Genuine Parts Company (NYSE:GPC) sells replacement parts in the automotive industry. The company has achieved good growth in recent years, but as the company’s growth seems to be maintained only through frequent acquisitions instead of organic growth, I believe investors should stay cautious. The current valuation seems to reflect quite minimal growth, in line with my expectations. For these reasons, I have a hold-rating for the stock.

The Company

Genuine Parts Company sells replacement parts in the automotive industry as well as for industrial customers. The company was founded in 1928 and has scaled its operations organically and through acquisitions into a globally recognized company, it has operations in North America, Europe, Asia, and Australia.

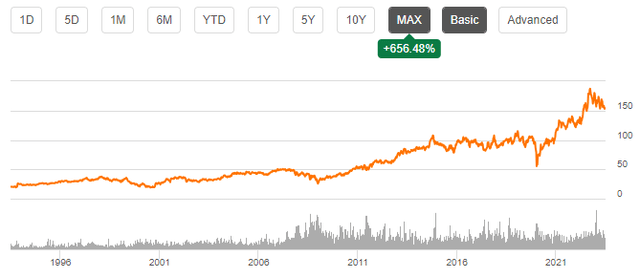

Genuine Parts Company has been listed on the stock market for a very long time. In the stock’s last 30 years, the stock has appreciated by 656%, translating to a compounded annual rate of around 7.0% – while the stock has generated a good return, it hasn’t been a significant outperformer.

Stock Chart (Seeking Alpha)

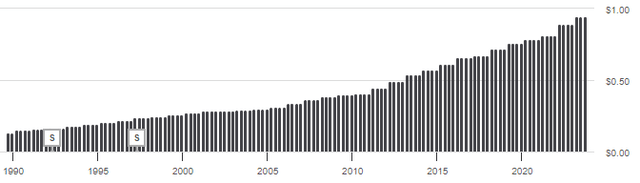

On top of the share appreciation, investors get quarterly dividends of $0.95, making the stock’s dividend yield around 2.47%. The dividend has a good history of growth, as dividends were only $0.13 back in 1989:

Dividend History (Seeking Alpha)

Other than dividends, the company seems to use its free cash flow in acquisitions – the company’s annual spend on cash acquisitions seems to be in the hundreds of millions in most years. In the latest years, for example, the part distributor bought Alliance Automotive Group in 2023 and Lausan Group in 2022.

Financials

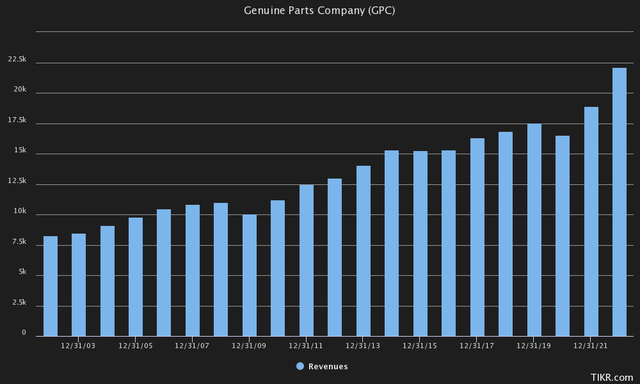

As the company has spent significant resources on acquisitions, Genuine Parts Company has achieved a compounded annual growth rate of around 5.0% from 2002 to 2022:

GPC’s Revenue History (Tikr)

The company has a revenue growth guidance of 4% to 6% for 2023, fueled by the previously mentioned acquisitions.

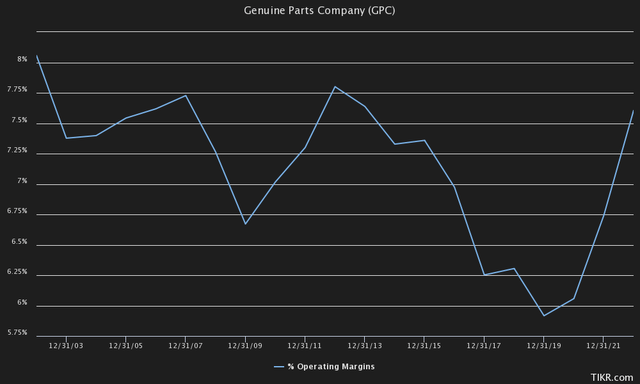

Throughout the company’s history, Genuine Parts Company has kept a stable operating margin – from 2002 to 2022, the margin has fluctuated between 5.92% and 8.06%:

GPC’s Operating Margin History (Tikr)

Adding to the stability, Genuine Parts Company’s revenues don’t seem to have very large fluctuations – during the 2008 financial crisis, while many other companies had a very hard time, Genuine Parts Company’s revenues only declined by 8.7% in 2009. The company’s operating income fell by 16.1% – the amount seems quite healthy compared to many other companies in the year.

The company has outlined financial targets for 2025 – the targets include revenues of $26.5 billion to $27 billion for the year, as well as an EPS of $11 to $11.5. The middle point of the revenue guidance would represent an annual growth rate of 6.6% from 2022 to 2025 – while the growth rate would be only slightly above the historical rate, I believe Genuine Parts Company can only achieve the growth with aggressive acquisitions.

Genuine Parts Company’s balance sheet seems relatively healthy to my eye. The company has $530 million in cash. On the other side, the company has around $3403 million in long-term debt – as Genuine Parts Company’s market capitalization is over $21 billion, I see the amount as healthy. Of the debt, $418 million is in current portions and the rest in non-current portions; I believe the current portion can be easily paid off with the company’s free cash flow.

Valuation

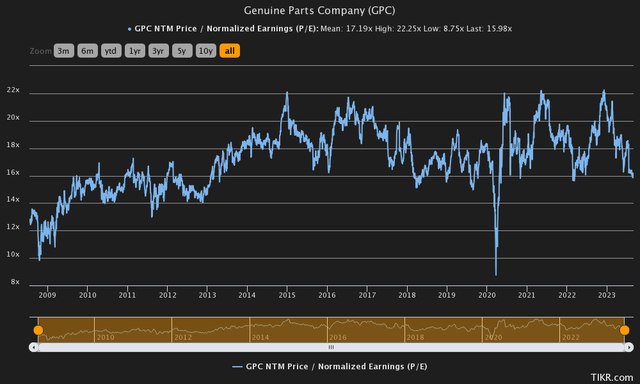

Not far from a historical level, Genuine Parts Company currently trades at a forward price-to-earnings ratio of around 16:

Historical P/E (Tikr)

The valuation seems to be modestly expensive in my opinion, as the company has low organic growth. To put the valuation into a more thorough perspective, I constructed a discounted cash flow model.

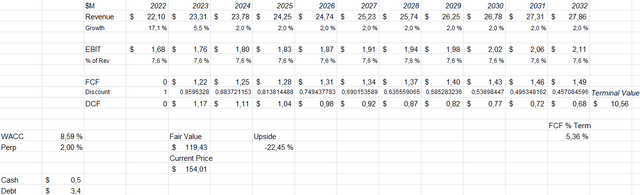

In the model, I expect to hit its growth guidance of 4% to 6%, as I expect a growth of 5.5%. After 2023, I expect a nominal growth of two percent for every year after – although the expectation is below Genuine Parts Company’s 2025 guidance, I don’t see it as reasonable to price in growth that I don’t see as happening organically; acquisitions eat away cash flows, which aren’t factored in the model either.

As for the company’s EBIT margin, I expect that the company keeps up its 2022 level of 7.6% indefinitely – I don’t see any current factors that would indicate a long-term margin that varies from the current level. Genuine Parts Company has also kept a mostly stable margin throughout its history; I don’t believe the margin should see large variance in the future, either.

These expectations, and a weighted average cost of capital of 8.59%, craft the following DCF model scenario with an estimated fair value of $119.43, around 22% below the current price:

DCF Model of GPC (Author’s Calculation)

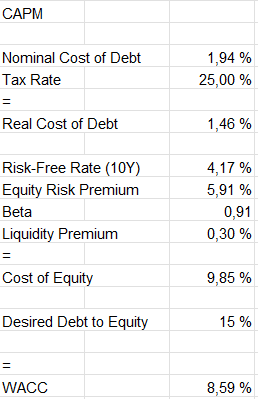

The used cost of capital is derived from a capital asset pricing model with the following assumptions:

CAPM of GPC (Author’s Calculation)

In Q2, the company had $16.5 million in interest expenses. Annualized, this comes up to an interest rate of around 1.94% – the company seems to pay an incredibly low interest rate on its debts. The company has quite moderate amounts of debt; I estimate the company’s long-term debt-to-equity ratio to be 15%.

I use the United States’ 10-year bond yield of 4.17% as the risk-free rate. The estimated equity risk premium of 5.91% is taken from Aswath Damodaran’s latest report. Tikr estimates Genuine Parts Company’s beta to be 0.91; the beta isn’t very high, as replacement parts are mostly a necessity. Finally, I add a small liquidity premium of 0.3% into the cost of equity, putting the cost of equity at 9.85% and the WACC at 8.59%, used in the DCF model.

Takeaway

Although the DCF model suggests some downside for Genuine Parts Company’s stock, I don’t believe a sell-rating is justified. The company has very stable earnings, that I believe are not represented entirely by the beta of 0.91 – the beta could very well be lower in the future, lowering the cost of capital. Also, the DCF model doesn’t take into account any acquisitions – as the company could create shareholder value through acquisitions, the DCF model could underestimate the stock’s potential. As such, I have a hold-rating for the stock.

Read the full article here

Leave a Reply