Geron Corporation (NASDAQ:GERN) could reach a turning point on June 16, 2024, after 34 years of its foundation. This date could represent the new company’s commercial transformation. It could bring its unique product Imetelstat to new life on the real market and this drug could be able to bring real benefits to serious and highly disabling hematological diseases (MDS and MF).

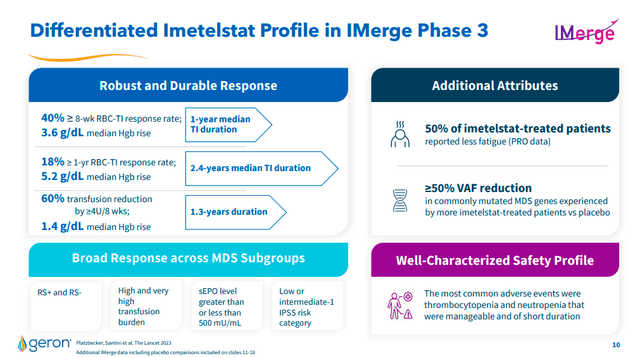

If we analyze the results of the IMerge Phase 3 clinical study we can see how there is statistical evidence to support the possibility that Imetelstat acts effectively on telomerase and can lead to a positive treatment of the disease.

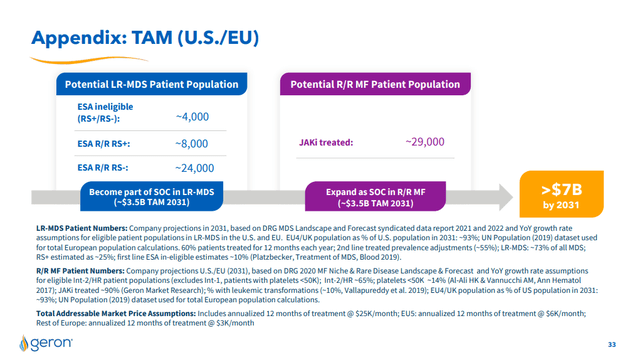

Market analyses also lead us to think that there is a large segment of the population that can benefit from Imetelstat which, according to Geron, could reach $7B in 2031. Assuming that Geron can realistically conquer 20% of this market share, my estimates indicate a possible 3-digit return on investment in the coming years.

The investment is highly risky because it involves betting on the success of a single-product business. In other words, there is only one parachute for a single launch. Given this high risk, in my opinion, there is a good chance that the business can evolve in positive terms and therefore my rate is Buy.

Technological Background and Business Overview

Geron Corporation is a late-stage biopharmaceutical company developing therapies focused on the treatment of hematological diseases.

Geron’s studies are based on important Nobel Prize-winning scientific discoveries in the field of Telomeres and aging (Blackburn, Szostak, Greider – Nobel prize 2009): awarded for their discoveries on telomerase, an enzyme that maintains telomeres, the ends of chromosomes that shorten with each cell division.

Trying to summarize the technological background that underlies the business, we could say that the human body grows and develops through the cell’s division. But cells can divide only a limited number of times, and this is caused by the length of the telomeres.

Every time a cell divides, telomeres shorten. When telomeres become too short, the cell dies. Nobel Prize winners discovered the importance of telomerase (a natural enzyme) which can inhibit the shortening of telomeres when the cell divides.

In tumor cells, telomerase allows the uncontrolled proliferation of diseased cells, which allows the tumor to develop. The inhibition of telomerase therefore represents an element of particular interest for the entire scientific community because of its ability to limit the proliferation of malignant cells.

Imetelstat, the product studied and created by Geron, is the first telomerase inhibitor to advance in clinical development and potentially enter commercialization in the coming months.

Imetelstat has as its main indication the treatment of low-risk MDS (Myelodysplastic Syndrome). In low-risk MDS, bone marrow cells (hematopoietic stem cells) are diseased and produce immature cells that do not function properly.

In August 2023, the FDA accepted Geron’s NDA (for the treatment of transfusion-dependent anemia in adult patients with low-risk MDS) and set a Prescription Drug User Fee Act (PDUFA) for June 16th, 2024. However, a meeting of the advisory committee was scheduled for March 24th, 2024, as part of the review of the NDA and the commission expressed itself positively with 12 votes in favor against 2.

Suppose Imetelstat is approved for marketing by the FDA. In that case, it is presumable that the launch of the product could take place in the same period (Q3 – 24) in the USA, while as regards the European market, Geron presented an MAA (Marketing Authorization Application) in September 2023. It is expected that the European Commission may review the request in 2025, with a possible launch in the EU in the same year.

