Global manufacturing remained in the doldrums in October, according to the latest JPMorgan Global Manufacturing Purchasing Managers’ Index™ (PMI®) compiled by S&P Global. The headline PMI registered 48.8, down from 49.2 in September to indicate a deterioration in business conditions for a fourteenth successive month.

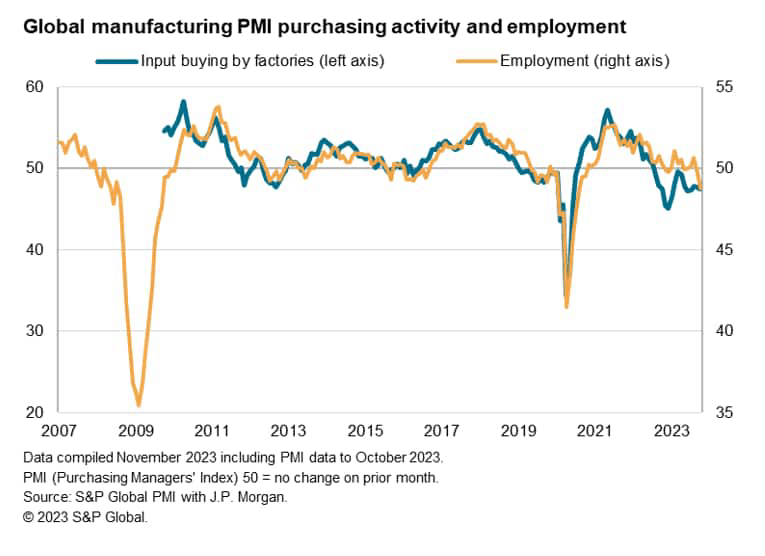

Production continued to edge lower, led by a further deterioration in order books. A lack of demand from customers pushed businesses into gloomier moods, in turn causing firms to cut back further on their purchasing of materials and on their payroll counts. The latter fell globally at the steepest rate since 2009 barring only the initial pandemic lockdown months.

