Moats and Monopolies

Here at Moats and Monopolies, we run a concentrated portfolio of high quality compounding assets from across the world. This is shared publicly and openly on Seeking Alpha. Games Workshop (OTCPK:GMWKF) is one of our newest holdings and we’re excited to tell you why.

Introduction

There are certain classic car brands like Ferrari (RACE) that bring people together for shows and events. There are certain lifestyle brands like Apple (AAPL), Nike (NKE) and Lululemon (LULU) that become part of one’s identify beyond the product itself. But there are few companies that form entire communities: Welcome fellow investors to the value opportunity of Games Workshop PLC, a small/mid cap, vertically integrated specialist retail outlet that licenses, designs, manufactures and distributes products under its table top hobby brand Warhammer.

Hobby gamers enter the world through basic starter kits where they assemble, paint and personalise a basic army. Extensions and further sets are then purchased as gamers modulate and further customise their chosen fantasy or science fiction based armies/factions with which to play, each with its own unique rule book and lore from within the universe. The company then offers various table top war arenas in its retail outlets where players can bring their armies to play against each other, creating strong relationships and a loyal community. The universe is expanded through rich libraries of books detailing storylines that often encourage the purchase of further model sets, and extensions of its IP through video games and more recently, at the end of 2022, a film and television deal with Amazon (AMZN) that has caused a large rally in the stock in the past 12 months.

Now you know a little about what the company does, why exactly should you consider investing your hard earned money into becoming a part owner in it?

Management

Let’s start with management. Games Workshop has a great management team who have been at the company of many years and have helped it to grow into a multibillion dollar enterprise. Kevin Roundtree has been CEO since 1998 and Rachel Tongue CFO since 1996. Management’s communications with shareholders are concise, straightforward and honest. Here at Moats and Monopolies, we look for companies that can compound for decades, and Games Workshop shares our long term mindset: “Our ambitions remain clear: to make the best fantasy miniatures in the world, to engage and inspire our customers, and to sell our products globally at a profit. We intend to do this forever. Our decisions are focused on long-term success, not short-term gains”.

Management understands both its business as well as its customer very well. It recognises the importance of the experience in the retail stores where collectors come to play with and against each other and builds out its store numbers slowly and steadily, typically with a single staff model, the main responsibility for which is not sales or sales targets but to bring people into the hobby and be a positive front facing representative of it. In this way, it is important to focus on the right person to open stores and to ensure that customer experience remains high; the retail outlets are opened very slowly. In the next year they expect to open around 30 new stores, 16 in North America, 11 in Europe and 3 in Japan where the hobby is slowly taking off. Further, because they roll out so slowly, Management believes that there is a long roadmap of growth into new, global ‘green field’ areas, which could bring steady long term growth for many years.

Content is King

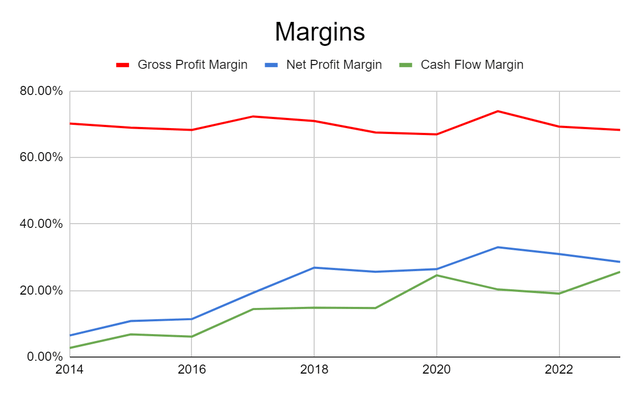

Games Workshop’s margins have been improving over time, partially down to organisational and manufacturing efficiencies, but also down to its product mix and the increase in operating profits from licensing endeavours. This is something that excites us. It has an increasingly long established and deep universe of interlocking stories and characters within its universe, and management is looking to utilise it: “Our strategy is to exploit the value of our IP beyond our core tabletop business, in multiple categories and markets globally. We intend to ensure Warhammer’s place as one of the top fantasy IPs globally”.

With that in mind, the company has for years licensed out its IP to video game developers, which has spawned several successful franchises, and now it is looking into moving into using its content for television through recent negotiations with Amazon Prime, itself desperate to establish its own catalogue following high budget acquisitions of MGM studios and production of recent The Lord of the Rings series. It is a deal with huge potential for both sides (although due to Game Workshop’s size, naturally it will be the biggest beneficiary) and the long time gamer and Hollywood star Henry Cavill (The Witcher, Superman) is likely to be a prominent part of whatever they choose to do with the IP.

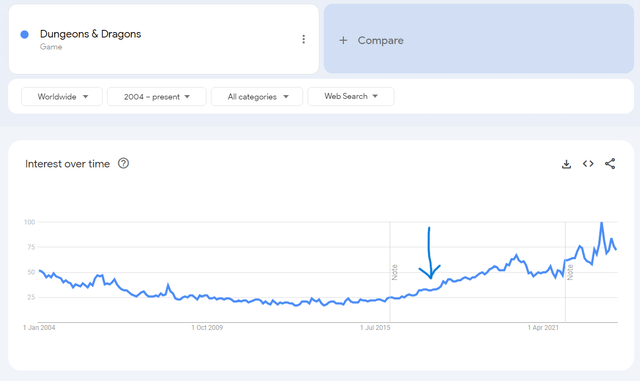

Not only does licensing bring in high margin operating income to Games Workshop, but it should act as a catalyst for its core manufacturing business. We see it as analogous with the buzz of excitement that brought millions of new fans to Dungeons and Dragons following its reference on Stranger Things. Below we can see the spike of interest from Google Trends following the shows 2016 release, which is marked by the slightly wonky blue arrow on the chart below.

Google Trends search of ‘Dungeons and Dragons’ since the Premier of Stranger Things (Google Trends)

Financials

We expect this new licensing income to support the company in increasing its already impressive margins that look to have settled around 20% free cash flow margin, comfortably above the 15% minimum that we look for from companies in our portfolio. Further, management prides itself in being based in Nottingham, UK and manufacturing all of its figures there. Should they take the future decision to use a 3rd party or to move some of those operations to China, where there is already production of parts of its table top war zones, books and other small tokens, that could also have an accretive impact on margins and therefore future shareholder return.

Margins over the past 10 years (Author’s own work)

Games Workshop has consistently demonstrated that it can then use these free cash flows and reinvest into itself at high rates of return. We look for high Returns on Capital Employed (ROCE) as well as a good spread between Return on Invested Capital (ROIC) and Weighted Average Cost of Capital (WACC). These numbers demonstrate how affective management is at reinvesting its capital. Current numbers are a ROCE in the high 50%s, a ROIC of around 60% with its WACC around 11%.

The company also has a long track record of being completely self funded from its cash flows and not using the debt market. In fact, over the last decade, the company has always had a surplus of cash to its debt. We look for companies that can pay off their debt within 5 years and ideally less; it is impossible to go bankrupt when a company has no debt and Games Workshop seems to be a pretty safe investment opportunity at this current moment.

The Dividend

Moats and Monopolies looks for total return and are not necessarily looking for dividend payers. That being said, we know that many of you are and this is another great reason to consider a position in Games Workshop. Their dividend policy is to only pay out what they deem to be ‘truly surplus to the business’, and so there is some variability in payments (albeit with a longer term upward trend). We expect the high margin licensing incomes to grow and that to generate increased demand in its core table top hobby products. With that in mind, we would forecast that the company will be in a position to continue to grow its dividend over the next decade, which already stands at a healthy 5%. Had one purchased shares of this company 10 years ago, their current yield on cost would be nearly 20% per year! Although we don’t expect it to continue at that pace, it is rare to find a 5% starting yield with a long pathway of comfortable above inflation potential growth in the market, and Games Workshop appears to be such an opportunity.

Life in Plastic, not Fantastic

No investment opportunity is perfect and Games Workshop does have potential risks that need to be considered. Its primary revenue source is the sale of its hobby figures. These are predominantly plastic based, and in a world in which the consumer is becoming increasingly aware of their impact on the environment there may be future pressures to change the base materials of products. This could have an unknown impact to margins should alternatives be pricier and would also have potential capital expenditures due to retooling or the purchase of new machinery for manufacturing.

There has also been the 3D printing elephant in the room for several years with the existential threat of having IP stolen or designs printed illegally either at home or by knock-off manufacturers, particularly in countries where copyright and trademark protection is a little, shall we say, sketchier. The company undoubtedly will lose money to crooks and their zero tolerance policy is unlikely to have too much real world affect. We do not believe that his is quite the issue it could be, as many industries and products have survived copyright infringement issues, from pirated movies to illegally downloaded music, unofficial sports jerseys and fake designer label handbags – when collectors want high quality and original items, they will do their best to attain them.

The Potential End of the World

A further risk posing the company is that of how widely they spread their IP and its licensing – particularly with the Amazon Prime deal. A high quality TV show could bring millions of new fans and these fans are typically loyal and bring in their friends and family within this sticky community. However, a poor quality product or mistreatment of the characters and universe could have either a negative impact. Either directly through loss of its core consumer leaving the hobby or the current valuation and 12 month bump on stock price being over inflated as it assumes growth from the franchising that may not come if it is ultimately critically unsuccessful. We feel that the risk of the former is quite low, particularly having seen a generation of Star Wars fans (a not dissimilar target audience) survive a horrible decade with the prequel trilogy to stand by the characters and world that mean so much to them; we can imagine hobby gamers simply ignoring any missteps and laughing about how terrible the series were over their table top game of war. The latter, though, is genuinely a problem. The stock price will inevitably fall if the expected growth from the Amazon series does not materialise. Having said that, we do believe that there is enough of a vested interest from the production side to get this right and to land their own equivalent of a Marvel Cinematic Universe, that there is a good chance that the show(s) and movie(s) are at least a decent standard.

Summary and Chance of Beating the Market

Games Workshop has a leading position in a loyal, niche community. It has opportunities for steady organic growth and a potential accelerant in its licensing business from an agreement with Amazon Prime that could also create a flywheel with new interest leading to more purchasing of Warhammer figures, higher pricing power and further future licensing opportunities. It has strong margins that have further room to grow, a healthy starting dividend and a high chance of future growth. All of this whilst maintaining a flawless balance sheet and a negative net debt.

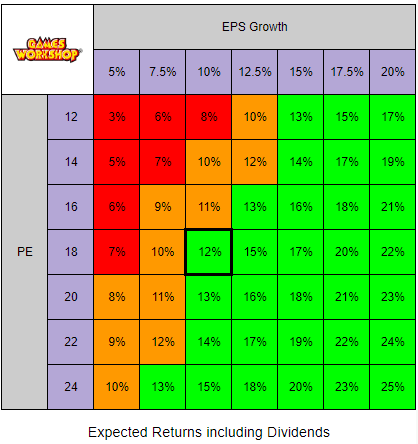

The matrix below allows one to make their own forecasted annual returns over the next 10 years. For a frame of reference:

Current TTM PE: 24

5 year average: 24

10 year EPS CAGR: 23%

10 year dividend CAGR: 22%

Red = 8% or less CAGR from current share price

Orange = between 8% and 12% from current share price

Green = 12% or more from current share price

Management requested that a 3rd party produce a research report based on current data to forecast the business into the next couple of years. Edison believe that EPS will grow around 4% for the next couple of years. This is a little lower than the around 6% forecast by analysts via Yahoo Finance.

We believe that both are a little conservative and haven’t fully priced in the media attention of potential television series impact on sales and licensing revenue. With that in mind, we forecast EPS to grow over the next decade at a 10% CAGR. This is a lower than 3, 5 and 10 year EPS growth rates but we believe that these are realistic. Time will tell.

As the company’s retail growth is quite conservative and capital expenditures have grown at a far slower rate than income in the past 10 years, we would expect dividend growth to track EPS growth at 10%. Further, we assume the market will reward it with a higher than market average PE multiple, but lower than the company’s 5 year average of 24. We have marked this below with the thickly bordered box.

Our assumptions:

10 year future EPS CAGR: 10%

PE in 2033: 18

Dividends are not reinvested

Author’s own work

Final Words

We thank you for reading this article and in advance for your constructive and critical comments in the conversation below; particularly, as we continue to iterate the way in which we write our analyses.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply