I last covered the iShares Floating Rate Bond ETF (BATS:FLOT) in late 2022. In that article, I argued that FLOT was a reasonable investment for more conservative investors, due to the fund’s low credit and interest rate risk, but I was somewhat apprehensive about its low dividends. Since then, the fund has outperformed most of its peers, due to Federal Reserve hikes. Dividends are much higher too, with the fund sporting a 5.0% dividend yield and a 5.9% SEC yield, for the same reason. FLOT has definitely outperformed expectations, and the fund is a much stronger investment opportunity now. I rate the fund a buy, and the fund seems targeted towards more risk-averse income investors and retirees.

FLOT – Basics

- Investment Manager: BlackRock

- Dividend Yield: 5.03%

- Expense Ratio: 0.15%

- Total Returns CAGR 10Y: 1.5%

FLOT – Overview

FLOT is a simple floating rate bond ETF, tracking the Bloomberg US Floating Rate Note < 5 Years Index USD. The fund invests in most relevant dollar-denominated, investment-grade, floating rate bonds with remaining maturities of five years or less.

Floating Rate Bonds

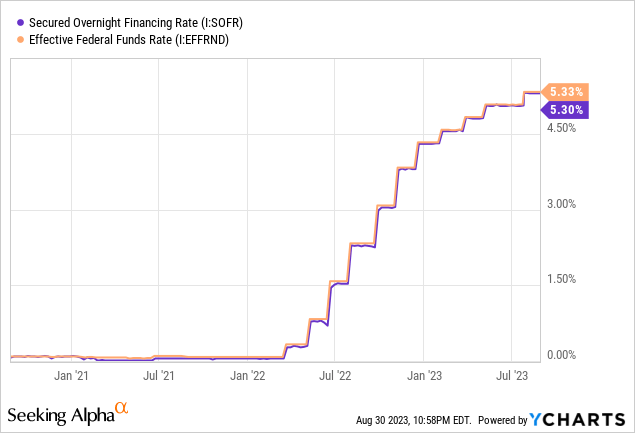

FLOT’s bonds are floating rate bonds, and so their coupon rates are indexed to certain benchmark rates. Bonds are generally indexed to SOFR, which closely tracks Federal Reserve rates.

Data by YCharts

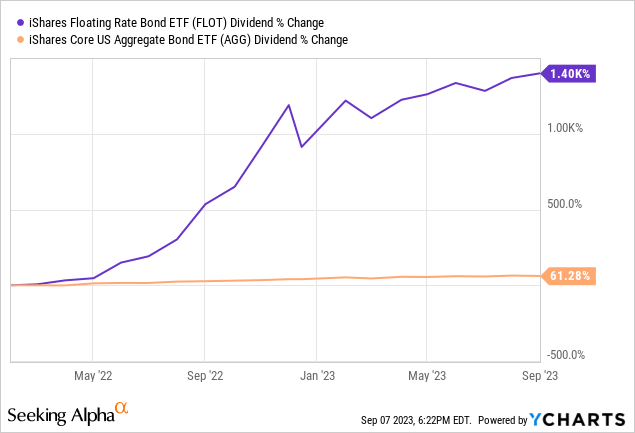

Simplifying things a bit, we can say that FLOT’s bonds see higher coupon rates when the Fed hikes, lower rates when the Fed cuts. This is not the case for most bonds, most of which are fixed-rate, and pay the same coupon rates from issuance to maturity. As such, variable rate bond funds tend to see strong, swift dividend growth when the Fed hikes, as has been the case for FLOT since early 2022. I’ve included the iShares Core U.S. Aggregate Bond ETF (AGG), the largest bond ETF in the market, below for reference.

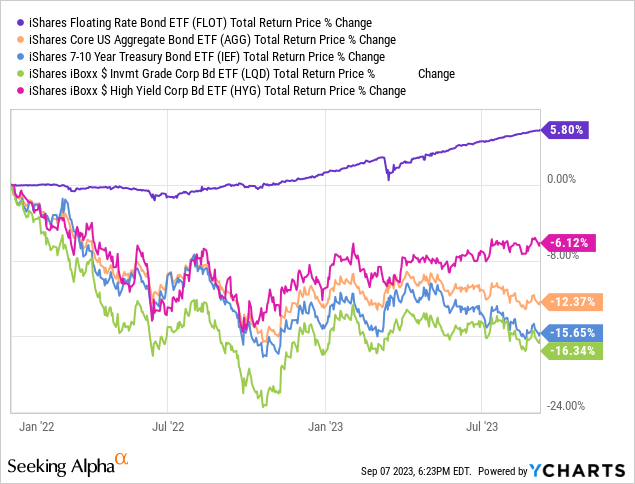

Strong, swift dividend growth leads to comparatively strong demand for FLOT’s underlying holdings, supporting their prices. The result is outperformance on a total return basis when rates rise, as has been the case since early 2022. FLOT has outperformed most relevant bond sub-asset classes since said date, including high-yield corporate bonds.

FLOT’s extremely low interest rate risk and outperformance during periods of rising rates are important benefits for the fund and its shareholders. As the Fed is slowing down / pausing its pace of hikes this is unlikely to be a short-term positive, but it remains a long-term benefit.

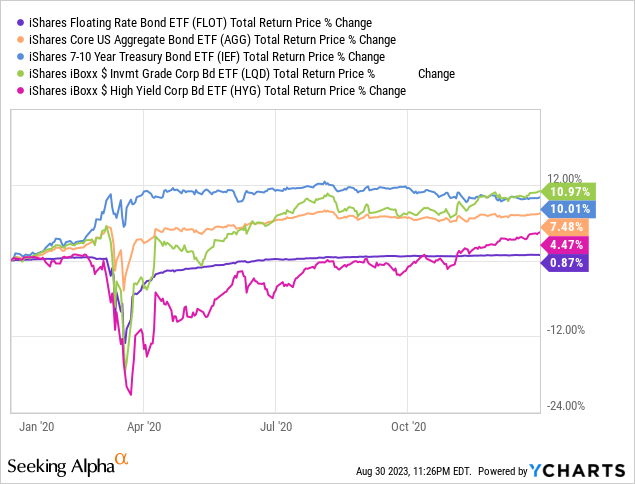

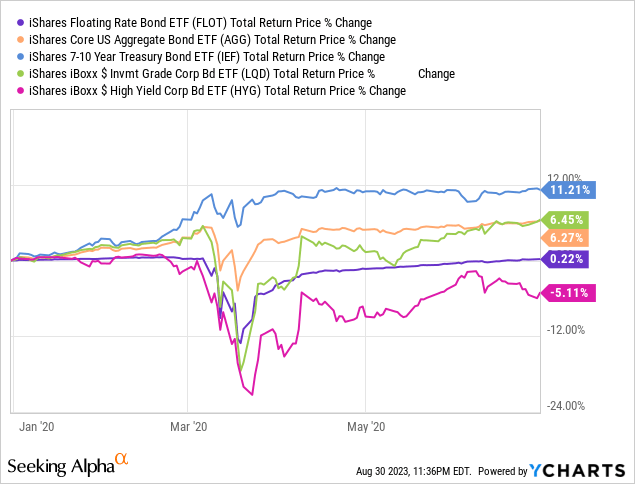

Flipside of the above is that FLOT tends to underperform when rates are cut, as was the case in 2020, during the coronavirus pandemic.

Data by YCharts

FLOT is likely to underperform if rates go down significantly. Moderate interest rate cuts might not necessarily lead to losses, as the market is expecting significant rate cuts already, and is pricing bonds accordingly.

Investment-Grade Bonds

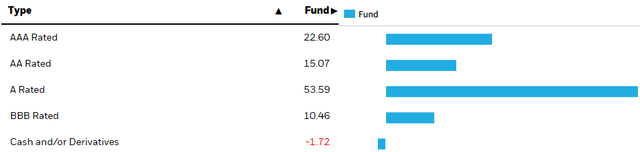

FLOT is an investment-grade bond fund, focusing on A-rated securities.

FLOT

The credit ratings on FLOT’s underlying holdings are quite strong, with low default rates, even during downturns and recessions. Losses should be low during downturns and recessions, as was technically the case in 1Q2020, the onset of the coronavirus pandemic. Losses seem a bit higher than expected to me, peaking at over 12%. It took the fund several months to recover from these too.

Data by YCharts

FLOT’s low credit risk is a significant benefit for the fund and its shareholders, although I do think the impact is a bit lower than expected.

Dividends and Dividend Growth

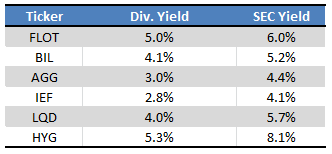

FLOT offers investors a solid 5.0% trailing twelve-months dividend yield. As Fed rates were lower in the past, said yield might not necessarily reflect the dividends that investors should expect moving forward. FLOT sports a 5.9% SEC yield, which measures the fund’s underlying generation of income during the past thirty days. Said metric is much more recent and, in my opinion, is much more indicative of current and expected dividends.

FLOT’s dividend yield and SEC yield are somewhat higher than average. High-yield corporate bonds do yield more, but credit risk is much higher too.

Fund Filings – Chart by Author

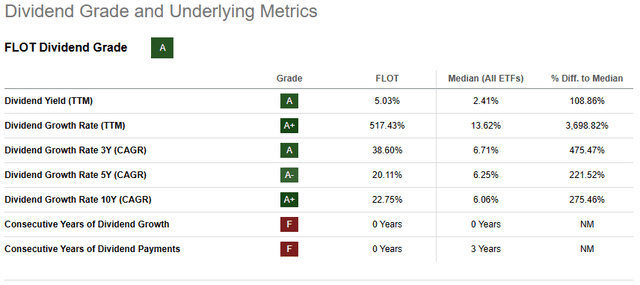

As mentioned previously, FLOT’s dividends have seen very strong growth in the recent past, due to Fed hikes.

