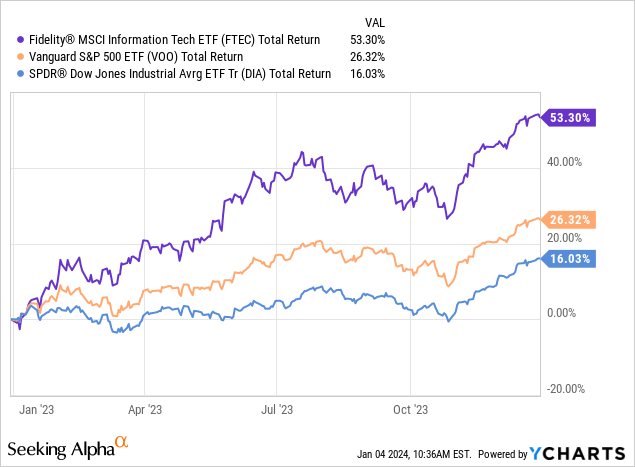

I have long maintained that the Fidelity MSCI Information Technology Index ETF (NYSEARCA:FTEC) should be considered as a core technology holding for investors who want to build and hold a well-diversified portfolio for the long term. The fund certainly came through for investors last year – outperforming the S&P500 by more than 2x and the DJIA by more than 3x (see graphic below). However, the fund’s 22.2% allocation to #1 holding Apple (AAPL) will likely prove to be a significant headwind over the near term. Other than that, I like the composition of this fund and, of course, its excellent long-term performance track record. Today, I’ll take a fresh look at the FTEC ETF in light of the challenges at Apple and how investors should consider initiating – or adding to – a position in the fund.

Investment Thesis

The investment thesis for a technology fund like FTEC is fairly well-known and has been intact for many years now: fast-growing demand across a number of sub-sectors including high-speed networking, 5G smartphone & infrastructure, data center, enterprise & cybersecurity software, EVs, wireless mobility, IoT, and clean-tech – just to name a few. Last year, the entire sector shifted into over-drive on the generative AI growth thesis.

In addition, most of the leading technology companies have strong global brands, excellent and investment grade balance sheets, and generate tons of free cash flow which are typically returned to shareholders via a mix of dividends and share buybacks (mostly the latter).

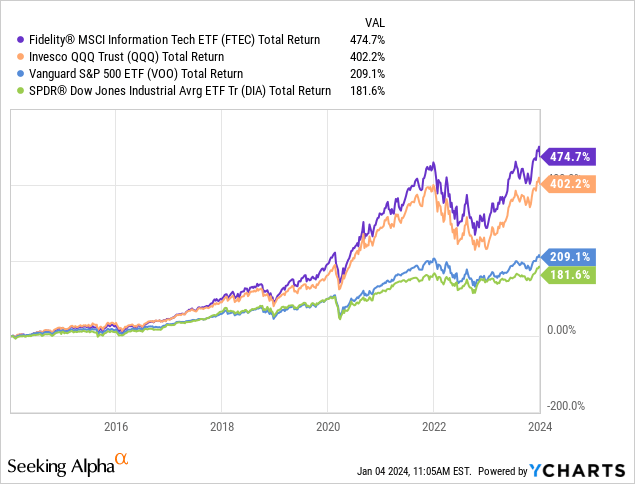

And it wasn’t just last year that the technology sector out-performed, this has been a long-term trend for many years, as evidenced by the dramatic out-performance of the FTEC and Invesco Nasdaq-100 Trust (QQQ) versus the broad market averages as represented by the Vanguard S&P500 ETF (VOO) and the SPDR DJIA ETF (DIA):

In my opinion, that trend is likely to remain intact over the coming decade due to the same reasons it outperformed in the past decade: the technology sector is the most vibrant, innovative, fastest growing, and arguably the most profitable sector of the entire market. That being the case, let’s take a closer look at the FTEC ETF to see if it deserves an allocation within your portfolio.

Top-10 Holdings

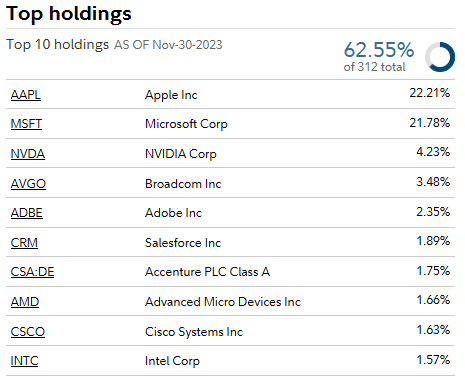

The top-10 holdings in the FTEC ETF are shown below and were taken directly from the Fidelity Investments FTEC webpage, where investors can find more detailed information on the fund:

Fidelity

As can be seen in the graphic, FTEC is significantly overweight in just two stocks: Apple and Microsoft (MSFT), which in aggregate equate to 44% of the entire fund. That being the case, if you have already established a full position in either Apple or Microsoft, I suggest you look elsewhere for a more differentiated technology ETF (perhaps focused on semiconductors). The high weighting in the top two holdings also means the top 10 holdings are what I consider to be a very concentrated 62.6% of the entire portfolio.

China: We Have A Problem

As mentioned earlier, Apple is facing some strong headwinds – particularly in China, where nationalist tendencies appear to be pivoting consumer demand toward domestic and more affordable handset makers while the macroeconomy has slowed significantly. Indeed, total revenue for Apple was down 2.8% yoy in FY23. In the face of an obvious deterioration in top-line revenue growth, I was amazed that Apple stock actually rose ~50% last year. The result is that AAPL currently trades with a TTM P/E = 29.7x, which is a premium as compared to the S&P500’s P/E of 26.1x.

Just this week, Apple has received two notable downgrades: by Barclays and by Piper Sandler, both of which cited weakening iPhone sales and macroeconomic headwinds.

Now, to be sure, Apple is one of the strongest brands on the planet (if not the strongest brand) and the company generates tons of free cash flow. According to MacroTrends, Apple generated $99.5 billion of FCF in FY23. However, that was actually down 10.6% on a yoy basis.

In my opinion, Apple’s strong free-cash-flow profile – combined with its nicely diversified portfolio of iPhones, Macs/iPads, wearables, and services – and with significant share buybacks helping to boost earnings, will likely keep any precipitous stock drop from occurring. That said, I could easily see AAPL stock declining another ~10-15% from here. All else being equal (but acknowledging they seldom are…), that would equate to an estimated and corresponding 3-4% drop in the value of the FTEC ETF.

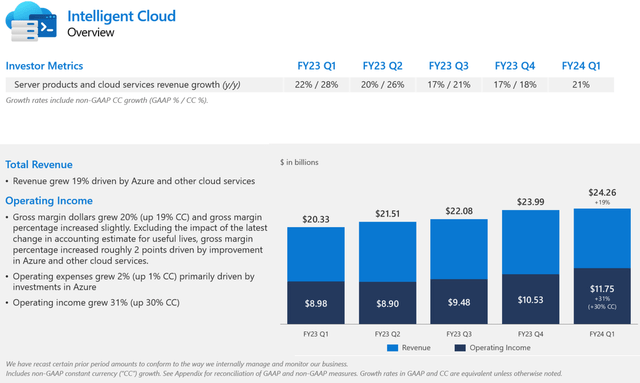

With a TTM P/E of 36.2x, Microsoft is significantly more highly valued than either Apple or the S&P500. That said, I think the valuation premium is definitely warranted. That’s because after a very strong FY23 performance, Microsoft continued the momentum in Q1 of FY24:

- Revenue of $56.5 billion was +13% yoy.

- Operating income was $26.9 billion, up a whopping 25% yoy.

- Net income of $22.3 billion was up 27% yoy.

- EPS of $2.99/share was up 27% yoy.

Microsoft generated $20.7 billion in free cash flow during Q1 (+22% yoy, see slide 6 of the Q1 presentation) and returned $9.1 billion to shareholders in the form of share repurchases ($3.6 billion) and dividends ($5.6 billion). This company is literally on fire, including continuing strong trends in its Intelligent Cloud Segment:

Microsoft

And to further cash in on the AI narrative, we learned today that Microsoft plans to add a “CoPilot AI Button” to all Windows PC keyboards, the first change in the PC keyboard in decades (if memory serves, since the “Start” key was added in 1994). This button will enable CoPilot AI functionality within Windows by seamlessly integrating it into users’ day-to-day activities.

The next two holdings in the FTEC top 10 are Nvidia (NVDA) and Broadcom (AVGO). Both of these companies expect to significantly grow revenue with AI-accelerators and high-speed networking products. Nvidia will grow revenue significantly faster on an organic basis, but Broadcom finally closed the VMWare transaction and, as a result, it too will significantly grow its revenue this year (albeit the majority of growth will be via M&A). Broadcom’s stock nearly doubled last year, and the company is now in the top 20 list of the highest-valued companies in the S&P500.

Combining the stakes in Nvidia and Broadcom with #8 and #10 holdings, AMD (AMD) and Intel (INTC), respectively, about 11% of the fund’s top-10 holdings is allocated to semiconductor companies. That said, note that both Nvidia and Broadcom have growing software components – Nvidia with its AI-centric software platform, and Broadcom with its enterprise software. As I mentioned in a previous article on Broadcom, they have a partnership with Nvidia that enables the VMware Cloud Foundation Software Stack – the whole VCF stack – to run the NVIDIA coder and the NVIDIA GPU. See Broadcom Stock: A 20:1 Split Is Likely for more details on this critical addition to Broadcom’s enterprise software platform.

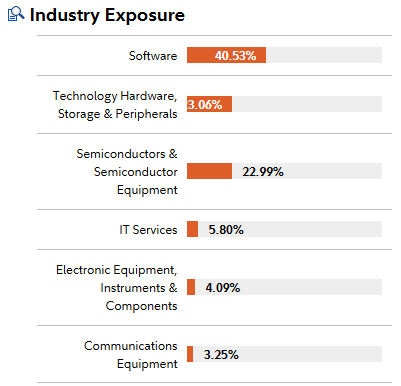

From a total FTEC portfolio perspective, the sub-sector exposure is as follows:

Fidelity

Author’s Note: The Tech Hardware, Storage, and Peripherals exposure as shown above should read 23.06% (it’s an issue on the Fidelity webpage).

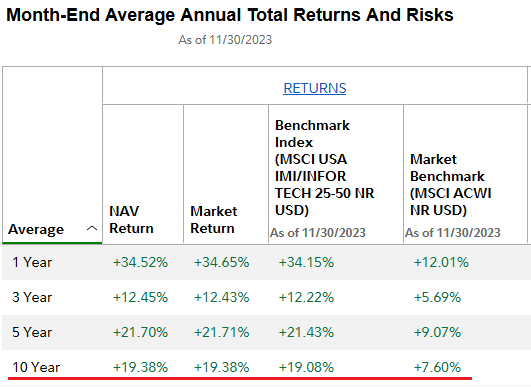

Performance

As mentioned earlier, the performance track record of the FTEC ETF is outstanding: the average annual return over the past 10 years is a remarkable 19.4%:

Fidelity

Risks

As I mentioned in a Seeking Alpha article published on Thursday, a big spike in the price of oil could lead to a significant sell-off in technology stocks, and thus the FTEC ETF. That is because a higher price for oil typically leads to higher inflation, higher interest rates, and a stronger U.S. dollar. This is explained in Prepare For What May Be An Epic Chance To Buy Big Tech… If Oil Spikes.

That said, after the huge “Magnificent 7” rally last year, and considering normal profit taking, the arguably high-valuation levels within the sector, and the headwinds Apple faces, FTEC is likely to be weak over the short-term regardless of what the price of oil does. The point of the article just referenced is that a big spike higher in the price of oil would likely turbocharge what is already a relatively weak set-up in tech stocks.

Summary & Conclusions

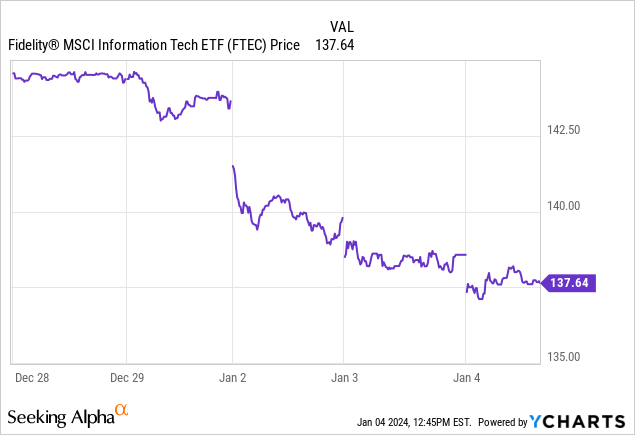

The FTEC ETF has a very strong performance track record and is a relatively cost-effective way (the expense fee is 0.084%) to gain excellent exposure to the technology sector. I currently rate FTEC a HOLD due to a relatively weak set-up for the tech sector and, specifically, due to relatively strong headwinds facing the #1 holding: Apple. That said, investors who are under-weight in the technology sector should put the FTEC ETF on their watch list and should be ready to buy on any significant sell-off. For those looking to establish a position in FTEC (or add to an existing position), I would start scaling in if the fund falls another ~4-5% from here. Note that FTEC has already dropped ~4% since the Santa Claus rally arguably ended in the last two trading days of 2023 and continued so far in 2024:

Read the full article here

Leave a Reply