Buy Investment Thesis

My investment thesis is based on the consistency of the clinical studies carried out, on the possible market demand, on the evaluation of a future share price, and on how the edge funds specialized in biotechnology are moving. Let’s see every single aspect in detail.

IMerge Phase 3 clinical trial

The applications (NDA and EMA) submitted to the competent authorities are based on the IMerge Phase 3 clinical study.

Study data demonstrated a transfusion independence rate (60% transfusion reduction) for ≥ 8 weeks (primary endpoint) and a transfusion independence rate at 24 weeks (secondary endpoint). Both results are considered statistically highly significant (p<0.001). The response rate (40% for ≥ 8 weeks) was also highly significant compared to the placebo (15%). This is a very significant difference that should have a positive impact on the evaluation by the FDA.

Another important aspect is the presence of a broad response on several key subtypes (positive RS – negative RS – patients with high baseline transfusion load and patients classified as low risk according to the IPSS) which represents another positive element in the treatment of high-risk MDS wide range and not limited to just one subtype.

These data represent, at the moment, solid foundations that provide statistical evidence that Imetelstat effectively acts on telomerase and inhibits the proliferation of malignant cells, allowing a recovery of good cells in the blood, and this suggests a probable positive treatment of the disease.

These studies and this evidence led the committee to vote favorably on the development of Imetelstat on March 24th and should lead, in my opinion, to a possible positive evolution also on June 16th.

In addition to the positive aspects, side effects should also be noted, which were thrombocytopenia (low number of platelets in the blood) and neutropenia (number of neutrophils – white blood cells in the blood). These effects appear to have been short-lived and easily managed.

Geron Corporate Presentation – May 2024

In addition to IMerge, it should be noted that Geron is carrying out a Phase 3 clinical trial called IMpactMF in patients with intermediate or high-risk MF with the primary endpoint being the overall survival (OS) rate. It is expected that this study can define a provisional analysis of 2025 and a final analysis in the first half of 2026.

Competition in MDS

To date, the standard protocol for the treatment of MDS is based on the use of ESA (erythropoiesis-stimulating agents). In addition, the treatment involves blood transfusions which may have serious contraindications due to iron overload.

We have seen in the previous paragraphs how the IMerge Phase 3 clinical study can act in terms of transfusion independence and a potential positive modification of the disease.

These characteristics are highly differentiating compared to all the other products used and, to date, there are no similar treatments (based on transfusion independence) on the market that represent active competition.

Potential market demand and income statement template

Based on the estimates provided by Geron, the two studies, if approved by the regulatory authorities, could each bring a contribution (Total Addressable Market) estimated at $3.5B in the US and EU markets by 2031. The total market should therefore amount to $7B per 2031.

Geron Corporate Presentation – May 2024

These estimates come from specialized sector studies and refer to “DRG MDS Landscape and Forecast data report” for LR-MDS and “DRG 2020 MF Niche & Rare Disease Landscape & Forecast” for R/R. Since sector studies are independent and highly specialized in healthcare, I believe they can be used for the subsequent analyses covered by this article.

Based on the estimates provided by Geron, I try to build an income statement model for the period between 2025 and 2031 based on the following hypotheses:

1. Revenue growth

- Geron will be able to acquire a maximum market share of 20% of the estimated TAM of $7B in 2031: Geron’s revenue in 2031 is estimated at $1.4B (=$7B X 20%)

- Revenue is estimated at $175M in 2025 (= 5% of $3.5B) – it is assumed that the launch will take place in 2024 and that in 2025 the company will be able to acquire at least 5% of the total US market

- In 2026 revenue will grow by a further 5% compared to the US TAM ($3.5M) and become $350M

- In 2027 US revenue remains unchanged ($350M) as the company focuses on EU revenue which is estimated at $175M (5% of EU TAM – $3.5B) – Total US + EU revenue: $525M

- From 2028 to 2031 revenue grows by 5% (on the TAM) every year until reaching the final 20% in 2031

2. Gross Profit: GP is estimated to be 56.82% of Revenue. This is the average GP figure for the biotechnology industry. For example, in 2025 the estimated revenue of $175M generates a GP of $99.4M (=$175M X 56.82%)

3. Other operating costs (R&D, G&A, and others): are estimated based on Geron’s final figures for 2023 and 2024 (FORM 10-K). For 2025 they are estimated at $316.1M based on 2024 costs (FORM 10-Q – $56.4 in Q1-24 multiplied by 4 and an increase of 40% which is the rate of increase in 2024 vs. 2023). Starting from 2025 these costs are estimated with an increase of 10% each year because in 2025 the launch in the US is finished and the organizational structure for the EU should have been fully implemented. For example, in 2026 operating expenses equal to $347.7M are obtained from $316.1M X 110%.

The difference between the GP and the other costs generates the Net Profit. For example, in 2025 the Net Profit of ($216.6M) is obtained from the difference between the GP of $99.4M and the other operating costs of $316.1M.

The total number of outstanding shares is estimated to be equal to the last one declared by Geron in Q1-24 (Form 10-Q).

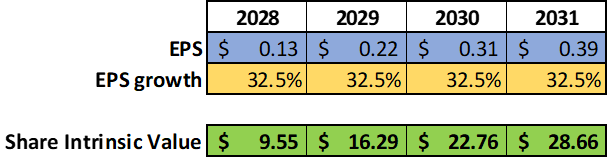

The EPS estimate is made by dividing the Net Profit by the number of outstanding shares. For example, for 2028 EPS = $0.13 (=76.5/603.5)

The following table shows the result of the mathematical model built based on the above hypotheses.

| 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | |

| Revenue | 175 | 350 | 525 | 875 | 1050 | 1225 | 1400 |

| GP | 99.4 | 198.9 | 298.3 | 497.2 | 596.6 | 696.0 | 795.5 |

| GP % | 56.82% | 56.82% | 56.82% | 56.82% | 56.82% | 56.82% | 56.82% |

| Other operative expenses | 316.1 | 347.7 | 382.4 | 420.7 | 462.7 | 509.0 | 559.9 |

| Net Profit | -216.6 | -148.8 | -84.1 | 76.5 | 133.9 | 187.0 | 235.6 |

| Tot Share Outstanding | 603.5 | 603.5 | 603.5 | 603.5 | 603.5 | 603.5 | 603.5 |

| Basic EPS | -0.36 | -0.25 | -0.14 | 0.13 | 0.22 | 0.31 | 0.39 |

We can see how, based on these assumptions, 2028 should be Geron’s first year of positive profit with an estimated EPS of $0.13.

The compound annual growth rate [CAGR] from 2028 ($0.13) to 2031 ($0.39) is 32.5%.

In my opinion, these hypotheses could best represent, based on the information in our possession currently, the possible evolution of the business subject to approval by the competent regulatory authorities.

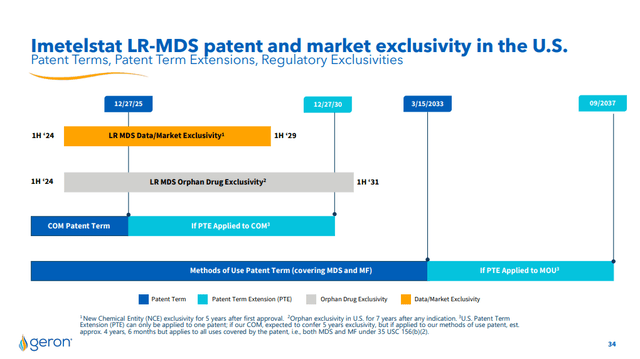

Regarding the duration of the patents and rights on Imetelstat, Geron owns the patents issued in the US and EU, which cover the company’s rights until 2033 on MDS and MF treatments. This coverage could guarantee the implementation of the economic plan set out above without the revenue being affected by external factors.

Geron Corporate Presentation – May 2024

Share Price Valuation

Based on the calculation and estimation hypotheses of future EPS, it is possible to set an estimate of the future share price, determining the potential profit in the event of an investment today.

In the previous paragraph, we calculated an estimate of EPS for the years from 2028 to 2031 and based on these calculations the EPS CAGR is 32.5% on an annual basis. In 2031, Revenue growth should have reached its maximum peak and therefore EPS growth should also stop. But from that date onwards, other business may likely develop within the company, which cannot currently be foreseen.

To estimate the share price, we could use a formula by popular investor Benjamin Graham:

Intrinsic value per share = EPS x (8.5 + 2 g)

Where

EPS = earnings per share

g = EPS growth rate = 32.5%

Author Calculation

Example of calculation for 2028:

Intrinsic value per share = EPS x (8.5 + 2 g) = 0.13x(8.5+2×32.5) = $9.55

Based on these assessments, we can hypothesize a possible return on the investment in Geron made in 2024 at the price of $3.7 equal to 158% in 4 years (in 2028 the price could reach $9.55).

How Hedge Funds are moving

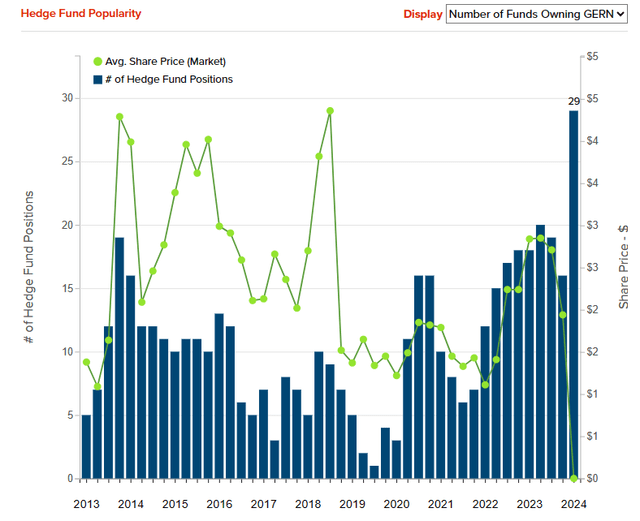

The following graph shows the number of hedge funds that have invested in Geron. We can see that in Q1-24 there are 29 funds in the shareholding structure and this is not only the highest number ever since 2013 but also represents a 50% increase when compared with the average number for 2023.

It would therefore appear that hedge fund managers are believing in Geron much more than in the last 10 years, and this could represent a further element of support in my investment thesis in the company.

Insider Monkey

Financials

Geron’s latest Form 10-Q identifies that the company has approximately $465M in cash and marketable securities (this includes the latest public offerings of common stock and warrants)

As regards operating costs, as we can read in the latest earnings call:

Our projected full-year 2024 operating expenses are expected to be between $270 million and $280 million.

2023 ended with a final operating cost of $194M, so the difference compared to the worst estimate for 2024 is $86M, which also represents a further net loss in 2024 compared to 2023. If the net loss in 2023 is amounted to ($184M) we can hypothesize that in 2024 the net loss could reach ($270M)

2025 should be the first year of business growth in terms of revenue and according to the economic model created in the previous paragraph, the net loss should be approximately ($216.6M)

The net loss for 2024 and 2025 is therefore expected to be ($486M). Considering that the cash of $465M refers to the end of Q1-24 we can identify that the business can continue without financial problems until Q1 2026.

In 2025, in my opinion, the company will therefore once again be committed to raising funds to guarantee business continuity for 2026 and probably for 2027.

As has happened in past years, a possible injection of new funds into the company should not represent a binding problem, and therefore I believe that the business will be able to continue its growth without problems. The investment in Geron made today can potentially guarantee an advantageous entry price compared to what it could be after June 16th, when the FDA may have approved the NDA.

Risks

Geron’s business is based on a single product, Imetelstat and this represents an obvious risk of lack of diversification. Should Imetelstat run into problems of any kind, there are no second-choice alternatives or possibilities: everything is based on a single candidate. This represents an element of risk for any company and especially for Geron when the product has not yet entered the marketing phase.

Although I believe it is likely that the FDA could approve Imetelstat, what could represent an additional element of risk is related to the timing of approval. There could be delays of any kind due to any new additional requests from the FDA or to operational elements relating to the launch of the product on the market. A possible delay in the launch of Imetelstat would imply a significant increase in costs and a possible collapse in the share price.

The IMpactMF clinical study represents another element of high risk: if this were to fail to demonstrate efficacy and safety for patients, then also in this case 50% of the estimated future revenue would be totally at risk and could also jeopardize the business continuity.

Bottom line

Geron Corporation has been finalizing lately a process that began in 1990 and could represent a possible investment opportunity based on some scientific evidence relating to the phase 3 – IMerge clinical study which led the FDA Oncologic Drugs Advisory Committee to vote in favor of Imetelstat in March 2024. If the FDA approves the marketing of the product in June 2024, we would probably be faced with an epochal turning point for the company, which could transform itself into a new commercial company. Market forecasts lead me to hypothesize a positive EPS starting from 2028 with a potential 3-digit return on investment. The risks are high as the commercial development is based on a single product, but the return should repay the risk within a few years.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply