Investment Action

In the second quarter of 2023, GlobalFoundries Inc (NASDAQ:GFS) demonstrated commendable financial performance. This achievement was not merely a result of favorable market conditions but also a testament to the company’s strategic foresight and adaptability. Their robust demand in sectors like automotive, industrial IoT, and aerospace and defense underscore their pivotal role in the ongoing technological transformation. Moreover, their strategic alignment with the transition to autonomous, connected, and electrified vehicles further solidifies their position as a key enabler in the automotive evolution.

However, the semiconductor landscape in 2023 was not without its challenges, including supply chain disruptions, geopolitical tensions, and rapid technological advancements. GlobalFoundries faced a substantial drop in revenue from communications infrastructure and data centers due to these challenges. As the semiconductor industry approaches groundbreaking advancements like quantum computing and AI chips, GlobalFoundries is poised to be the market leader. Yet, uncertainties persist, given anticipated revenue challenges and the inherent cyclical nature of the semiconductor sector. Considering these dynamics and a lack of margin of safety in its current share price, I recommend a hold rating for GFS.

Basic Information

GFS is a leading semiconductor manufacturing company at the forefront of technological innovation. Specializing in the fabrication of advanced semiconductor chips, GFS serves a diverse range of industries, from automotive and industrial IoT to aerospace and defense. With a strategic focus on cutting-edge technologies, innovation, and adaptability, GFS enables its clients to develop and deliver the next generation of electronic devices, from smartphones and autonomous vehicles to advanced IoT devices and more. The company’s commitment to excellence and its track record of resilience position it as a key player in the semiconductor industry, addressing the growing demand for high-performance, energy-efficient, and technologically advanced chips.

Over the past five years, GFS’s revenue trends have closely mirrored macroeconomic conditions. The notable decline in GFS’ revenue in 2020 can be primarily attributed to the adverse impact of the COVID-19 pandemic. The pandemic resulted in reduced demand for semiconductors due to economic uncertainties and disruptions in various industries. Moreover, the global supply chain disruptions stemming from the pandemic posed challenges for GFS in procuring essential raw materials and components necessary for semiconductor production.

In addition to pandemic-related challenges, GFS faced intensified competition from other semiconductor manufacturers. These competitors had been making substantial investments in cutting-edge manufacturing technologies, enabling them to produce more advanced semiconductors at a lower cost.

Looking to 2022 and 2023, the company experienced robust revenue growth. This growth was primarily driven by the global semiconductor shortage, which created an upsurge in demand for semiconductors across various sectors. As a result, GFS benefited from increased orders and heightened market demand during this period. However, this robust demand for semiconductors has created access inventory issues, which leads to a poor 2023 demand outlook.

Review

In the second quarter of 2023, GFS witnessed a notable increase in its revenue, reaching approximately $1.845 billion. This figure was at the upper end of their projected guidance, showcasing the company’s strong performance for the quarter. A significant factor contributing to this better-than-expected performance was the favorable timing of positive manufacturing variance. However, it’s worth noting that they anticipate this variance to moderate as they move into the second half of 2023.

Furthermore, the company reported an adjusted gross margin of 29.6%, which surpassed their initial guidance range. This achievement underscores the company’s ability to maintain profitability and manage costs effectively. In terms of earnings per share, GFS delivered an adjusted value of $0.53, aligning with the high end of their guidance range. This EPS figure further emphasizes the company’s robust financial health during the quarter.

GFS has been observing a robust demand in several rapidly growing markets, particularly in the automotive, industrial IoT [Internet of Things], and aerospace and defense sectors. Within the automotive industry, the company is playing a pivotal role in supporting the significant transition from traditional internal combustion engine vehicles to ACE vehicles, which stands for Autonomous, Connected, and Electrified vehicles. This transition represents a massive shift in the automotive landscape, and GFS is positioning itself as a key enabler in this evolution.

Moreover, the company’s product portfolio is strategically designed to cater to the increasing demands of automotive manufacturers. These manufacturers are not only aiming to compete based on traditional metrics but are also focusing on offering differentiated driver experiences and advanced features. They are also ensuring their electronic architectures are compliant with evolving safety and security standards, and GFS is aiding in this endeavor.

In the realm of smart mobile devices, GFS is making strides to establish its leadership. The company is actively working to remix its business to cater more to the premium-tier handset market. This segment of the market has demonstrated greater resilience in demand, making it a lucrative focus area for the company.

In the midst of 2023’s second quarter, the semiconductor industry, as described by management, was navigating a complex landscape. This industry, inherently cyclical and influenced by global economic dynamics, faced a series of challenges. From disruptions in the supply chain to geopolitical tensions affecting international trade and the relentless pace of technological advancements necessitating hefty R&D investments, the hurdles were numerous.

In the second quarter of 2023, GFS faced a notable downturn in its revenue streams, particularly in the sectors of communications infrastructure and data centers. The company reported a sequential decline of approximately 40% and a year-over-year drop of about 38%. This significant reduction was primarily driven by decreasing volumes. Delving deeper into the reasons, it became evident that prolonged levels of inventory in the data center sector played a crucial role. This accumulation might have been a result of previous overestimations of demand or potential supply chain disruptions leading to a backlog of unsold products. Additionally, there was a discernible softening in the demand for enterprise wired infrastructure. This could be indicative of a broader industry trend, with enterprises possibly gravitating towards wireless solutions or even cloud-based infrastructures, thereby diminishing the reliance on traditional wired systems. As GFS looks ahead, the company anticipates this revenue decline in these specific sectors to continue throughout the latter half of 2023. However, in response to these challenges, GFS is strategically pivoting, planning to channel its manufacturing capacity towards more promising and lucrative markets, with the automotive sector being a prime focus.

Yet, against this backdrop, GFS emerged as a beacon of resilience. Their ability to achieve results at the pinnacle of their guidance wasn’t just a testament to their robust strategies but also a reflection of their adaptability in a volatile market. Several factors underpinned this success. A diversified product portfolio ensured they catered to a broad spectrum of sectors, insulating them from downturns in any particular segment. Strategic partnerships with industry giants like Lockheed Martin (LMT), aimed at advancing U.S. semiconductor manufacturing and innovation, have potentially strengthened GFS’ market position, ensuring a steady demand for their products.

Furthermore, GFS’ unwavering commitment to innovation and research might have been their ace in the hole. By staying at the forefront of technological evolution, they could offer clients cutting-edge solutions, setting them apart in a competitive market. Operational efficiency, marked by streamlined processes and a focus on waste reduction, likely played a pivotal role in bolstering their margins, even amidst industry challenges.

But GFS’ vision wasn’t confined to the present. They were already charting the course for the future. With the semiconductor realm on the brink of revolutionary breakthroughs, from the promises of quantum computing to the advancements in AI chips, GFS was gearing up to be at the vanguard of these transformations. Their forward-looking approach, centered on seizing growth opportunities, showcased a company not just focused on the immediate but one with an eye on long-term industry dominance.

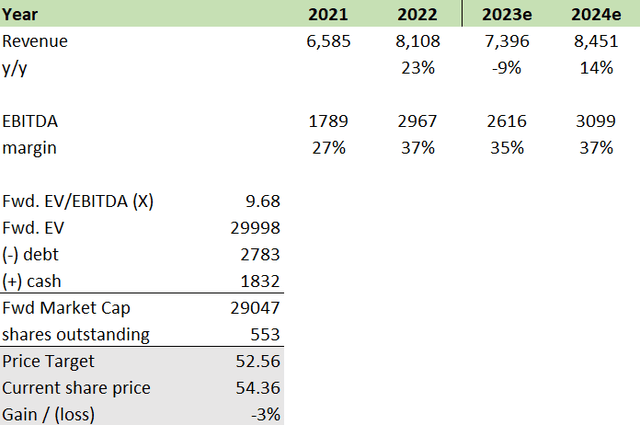

Valuation

For 2023, GFS’ revenue is estimated to be $7.39 billion, representing a decline of 9% compared to the revenue of 2022. This projection is grounded in the management guidance provided during their earnings call. The semiconductor industry faced challenges, including supply chain disruptions, geopolitical tensions, and the rapid pace of technological advancements. A significant downturn was observed in the sectors of communications infrastructure and data centers, attributed to prolonged inventory levels and a shift in enterprise infrastructure demand. However, collaborations, such as the one with Lockheed Martin, aimed to fortify GFS’ market position and ensure consistent demand.

Moving to 2024, the revenue is anticipated to be $8.45 billion, marking a growth of 14% compared to the projected revenue of 2023. This projection aligns with the market consensus. Factors driving this assumption include robust demand in rapidly growing markets, especially automotive, industrial IoT, and aerospace and defense sectors. The transition to ACE vehicles in the automotive sector is particularly noteworthy. Despite challenges in 2023, GFS showcased adaptability, achieving results within the top range of their guidance. Their diversified product portfolio and strategic partnerships are expected to continue bolstering their market position. Furthermore, GFS’ commitment to staying at the forefront of technological evolution is anticipated to offer clients cutting-edge solutions, setting them apart in a competitive market.

Author’s work

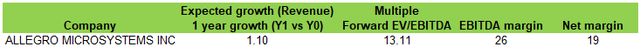

GFS is presently trading at an approximate forward EV/EBITDA multiple of ~9.7x, while its industry peer is trading at around ~13x. Despite GFS boasting a superior EBITDA margin of ~34%, compared to its peer’s ~26%, it lags in terms of projected one-year growth, with an expectation of ~3% versus the peer’s more robust ~10%. Additionally, GFS’s net margin stands at about ~15%, which is overshadowed by its peer’s ~19%.

The semiconductor sector’s cyclical nature means that investors often prioritize revenue and net margin projections, as these are crucial indicators for the outlook of businesses in this industry. Given GFS’s lower revenue growth forecast compared to peers, it’s justifiable that its forward EV/EBITDA trades slightly below its faster-growing counterpart. My model pegs GFS’s target share price at approximately $52.5, aligning with its current market price. Taking all these factors into account, I recommend a hold rating on GFS.

Author’s work

Risk and Final Thoughts

One potential upside risk to my hold recommendation on GFS stems from the swift advancement of technologies like 5G, IoT, and AI. These developments are driving an increasing demand for sophisticated semiconductors. Should GFS adeptly seize this opportunity and expedite its innovation endeavors in these domains beyond current projections, it might witness a pronounced uptick in product demand. This, in turn, could translate to elevated revenues and enhanced profitability, possibly surpassing management’s current forecasts. Moreover, if GFS clinches pivotal contracts or forges strategic alliances pertaining to these tech firms, or announces groundbreaking innovations, it could act as a catalyst for the stock. In such an event, the hold recommendation could potentially underestimate the share price GFS.

In the second quarter of 2023, GFS demonstrated a commendable financial performance, hitting revenue figures at the upper echelons of their guidance. This achievement was not merely a result of favorable market conditions but a testament to the company’s strategic foresight and adaptability. Their robust demand in sectors like automotive, industrial IoT, and aerospace and defense underscore their pivotal role in the ongoing technological transformation. The company’s strategic alignment with the transition to Autonomous, Connected, and Electrified vehicles further solidifies its position as a key enabler in the automotive evolution.

However, the semiconductor landscape in 2023 was not without its challenges. The industry grappled with supply chain disruptions, geopolitical tensions, and the relentless pace of technological change. For GFS, these challenges manifested in a significant downturn in revenue from communications infrastructure and data centers. Yet, the company’s resilience shone through. Their diversified product offerings, partnerships with industry leaders like Lockheed Martin, and unwavering commitment to innovation have fortified their market position.

As the semiconductor industry stands on the cusp of groundbreaking advancements, from quantum computing to AI chips, GFS is poised to be a frontrunner. Yet, given the anticipated revenue challenges and the inherent cyclical nature of the semiconductor sector, uncertainties persist. Considering these dynamics and taking into account GFS’ current strengths while recognizing the potential challenges ahead, I recommend a ‘hold’ rating for GFS.

Read the full article here

Leave a Reply