Introduction

Galp Energia (OTCPK:GLPEF) (OTCPK:GLPEY) is a relatively small Portuguese integrated oil and gas company with a production rate of just over 100,000 barrels of oil-equivalent per day. The company owns a refinery and has recently been investing in renewable energy sources as well. In an article that was published earlier this year,

Yahoo Finance

Galp’s primary listing is on Euronext Lisbon, where the stock is trading with GALP as (straightforward) ticker symbol. There current share count is little bit obscure as the company did not provide an exact share count and even its corporate website only lists the year-end share count. However, we know the company spent 235M EUR on share buybacks in the first semester, and that it owns 2.7% of its share count. Logical deduction results in an assumed net share count of 792M shares, which is also confirmed by reverse engineering the EPS with the net attributable income. This means the current market cap of the company is approximately 10.9B EUR. I will use the Euro as base currency throughout this article.

The cash is still flowing

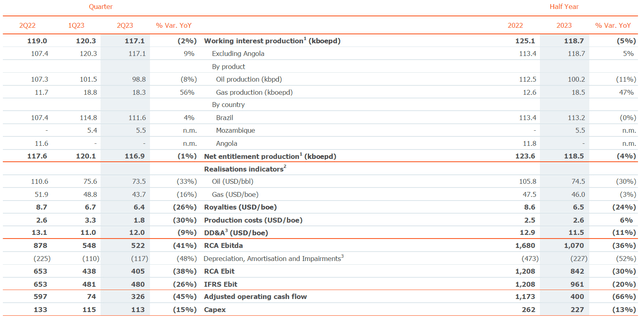

In the first half of the year, the company produced an average of 119,000 barrels of oil-equivalent per day, of which just over 100,000 barrels were oil (with the remaining portion of the oil-equivalent production coming from natural gas). The vast majority of the production came from Brazil, which accounts for 96% of the oil-equivalent output. The remainder of the production, 5,500 boe/day, comes from Mozambique, another former Portuguese colony.

Galp Investor Relations

As you can see above, the oil was sold at an average realized price of $74.50 while the natural gas was sold at a realized price of $46 per barrel oil-equivalent. As the standard conversion rate is 6 Mcf of natural gas per barrel of oil-equivalent, the average realized natural gas price was approximately $7.5 per mcf.

The image above also shows how important those ultra low cost Brazilian assets are for the company: the production cost is just $2.6 per barrel of oil, and after taking royalties and the depreciation expenses into account, the all-in production cost per barrel of oil-equivalent is just around $20. At the current Brent oil price and taking a slightly lower natural gas price into consideration, the margin is approximately $55-60 per barrel of oil-equivalent (including a higher royalty payment on the back of the current higher oil price).

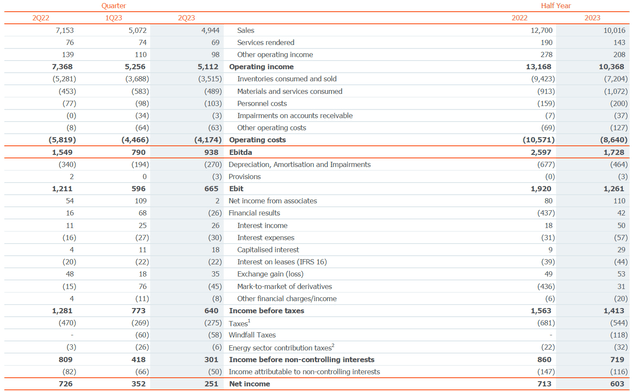

The income statement below shows how the company generated a total EBITDA of 1.73B EUR in the first half of the year, and how this translated into a net income of 719M EUR of which 603M EUR was effectively attributable to the common shareholders of Galp. And as you notice: that includes a total tax payment of almost 700M EUR for an average tax rate of close to 50%, including windfall taxes.

Galp Investor Relations

That net income of 603M EUR represents an EPS of 0.76 EUR per share.

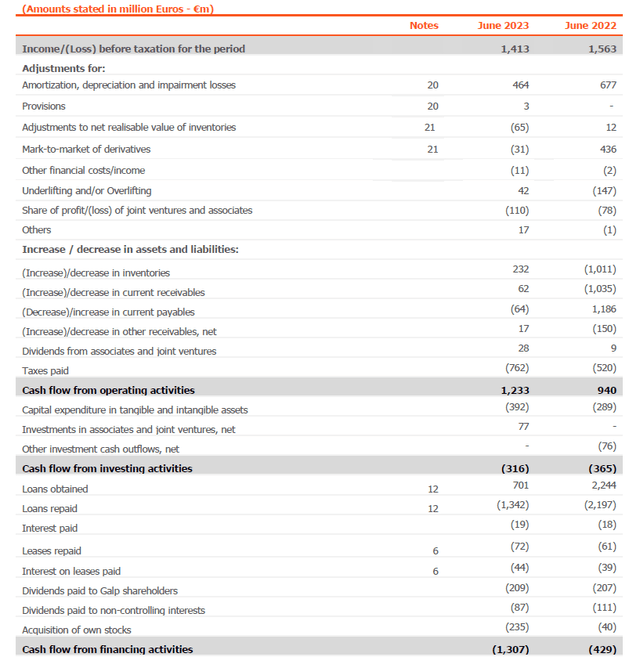

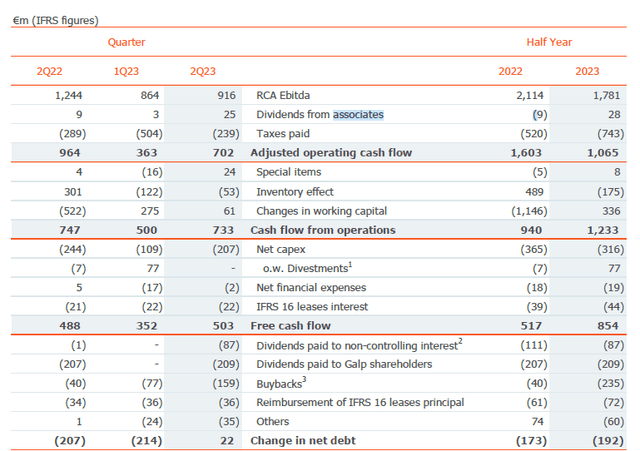

Looking at the cash flow result of Galp, we see a total reported operating cash flow of 1.23B EUR. However, this includes about 70M EUR in taxes paid that were not owed based on the H1 income statement. But it also includes a contribution of 247M EUR from changes in the working capital position. Additionally, we should deduct the 87M EUR in dividends paid to non-controlling shareholders and the 135M EUR in interest payments and lease payments.

Galp Investor Relations

Adjusting the cash flow result for all those elements reduces the underlying operating cash flow was approximately 834M EUR.

We see the total capex was 392M EUR, which means the underlying free cash flow generated by Galp Energia was approximately 440M EUR in the first half of this year. That’s approximately 56 cents per share. That is lower than the reported net income, but the difference is relatively easy to explain. First of all, the net income includes almost 110M EUR in gains on derivatives and the value of inventories, but this is an accounting gain and does not involve cash flow. Secondly, there was a 110M EUR contribution from joint ventures and associates, which also boosted the net result by about 82M EUR (110M EUR in accounting profit minus the 28M EUR in dividends received).

As you can see below, Galp offers an alternative way to calculate the free cash flow, and according to its own calculation which includes the positive impact from working capital changes.

