There are several ways to capitalize on the recovery and return-to-growth of air travel. The most straightforward one is investment in airlines, though I consider airlines to be somewhat risky due to their stock price fluctuation on oil price data, capacity and fare change and macro-economic indicators. Airports are another way to capitalize but should also be carefully picked. Some airports, for instance, have a high CapEx burden in the coming years while others appreciated so much over the past year that there is little upside left. In this report I will be discussing the prospects of Grupo Aeroportuario del Pacífico, S.A.B. de C.V. (NYSE:NYSE:PAC) (“GAP”).

How Many Airports Does Grupo Aeroportuario del Pacífico Have?

Grupo Aeroportuario del Pacífico

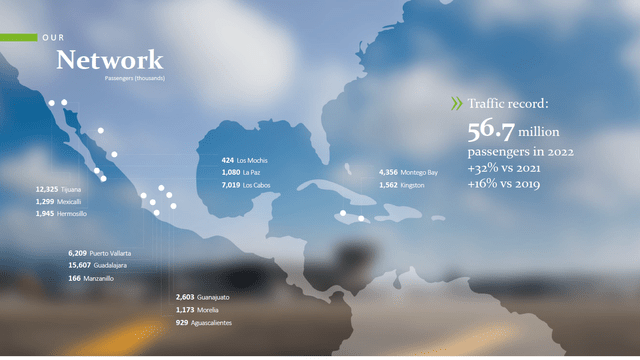

GAP operates 12 airports in Mexico and 2 airports outside of Mexico. In its Mexican airport portfolio, it has 5 out of the 10 biggest airports in Mexico. These airports are also of importance to GAP as it accounts for over 75% of the total number of passengers handled. The group owns 100% of the Kingston and Mexican airport operations while it owns 74.5% of the joint-venture operating the Montego Bay airport. GAP itself is owned for 15% by Controladora Mexicana de Aeropuertos and AENA (OTCPK:ANNSF) and for 85% by investors.

How Do Airports Make Money?

So, how do airports make money? The revenue stream consists of two parts, the first one is aeronautics revenues that include landing and departure fees, passenger charges, terminal space rentals, security and aircraft parking. The second stream is non-aeronautical revenues which include things like car parking, car rental, ground transportation, retail, food and beverages and fast track.

So, there are two revenue streams that are well-suited to capitalize on the travel rebound. On one hand, we have airlines increasing their flight schedules again, which benefits the airline via aeronautical revenues. On the other hand, the passengers are returning to the terminal halls and they have money to spend, which benefits the commercial revenues which form a big portion of the non-aeronautical revenues.

So, for an airport to make money you have to appeal to airlines providing smooth operations and offer travelers a unique experience.

A Look At The Grupo Aeroportuario del Pacífico Q2 2023 Financial Results

Grupo Aeroportuario del Pacífico

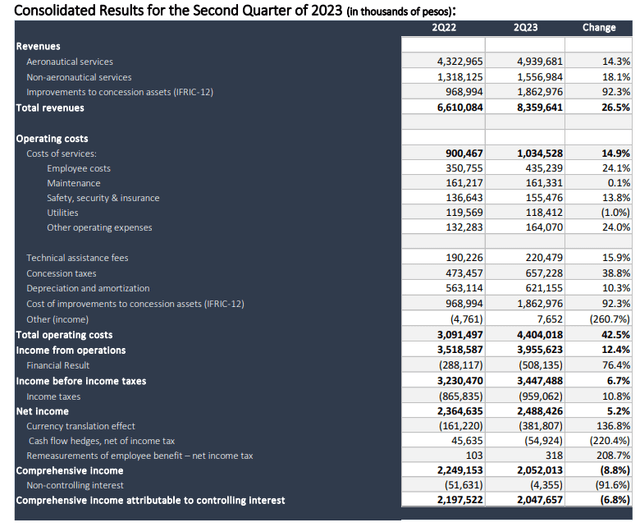

Total revenue increased by 26.5% or 15.2% excluding improvements to concession assets, which basically means pass through construction costs. Total operating costs increased by 42.5% or 19.7%. On 17.6% growth in passengers, the revenues excluding construction costs grew by 15.2% indicating lower revenue per passengers. This, however, was mostly caused by negative forex effects affecting the results of the Jamaican airports when translated to pesos. Cost growth outpaced top line growth pointing at margin contraction.

In Mexico, cost grew due to higher business activity, a 20% increase in minimum wages, higher utility costs and a higher headcount. In Jamaica, the costs increased by 28.6% due to higher construction costs and concession taxes but cost of services reduced by 8.8%.

EBITDA grew 12.1% to 4.58 billion pesos indicating a margin contraction of 11.3 points. Adjusted EBITDA margin, which I consider to be a better indicator due to the nature of the business with significant pass through costs and depreciation, contracted by 2.6 percentage points which I think is not too bad if we consider the forex headwind for the Jamaican operations and the minimum wage hike and head count growth in Mexico. While costs of services did increase by 14.9%, it should also be pointed out that as a share of adjusted revenues it actually declined from 16% to 15.9%. So, the results are not bad at all.

The Risks And Opportunities For Grupo Aeroportuario del Pacífico

Grupo Aeroportuario del Pacífico

Obviously, as an airport operator, there is a big dependence on continued demand for air travel, meaning that economic growth is a risk factor as well as an opportunity. Another opportunity is the continued penetration of air travel in Mexico. Mexico currently is an underpenetrated market for air travel, so there is a significant growth ahead that could benefit airports.

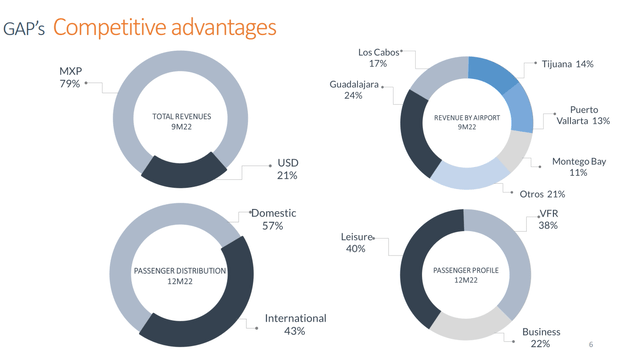

Perhaps if you think about Mexico, you might think of it as a tourist destination. However, GAP’s passengers are a mix of Leisure (40%), VFR (38%), and business (22%). So, this is not an airport group that almost exclusively relies on either business or leisure. As the market remains underpenetrated there is a huge potential for higher passenger numbers, and GAP is positioning for that with expansion of Guadalajara Airport with a second terminal and runway, as well as terminal expansions in other airports and development of commercial spaces, parking lots, hotels, corporate offices and VIP lounges.

What I would consider a bigger risk is the gang violence in Mexico, but it should be noted that not all airports are in parts of Mexico with gang conflicts and it is also not the case that if an airport is in a conflict area that the entire area is unsafe. Nevertheless, the biggest risk for the ability to attract business and leisure passengers in my view is the cartel-related violence in Mexico.

Is Grupo Aeroportuario del Pacífico Stock A Buy?

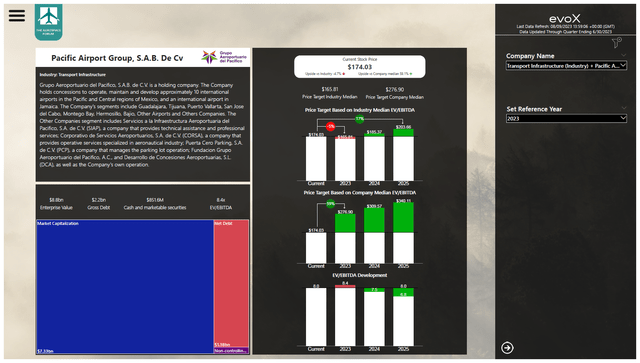

Grupo Aeroportuario del Pacífico stock price valuation using evoX Financial analytics (The Aerospace Forum)

I previously marked the stock a buy and I am maintaining that buy rating as the PAC trades significantly below its median EV/EBITDA which provides 60% upside with 2023 results in mind. I wouldn’t want to make the case that the price should be 60% higher but I do believe that with the significant discount to the median EV/EBITDA, it is justified to pull the forward earnings for 2025 into the current stock price in which case the company will still trade at a significant discount compared to its usual multiple. As a result I am marking shares a buy with a $203.66 price target.

Conclusion: Grupo Aeroportuario del Pacifico Stock Was A Buy, Still A Buy

Currently, analysts have a price target of $199.40 per share which provides 15% upside and is in line with the 17% upside I see for the stock. I believe the current stock price does not accurately reflect the usual EV/EBITDA that the company normally trades on. It also does not reflect the growth that can be expected from growth in passenger numbers as domestic and international travel increases. Airports in Mexico have to perform hub functions for international traffic, as there is no clear development plan for improving connectivity for the country’s capital, which I believe will benefit other airports in GAP’s portfolio (Mexico City Airport is not in their portfolio). In 2018, the development of a state-of-the-art new Mexico City airport was cancelled, leaving the capital with a capacity-constrained airport allowing other airports in the country to play a more meaningful role in international connections. As the airport group with the highest market share, GAP might not be seeing an expansion drift to add to the airport portfolio, but we will most definitely see expansion to drive further commercial value and capacity for additional passenger traffic.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply