase I and II combined will account for approximately 30% of HMY’s peak daytime demand for its South African operations and will result in ~R425 million in annual electricity cost savings. While these cost savings only represent ~1% of HMY’s total ‘cost of sales’ for FY 2023, I expect them to increase (in real terms) in the future. On that note, Eskom’s (the South African utility company) tariff hike for electricity and water costs resulted in a 9% YoY increase in HMY’s cash operating costs. Rising oil prices will likely force Eskom to further increase its tariff during FY 2024. Combined with an overall weakening Rand against the USD, these catalysts indicate that HMY’s electricity cost savings from its decarbonization program will increase.

Nevertheless, I anticipate that the following challenges may impact HMY’s FY 2024 cost performance (the list is not exhaustive):

- A potential tariff increase by Eskom,

- The expected increase in power outages during Q2/Q3 of FY 2024 as Eskom struggles to meet the national electricity demand (including industrial demand for the mining sector),

- Cost inflation for imported materials and supplies (caused by supply chain issues/ the implications of the Russia-Ukraine conflict), etc.

3. Gold prices: HMY’s average realized gold prices marginally declined (~1% YoY) during 2023, from $1,829/oz to $1,808/oz. In Rand terms, the average realized gold prices increased from R894,218/kg to R1,032,646/kg (or 15% YoY).

During HMY’s Q1 2024 (period from July 2023 to date), I expect the average realized gold prices to be significantly increased to the range of ~$1,950/oz, implying a significant corresponding increase in Rand-based average realized gold prices (then again, thanks to a weak Rand-USD ratio). Also, it remains to be seen how the Fed’s September 2023 rate decision will affect the gold prices.

4. Revenues: HMY’s FY 2023 revenues of R49,275 MM witnessed a significant YoY increase of 15.5% despite the closure of the Bambanani mine in 2022. The revenue increase was primarily attributable to improved Rand-based gold prices YoY, stronger gold recovery grades, and a weakening Rand-USD ratio.

Since production volumes and average realized gold prices are expected to witness improvement in FY 2024 (as discussed above), I anticipate moderate revenue growth in FY 2024.

5. Profitability: HMY’s FY 2023 cost performance had been remarkable; the cost of sales declined YoY despite revenue growth. This resulted in a 12.5x increase in YoY gross profits, with headline EPS almost doubled to 800 SA cents (from 499 SA cents). In USD, the headline EPS improved from $0.33 to $0.45. In addition to the factors outlined in the ‘cost performance’ section, HMY’s FY 2024 bottom-line profitability will likely benefit from HMY’s operational optimization strategy.

As part of this strategy, the company decided to unbundle Tshepong operations into Tshepong North and Tshepong South to ensure smaller but more profitable mines. Similarly, portfolio optimization at the Target 1 mine will favorably impact HMY’s FY 2024 profitability. To quote the company’s CEO,

AISC for the South African underground optimised operations increased by 11% to R989,249/kg (US$1,732/oz) in FY23 from R888,636/kg (US$1 817/oz) in FY22. This increase was mainly due to flexibility and operational challenges including pillar failure, power failures and ventilation constraints at Target 1. The ongoing recapitalisation project at Target 1 is nearing completion and we anticipate margins and profitability to improve in the second half of FY24 on the back of improved operational performance, efficiencies and costs.

6) CAPEX and Free Cash Flow Growth: It’s worth noting that HMY’s strong operational cash flows enabled the company to witness >100% FCF growth (from R2,905 MM to R6,031 MM) despite a ~23% YoY increase in capital expenditure (from R6,192 MM to R7,598 MM). In 2024, HMY anticipates CAPEX to further increase to the tune of R9,500 million, mainly due to fleet replacement at the Hidden Valley mine to extend the mine life (or LoM) to FY 2028, an increase in ongoing development capital and investments in other projects (including LoM extension project at Moab Khotsong, and the expansion of the Kareerand Tailings Storage Facility at HMY’s Mine Waste Solutions business, etc.).