Galp Investor Relations

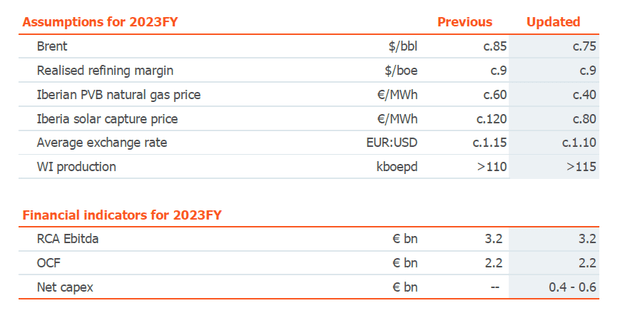

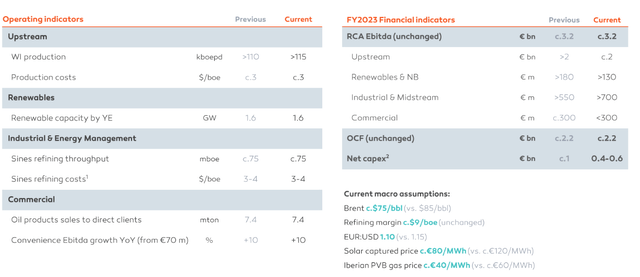

Although the first half of the year was a bit weaker than anticipated, Galp Energia confirmed its full-year outlook. The company was optimistic at the end of June thanks to an improved business environment. As you can see below, the company now still expects to generate 3.2B EUR in EBITDA and a 2.2B EUR in operating cash flow despite lower power prices and assuming a lower Brent oil price. The image below now shows a full-year guidance based on $75 Brent and the current Brent oil price which is trading around $90/barrel should for sure help the company to realize its objectives.

Galp Investor Relations

Using Galp’s own operating cash flow guidance of 2.2B EUR and assuming a total net capex of 0.6B EUR (the higher end of the guidance), the net free cash flow will come in around 1.6B EUR, or just over 2 EUR per share.

Galp Investor Relations

That is good news, but let’s not forget the company’s guidance includes the net cash inflow from the sale of the Angolan operations (and that’s why Galp talks about the ‘net capex’, referring to the capex minus cash inflow from divestments).

Galp Energia plans to pay a full-year dividend of 54 cents per share for a dividend yield of approximately 4% based on the current share price. Unfortunately, the standard dividend withholding tax rate in Portugal is approximately 35%, so investors are cautioned to check for double taxation treaties to reduce the tax pressure.

Investment thesis

I admit I am somewhat surprised by Galp Energia keeping its full-year guidance unchanged, although it reduced the expected realized prices for its oil and electricity production and the very strong performance and increased guidance in the industrial and midstream division is saving the day. I expect Galp to provide a more detailed guidance update after the third quarter and based on the current situation on the oil and gas market, I wouldn’t be surprised to see yet another confirmation of the full-year guidance, boosted by a strong third quarter.

We know the underlying free cash flow using an oil price of $75/barrel is already pretty strong at an annualized result of 1.1-1.15 EUR per share. I also expect the company to further reduce its net debt which should keep the interest expenses and related cash outflow under control. In any case, the 2B EUR in cash makes for a very robust balance sheet. This also means the company can continue to elect to pay off maturing debt rather than refinancing 100% of the amount. The average cost of debt was 3.1% during the first half of the year, and considering the 2026 bonds are trading at a yield to maturity of 4.5% on the secondary markets, I don’t expect the net interest expenses to increase by a whole lot from the current level. Even if the cost of debt increases by 150 bp, that will increase the gross interest expenses by less than 55M EUR per year. Meanwhile, the 2B EUR cash pile will also start to generate some interest income.

Going forward, Galp will see its capex increase as the company is still investing in growth. There will be less growth in the renewables division as the company’s management confirmed on the Q2 call it doesn’t want to add capacity for the sake of adding capacity; it needs to make economic sense as well. The longer-term guidance is for an annual net capex of 1B EUR and this likely already includes some capex related to a Mozambique LNG project (although this still needs to be sanctioned as it is in the pre-FEED and FEED stage). Meanwhile, the Bacalhau project ($1.6B capex attributable to Galp, but subject to some cost overruns) should be up and running in the summer of 2025 and add 40,000 barrels of oil to the production profile. That will represent a 30-40% production increase. At $75 Brent, these barrels should add about $900M in pre-tax operating cash flow per year.

While Galp Energia does not appear to be extremely cheap based on this year’s results, the anticipated production growth in combination with low decline rates (around 5%) means Galp could and should be seen as an investment in production growth. The Brazilian assets are producing oil at a cost of less than $3/barrel and this will be the main economic driver for the company.

I currently have no position in Galp Energia, and although I don’t think there is any rush, I will likely start to accumulate a position in anticipation of the strong production growth in 2025.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply