GNK’s Dry Bulk Investment Thesis Remains Robust, Thanks To The Highly Competent Management

We previously covered Genco Shipping & Trading Limited (NYSE:GNK) in May 2023, discussing its balance sheet improvement and excellent dividend payouts during the hyper-pandemic windfall.

However, the recent easing in global supply chain issues had triggered the stock’s moderation from its heights, with its TCE rates moderated in a highly cyclical dry bulk industry.

For now, GNK’s TCE rates remain excellent, with Capesize rates of $19.46K (+22.2% QoQ/ -28% YoY) and Ultramax/ Supramax rates of $12.85K (+3.2% QoQ/ -56.6% YoY) in FQ2’23.

With an overall fleet wide rate of $15.55K (+11.5% QoQ/ -45.9% YoY), compared to its FY2019 averages of $10.18K (-10.3% YoY), we maintain our conviction that its prospects are much improved compared to the pre-pandemic period.

GNK’s FQ2’23 fleet rates are also noticeably higher compared to the average Capesize spot rates of $17.08K between April and June 2023, based on data from the Alibra Shipping Limited, though behind the Ultramax/ Supramax spot rates of $14.66K.

Based on the forward FQ3’23 numbers, we also believe that its contracted fleet wide TCE rates of $12.26K (-21.1% QoQ/ -48% YoY) remain decent, similar to the FQ2’23 trend.

This comprises of GNK’s Capesize contracted rates of $16.96K (-12.8% QoQ/ -11.8% YoY) and the Ultramax/Supramax contracted rates of $9.51K (-25.9% QoQ/ -63.2% YoY), compared to the spot rates of $13.75K and $11.75K between July and September 2023, respectively.

Combined with the dry bulker’s efficient cost management, its Daily Vessel Operating Expenses Per Vessel has also drastically moderated to $5.64K (-8.4% QoQ/ -23.2% YoY) in FQ2’23.

And it is for these reasons that the GNK has been able to expand its adj EBITDA generation to $29.96M in the latest quarter (+51% QoQ/ -53.3% YoY), with EBITDA margins of 33% (+12 points QoQ/ -13.6 YoY).

This is an impressive feat indeed, compared to FY2019 EBITDA margins of 11.4% (-6.3 points YoY) despite the drastic normalization from the hyper-pandemic TCE rates.

These developments have directly contributed to GNK’s much healthier balance sheet, with long-term debts (including operating lease liabilities) of $151.22M (-5.5% QoQ/ -16.7% YoY) in the latest quarter.

Thanks to the voluntary debt retirement, we can understand why the management has felt comfortable to adjust its quarterly reserve accordingly, with $2.19M reported in FQ1’23 and $9.92M in FQ2’23, compared to the usual $10.75M.

This has allowed the management to sustain its shareholder returns, with $43.1M disbursed as dividends for both quarters, at $0.15 per share.

Barring any unforeseen events, we maintain our conviction that GNK is a dry bulker stock that continues to be very shareholder friendly, with it likely to sustain its dividend payouts moving forward, despite the volatile nature of the industry.

So, Is GNK Stock A Buy, Sell, or Hold?

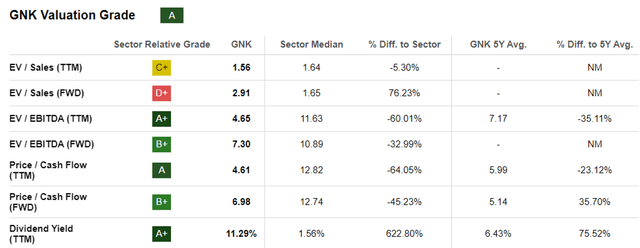

GNK Valuations

Seeking Alpha

And it is for this reason that we share the same belief as the Seeking Alpha Quant, that the GNK is trading very attractively compared to its dry bulker sector medians.

For example, the stock is currently trading at FWD EV/ EBITDA of 7.30x and FWD Price/ Cash Flow of 6.98x, cheaper than the sector median of 10.89x and 12.74x, respectively.

The management’s decision to sustain its dividends have also triggered its excellent TTM dividend yields of 11.29% and FWD yields of 4.29%, compared to the sector median of 1.56%.

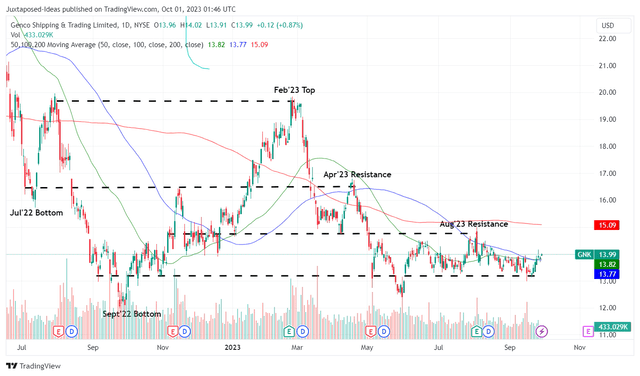

GNK 1Y Stock Price

Trading View

GNK appears to be well-supported at $13s as well, with the stock still meeting an immense resistance levels at the $14.70s, suggesting a well-established trading cadence for interested investors.

As a result of the attractive risk reward ratio at current levels, we maintain our Buy rating for the GNK stock.

However, investors must also note that the dry bulk industry is one that is highly cyclical, with the fluctuating global economic/ geopolitical activities dictating the demand for commodities and consequently, the fleet utilization.

The property market appears to be impacted globally as well, thanks to the elevated borrowing costs, with the Fed now expecting a prolonged path towards a normalized inflation rate of 2% only by early 2026, instead of the previous early 2025.

The Chinese reopening cadence has been underwhelming as well, with Q4’23 likely to bring forth slower iron ore restocking and steel production cuts.

Due to the impacted demand for iron ore and lower grain export due to the ongoing Russia-Ukraine crisis, both of which are common dry bulk commodities, we expect the dry bulk shipping industry to remain impacted in the intermediate term, with the GNK stock likely to trade sideways at the same time.

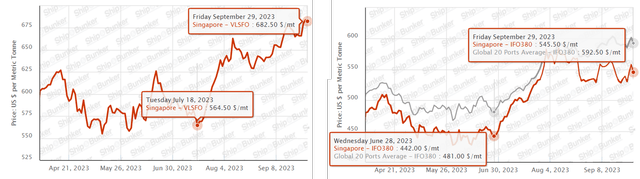

VLFSO & IFO380 Prices In Singapore

Ship & Bunker

In addition, while the GNK management has been able to manage the volatile fuel costs, it remains to be seen how things may develop in H2’23, attributed to the rising WTI crude oil prices to $90.78 per barrel (+6% MoM/ +5% YoY/ +51.3% from 2019 averages).

The same increase has been observed for IFO380 spot fuel prices to $545.50/ MT (+2% MoM/ +33% YoY/ +34% from 2019 averages) and VLSFO to $682.50/ MT (+7% MoM/ +2.6% YoY/ +68.5% from 2019 averages). Both are very important metrics, since the dry bulker relies on both fuels for their Capesize and minor bulk vessels, respectively.

As a result, we may see GNK’s operating costs temporarily increasing over the next few months, if not longer, depending on when the WTI crude oil prices normalizes.

As a result of the uncertain near term prospects, the stock is only suitable for income seeking investors who are well versed in the dry bulk sector and not seeking regular quarterly payouts, since the variable payout framework depends on its eventual operating cash flow.

Combined with the volatile nature of the stock, those who add the GNK stock must also be patient, while sizing the portfolio according to their risk tolerance.

Read the full article here

Leave a Reply