For those who follow my analyses, you know I’m quite intrigued by micro-cap stocks with a strong mission: the name of the game is either revolutionize an entire industry or fade away. After delving into Nano-X Imaging (NASDAQ:NNOX), I’m inclined to believe this company is leaning more toward the latter option. While its mission is indeed compelling and the company has made significant strides on the regulatory front in recent months, I find that the red flags outweigh the signals of optimism.

An important caveat to consider is that when it comes to companies operating in the biotechnology field, there’s often a significant gap in expertise between investors and the company itself. Evaluating elements like regulatory approvals, pre-sale agreements, or financial data projections is one thing; however, properly assessing the technology and product requires a deep understanding of an entirely different field. The histories of Theranos and many other ventures have taught us that it’s easy to get carried away by enthusiasm, much easier than diving into dozens of scientific papers.

Nano-X Imaging: What Makes It Special?

Nano-X is a company specializing in X-ray machinery. There are three major innovations that set it apart from other industry players:

-

Its machines employ a specific technology, which we’ll delve into shortly, potentially capable of making them much lighter, more efficient, and, above all, less costly than traditional X-ray machines.

-

These machines are connected to a cloud platform where an AI algorithm can analyze the produced image and determine if everything is in order.

-

If everything is in order, feedback is promptly sent to the medical professionals. If there are issues, the cloud platform can send the images to a radiologist registered on Nano-X’s marketplace. Thanks to this marketplace, images can be analyzed by doctors located thousands of kilometers away. This helps address the shortage of specialists, especially in rural hospitals.

The company’s goal is to provide revolutionary machines along with a revolutionary experience. With this business model, it hopes not to directly compete with traditional X-rays but to expand the market to many smaller centers where X-ray machines are unavailable or extremely outdated.

To achieve this goal, Nano-X has also devised an innovative sales model: instead of selling its Nano.ARC machine in a traditional manner, will use a pay-per-use model where the buyer pays a predetermined amount for each X-ray. The minimum contract is for 7 X-rays per day, but Nano-X believes that each machine can perform an average of 20 at full capacity. Currently, the company has negotiated an average price of $40 per X-ray in pre-sale contracts.

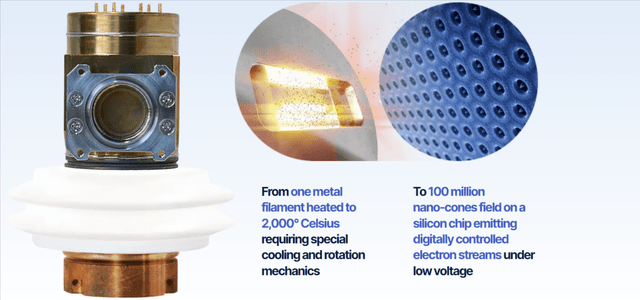

The Key Innovation: Cold Cathode System

Almost all X-ray machines worldwide operate on the same principle. A cathode is heated to temperatures of 1,000-2,000°C, and the heat forces the metal to emit electrons. Thanks to the potential difference generated by the electric current supplied to the machine, electrons travel within a tube, called a thermionic tube, towards the anode. When they strike the anode, they release X-rays.

Once the X-rays hit the patient, they penetrate to varying depths depending on the encountered tissues. In old X-ray machines, the rays then struck a film, leaving an imprint of their penetration; nowadays, digital sensors are almost always used to produce a computerized image. Nano.ARC is also designed to produce a computerized image, which is immediately sent to the cloud system and processed by the AI.

Nano-X Imaging Website

The significant difference lies in Nano-X’s machines, where the process occurs “at a cold cathode.” Instead of heating the cathode, electrons are released through the creation of a magnetic field. This should give Nano-X Imaging’s machines several advantages over the competition:

- Reduced weight and size.

- “Potentially” lower production costs (as cited by the company).

- Greater energy efficiency.

- Longer lifespan, especially due to the absence of cathode corrosion caused by high-temperature heating.

As of May 2023, the company has secured FDA 501(k) approval to market Nano.ARC and Nano.Cloud in the United States. Three systems are already installed in Africa, awaiting approval, where they are collecting test data in some hospitals in Morocco, Nigeria, and Ghana.

Too good to be true?

The radiography market is expected to be worth approximately $3 billion by 2026, according to Fortune Business Insights. Nano-X Imaging is currently valued at only $360 million, boasts superior technology compared to anyone else, has a strong price advantage with its products, offers revolutionary AI, and is finally ready for large-scale production. Shouldn’t you just buy the stock and wait for it to become the next big winner? Not so fast.

I don’t think so. I believe anyone saying this is ignoring some potentially glaring red flags that are right in front of us. I’ve taken the liberty of organizing and explaining them in detail.

Cold cathode: the nuclear fusion of radiography

Much like nuclear fusion, cold cathode X-ray machines are that innovation that always seems poised to hit the market tomorrow and revolutionize the industry. And much like nuclear fusion, they have decades of failures behind them.

A cold cathode diode X-ray source for radiation imaging, especially computed tomography, comprises a rod-like anode (48) and a generally cylindrical cathode (52), concentric with the anode. This invention relates to a radiation imaging apparatus. It relates more particularly to 5 apparatus of this general type which employs stationary X-ray source and detector arrays capable of acquiring multiple ultrafast scans per second to facilitate the dynamic study of moving human organs such as the beating heart.

These are the opening lines accompanying a 1982 patent granted in the UK to the American company Butler-Newton Inc. Since then, dozens of similar patents have been filed, but cold cathode machines have always remained secondary.

As stated in a doctoral thesis from the Harvard-MIT Program in Health Sciences and Technology, published in 2021:

Many cold-cathode technologies have been demonstrated. These include silicon (Si), carbon nanotube (CNT), zinc oxide, and molybdenum Spindt-type field emitter arrays (FEAs). Unfortunately, despite these promising lab demonstrations, the deployment of cold-cathode X-ray sources has been hampered by their fragility, drift, need for ultra-high vacuum, and modest lifetime over which they function reliably. While much progress has been made, the performance of such systems – which remains inferior to thermionic cathodes for most X-ray applications – has not achieved the original promise of this technology in terms of pulsing frequency, current density, and X-ray focal spot size.

The thesis goes on to describe a promising new system for generating X-rays with a magnetic field, which has nothing to do with the process used by Nano-X.

No demonstrated ability for large-scale production

The main problem encountered in the past with cold cathode machines was the inability to maintain consistent results from prototypes to industrially produced machines. This is a problem that Nano-X cannot claim to have solved yet; the company is still gearing up for large-scale production. While there is a possibility that it may succeed in vindicating over forty years of failures in this field, it’s worth noting that the world of radiography already has its giants.

Samsung, Fujifilm, Canon, Verex, Siemens (OTCPK:SIEGY), General Electric (GE), and all other global players are well aware of the historic pursuit of cold cathode radiography machines. The fact that they continue to release products with heated filaments is quite telling in my view.

No obvious interest from industry giants

It seems quite unusual that none of the major players in the industry have shown any interest in acquiring even a stake in Nano-X Imaging. The company has invested over $78 million in R&D over the past three years. At the current market capitalization, an investment of $40 million would be enough to secure a 10% stake. If any of the industry giants saw real potential in Nano-X, and it’s reasonable to assume they’ve closely examined its products, I believe it would almost be a no-brainer to acquire a stake. Every true OpenAI needs its Microsoft (MSFT) in my view.

Zero insider investments

By scouring SEC filings, Seeking Alpha, Fintel, and all the major sources, I’ve searched for any significant investments by the company’s insiders. There’s no sign of it, not even after Nano.ARC received FDA 501(k) approval. If it’s reasonable to think that industry giants would invest in a company with such high potential, it’s even more reasonable to assume that its managers would. Especially after such a significant achievement.

Increasing competition

Anyone who thinks that Nano-X is the only company chasing the dream of cold cathode radiography is mistaken. In recent years, patents have multiplied:

- Swedish company Luxbright has already begun shipping its special cold cathode tubes to customers producing radiography machines in the USA in 2021.

- Carestream has already demonstrated the capabilities of its 200-pound machine, leaving radiologists highly impressed.

- Japanese Meidensha Corporation produces some of the most promising cold cathode X-ray tubes on the market.

- The Chinese group Haozhi Imaging is determined to break into the market with its new tubes.

In reality, there are many more Chinese competitors worth mentioning, but the sources are not clear. There is much celebration of successes not supported by concrete scientific evidence, so I will stick to the competitors I mentioned. They are already sufficient to demonstrate that Nano-X is by no means alone in its market space.

No financial projections

For a company preparing for mass production, Nano-X has been rather tight-lipped in its last two earnings calls. We have no idea how much it will cost to produce Nano.ARC on a large scale or what the expected break-even time for each device is under this new pay-per-use model.

Furthermore, while it may be encouraging for customers, it could turn out to be a disastrous model for the company. Especially during the early years, there most likely won’t be concrete data on maintenance costs. There could be manufacturing defects, customers might abandon the product, cancel contracts before break-even, or in the worst case, products might need to be recalled. These are by no means new situations for a company facing its first wave of large-scale production.

The pay-per-use model implies that Nano-X will have to shoulder all the initial investments and only recoup the invested capital on each product over the medium to long term. Financing all of this with debt or by issuing new shares, neither of these prospects is probably appealing to shareholders right now.

Financials at a Glance

Below, I provide some of the main financial data related to the income statement for the past three years (in $ millions, source: Seeking Alpha).

|

2020 |

2021 |

2022 |

TTM |

|

|

Revenues |

0 |

1.3 |

8.6 |

9.6 |

|

Gross profit |

– |

-1.5 |

-6.9 |

-6.4 |

|

Total OpEx |

43.5 |

57.5 |

64.1 |

54.5 |

|

Operating Income |

-43.5 |

-59.1 |

-71 |

-60.9 |

|

Net income |

-43.8 |

-61.8 |

-113.2 |

-101.1 |

These are the typical figures for a company that is still in the early stages of its first real expansion, primarily focusing on R&D. Margins are nearly non-existent at this point: revenue comes solely from the remote radiology marketplace, where radiologists receive compensation through incentives the company is using to attract professionals to its platform.

The silver lining is that the company has low indebtedness: Currently, the company has over $77 million in current assets compared to just over $20 million in current liabilities. Even in the long term, debts are almost non-existent, mitigating the risk of bankruptcy.

However, what is by no means eliminated is the risk of significant share dilution from new stock issuances. The company is losing tens of millions per quarter, and the situation is expected to worsen. When thousands of machines with a pay-per-service model start being produced, Nano-X will have to make immediate expenditures for each Nano.ARC while revenues are spread out over time. If this is not financed through debt, it will probably be financed through new stock issuances.

Risks of the analysis and potential sources of reconsideration

Currently, I don’t see significant possibilities for Nano-X to change my SELL rating. However, it’s possible that, with a combination of positive factors, my current concerns may disappear:

- Production – The company could prove capable of producing at scale while keeping the machines in line with laboratory test quality from the first production batch;

- Liquidity – OEM agreements could be established to prevent the pay-per-service model from putting too much strain on the company’s liquidity;

- Acquisition Target – If a major competitor truly begins to believe in Nano-X’s potential, the company could be acquired at an attractive valuation;

- Profitability – Clear financial projections on the economic prospects of Nano.ARC and Nano.Cloud may arrive in the coming months once commercial sales begin.

I find it challenging for all of this to materialize, but in case it does, I would be prepared to completely change my forecast and possibly even buy the stock. This is why I will commit to monitoring the stock and updating my predictions regularly.

My final verdict

Honestly, I can’t say it’s worth shorting the stock because the markets could still experience a surge, especially if the company announces a significant sales contract or the start of large-scale production. I will simply say that Nano-X is not a company I would invest in, and if I had shares in my portfolio, I would sell them now.

I remain interested in a potential short, but only in Q1-Q2 2024. I will wait for the company to start large-scale production, thereby exhausting the potential catalysts for a short-term rally. At that point, I am convinced that reality will take its course: without financial projections and without a path to profitability, with the risk that large-scale production could turn into a disaster, I am rather convinced that things will likely take a turn for the worse in the medium term.

Read the full article here

Leave a Reply