In my view, despite the expected increase in YoY CAPEX, HMY’s strong operating cash flows (in 2024) stemming from an overall improved gold price environment, together with increased gold production (augmented by strong gold recoveries), will enable the company to continue positive FCF generation.

The South African Risk

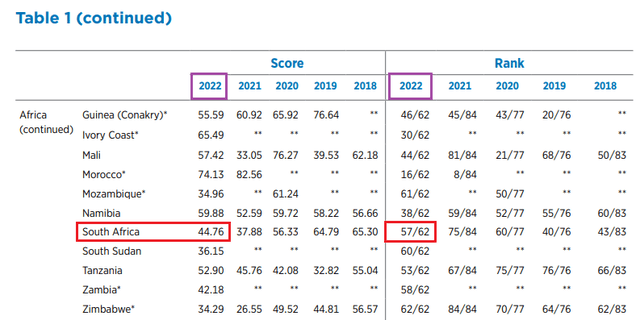

The Investment Attractiveness Index (or IAI) in the Fraser Institute’s 2022 Annual Survey of Mining Companies is a valuable metric to determine the mining attractiveness/ jurisdictional risks relevant to a particular jurisdiction. The 2022 survey report incorporated the results from 62 countries, and South Africa ranked fifth from the bottom (ranked 57/62; the lower the rank, the higher the risk). With an IAI score of 44.76 points, South Africa can be termed a Tier-3 (or high-risk) jurisdiction.

South Africa’s 2022 IAI score (Figure 3) – Source: Fraser Institute

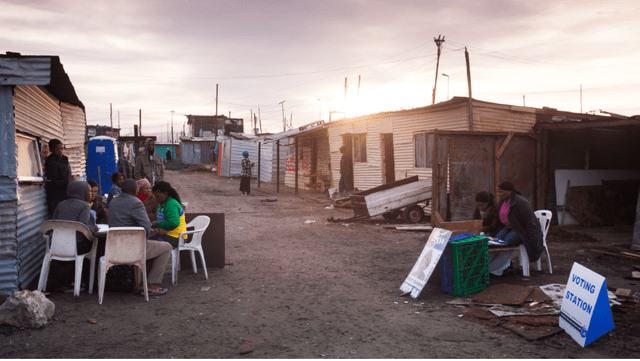

Besides power outages from Eskom, there are greater risks of political uncertainty in South Africa, especially with general elections coming up in 2024. Briefly, South Africa is affected by economic mismanagement (including corruption), rising inflation, deteriorating public/investor confidence in the State, and high levels of poverty/unemployment (fuelling the risk of crime/civil unrest). Some think tanks fear South Africa is fast moving toward achieving the status of a failed State.

Figure 4 – Source: BusinessTech South Africa

This political and economic turmoil is already impacting the mining sector through cost inflation, power cuts, etc. With a potential change in government, these risks can hurt the mining sector further through inconsistent government policy, higher taxation, wage disagreements, and other conflicts between the mining companies and other stakeholders (government authorities, mineworkers’ unions, etc.).

Valuation

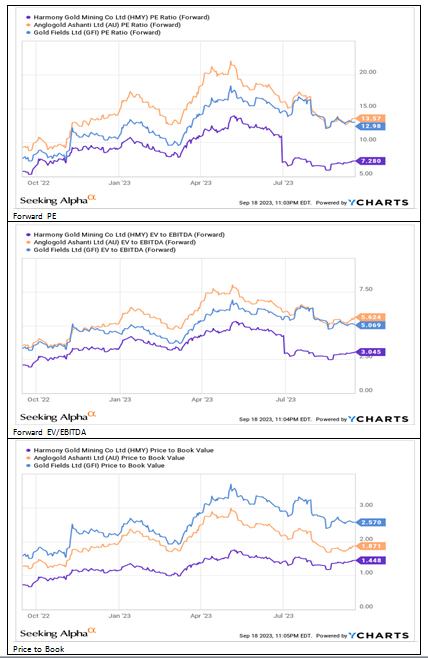

Compared with a couple of Africa-based senior gold producers, such as AngloGold Ashanti (AU) and Gold Fields (GFI), HMY appears to have an attractive valuation on multiple metrics, including forward PE, forward EV/EBITDA, and Price-to-Book ratios. However, I believe the apparently low valuation is indicative of the South African risk that weighs on an investment thesis in HMY. Notably, a dominant portion of HMY’s revenues comprises gold production from its South African assets (~65% of HMY’s 137.8 million gold-equivalent ounces mineral resources are related to its South African mines). Meanwhile, the other Africa-based gold miners have a more diversified portfolio of ‘producing’ assets.

Valuation – HMY v/s Peers (Figure 5) – Source: YCharts

Diversification – Ensuring Long-Term Growth

That said, I believe HMY’s diversification strategy (in its early stages) to expand beyond South Africa (and beyond gold) will benefit the company in the long run. On that note, HMY’s 50% stake in the Wafi-Golpu JV (currently in the permitting stage) in Papua New Guinea is an important catalyst that could add to the company’s growth story in the long run (expected first production from FY 2030 onward) while simultaneously catering to HMY’s product/geographical diversification needs (Wafi-Golpu is a long-life copper-gold JV between Harmony Gold and Newcrest Mining, with an option for PNG government to purchase up to 30% project stake). However, the recently acquired Eva Copper project in Australia is the more significant catalyst in the near-to-medium term as it represents an open-pit, Tier-1 copper-gold project capable of augmenting HMY’s long-term copper and gold production. As HMY is working on updating the project’s feasibility study, it’s possible that the company may add ~3.9 million gold-equivalent ounces (or more) to its mineral reserves once it concludes the study and will then issue updated guidance on the project development cost and funding structure.

Investor Takeaway

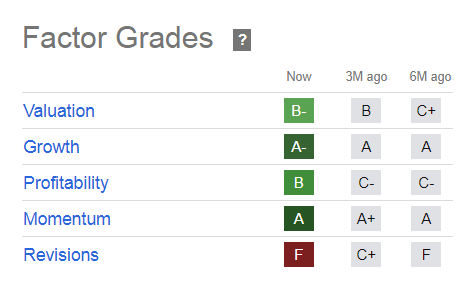

In the preceding discussion, we have discussed HMY’s growth story based on its exceptional operational/financial performance during FY 2023. The company’s FY 2024 operational guidance indicates room for moderate growth linked with catalysts such as a weakening Rand against the USD, increasing YoY gold production, improvement in recovery grades, expected cost reduction combined with higher average gold prices, potentially enhanced operating margins, and growth in CAPEX investments and Free Cash Flows. The above factors combined give the stock an appropriate quant rating based on largely positive factor grades. In my view, the growth prospects are largely factored in the share price, as evidenced by HMY’s total returns outperforming those of its benchmark gold/silver ETFs.

HMY’s Factor Grades (Figure 6) – Source: Seeking Alpha

Together with significant CAPEX investments (to the tune of R1,155 MM or ~12% of FY 2024 guidance) planned for the Hidden Valley mine in 2024, a strong balance sheet (net debt/EBITDA ratio declined from 0.6x to 0.2x during the last 6 months) to support development capital requirements, and the growth opportunity linked with diversified international projects (WGJV and Eva Copper), I believe HMY’s medium-to-long term (5-8 years, and beyond) growth outlook is bright.

Nonetheless, the South African risk factor weighs on the near-term investment thesis, and if, during the next 12 months, the price of gold retraces to the range of $1,850-$1,900/oz, it could spell trouble for the stock.

In view of the above, I think the stock is a ‘hold’ at present.

Read the full article here

Leave a Reply