Introduction

Grindrod Shipping (NASDAQ:GRIN) is one of the smaller bulk carrier companies owning 12 Handysize and 7 Ultramax/Supramax vessels. Its fleet average age is 9.6 years, and it is all built in Japan. None of the company’s vessels have installed scrubbers.

GRIN has a robust balance sheet with $71 million cash and $168 million total debt (including lease obligations). The company’s debt to equity and total liabilities to assets fall in the lower percentile rank than its peers. The last quarter’s figures were disappointing due to declining daily rates. However, GRIN realized substantial FCF, partially driven by the sales of a few vessels. The company paid dividends with an attractive yield. Unfortunately, last year, GRIN management decided to reduce its distribution capital. This means lower yields for the shareholders.

GRIN offers a margin of safety with a 0.59 MCAP/NAV ratio. The company trades below its five-year average figures and peaks. The lack of scrubber-equipped vessels, a large percentage of chartered-in ships, and expected lower dividend yields puts GRIN on the watch list for the foreseeable future.

GRIN fleet overview

GRIN owns 19 vessels and operates six additional under long-term charter agreements. The chart below from the company website shows GRIN’s current fleet.

GRIN website

GRIN is focused on 28,000 to 64,000 dwt sized ships: 12 Handysize vessels (28,200 – 38,460 dwt) and 7 Ultramax/Panamax (58,000 – 64,000 dwt). All ships are built in Japan.

None of the company’s vessels have installed scrubbers. It is a deliberate decision announced by the company’s management in its 2021 ESG report. However, 100% of its fleet has a Ballast Treatment system (BWT). BWT does not directly impact the company’s bottom line. However, from September 2024, it will be mandatory for all vessels over 400GT following the IMO Ballast Water Management Convention. Besides that, almost all ships have Variable Frequency Drives (VFD) installed on essential auxiliaries. They significantly improve equipment efficiency, resulting in reduced fuel consumption.

The company has multiple changes in its fleet in 2023. In August, it sold two Ultramax vessels: IVS Bosch Hoek, 2015, built, and IVS Hayakita, 2016, built for $46.5 million. In September, the company decided to sell 2013-built Handysize IVS Raffles for $11.6.

Apart from its ships, GRIN operates six chartered-in Supramax/Ultramax vessels. There are under long-term charters (longer than one year). In such a way, GRIN locks TC rates for the long term. In the meantime, the company can contract those vessels under shorter spot charters if the day rates are rising, thus earning a premium.

Chartered-in vessels in its portfolio add voyage costs to GRIN’s cost structure. The voyage costs include bunker costs, port charges, stevedoring charges, canal transit dues, and cleaning cargo holds.

3Q23 highlights

The 3Q23 report was disappointing for investors. GRIN realized 3Q23 net loss of $6.5 million and $11.2 million adjusted EBITDA (81% decline YoY). The company revenue YoY grew because of vessel sales. In 3Q23, 52% of the company’s revenue came from ship sales, while in 3Q22 2%. The declining day rates over the first three quarters in 2023 squeezed the company’s margins. Daily operational costs increased by 2.3% for Handysize ships and 10.1% for Supramax/Ultramax ships. The reason is extended periods for maintenance requiring more crew.

In 3Q23, TC rates were $9,744 for Handysize and $12,380 for Supra/Ultramax. In 3Q22, TC rates were $23,257 for Handysize and $24,645 for Supra/Ultramax. Over the last two months, the disruptions caused by the Panama Canal drought and Red Sea issues impacted all ships. Bulkers are affected mainly by the former. For 4Q23, GRIN vessels were chartered under higher rates QoQ: $10,400 for Handysize and $15,235 for Supra/Ultramax.

The company announced its plans for capital reduction, limiting the shareholders’ total cash distribution to $45 million. On August 10, 2023, the resolution was approved.

GRIN financials

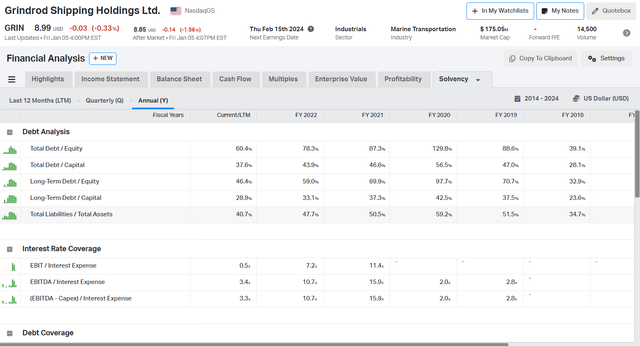

GRIN has a healthy balance sheet with $71.3 million cash and $168 million total debt. The company has reduced its debt burden by over 50% since 2020.

Koyfin

$10 million of the proceeds from Hayakita and Bosch Hoek sales were used to repay the company’s debt. GRIN has adequate liquidity, too. The annual Interest expenses are $15-$17 million, resulting in 3.4 EBITDA/Interest Expenses.

Let’s compare GRIN’s balance sheet with its peers:

- Grindrod Shipping (GRIN) $71 million cash; $168 million total debt; 0.42 cash to total debt ratio, total debt to equity 60%

- Genco Shipping (GNK) $48 million cash; $144.6 million total debt; 0.33 cash to total debt ratio, total debt to equity 15%

- Safe Bulkers (SB) $74 million cash; $440 million total debt; 0.17 cash to total debt ratio, total debt to equity 57%

- Pangaea Logistics (PANL) $87 million cash; $275 million total debt; 0.31 cash to total debt ratio, total debt to equity 73%

- Diana Shipping (DSX) $175 million cash; $657 million total debt; 0.26 cash to total debt ratio, total debt to equity 135%

GRIN has the highest cash-to-total debt ratio. Moreover, the company has a healthy capital structure with 60% debt to equity and 40.7% total assets to total liabilities.

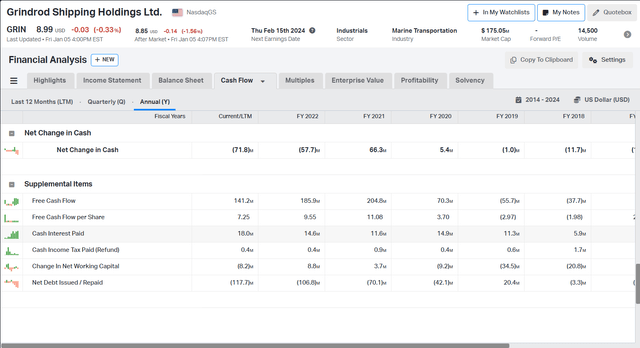

GRIN keeps generating free cash flow despite the lower rates and declining net profits. The chart below shows GRIN’s FCF over the last five years.

Koyfin

For nine months of 2023, GRIN realized $141 million in free cash flow or $7.25 per share. Approximately $50 million came from the sales proceeds. Even then, $91 million is a respectable figure for a company with a $175 million Market Cap.

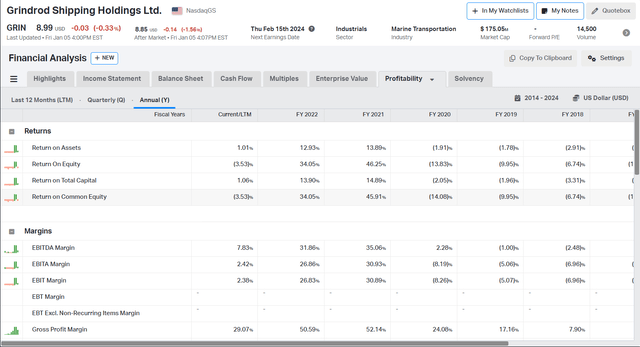

Over the years, GRIN margins and returns are shown in the table below.

Koyfin

The company’s focus on longer-period charters mitigates the risk of declining day rates. However, it has its price. In a growing day rates environment, it has a high opportunity cost. I expect the rates to rise in the coming months, lifting all boats. However, the best-positioned companies focus on spot charters instead of period time charters.

Last but not least, let’s see how GRIN’s performs against its peers:

- Grindrod Shipping (GRIN) 29% gross margin, 7.8% EBITDA margin, (3.5)% ROE, 1.0% ROTC

- Genco Shipping (GNK) 36.5% gross margin, 26.3% EBITDA margin, 1.2% ROE, 3.71% ROTC

- Safe Bulkers (SB) 62% gross margin, 52% EBITDA margin, 11.1% ROE, 5.1% ROTC

- Pangaea Logistics (PANL) 21% gross margin, 17% EBITDA margin, 11.4% ROE, 5.2% ROTC

- Diana Shipping (DSX) 65% gross margin, 49% EBITDA margin, 14.4% ROE, 6.0% ROTC

GNK had a disappointing quarter, too, although it realized better margins and returns. GRIN figures are closer to PANL. The latter, however, has a different business model. It owns ice-class vessels and gives them under voyage charters. In that case, operating and voyage costs are on the owner. This means lower profit margins for the company, although lower risk.

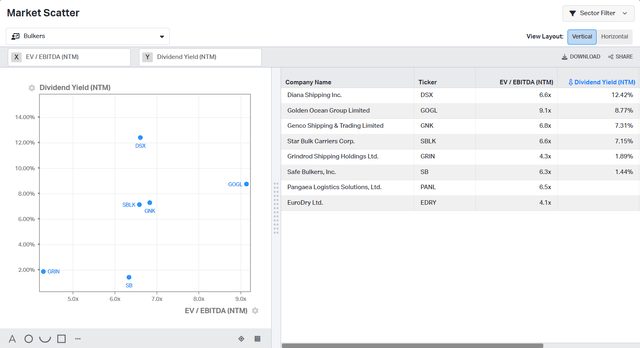

The decision to reduce the distributing capital is disappointing. The graph below compares similar-sized bulk carrier companies on EV/EBITDA and dividend yield. Both metrics are NTM.

Koyfin

GRIN and EDRY have the lowest EV/EBITDA. Apart from that, the GRIN NTM dividend yield is 1.89%. Investing in the company means we pay 4.3 EV/EBITDA to obtain 1.89%. It is not the best deal. GNK (6.8 EV/EBITDA and 7.31% dividend yield) and DSX (6.6 EV/EBITDA and 12.42% dividend yield) offer more value for their price.

GRIN Valuation

Let’s see how valuable GRIN is based on NAV. To estimate vessel prices, I use Fearnley’s last report.

Fearnley

GRIN has 12 Handysize vessels and 7 Ultra/Supramax vessels. The replacement cost of its fleet is $378 million. The company has $107 million in current assets and $192 million total liabilities, resulting in NAV of $293 million. The company’s market cap is $175 million. In other words, we pay $0.59 per $1 for GRIN’s net assets.

Now let’s compare GRIN against its peers:

- Grindrod Shipping (GRIN) 0.73 EV/Sales, 9.34 EV/EBITDA, 0.57 P/BV

- Genco Shipping (GNK) 1.99 EV/Sales, 7.56 EV/EBITDA, 1.02 P/BV

- Safe Bulkers (SB) 2.8 EV/Sales, 5.38 EV/EBITDA, 0.57 P/BV

- Pangaea Logistics (PANL) 1.22 Ev/Sales, 7.15 EV/EBITDA, 1.12 P/BV

- Diana Shipping (DSX) 2.83 EV/Sales, 5.72 EV/EBITDA, 0.62 P/BV

GRIN trades at the highest EV/EBITDA, lowest EV/Sales, and the second lowest Price/TBV. The last step is to measure GRIN multiples against its past figures.

Koyfin

The company trades below its five-year average figures (1.3 EV/Sales, 39.2 EV/EBITDA, 0.71 P/BV) and peaks (2.9 EV/Sales, 449 EV/EBITDA, 1.6 P/BV). Using NAV and comparative valuation, GRIN is undervalued, offering a 41% margin of safety. The discounted price, however, is not a sufficient reason to invest. I believe the market discounts GRIN’s arguably questionable decisions not to install scrubbers and to cut the capital for distribution.

Risks

Financially, the company is sound. It has liquidity to cover its debt and operations. GRIN management has sold a few vessels, adding liquid assets to the company’s balance sheet to renew its fleet. More pronounced, in my opinion, is the operational risk. The company has six chartered-in vessels, which equals 30% of its fleet.

I am not keen on the high percentage of chartered-in ships compared to the company’s fleet. At first glance, it is enticing because the company saves capital costs. But this feature comes at a price. Operating your fleet is better in a rising rate environment. The reason is twofold: by owning the vessels, the company benefits from soaring secondhand prices due to growing day rates. This means the company’s NAV grows, and the management can sell the ships later in the cycle for capital gains. The second reason is the simplified cost structure. By chartering vessels, the company must cover operational and voyage costs while running its ships.

Investors takeaway

GRIN owns 12 Handysize and 7 Ultramax/Supramax vessels. Its fleet average age is 9.6 years. Apart from its fleet, the company has six chartered ships. GRIN has a sound balance sheet with $71 million cash and $168 million total debt. The company’s debt to equity and total liabilities to assets fall in the lower percentile rank than its peers. The company has lower margins and returns compared to its peers. GRIN trades at a discount to MCAP/NAV, five-year average figures, and peaks. The lack of scrubber-equipped vessels, a large percentage of chartered-in ships, and expected lower dividend yields puts GRIN on the watch list for the foreseeable future.

Read the full article here

Leave a Reply