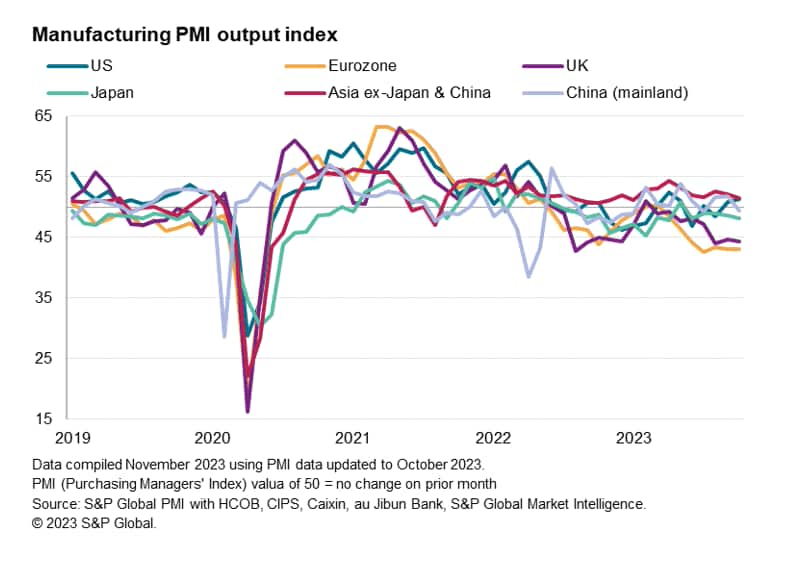

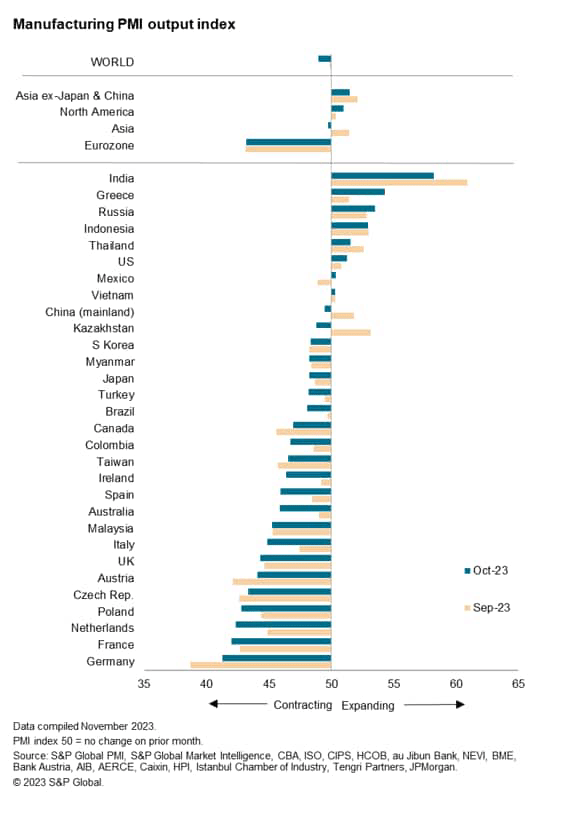

Europe continued to see the steepest downturn, with output also falling in Japan and mainland China. The worsening production picture was by no means universal however, as the US notably bucked the downturn trend, and India continued to report the best performance by some margin as business continued to boom.

Global factory output slips lower again in October

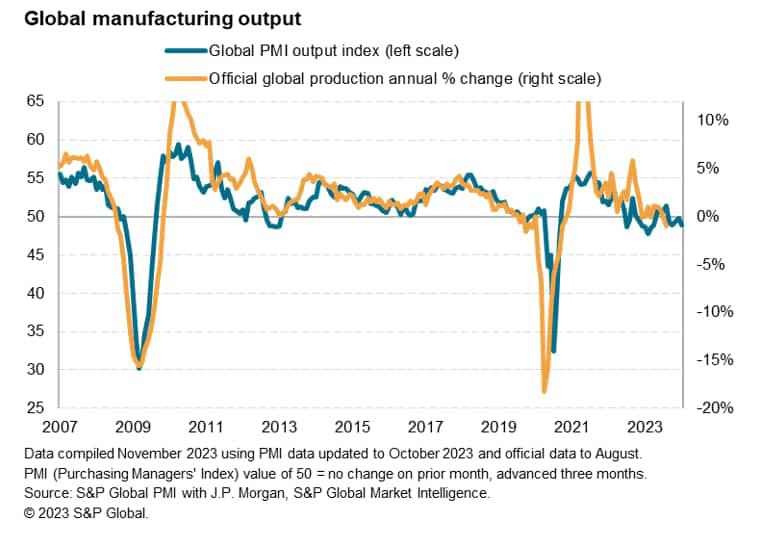

Global manufacturing output fell for a fifth consecutive month in October, according to the latest PMI surveys compiled by S&P Global and sponsored by JP Morgan. At 48.9, down from 49.8 in September, the output index from the Global Manufacturing PMI – our key measure of current factory production – signalled a slight acceleration in the rate of contraction. Although the overall pace of decline remained only modest, it is unusual for worldwide manufacturing output to decline at all.

Official data, compiled from various national statistical agencies, is starting to show a similar deterioration in manufacturing performance to that presented by the PMI data. Global output was 1.0% below that of a year ago in August (the latest month for which official data are available for the major economies) based on our calculations. That’s the steepest rate of decline for three years.

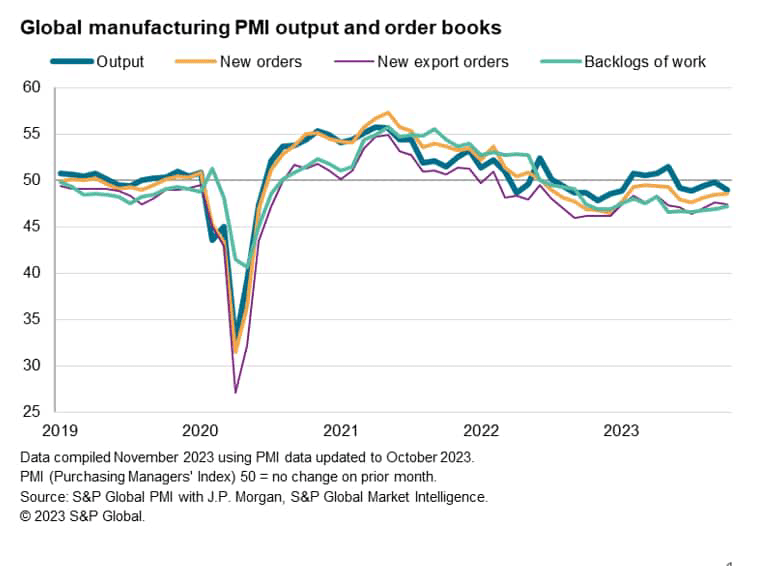

The rate of global production decline would have been even steeper in recent months had factories not been able to rely on backlogs of orders to sustain activity levels. However, these backlogs – accumulated in many instances during the pandemic – have now been depleted globally in each of the past 16 months, meaning companies are becoming increasingly concerned about overall order book levels.

Demand downturn extends into sixteenth month

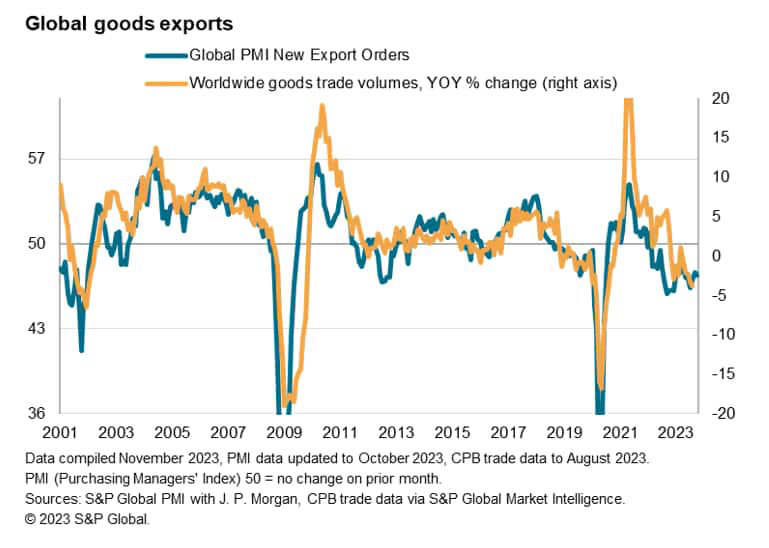

Worryingly, new order inflows are not helping to replenish order books. In contrast, new orders have now also fallen worldwide continually over the past 16 months, in part reflecting a sustained decline in global trade volumes. Globally, new export orders for goods have now fallen for 20 straight months, with the rate of decline remaining marked by historical standards into October.

Job culls mount amid gloomier outlook

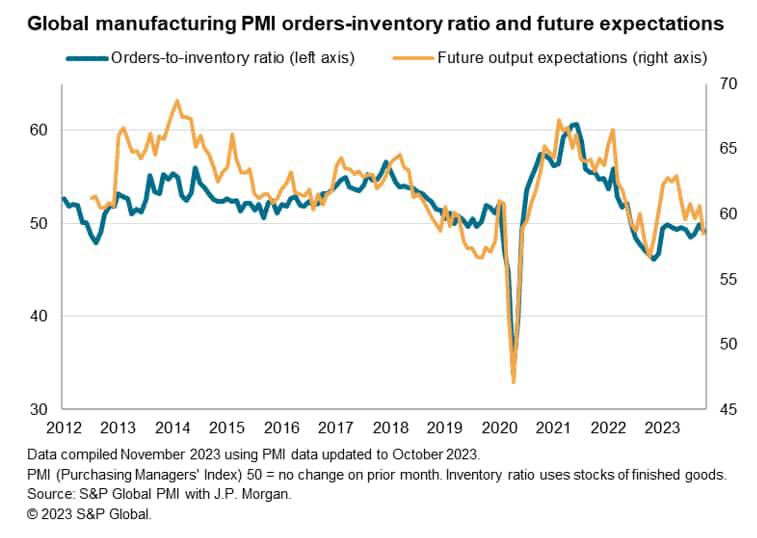

With order books becoming increasingly depleted, companies’ expectations of future output have sunk lower. Optimism about output in the year ahead sank sharply in October to its lowest for 11 months.

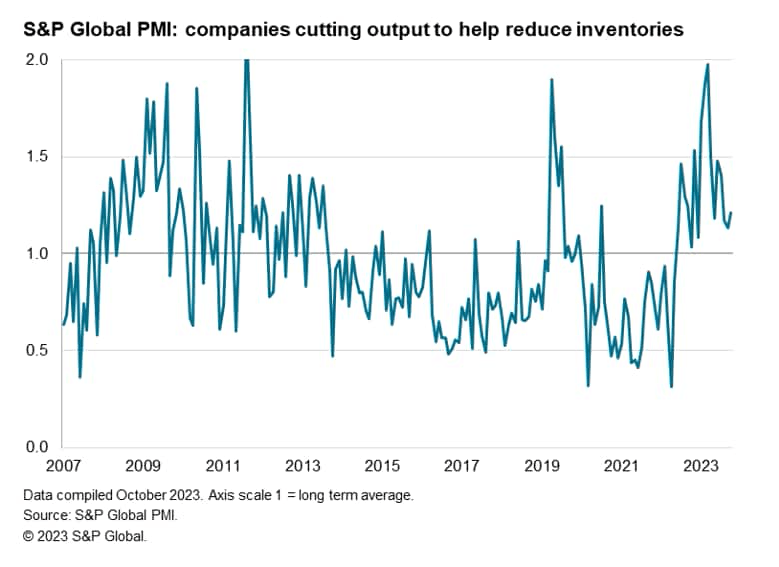

October also saw an elevated incidence of output being cut as firms sought to reduce inventory levels, in turn often reflecting the anticipation of weak sales in the months ahead.

The growing gloom about business prospects caused producers to cut capacity. Factory employment fell worldwide for a second successive month at the start of the fourth quarter, dropping at a rate not seen since August 2020. Barring the early pandemic months, the drop in headcounts was the steepest since September 2009.

Companies also cut back on their purchasing of inputs, reflecting perceived lower production requirements in the coming months. Input buying has now been scaled back continually over the past 15 months.

Europe reports steepest production losses

Drilling down geographically, the global factory downturn continued to be led by Europe in October. In fact, the eight fastest-contracting manufacturing economies were all found in Europe, led by Germany.

Overall eurozone output fell for a seventh successive month and UK production fell for an eighth consecutive month. In both cases, the latest declines were among the steepest recorded since the global financial crisis, barring the initial COVID-19 lockdown months.

Production also continued to fall in Japan, down for the fifteenth time in the past 16 months, and in mainland China, where production slipped back into contraction after two months of modest growth.

In the rest of Asia, output rose for a twenty-sixth straight month, though the rate of increase waned to the slowest since January.

In contrast, output grew at a slightly increased rate in the US where, although only modest, the latest rise was the steepest since April. However, the strongest output gain continued to be recorded in India, where an ongoing production boom far outpaced all other economies covered by the S&P Global PMI surveys.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here

Leave a Reply