SeekingAlpha

FLOT’s above-average dividend yield and outstanding dividend growth track-record are both important benefits for the fund and its shareholders. Investors can achieve higher dividends, but only by taking a lot more credit risk.

Performance Track-Record

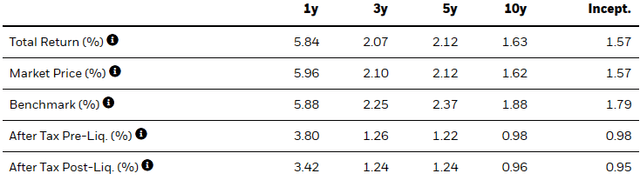

FLOT’s long-term total returns are quite weak, as interest rates were stuck at zero for close to a decade. Returns have materially improved in the recent past, due to recent Fed hikes. Future returns are strongly dependent on future Fed policy, which is obviously not set in stone. I’m optimistic, especially short-term, as the ZIRP era seems like an aberration in hindsight.

FLOT

Although FLOT’s weak long-term returns could be construed as a negative, current economic conditions are significantly different, so potential returns are quite different too.

FLOT – Alternatives

I’ve written about several ETFs focusing on variable rate bonds in the recent past. Thought a quick look at some of these alternatives, to help investors make appropriate investment decisions.

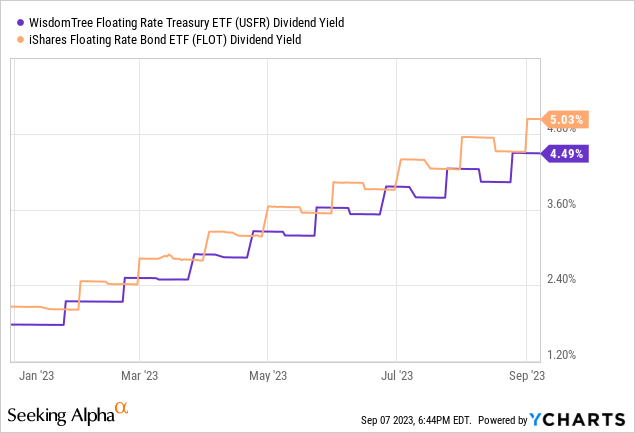

The WisdomTree Floating Rate Treasury Fund ETF (USFR) focuses on variable rate treasuries. USFR’s credit risk and dividend yield are both a bit lower than those of FLOT.

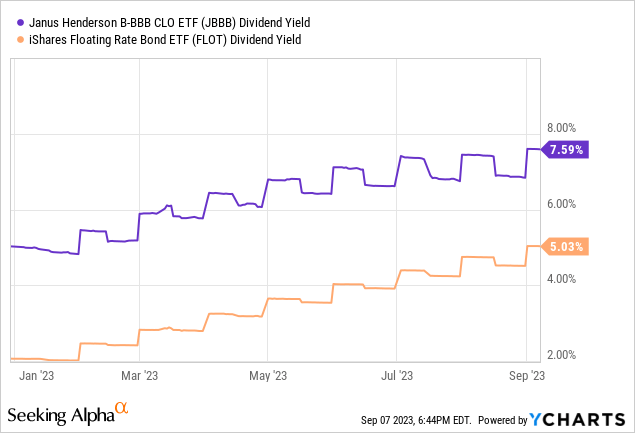

The Janus Henderson B-BBB CLO ETF (JBBB) focuses on BBB-rated CLO tranches. Credit risk is somewhat lower than that of FLOT, but volatility is higher, due to the (perceived) complexities of CLOs. JBBB yields quite a bit more as well.

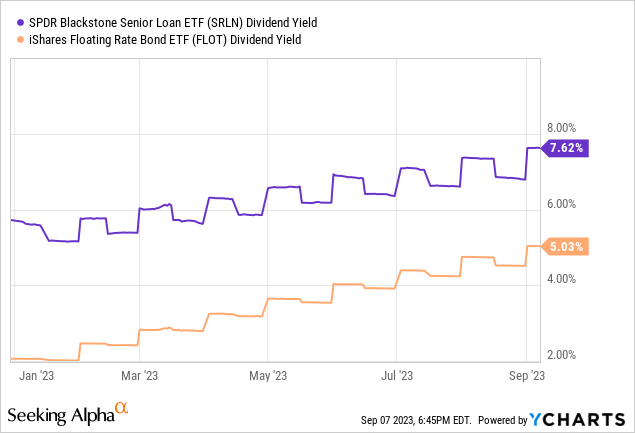

The SPDR Blackstone / GSO Senior Loan ETF (SRLN) focuses on senior loans. Credit risk and dividend yields are both higher than those of FLOT.

On net, I don’t think that FLOT is significantly stronger or weaker than the funds above. Each of the funds above simply offers investors a slightly different risk-return profile and might be more or less appropriate for different types of investors. FLOT is safer and less volatile than average, which might interest risk-averse investors more. USFR is a bit safer, however.

Conclusion

FLOT’s above-average 5.0% dividend yield, extremely low interest rate risk, and low credit risk, make the fund a buy.

Read the full article here

Leave a Reply