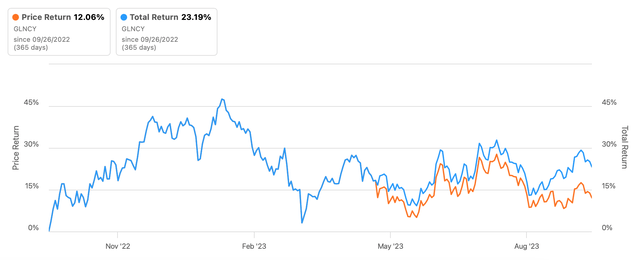

Here’s an interesting trend for the Swiss multi-commodity miner and marketer, Glencore ADR (OTCPK:GLNCY). In the past year, its price returns have been at 12.1%, but its total returns are almost double that at 23.2%. This means, that when considering GLNCY, it’s important to consider the value of dividends and buybacks, which have made it a decent investment in the recent past.

Source: Seeking Alpha

But miners are cyclical stocks, and Glencore is no exception. With the economies of the US and EU expected to be sluggish over the next year and signs of uncertainty present in the big China market, can the company sustain its dividends?

Shrinking sales and earnings

This question is particularly pertinent right now, as there’s a visible slowing down in the company’s numbers already. In the first half of 2023 (H1 2023), revenues declined by 20% year-on-year (YoY), the adjusted EBIT fell by 59% and net income fell by an even bigger 62% (see table below). To be fair, H1 2022 was particularly good, with a big 43.3% rise in revenues, as post-pandemic demand was strong and the base period was one of lockdowns.

Source: Glencore

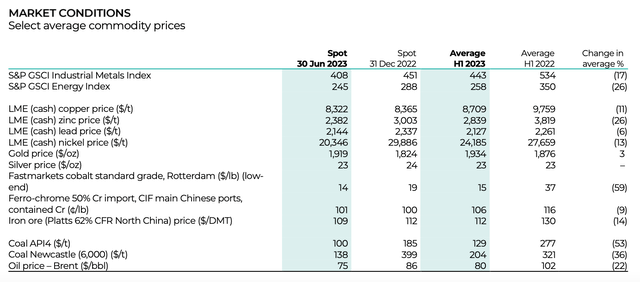

Even then, the decline in commodity prices over this time can’t be overlooked (see table below). Not only have they corrected from last year, but the S&P GSCI Industrial Metals index is up just 3.5% in the past 5 years and the corresponding Energy Index is up by 5.2%. This underlines the fact that the commodity cycle is indeed sluggish right now.

Source: Glencore

Improved outlook

However, recent price developments look less disappointing. While the industrial metals index has ceased declining quarter-to-date the energy index is actually up by 22.9% over this time. This is significant considering that energy products contributed to 72.4% of the company’s adjusted EBIT in H1 2023.

What Glencore expects

Glencore is also positive on its H2 2023 performance based on “Moderating inflation and supportive government policy in China..”. It also expects commodity prices to stay elevated over the longer term due to “Low metal inventories, higher production costs, geopolitical uncertainty and energy transition demand..”.

Estimates for 2023 and 2024

Analysts, too, are more optimistic about its H2 2023 revenue figures. On average, they expect revenues to decline by 13.5% for the full year 2023, which indicates a far more muted 6% YoY revenue decline in H2 2023.

If the net profit margin for the full year remains the same as in H1 2023 at 4.3%, the EPS decline can also soften a bit from 61% in H1 2023 to 45% for the full year 2023, resulting in an EPS of USD 0.74, based on the trailing twelve months [TTM] number of shares.

The actual number can differ. In fact, my alternate estimates, assuming that the net margin is actually higher for the full year, at 6.8%, the same as in 2022, the EPS figure rises to USD 1.17. The two estimates give an average of USD 0.95, which is quite close to that projected by other analysts too.

With dividends already announced for 2023, though, the really interesting number is the one for 2024. A continued revenue drop of 2.8% is expected for the year, but it has a trivial impact on the average EPS from 2023, to finish the year at USD 0.94. The actual number would probably be higher if there were more buybacks. In fact, other analysts expect the number to come in at a higher USD 1.1 compared to 2023.

What’s next for dividends?

With declining EPS for 2023, though, I believe we should brace for a dividend cut. The dividend payout can decline by 28% in the next year if the payout ratio remains constant at the 2022 level of 39%. Note that the payout ratio here considers earnings for 2022 and dividends for 2023 because the previous year’s dividends are paid only in the next year. In 2025, considering the almost no change to projected EPS in 2024, dividends will remain flat.

This of course doesn’t take share buybacks into account, which both reduce the number of shares among which dividends are distributed and also result in additional earnings for shareholders, bumping up total returns higher.

What’s next for price?

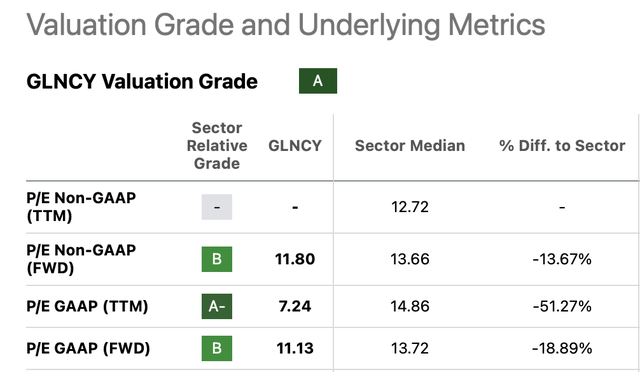

There can even be price gains over time. Here’s why. Glencore’s trailing TTM GAAP price-to-earnings (P/E) ratio is at 7.2x, which is around half that of the materials sector at 14.9x. It’s also lower than its own average of 16.1x over the past decade. Further, the forward P/Es are also lower than that for the materials sector (see table below). This indicates, that there’s a 10-15% upside to the stock even right now. And this is just the price returns.

Source: Seeking Alpha

The China risk

However, there’s one big risk to these estimates, and that’s China. It’s the biggest importer of commodities, after the US, as of 2022. Unlike the US, though, it’s still a wild card. Forecasts for its growth have been cut from 5.5% in 2023 to 5% recently, and the economy’s growth is expected to slow down further in 2024 and 2025 to under 5%.

These numbers are still not bad, especially, considering that the economy is the world’s second largest. But they are a softening from the much higher rates that the world has gotten used to in the past. Between 2010 and 2019, the economy grew in the range of 6-11%. Further, policymakers have expressed commitment to economic recovery recently. What happens next remains to be seen, but the key point now is, that the China story is still evolving. If growth slows down faster than anticipated, it can drag Glencore’s financials down further in the coming months.

What next?

Aside from this risk, the Glencore story doesn’t look bad, all things considered. There are both price returns and income returns to be made here. Over the next year, total returns are likely to be at least in the mid-teens percent, even with an expected decline in both revenue and earnings in the foreseeable future.

These returns aren’t the highest, of course, but then this isn’t the best time for cyclicals. I think it’s a good time to buy the stock while it’s at a relative low before the upturn starts again. Essentially, it’s for the medium-term investor with some patience, who can get some returns and wait for bigger ones over the next 3-5 years. I’m going with a buy on Glencore.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply