Note: I have covered FuelCell Energy (NASDAQ:FCEL, OTCPK:FCELB) previously, so investors should view this as an update to my earlier articles on the company.

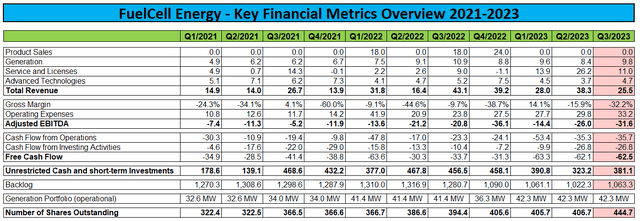

On Monday, FuelCell Energy reported another set of disappointing quarterly results. While revenues came in roughly in line with consensus expectations margins, profitability and cash flows continued to suffer:

Company Press Releases / Regulatory Filings

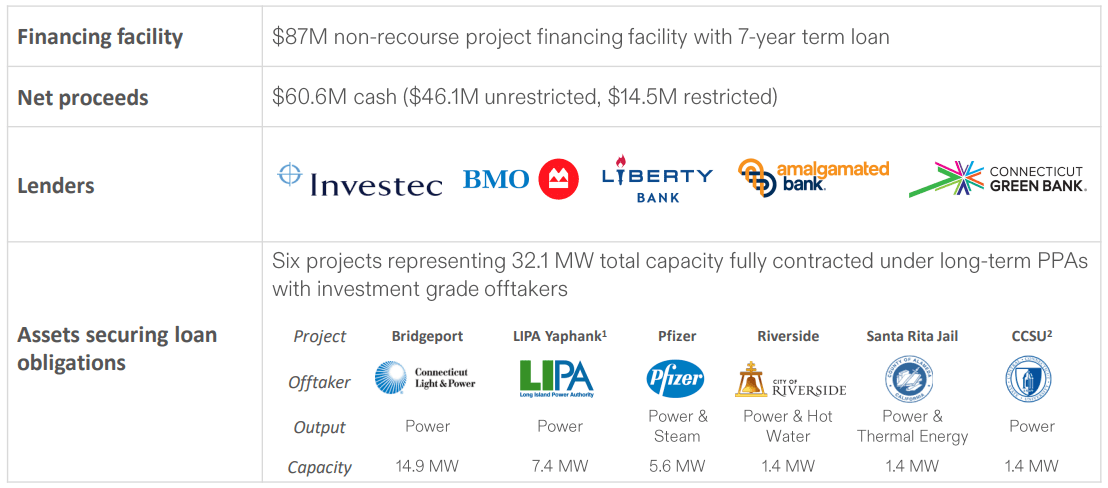

However, the company managed to more than offset negative free cash flow of $62.5 million by generating substantial net proceeds from a recent non-recourse project financing transaction and the sale of approximately 41.3 million newly-issued shares into the open market (emphasis added by author):

“We ended the quarter on July 31, 2023 with a total cash and short-term investment position of approximately $414 million,” added Mr. Few. “During the quarter, we added liquidity to our balance sheet by entering into an $80.5 million non-recourse project financing facility through a multi-bank financing agreement with Investec Bank plc, Bank of Montreal (Chicago Branch), Connecticut Green Bank, Liberty Bank and Amalgamated Bank. The net proceeds from this transaction added approximately $46.1 million to the Company’s unrestricted cash position after repayment of existing project debt obligations and partial repayments of corporate debt obligations, and the related release of certain reserves in connection with such repayments. In addition, we were able to further support our liquidity through sales of shares under our at-the-market offering program, which raised net proceeds of approximately $83.3 million during the quarter.”

Company Presentation

FuelCell Energy’s quarterly report on form 10-Q provides additional details:

Of this 41.3 million shares, approximately 37.9 million shares were issued and settled during the three month period ended July 31, 2023, resulting (…) net proceeds of approximately $83.3 million (…).

The balance of approximately 3.4 million shares was settled subsequent to July 31, 2023, resulting in (…) net proceeds of approximately $7.3 million (…).

Common shareholder dilution has continued into the current quarter with an additional 2 million shares having been sold into the open market for net proceeds of approximately $4.2 million.

As of September 5, outstanding shares amounted to 450.6 million with 32.2 million shares still available for issuance under the company’s existing Open Market Sale Agreement with a number of investment banks.

As a result of the above-discussed transactions, unrestricted cash and short-term investments increased by $57.9 million to $381.1 million sequentially.

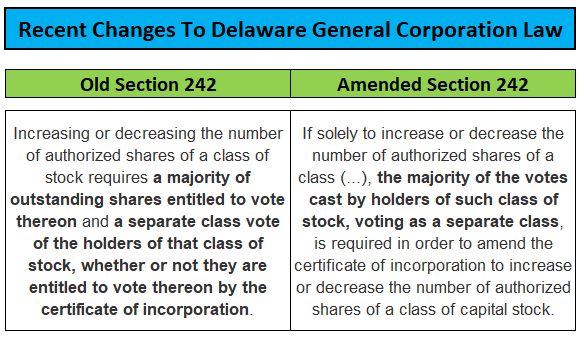

With the company running out of authorized shares, FuelCell Energy is seeking shareholder approval for doubling the number of authorized shares in a special stockholder meeting scheduled for October 10, 2023 (emphasis added by author):

DANBURY, CT, July 18, 2023 – FuelCell Energy, Inc. (…) today announced that it plans to hold a special meeting of its stockholders (“Special Meeting”) on October 10, 2023 to consider and vote on a proposal to amend the Company’s Certificate of Incorporation, as amended, to increase the number of authorized shares of common stock of the Company from 500,000,000 shares to 1,000,000,000 shares.

After two failed attempts earlier this year, the company apparently decided to wait until recent amendments to Delaware’s General Corporation Law have made approval much easier:

Manatt.com

Considering ongoing, elevated cash burn and the fact that the company has increased outstanding shares by more than 3,000% over the past four years by relentlessly selling newly issued common stock into the open market, I would expect dilution to continue for the time being.

While the company’s much-touted Toyota Tri-Generation project at the port of Long Beach, California is finally approaching commercial operations, management’s failure to timely secure renewable natural gas (“RNG”) supply has resulted in the requirement to expense the majority of the project investments, rather than capitalizing them:

As further background on the costs related to the Toyota project, it was determined in the fourth quarter of fiscal year 2021 that a potential source of renewable natural gas (“RNG”) at favorable pricing was no longer sufficiently probable for the Toyota project, resulting in impairment of the asset. Thus, as the Toyota project is being constructed, only amounts associated with inventory components that can be redeployed for alternative use are being capitalized. The balance of costs incurred are being expensed as cost of generation revenues. As of July 31, 2023, current market pricing of RNG continues to result in non-recoverability consistent with the Company’s prior assessment.

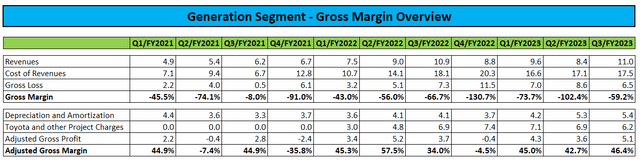

Company Presentation

Not surprisingly, the issue has been a major drag on generation margins for some time already, with almost $40 million in expenses related to the Toyota project having been recorded since Q1/FY2022:

Regulatory Filings

That said, adjusted for the Toyota project charges as well as depreciation and amortization, segment gross margin of 46.4% represented one of the best performances in recent years.

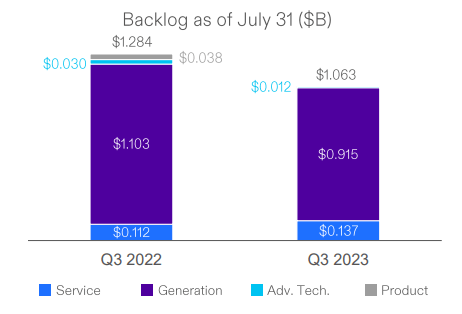

In addition, while still down on a year-over-year basis, backlog increased sequentially due to the recently announced long-term service agreement with Korea-based Noeul Green Energy:

Company Presentation

In combination, FuelCell Energy’s service and generation backlog had a weighted average term of approximately 17 years at quarter end.

According to statements made in the 10-Q, the company continues to expect capital expenditures of between $60 million and $90 million in fiscal year 2023 with some of the cash outlays now anticipated to move into the next fiscal year:

Commitments for property, plant and equipment are expected to range between $60.0 million to $90.0 million for fiscal year 2023, which includes expected investments in our manufacturing facilities for molten carbonate (including carbon capture) and solid oxide production capacity expansion, the addition of test facilities for new products and components, the expansion of our laboratories and upgrades to and expansion of our business systems. Actual cash outlay for such capital expenditures will be dependent on, among other things, the timing of receipt of equipment and the payment terms negotiated with suppliers, but we expect that cash for such capital expenditures will be expended over fiscal years 2023 and 2024. To date in fiscal year 2023, cash payments for capital expenditures have totaled approximately $28.0 million.

The company also reaffirmed previously issued guidance for research and development expenses:

Company-funded research and development expenses are expected to be in the range between $50.0 million and $70.0 million for fiscal year 2023.

During the nine months ended July 31, 2023, we incurred a total of $43.0 million of Company-funded research and development expenses as we continued to accelerate commercialization of our Advanced Technologies solutions including distributed hydrogen, hydrogen based long duration energy storage and hydrogen power generation. The Company continues to advance its solid oxide platform research, including increasing production of solid oxide fuel cell modules and expanding manufacturing capacity. The Company continues to work with INL on a demonstration high-efficiency electrolysis platform. This project, done in conjunction with the U.S. Department of Energy, is intended to demonstrate that the Company’s platform can operate at higher electrical efficiency than currently available electrolysis technologies through the inclusion of an external heat source.

Investments in project assets for the full fiscal year are expected to between $55 million and $65 million, with up to $30 million anticipated for the final quarter of fiscal year 2023.

As a result, I would estimate full year cash usage of between $260 million and $300 million, with cash outflows reaching new all-time highs in the final quarter of the fiscal year.

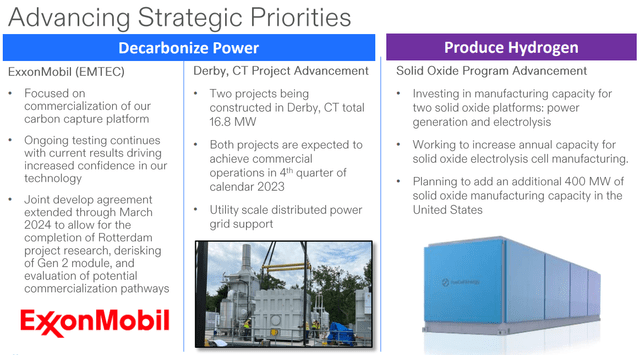

On the conference call, management once again touted its strategic growth initiatives with a focus on commercializing its carbon capture platform in collaboration with a subsidiary of Exxon Mobil Corporation (XOM) and advancing the company’s solid oxide program for power generation and electrolysis:

Company Presentation

Unfortunately, neither carbon capture nor the solid oxide platforms won’t contribute meaningfully to the company’s financial performance anytime soon which leaves FuelCell Energy mostly dependent on the core molten carbonate fuel cell business for the time being.

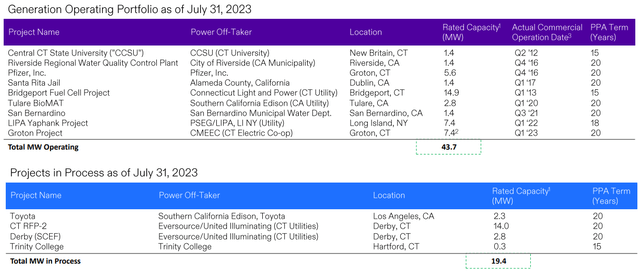

However, with a combined 16.8 MW of projects expected to achieve commercial operations in the fourth quarter of calendar year 2023, the company’s power generation portfolio capacity is expected to increase by approximately 40%:

Company Presentation

On the flip side, these are the company’s last meaningful projects still under construction.

Consequently, near-term revenue growth will require new product sales and/or more large-scale service agreements for legacy fuel cell projects in Korea.

While I do expect at least some success in this regard, I have no idea how management would be able to achieve its stated target of more than $300 million in revenues for fiscal year 2025.

On the call, management also advertised potential benefits from last year’s Inflation Reduction Act (“IRA”), but investors should not expect any near-term revenue impact from potential IRA incentives as market participants are still waiting for additional guidance from the Treasury Department and Internal Revenue Service.

Based on statements made in the 10-Q, management does not seem to expect growth in the core business to pick up anytime soon:

For the three months ended July 31, 2023, we operated at an annualized production rate of approximately 28.9 megawatts (“MW”) in our Torrington, CT manufacturing facility, compared to the annualized production rate of 36.5 MW for the three months ended July 31, 2022. The lower annualized production rate for the three months ended July 31, 2023 is primarily a result of reduced staffing in certain production areas during the three months ended July 31, 2023 compared to the three months ended July 31, 2022. The Company continuously evaluates its production rate and staffing levels and has determined that the current levels are sufficient to satisfy the current demand for carbonate fuel cell modules.

Please note that this is just 40% of the company’s production rate achieved a decade ago already.

Bottom Line

FuelCell Energy reported another less-than-stellar quarter, with ongoing margin and profitability issues and cash burn hovering near all-time highs.

In addition, the company has committed to aggressive growth investments, which in combination with anticipated losses from operations might result in negative free cash flow of up to $300 million this year.

As a result, investors better prepare for further, aggressive utilization of open market share sales to compensate for elevated cash outflows.

That said, the heavy dilution suffered by common shareholders actually strengthens the investment case for the company’s Series B Preferred Shares (OTCPK:FCELB) which trade around 42% of face value despite ranking senior to common stock and paying a rather safe and juicy 12% cash dividend on an annualized basis.

Given my expectations for further, material dilution going forward, I would abstain from chasing the common shares even with the stock price near multi-year lows.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply