Thesis

I covered Gain Therapeutics, Inc. (NASDAQ:GANX) some months ago, having found both the company’s drug-discovery platform Magellan and drug candidate GT-02287, the second drug candidate with best-in-class potential which has been generated by that platform, fascinating.

I believe GT-02287 may be able to slow or stop disease progression by a disease-modifying mechanism, contrary to current therapies which are only symptomatic.

I am returning to coverage of the company because Gain is at a pivotal moment in its progression, and because the recent dip presents a good buying opportunity. Gain’s stock has been volatile lately, having seen gains of +40% since my initial coverage, but now trading -30% below.

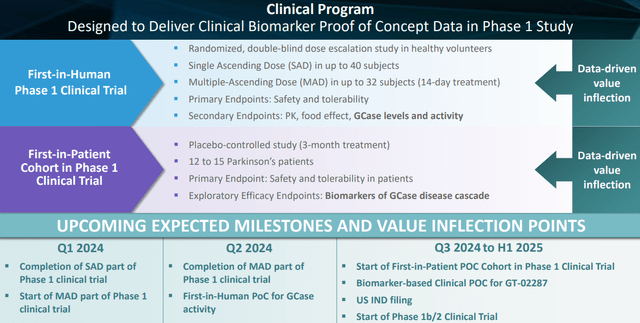

The progression of the company has been drastic. A Phase 1 trial has been initiated in October 2023, Gain has already reported on the SAD part, will probably end the MAD part in a month’s time, and may potentially report on it soon after. That readout should include data on GT-022287’s effect in healthy humans. As an extension to that trial, a 3-month first-in-human proof of concept in 12 to 15 patients with Parkinson’s disease will follow.

Phase 1 trial and upcoming milestones (Corporate Presentation)

The company’s valuation remains drastically disproportional to other valuations in the space and recent acquisition targets.

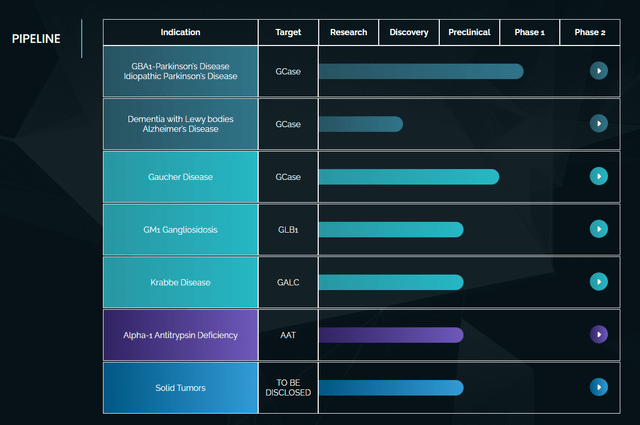

Gain Therapeutics’ pipeline

This is Gain Therapeutics’ current pipeline.

Gain pipeline (Corporate Presentation)

Most of the work is preclinical, probable due to the focus and good results on Parkinson’s, by far the largest indication with the highest unmet medical need.

Parkinson’s disease

Parkinson’s disease is the second-largest neurodegenerative disease, with 1 million patients in the U.S. and 10 million worldwide. Current treatments are only symptomatic, with levodopa being considered the most potent of available drugs.

There is no disease-modifying treatment available, nor is there a progression similar to Alzheimer’s disease where after two decades of failures, first disease-modifying therapies are finally starting to yield some results with FDA [accelerated] approvals to follow.

Three elements typically characterize Parkinson’s disease. One of them is also found in several neurodegenerative diseases, namely chronic low-grade neuroinflammation with the related atypically reactive/inflammatory profile of different types of reactive/inflammatory glial cells, which thereby fail to execute their neuron-nurturing functions. The two other elements are degeneration of dopaminergic neurons, and the presence of aggregates of the protein α-synuclein which are often referred to as Lewy bodies. Parkinson’s is further linked to different cellular dysfunctions, such as dysfunction of the lysosome and mitochondria.

The disease will probably not be solved with a one-drug-fits-all approach, and I believe it would be incorrect to consider that GT-02287’s drug would be the exception here. Triggers for Parkinson’s are multiple and may be different from one person to another. The onset and progression of Parkinson’s may be linked to genetic predispositions, pesticides, microbiome health, inflammation, ageing, etcetera. Efforts to treat the disease from the angle of [solely] removing or reducing the load of α-synuclein aggregates have been the most abundant, but have failed so far.

Gaucher disease

Gaucher disease, as the most common lysosomal storage disease, is caused by mutations in the GBA1 gene. These mutations cause misfolding and dysfunction of GCase, which leads to the toxic buildup of fat in various organs and tissues.

GT-02287

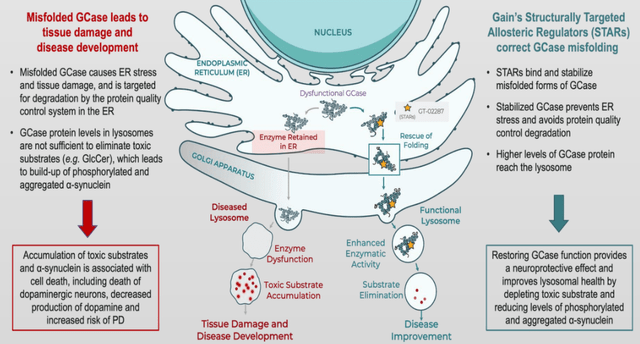

GCase dysfunction and the lysosome

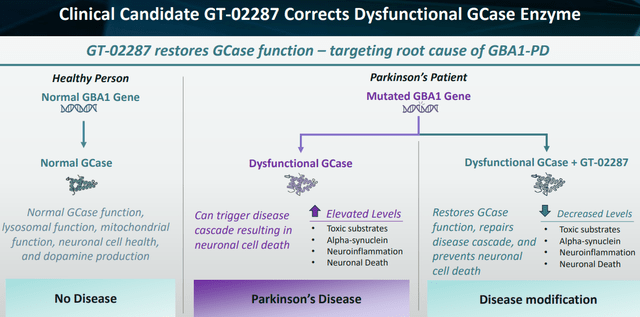

Gain’s orally administered drug candidate GT-02287, generated from the drug discovery engine Magellan, is a small brain-penetrant molecule that modulates the activity of glucocerebrosidase or GCase. Mutations in the GBA1 gene, which is responsible for the creation of GCase, are the second-highest genetic risk factor for Parkinson’s disease. Such mutations are found in up to 15% of all patients with Parkinson’s disease. Parkinson’s disease patients in general have GCase-related lysosomal dysfunction, implying that GCase may be implicated in PD beyond genetic mutations solely. GBA mutations have also been linked to inflammation in Parkinson’s disease.

There is one off-patent GCase modulator, commonly known as Ambroxol. Ambroxol is being tested in Phase 3 trials for Parkinson’s. Another GCase modulator in Phase 1 trials for Parkinson’s is Vanqua Bio’s drug candidate VQ-1010. The rationale behind both treatment candidates is that improving GCase activity may halt or slow down disease progression.

Only GT-02287 prohibits GCase misfolding

Unique to GT-02287 is that it is the only drug that prohibits GCase-misfolding. This may be the game-changer and the explanation of the impressive preclinical results that have been presented by Gain so far, which I will discuss further below.

GT-02287 allows a regain of lysosomal function by preventing or repairing misfolded GCase. That intervention should create a cascade of positive downstream effects, including reduction of inflammation and reduction of neurodegeneration. Misfolded GCase accumulation on the outside of the lysosome may prevent the lysosome from functioning correctly, and may lead to, among other things, the accumulation of α-synuclein in the intracellular space, and other debris which is being prevented from entering the lysosome. Some of that debris is being aggregated and removed from the cell, where it becomes extracellular waste which glial cells may interact with, leading to an extracellular inflammatory reaction.

GCase dysfunction in Alzheimer’s (Corporate Presentation)

Scientists have recently discovered that GCase also has a function in mitochondria, and that mutant GCase may be implicated in mitochondrial dysfunction. By allowing correct folding of GCase, GT-02287 may be able to prevent lysosomal and mitochondrial dysfunction.

GCase dysfunction has also been linked to neuroinflammation and is linked to more the buildup of α-synuclein, possibly in a feedback loop.

As lower levels of GCase are found in patients without a GBA1 mutation, the beneficial effect of GT-02287 may not only be for those with a GBA1-mutation, but in all idiopathic Parkinson’s patients. GBA-mutant Parkinson’s patients are known to have more severe, early onset disease.

GT-02287 corrects dysfunctional GCase (Corporate Presentation)

At the time of its discovery, the science on Parkinson’s disease had not yet evolved to the point where the abnormal accumulation of misfolded GCase and its downstream effects was seen as a potential cause of Parkinson’s disease.

LRRK dysfunction in Parkinson’s and potential crosstalk with GBA

Mutations in the LRRK genes are most common in Parkinson’s, and Denali Therapeutics’ (DNLI) drug DNL151 pursues that target together with Biogen (BIIB) under the name BIIB122. That collaboration between Denali and Biogen included a $560 million upfront payment, a $465 million equity investment and potential milestone payments, profit sharing and royalties.

LRRK also regulates the autophagic-lysosomal pathway, and mutant LRRK2 is considered to impair autophagy, leading to accumulation of α-synuclein on the lysosomal membrane. LRRK2 and GBA influence each other. GCase activity is reduced in LRRK2 mutant cells, and LRRK2 inhibition alters GCase activity in GBA mutant cells. There appears to be a crosstalk between LRRK2 and GBA in Parkinson’s disease, the exact mechanism of which is considered unclear.

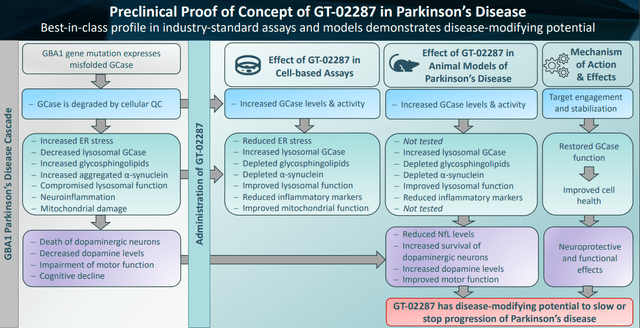

Positive preclinical data

Gain has been releasing an abundant amount of positive preclinical news on GT-02287 over the past years. I highlighted some of those findings in earlier coverage and will therefore focus on the more recent news below, briefly passing over what has been found before.

Reversal to baseline of neurofilament light: biomarker of excellence of neurodegeneration

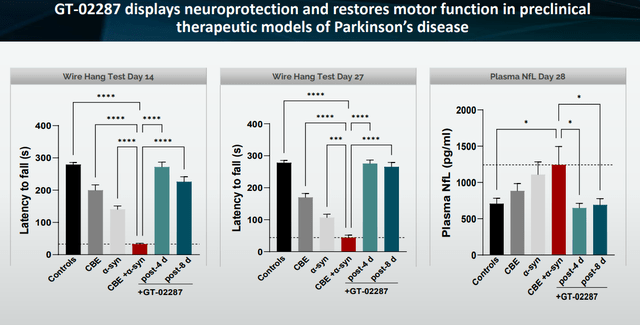

In February 2024, Gain presented data demonstrating that GT-02287 completely restored motor function in a mouse model of GBA1 Parkinson’s disease, and at the same time substantially reduced plasma levels of neurofilament light chain, implying that neuroregeneration is indeed taking place.

Wire Hang Test and NfL data (Corporate Presentation)

The wire hang test measures how long mice can dangle on a wire. Healthy mice on average hang on the wire for five minutes, compared to less than one minute for the mouse with a Parkinson’s and mutant GCase insult.

With GCase administration, at day 14, there is basically no difference between motor control of the control group and the group that had the toxic insult mimicking Parkinson’s disease which received GT-02287 after four days. That means full restoration of function in these mice was possible in ten days. That means that when the Parkinson’s mice were treated with GT-02287, they performed comparable to healthy mice. Even when treatment began only 8 days after the toxic insult, regain of function was high. At 27 days, the functional difference between both treatment groups was almost identical. These results are contrary to the loss of function seen in the CBE-model representing the mutant GCase insult, the α-synuclein model and the CBE+α-synuclein mouse models, which gradually performed poorer.

To put this into perspective, there is no disease-modifying drug for Parkinson’s disease. A drug that may halt the progression of the disease or, even better, improve function, would be received as a miracle drug.

The NfL differences are truly remarkable as well. Neurofilament Light is a biomarker of neurodegeneration, or regeneration if you will, accepted by the FDA for Biogen’s (BIIB) Qualsody in ALS with an SOD1-mutation at least. It is seen by many as the biomarker of excellence to assess the state of the underlying neurons, and hence potentially also the disease-modifying impact of a drug. In the concerned models, NfL dropped back to control levels immediately after treatment with GT-02287, whereas it was almost double in the CBE+α-synuclein group. Concretely, that means about a 40-50% reduction immediately after drug treatment and, perhaps more interestingly, a reversal to baseline.

In August 2023, Gain had already presented preclinical data that indicated a significant reduction of plasma NfL levels over the course of 14 days. And before that, Gain had reported statistically significant and dose-dependent motor improvements in a mouse model of Parkinson’s.

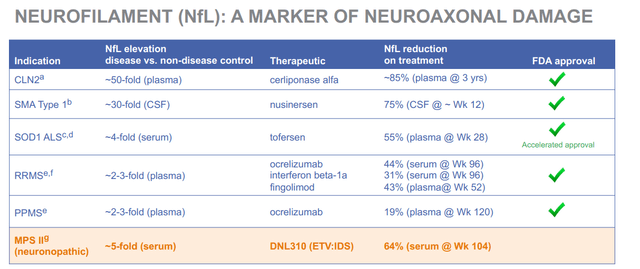

To put these NfL data in perspective, I am referring to a corporate presentation slide of another company in the neurodegenerative space, namely Denali Therapeutics (DNLI), linking NfL reductions and FDA approvals.

NfL and FDA approval (Denali corporate presentation)

Remark the percentage reductions and their long respective timeframes particularly. The best performer here is a 75% reduction over 12 weeks. Comparing mice and men may be apples to oranges, but a 40-50% reduction in a model of Parkinson’s disease, reverting to the level of controls after toxic insults, seems indicative of strong disease modification to me.

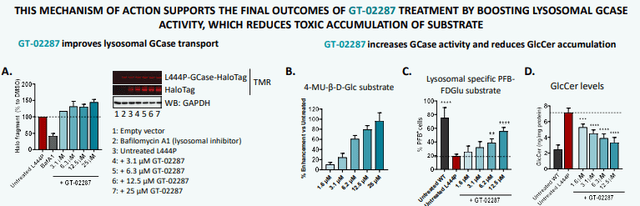

Mechanism of action of GT-02287

In March 2024, Gain has presented the mechanism of action of GT-02287 in detail at the annual AD/PD conference, showing how GT-02287 aids GCase in the endoplasmic reticulum to fold correctly, thereby preventing ER stress and allowing GCase to travel to the lysosome, with improved lysosomal activity and processing of glucosylceramide as the GCase substrate as a consequence.

GT-02287 MoA (Poster March 2024)

Earlier preclinical findings

I am summarizing the earlier preclinical findings below to a minimum. Readers are referred to my earlier coverage for more detail.

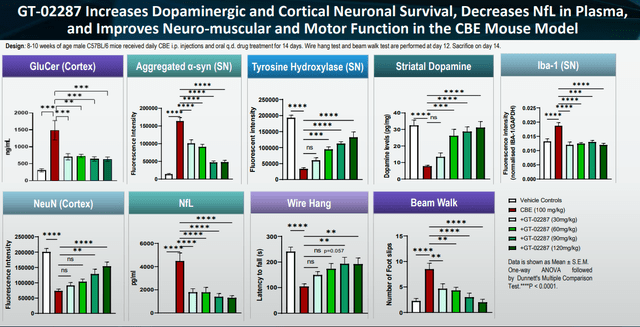

Gain had previously shared preclinical research showing reduction of α-synuclein, raised levels of striatal dopamine and reduced inflammation through lowering of microgliosis. As these are hallmarks of Parkinson’s disease, this is of true importance.

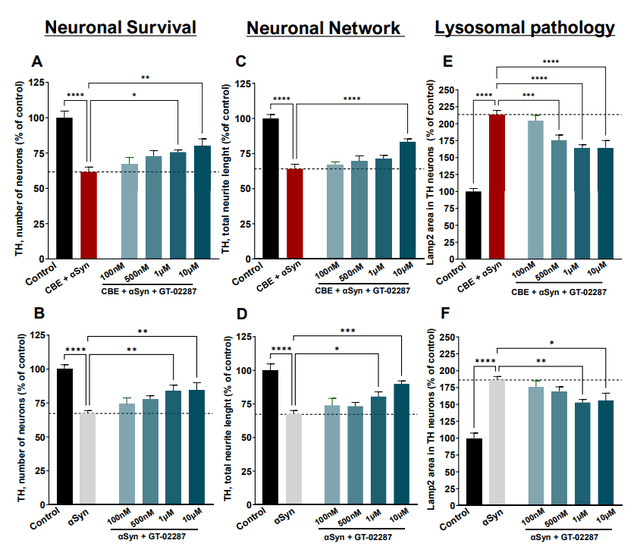

Preclinical findings slide (Corporate Presentation)

GT-02287 had also shown efficacy in repairing neurons and lysosomal function, and had been shown to 02287 reduce the accumulation of GCase outside the lysosome and reduce TNF-α levels, and increase dopamine levels.

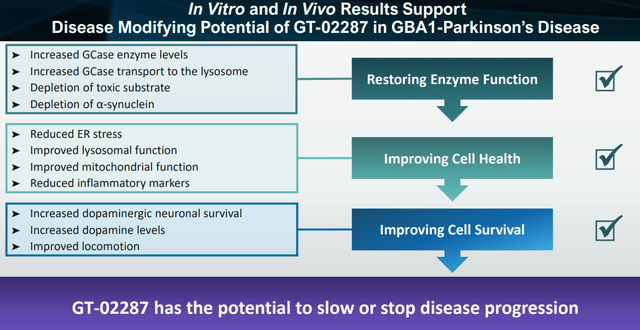

GT-02287 improves neuronal survival, neuronal network and lysosomal pathology (Corporate Presentation)

GT-02287 basically seems to address all elements of the Parkinson’s cascade, at least to some degree. It remains to be seen to what extent that may impact human with a GBA1-mutation and those with idiopathic Parkinson’s disease.

GT-02287 restores enzyme function and improves cell health and cell survival (Corporate Presentation)

I believe that Gain, therefore, rightfully considers that GT-02287 may have a best-in-class profile.

GT-02287 best-in-class profile (Corporate Presentation)

Thoughts on valuation

Trading has been volatile over the past six months, with two lows of $2.14 and $2.34 respectively and an intermediate high of $5.33. The current market cap of Gain is $43 million.

I remain of the opinion that Gain is drastically undervalued compared to its peers and believe that a correction to a more appropriate valuation will one day probably be drastic as a consequence, either in response to a catalyst or interest from third parties. The fact that about half of the last financing came from a private placement with an accredited investor may indicate the same, and one of the Company’s longest and largest shareholders remains Billionaire David Einhorn of Greenlight Capital, who sits on the Michael J. Fox board of directors.

Even if one would make an abstraction of Magellan and Gain’s other preclinical candidates of Gain, the current share price reflects about a $43 million market cap which is low for a drug with this potential, this much successful preclinical research, this state of progression, and this market potential. I can already refer to the above-mentioned collaboration between Biogen and Denali that included a $560 million upfront payment, a $465 million equity investment and potential milestone to indicate that.

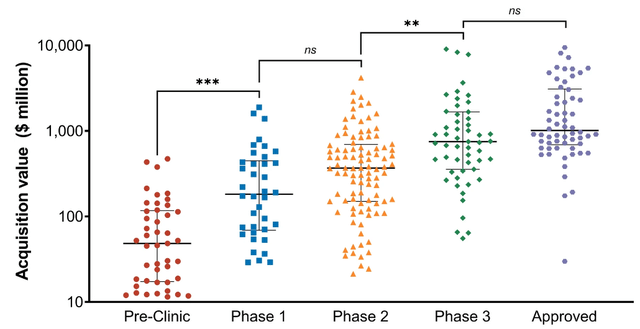

Seeking Alpha analyst Vision and Value had in previous coverage used a blended analysis based on comparable valuations, where he estimated Gain’s enterprise value to be $680 million, leading to a fully diluted share price of just over $30.

Gain has meanwhile progressed towards the end of its Phase 1 trial already, warranting a valuation that is in any case not lower than before, but much higher. That can be seen from the below graph on valuations as a function of the clinical trial phases.

Acquisition values biotech (The European Journal of Health Economics, Value drivers of development stage biopharma companies)

In the present case, the indication Gain is targeting is the second-highest unmet medical need in neurodegenerative diseases, with Alzheimer’s being highest.

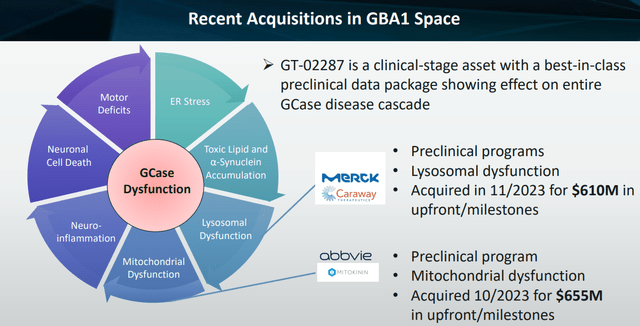

It makes sense, then, that Merck’s (MRK) Caraway was acquired for $610 million for a preclinical drug targeting the lysosome in neurodegenerative diseases supported the above valuation, even if Caraway lacked a drug discovery engine similar to Gain – and Gain probably holds a better and in any case further-progressed drug candidate. AbbVie’s (ABBV) acquisition of Mitokinin for $655 million for a preclinical program focusing on mitochondrial dysfunction in Parkinson’s disease again confirms the undervaluation here.

Recent acquisitions in GBA1 space (Corporate Presentation)

For Gain, it is really a sum-of-the-parts story that makes the story so compelling.

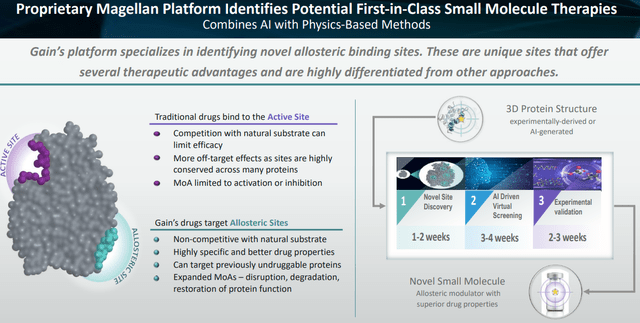

The market may be fully neglecting the quality and value of Magellan, Gain’s AI-based drug-discovery engine. When Vividion’s drug discovery platform was bought by Bayer (OTCPK:BAYRY) for $1.5 billion, plus $500 million in milestones, one of the reasons stated was that Vividion’s platform enabled the development of drugs that bind to “undruggable” targets. That is precisely what Gain’s Magellan does, and successfully so.

Magellan platform slide (Corporate Presentation)

In fact, Gain had IPO’d in 2021 after it had been spun-off in 2018 by Minoryx Therapeutics, at the time primarily incorporating See-Tx. Minoryx’s drug leriglitazone was See-Tx’s first brain child, so to speak, and has in May 2023 been granted FDA approval to progress to a Phase 3 trial.

The platform is now called Magellan. Magellan has meanwhile created several other drugs, one of which I had covered before, targeting Alpha-1 antitripsyn deficiency which is caused by the misfolding of ATT. Since doing so, the platform has been dramatically improved and is far more powerful today than in its original state. Upcoming MAD safety data should prove as an important validation for the power of Magellan. Some smart investors I’ve spoken with in the space believe Magellan alone could be sold for nearly 10X the value of the entire company. Earlier this year, Sanofi acquired Inhibrx for its Alpha-1 antitrypsin deficiency drug candidate. Inhibrx’s lead asset was in Phase 2 trials, which is further along than Gain’s, but Inhibrx buyout was also valued at $1.7 billion or about 1/38th of Gain’s actual market value.

Progress and catalysts

Gain is currently in the middle of a fast-progressing single-center randomized placebo-controlled Phase 1 trial consisting of two phases: a single-ascending dose and multiple-ascending dose phase in 40 and 32 healthy subjects respectively with focus on safety, tolerability, identification of a maximum tolerated dose, identification of recommended patient dosing and impact on lysosomal GCase.

First dosing had taken place in October 2023 and a first positive readout of the SAD phase has already taken place. GT-02287 was generally well tolerated up to and including the highest planned dose level, and there were no serious adverse events.

The MAD part of that trial had been initiated in February 2024.

First results of the MAD phase may already be available in the coming month or so. Repeated guidance of the company mentioned that the end of the Phase 1 trial is foreseen for Q2 2024. I assume that around the same time, further data on GT-02287’s impact on GCase may be reported.

Gain then plans to initiate a 3-month cohort of 12–15 Parkinson’s patients, as an extension to its Phase 1 trial, to generate clinical proof of concept based on biomarkers of the GCase cascade, to be initiated some time in Q3 2024 – 1H 2025. Data from that extension are expected in late 2024 or early 2025, ahead of starting a Phase 2 clinical trial in the first half of 2025. That is quite the tempo.

I believe mostly the data on GCase impact from the SAD and MAD phases of the Phase 1 trial, and subsequently data from the 12–15 patients with Parkinson’s disease may be impactful for investors and big pharma if tuned in. Gain has made it no secret that it has been having talks with big pharma over the past years. Though acquisitions can happen anytime, I would understand it if big pharma wanted to see more data coming out of the trial before it proceeds to talks on valuation.

Financials

On May 14, 2024, gain had reported cash of $12.7 million as compared to $16.8 million at the end of the previous quarter. The net loss for the year ended December 31, 2023, was $22.3 million, compared to a net loss of $17.6 million for the year ended December 31, 2022. Gain estimates that its existing cash levels should be sufficient for a cash runway to fund operations into the first quarter of 2025, which seems a correct estimate with a cash burn of about $4 million per quarter.

The recent $610 million acquisition of lysosome-targeting Caraway Therapeutics could be seen as a confirmation of the right approach being taken by Gain. Gain comes at one tenth of Caraway’s acquisition price and is further evolved, clinical stage versus pre-clinical.

Conclusion

Gain continues to be well positioned to achieve multiple clinical data-driven value inflection points with lead program GT-02287 for GBA1 Parkinson’s disease.

GT-02287 may be a drug with best-in-class potential which may be able to slow or stop disease progression by a disease-modifying mechanism, contrary to current therapies which are only symptomatic. This is apparent from abundant preclinical work, including recently shared data showing full restoration of motor function in mice and restoration of NfL values to baseline in mice. NfL is the biomarker of excellence of neurodegeneration.

Gain Therapeutics is significantly undervalued, either when compared to other players in the neurodegenerative space, in light of recent acquisitions of companies with preclinical drug targets, or in light of the quality and proven history of its drug discovery engine. Preclinical valuations of about $600 million or clinical collaborations of $500 million plus equity investments and milestone payments are no exception. Gain has a proven track record with Magellan, as that platform has already delivered a drug with best-in-class potential which is currently in Phase 3 trials, and GT-02287 appears to be following suit with staggering potential.

Gain should soon report on the MAD part of its Phase 1 trial assessing safety and tolerability of the drug, and GCase function. After comforting preclinical data and data from the MAD phase of the Phase 1 trial, I expect further positive data. Additionally, data on impact on lysosomal GCase may really trigger interest here – if not from the market, then possibly from big pharma. The space shows there is interest from big pharma, for good reason, and Gain has made it no secrets it has had talks with big pharma. It makes perfect sense, a drug that can stop neurodegeneration early in advance of the devastating disease cascade effect, restore both motor function and cognitive function, while improving mitochondria function, represents the holy grail. With biomarkers and testing now available, the drug could rival Humira as all middle-aged people could possibly take it as a prophylactic and preempt onset of Parkinson’s, ALS and others debilitating diseases.

Gain is subsequently expected to initiate a 3-month proof-of-concept study in GBA1 Parkinson’s patients as an extension of that same Phase 1 trial, with results by the end of 2024 or early 2025. That could really heat up things.

At a market cap of about 40 million, I believe the undervaluation is drastic. As a consequence, the eventual repricing may be equally drastic. For all of the above reasons, Gain Therapeutics, Inc. stock remains a Strong Buy for me.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply