The iShares China Large-Cap ETF (NYSEARCA:FXI) product has been a bearish beast over the past years. While the U.S. and most other leading world stock markets posted impressive gains in 2023, FXI continued its descent, and the path of least resistance continues to head toward a bearish abyss.

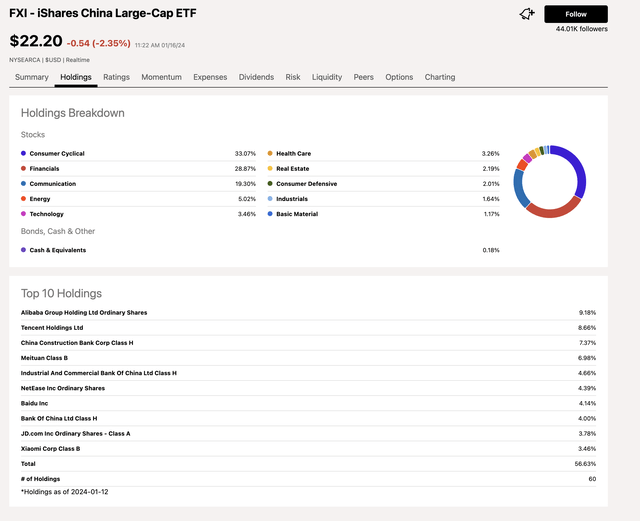

As of January 12, 2024, FXI’s top holdings included:

Top holdings of the FXI ETF Product (Seeking Alpha)

At $22.20 per share, FXI had a $4.16 billion market cap. The annual $0.61 dividend translates to a 2.75% yield, higher than the SPDR® S&P 500 ETF Trust (SPY) at 1.39%, Invesco QQQ Trust ETF (QQQ) at 0.62%, SPDR® Dow Jones Industrial Average ETF Trust (DIA) at 1.81%, and iShares Russell 2000 ETF (IWM) at 1.40%.

FXI trades an average of nearly 41.5 million shares daily and charges a 0.74% management fee. FXI needs to pay a higher dividend as its price performance in 2023 and over the past years has been horrendous, leading to capital depreciation for investors.

In mid-October 2023, in a Seeking Alpha article on FXI, I wrote:

“Chinese equities are inexpensive for good reason, but a contrarian approach to the world’s second-leading economy could pay off in the coming years despite the ugly bearish trend.“

FXI was at the $26.84 level on October 10, 2023, and continued to move lower throughout 2023, underperforming the leading U.S. stock market indices.

FXI far underperforms the leading U.S. stock market indices

Since FXI is the ETF that tracks Chinese companies that trade on foreign exchanges, measuring it against the top U.S. stock market ETF products provides relative performance insight.

- In 2023, FXI fell 15.09%.

- SPY rose 24.3%.

- QQQ increased 53.8%.

- DIA moved 13.7% higher.

- IWM rallied 15.1%.

The over 15% decline in FXI in 2023 far underperformed all the leading U.S. stock market indices and most other international equity benchmarks.

China’s economy remains weak – Investors shun Chinese equities

The slowdown in China’s economy over the past years, since the 2020 pandemic, has weighed on Chinese stocks. While economic weakness has been one factor contributing to the low equity levels, the bifurcation of the world’s nuclear powers has been a reason for U.S. and European investors to avoid Chinese equities.

Until some détente between Washington, DC, and Beijing occurs, buyers could continue to shun Chinese equities. Since China is a centrally planned economy, an investment in Chinese companies translates to an investment in the Chinese government.

Value is hard to come by: We could see money flow into Chinese stocks if geopolitical factors stabilize

After significant double-digit percentage gains in U.S. stocks in 2023, identifying value has become challenging, leading investors to seek alternative investment assets.

The late Charlie Munger, Warren Buffett’s investment partner for decades, remained a firm supporter of Chinese investments until his death despite China’s economic woes.

In a 2023 interview, Munger said, “The Chinese economy has better future prospects for the next 20 years than almost any other big economy.” Munger and Buffet have been the leading world “value” investors for decades. Their results have been a testament to patience and perseverance in undervalued assets. However, the price action in Chinese stocks shows the overwhelming market sentiment runs counter to the Oracle of Omaha and his late partner.

Meanwhile, any improvement in relations between China and the U.S. could cause a tidal wave of capital to flow into Chinese equities.

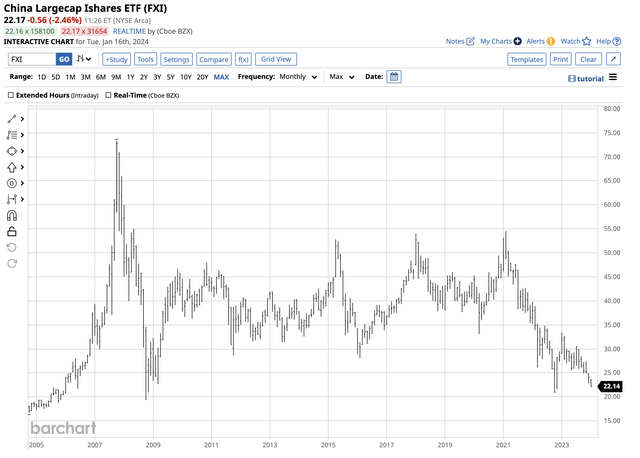

A bearish trend since early 2021- FXI is approaching its critical support level

The trend is always your best friend in markets across all asset classes. FXI’s trend remains bearish in early 2024.

Long-Term Chart of the FXI ETDF Product (Barchart)

The chart highlights FXI’s bearish trend since the February 2021 $54.52 high. The peak came before China and Russia shook hands on their “no-limits” alliance and before Russia invaded Ukraine. Meanwhile, Chinese plans for Taiwanese reunification have caused the further deterioration of relations with the U.S., weighing on FXI and other Chinese equities trading on foreign exchanges.

FXI reached a $20.87 per share low in October 2022, a higher low than in 2008 when it fell to a $19.35 bottom. At $22.73 on January 12, FXI was not far from challenging these critical technical support levels.

Meanwhile, U.S. and other stock market indices have soared over the past years, leaving FXI in the dust. While it may offer value, the performance has made FXI dead money from an investment perspective.

The essential issues for China in 2024

The crucial factors facing China in 2024 are:

- The economic conditions remain weak in early 2024. Chinese exports fell in 2023 for the first time since 2016. The 4.6% decline from the previous year in the manufacturing-driven economy comes amid slowing global growth.

- High youth unemployment and low domestic consumption have added to China’s economic woes.

- Voters chose pro-sovereignty candidate William Lai as President in the recent Taiwan election, angering China and increasing the potential for a hostile reaction from Beijing.

- The war in Ukraine continues, and Chinese support for Russia remains steadfast.

- The U.S. election could cause U.S. policy toward Beijing to change over the coming months, for the better or the worse.

- The war in the Middle East has divided the world. China’s position as a nuclear power, the world’s second-leading economy, and a population of over 1.4 billion means China will play a critical role in the region. China has close ties with Tehran and Moscow.

- The increasing potential for a BRICS currency to challenge the U.S. dollar’s reserve currency role could change cross-border payments and trade dynamics, impacting the global financial system and tilting it more in China’s favor.

These issues and other unexpected events could cause market volatility across all asset classes. While Charlie Munger favored Chinese investments until his recent death, many investors are unlikely to follow the value investor, given the current economic and geopolitical climates. However, patience and perseverance could pay off handsomely when the situation improves.

I favor a small portfolio allocation in iShares China Large-Cap ETF, leaving room if the ETF challenges the critical October 2022 and October 2008 technical support levels. I view FXI as a lotto ticket for an improvement in Chinese-U.S. relations. The ugly price action over the past years creates significant value for investors with a long-term horizon and stomach for the potential for a continuation of mark-to-market losses.

Read the full article here

Leave a Reply