Investment thesis

My initial bullish thesis about Green Brick Partners (NYSE:GRBK) did not age well, as the stock price dropped by about a third over the last quarter. However, my analysis suggests that the recent sell-off is more likely due to the overall weakening investors’ sentiment and not due to the GRBK’s underlying fundamentals. According to my analysis, the company is highly likely to absorb positive secular shifts in the American homebuilding industry as it demonstrates best-in-class profitability and operational excellence. GRBK’s strong balance sheet provides the company with more financial flexibility, which is also good amid the current high rates environment. Last but not least, my valuation analysis suggests that the stock is about two times undervalued. That said, I upgraded my rating for GRBK to “Strong Buy”.

Recent developments

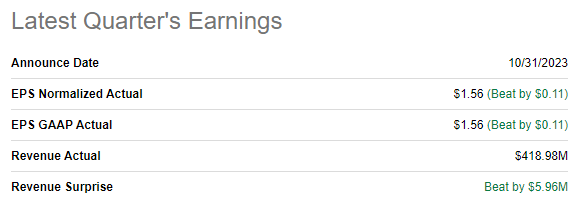

The latest quarterly earnings were released on October 31, when the company topped consensus estimates. Despite the current challenging environment of high-interest rates, revenue demonstrated solid dynamics with a slight 2.7% YoY growth. The adjusted EPS was about flat YoY with a one-cent decrease.

Seeking Alpha

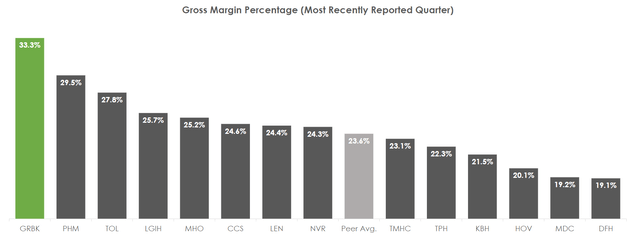

According to the latest 10-Q report, home deliveries increased by 16% YoY, and net new home orders increased by 95%, which are solid bullish signs amid the current weak macro environment. The increase in home deliveries was powered by the improved cycle times for home closing, which were reduced by a notable 41 days sequentially. Strength in volume dynamics was partially offset by a 9.2% average price YoY decrease, which looks fair in the current environment of high interest rates. Another positive sign is that the Homebuilding gross margin achieved a record level of 33.3%, the highest among public homebuilders.

GRBK’s latest earnings presentation

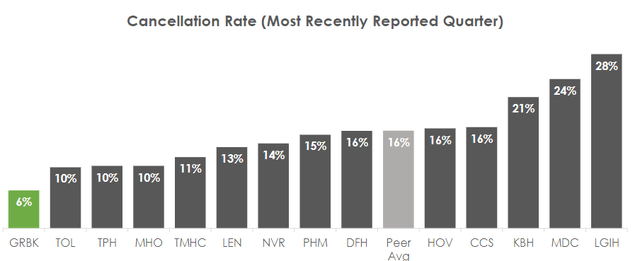

Having a best-in-class gross margin means the company has more room to reinvest in the business and spend on marketing, which will likely become a solid long-term driver in building shareholder value. I would also like to underline that GRBK’s gross margin outnumbers its closest competitors by a notable margin, which means the company has higher customer loyalty, enabling it to pass on the inflationary effects to buyers. Solid cancellation rate stats also support my reasoning regarding strong customer loyalty compared to competitors.

GRBK’s latest earnings presentation

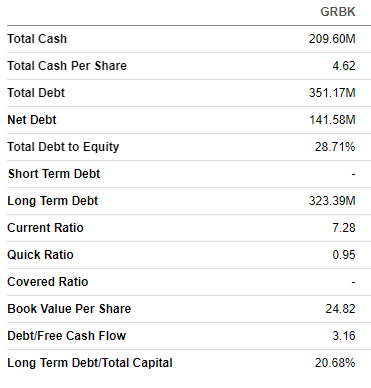

The company’s solid financial performance and resilient profitability metrics amid the current macro turmoil suggest the high quality of management’s execution and sound strategic priorities. Apart from the operational excellence, I also like the prudent approach to capital allocation, which is crucial in the current environment of high-interest rates and tightening credit conditions. The leverage ratio is low, and the central part of the debt is long-term. Near-term liquidity is also in strong shape and I see no potential disruptions for GRBK from the balance sheet perspective. The company’s solid above $200 million total cash position is also crucial because it provides more financial flexibility in the current environment of high rates.

Seeking Alpha

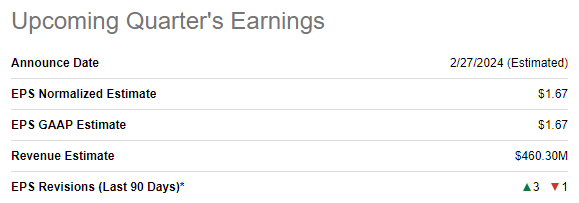

The upcoming quarter’s earnings are scheduled for February 27, 2024. Quarterly YoY revenue growth is expected by consensus to accelerate to almost 7%, which looks like a solid dynamic. Another bullish sign is that the adjusted EPS is also expected to expand notably YoY from $1.18 to $1.67.

Seeking Alpha

The company’s strong performance amid the current macro turmoil does not surprise me. First, GRBK’s solid profitability allows it to invest in streamlining and improving internal processes, resulting in decreased lead times and increased operational productivity. This ultimately leads to increased operating capacity and drives down costs. Second, the substantial underinvestment in the American homebuilding industry after the Great Recession is another tailwind for GRBK, which is secular. Third, the U.S.’s largest population group, millennials, is entering the housing market, which spurs the demand for residential real estate even in the current environment of expensive mortgages. According to Fox Business, the U.S. housing market needs one million more homes to satisfy the demand. That said, I believe that secular tailwinds multiplied by GRBK’s operational and financial excellence make the company well-positioned to sustain solid growth momentum over the long term.

Valuation update

The stock rallied by 56% year-to-date, significantly outperforming the broader U.S. market. Seeking Alpha Quant assigns the stock with a “B+” valuation grade, which is decent. Indeed, most of the ratios look attractive compared to the sector median and historical averages. However, some of the ratios might indicate overvaluation, so I have to expand my analysis with another approach.

Seeking Alpha

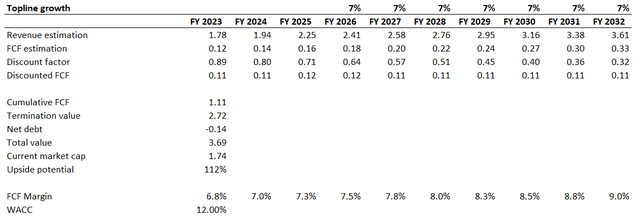

Given that GRBK is a growth company, I believe that the discounted cash flow [DCF] approach would be suitable to proceed with. I use an elevated 12% WACC due to the Fed’s recent hawkish stance. Consensus revenue estimates were upgraded after the earnings release, and I need to incorporate this. I want to underline that consensus estimates are available only until FY 2025, and for the years beyond, I project a 7% revenue CAGR. I implement a 6.8% TTM FCF margin ex-SBC and expect a 25 basis points yearly expansion.

Author’s calculations

My DCF simulation shows the business’s fair value is almost $3.7 billion, with very conservative underlying assumptions implemented. This amount is more than twice higher than the current market cap, indicating a 112% upside potential for the stock price. My target price for GRBK is around $80 per share.

Risks update

The current stock market sentiment is weak as the Fed’s tight monetary policy seems to start weighing on corporate profits. Last week’s Big Tech earnings releases disappointed investors, especially from the cautious Q4 guidance from top managers. As more than a quarter of the S&P 500 index is represented by the Technology sector, the financial performance of the sector’s largest names significantly affects the whole U.S. stock market. That is the reason why the near-term sentiment around GRBK might be weak, even despite strong financial performance.

The vast uncertainty regarding the macro environment is also a significant risk in the near term. Interest rates are high and there is little certainty regarding the timing of the Fed’s pivot in its monetary policy, geopolitical tensions are escalating, and 2024 is the American presidential election year, adding uncertainty and volatility to the stock market. That said, potential GRBK investors should be ready to stomach substantial volatility and have a long-term mindset.

Bottom line

To conclude, GRBK is a “Strong Buy”. The near-term uncertainty is massive, but I think the upside potential far outweighs all the risks. Despite substantial near-term volatility, I am highly convinced that GRBK is a strong long-term bet in the home building industry, which is poised to experience multiple secular tailwinds. GRBK’s strong performance and solid financial position make it well-positioned to capture positive secular shifts in the industry.

Read the full article here

Leave a Reply