Fortinet, Inc. (NASDAQ:FTNT), a prominent player in cybersecurity, recently went through a shift that unsettled its investor base. Although the company achieved its expected quarterly earnings, it saw a decline in share prices in August 2023. This article offers a technical examination of Fortinet’s stock price to forecast its upcoming trajectory and identify potential investment avenues. Notably, the downturn in August has encountered significant support at a crucial level, presenting a promising opportunity for long-term investors.

Fortinet Offers Investment Potential

In a rather unanticipated turn of events, Fortinet, a renowned cybersecurity leader, witnessed a considerable setback that jolted investor trust. The company’s shares plummeted in August. Though Fortinet’s quarterly earnings met investors’ predictions, the projected growth rate for the upcoming quarters has raised eyebrows.

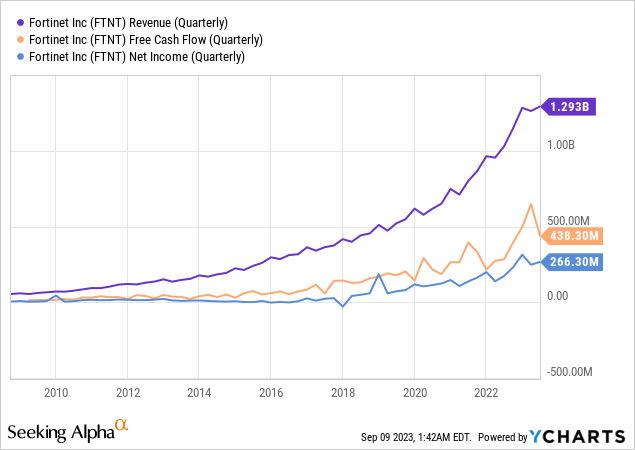

The company showcased an impressive growth rate with a revenue surge of 26% compared to the prior year. The chart below details the quarterly revenue, free cash flow, and net income at figures of $1.293 billion, $438.30 million, and $266.30 million, respectively. While there’s a modest uptick in revenue and net income, the free cash flow experienced a dip this quarter. Nonetheless, Fortinet’s long-term trajectory for free cash flow is on an incline, and the escalating cybersecurity needs could further bolster profitability in the future.

It’s crucial to recognize Fortinet’s ongoing growth journey. Its expansion rate is laudable, especially when juxtaposed with several other stock market contemporaries. Esteemed as an industry frontrunner in the network firewall segment, it’s poised to capitalize on the long-term growth opportunities inherent in this cybersecurity niche. While potential challenges from competition or operational issues are possible, Fortinet appears well-prepared for success.

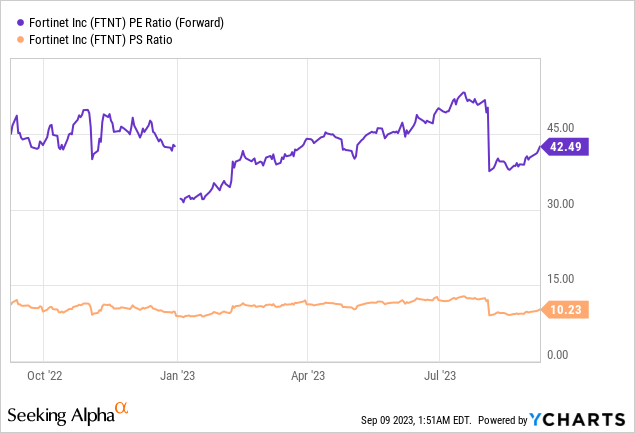

Recent market fluctuations have transformed Fortinet into a prospective gem for discerning investors with a long-term perspective. Its forward P/E ratio has dipped below 43, while the price-to-sales ratio now stands at 10.23, as shown in the chart below. These figures are consistent with market standards when weighed against its present and anticipated growth velocities. Provided that the company’s existing growth impediments are transient and it maintains its current growth momentum in the intermediate term, its valuation presents a golden investment window.

Unraveling Fortinet’s Technical Support Dynamics

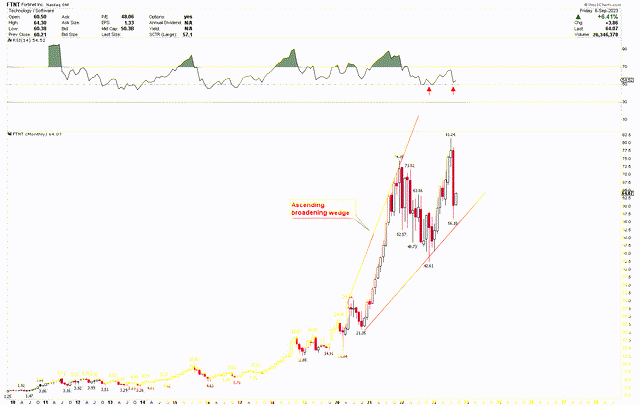

The monthly chart of Fortinet demonstrates the technical perspective and exhibits a robust bullish sentiment. The stock’s trajectory since 2020 suggests an ascending broadening wedge, pointing to significant market volatility. A notable rally in Fortinet’s stock is traced from its 2020 low at $14.04 to its record peaks. The stock saw remarkable gains in 2020 and 2021, predominantly fueled by the soaring need for cybersecurity measures. This surge resulted from the swift pivot to remote working models due to the COVID-19 crisis. This worldwide transition to digital work environments heightened the fears of cyber threats, prompting enterprises to enhance their online security measures. As a leading figure in the cybersecurity domain, Fortinet leveraged this shift. Fortinet presented holistic solutions to tackle the unique hurdles of this digital age. Continued innovation and diverse product range, catering to enterprises big and small, further entrenched their market foothold, luring investors and amplifying stock’s performance during these times.

Fortinet Monthly Chart (stockcharts.com)

The significant adjustment in 2022 was a technical course, culminating in an impressive and sturdy price foundation, hinting at potential upward trends. The 2022 downturn coincided with the RSI touching the 50-mark, signifying potential for higher prices. Moreover, the recent dip in August 2023 saw the RSI at a similar level, suggesting a likelihood of a robust upswing in the forthcoming weeks.

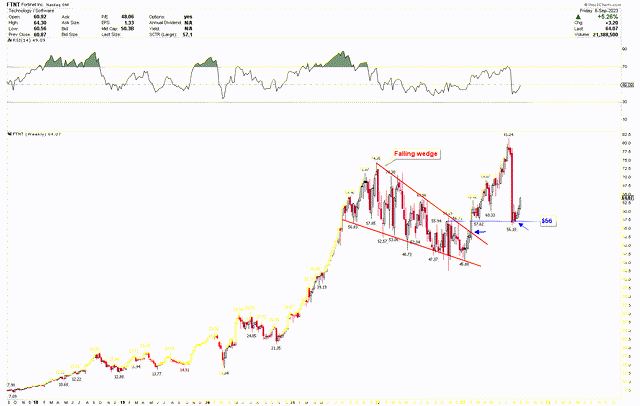

For a deeper dive into Fortinet’s 2020 vulnerability, the weekly chart below underscores that the 2022 decline was contained within a Falling Wedge triangle. This triangle’s breakout led to a swift surge, surpassing previous highs. This Falling Wedge pattern is traditionally viewed as a bullish indicator. However, after reaching the pinnacle at $81.24, the stock retracted to the $56 support level, where the wedge had previously been breached. This retracement signifies robust price support, hinting at a potential surge from this juncture. The momentum from the $56 support has already initiated, with the stock trending upwards. The past three weeks’ weekly candles reinforce this sentiment, indicating a likely acceleration in the stock’s value. Investors might consider buying Fortinet shares at this juncture for long-term prospects.

Fortinet Weekly Chart (stockcharts.com)

Risks

Fortinet recently experienced a substantial drop in share prices in August, causing a disturbance in investor confidence. Even though the company met its quarterly earnings expectations, the projected growth for upcoming quarters has brought concerns, casting doubts on its future performance. Moreover, Fortinet attributed its deceleration in bookings to the challenging macroeconomic conditions, affecting its sales performance. The external economic challenges might persist and continue affecting its growth. As an industry leader in the network firewall segment, Fortinet undoubtedly faces fierce competition. Rising competition or operational issues can pose significant risks to the company’s growth story, even though it is presently positioned well in the market. Additionally, Fortinet’s exceptional performance in 2020 and 2021 was majorly due to the global shift to remote work structures amidst the COVID-19 pandemic. This shift might not be as pronounced in the post-pandemic era, potentially slowing its growth. From the technical perspective, the recent decline to the $56 support level shows that the stock isn’t immune to downturns. Such patterns, while offering potential upside, also indicate vulnerabilities that market bears can exploit.

Bottom Line

Fortinet’s journey in the cybersecurity realm has been both commendable and turbulent. Their recent setbacks, particularly the drop in share prices, have understandably shaken investor confidence. However, when viewing the larger picture, Fortinet’s track record exhibits resilience and a capacity for innovation. The company’s adaptability during the remote work boom due to the COVID-19 pandemic showcases its ability to anticipate and cater to market needs. While concerns about its growth rate and potential macroeconomic challenges impact sales, Fortinet’s foundational strength in the network firewall segment provides reassurance. The company’s position as an industry leader means it is well-equipped to tap into long-term cybersecurity opportunities, even as it navigates the risks posed by competition and market vulnerabilities. The technical insights further accentuate a potential upside, pointing to promising prospects for investors with a long-term vision. Despite its short-term hiccups, Fortinet’s enduring strengths and commitment to innovation make it a contender worth watching in the ever-evolving cybersecurity landscape. Investors may consider buying the stock at its current value, given the rebound from the $56 support has begun, with an emphasis on long-term prospects.

Read the full article here

Leave a Reply