Roughly one year ago, I wrote on First Watch Restaurant Group (NASDAQ:FWRG), noting that the company’s strong traffic performance relative to peers was encouraging, and that the stock was a name worth considering on any pullbacks below $13.50. Since bottoming at $13.30 in December, the stock is up over 34% and has significantly outperformed the AdvisorShares Restaurant ETF (EATZ) and especially its peer group, with several casual dining names sitting at negative year-to-date returns. In this update, we’ll look at First Watch’s valuation, the setup for the stock heading into its Q3 results with unfavorable industry-wide traffic trends, and whether the stock is worth adding to following the sharp correction we’ve seen in the iShares S&P Small-Cap 600 Growth ETF (IJT).

First Watch Menu Offerings – Company Website

Recent Results & Developments

First Watch Restaurant Group (“First Watch”) has had a busy year and has continued to perform well against its peer group. The company’s solid operating performance has been evidenced by industry-leading two-year stacked comp sales growth of 21.2% in its most recent quarter (Q2-2023), only a minor dip in traffic growth despite difficult year-over-year comps (lapping 8.1% growth in Q2-2022), and industry-leading revenue growth of 17% on the back of acquisitions of franchised restaurants, planned double-digit unit growth (~50 net new restaurants added to system this year). In fact, the company raised its revenue growth guidance to 18% to 21% even ahead of the acquisition of another six franchised restaurants, up from 15.0% to 19.0% when it announced its FY2022 results.

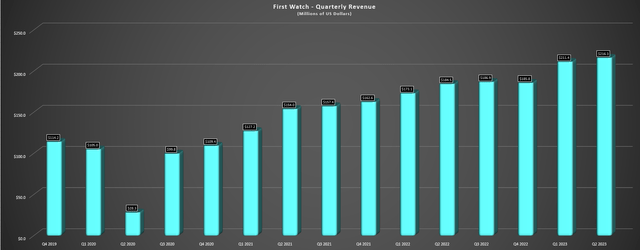

First Watch – Quarterly Revenue – Company Filings, Author’s Chart

Digging into the company’s most recent quarter a little closer, the company put together solid performance across the board. For starters, system-wide sales soared 17% to $271.5 million, the company reported strong comp sales growth of 7.8% helped by menu pricing and favorable mix, and restaurant level operating margins soared 270 basis points to 20.9%. This translated to $44.4 million in restaurant level profit (Q2 2022: $33.1 million) despite sticky labor costs that continue to affect margins industry-wide. Meanwhile, from a development standpoint, the company is inching towards the 500 restaurant mark in its system, and will end the year with a much higher proportion of company-owned vs. franchised restaurants because of the acquisition of 17 restaurants year-to-date, with room to continue converting franchised restaurants according to the company. The company also shared the following:

“As a reminder, our franchise-operated restaurants performed similarly to our company-owned restaurants. So for us, converting franchises to company-owned restaurants is compelling for both the financial and strategic perspective and represents a significant growth opportunity for our entire enterprise.”

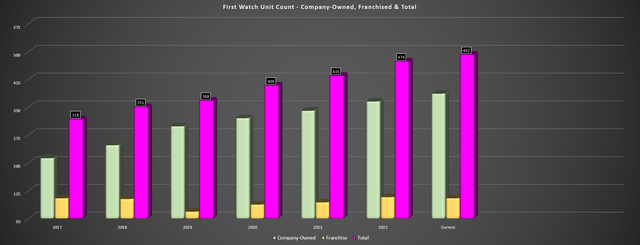

As we can see, the company’s impressive unit growth and continued acquisition of franchised restaurants has left the company with just shy of 400 company-owned restaurants following quarter-end. Plus, with similar unit economics and the ability to easily add new restaurants for cash and with no share dilution, First Watch will continue to see above-average sales and earnings growth relative to peers, especially in a trickier development environment with permitting delays and higher build costs for some brands. Hence, there’s certainly a lot to like about this strategy of converting franchised restaurants. Plus, with these already being First Watch restaurants, the transition is simpler than it’s been in the past when it acquired the 100 Egg and I restaurant chain (fleet of 114 restaurants) in 2015.

First Watch – Company-Owned, Franchised & Total Restaurants – Company Filings, Author’s Chart

Industry-Wide Trends

Starting with the positives for industry-wide trends, several restaurant brands have benefited from a deceleration of commodity inflation in their market basket after two tough years, with First Watch reporting a 250 basis point improvement in food & beverage costs (22.4% vs. 24.9%) helped by lower pork and avocado prices. Fortunately, this is expected to continue into H2 of this year, with deflation in commodity costs called out by some companies, and First Watch specifically noting that it expects commodity deflation after lapping elevated prices last year. That said, restaurant brands are still seeing net inflation because of sticky labor costs and wage inflation, with First Watch reporting a 90 basis point increase in labor as a percentage of sales (33.2% in Q2 2023) despite menu pricing, with First Watch electing to increase menu prices 1% at the start of Q3 to help offset labor inflation.

First Watch Drinks – Company Website

The good news is that despite the labor inflation, lower to-go packaging costs and lower food and beverage costs helped to offset the higher labor costs (wage inflation and additional staffing), with the company reporting a 270 basis point increase in restaurant level operating margins. And while some companies have called out check management, the only major difference that First Watch is seeing is lower off-premise sales (17.9% of revenue vs. 20.2% last year), with this not being surprising when this offers less of an experience at the highest cost and is the most expensive option by a wide margin for most restaurant concepts, especially with added third-party delivery costs. In fact, given First Watch’s regular menu refresh, it’s actually seeing favorable mix, a positive divergence vs. some other brands.

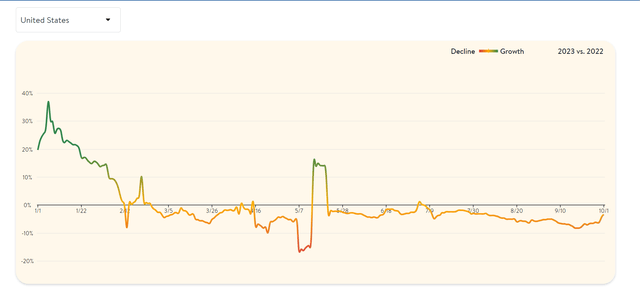

Open Table – Seated Diners by Week – OpenTable

However, on a negative note, gas prices remain elevated at ~$3.82/gallon, which is up sharply from Q2 2023 levels, and in an environment where the average consumer is already getting pinched from multiple angles, the added costs to fill up doesn’t help sentiment for choosing to dine out. In addition, casual dining sales have suffered the past couple of months, hovering in negative territory since late May according to data tracking seated diners by week according to OpenTable. And while First Watch appears to have bucked this trend more than its peers, with several casual dining brands reporting low to mid single digit sales (implying 2-3% negative traffic depending on their level of pricing), I wouldn’t consider First Watch completely immune and it’s difficult to have confidence in the company beating its Q3 and Q4 revenue and earnings estimates with choppy and less favorable traffic growth industry-wide through Q3 that could extend into Q4.

Valuation

Based on ~59.6 million shares and a share price of US$13.70, First Watch trades at a market cap of ~$1.03 billion and an enterprise value of ~$1.50 billion with roughly $460 million in net debt. This leaves the stock trading at ~14.5x EV/EBITDA using FY2024 estimates and over 90x FY2025 free cash flow estimates. While this is a steep free cash flow multiple, it’s difficult to value First Watch on free cash flow given that it is plowing capital into opening new stores, evidenced by $100+ million that it will spend this year alone on new restaurants and remodels. So, while the stock may appear expensive relative to peers on this metric, a better to value the stock is on an EV/EBITDA basis. And based on its current multiple, FWRG trades at a premium to peers like Red Robin (RRGB), Bloomin’ Brands (BLMN), and BJ’s Restaurants (BJRI), but a steep discount to other high-growth peers like Dutch Bros (BROS) at over 35x EV/EBITDA.

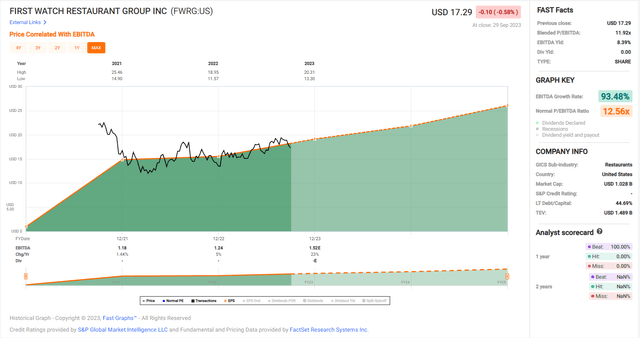

First Watch – Historical P/EBITDA Multiple – FASTGraphs.com

Assuming we use a more conservative multiple of 16.0x EV/EBITDA to adjust for the multiple compression and the proverbial long winter we’re going through for the small cap space currently, I see a fair value for First Watch of $19.90, pointing to a 15% upside from current levels. However, for small-cap growth stocks, I am looking for a minimum 30% discount to fair value to ensure an adequate margin of safety when starting new positions. And if we apply this discount to fair value, First Watch’s ideal buy zone comes in at $14.00 or lower. So, while I continue to see First Watch as one of the more reasonably valued growth stories in the sector following several IPOs in the past two years, I don’t see this as a favorable area to add to positions and I am neutral on the stock short-term.

Summary

First Watch continues to stand out as one of the better performers in the casual dining space from a traffic standpoint, reporting two-year stacked same-traffic growth of ~7.0% in Q2 2023, an impressive metric given the slowdown in traffic experienced sector-wide. In addition, the company reaffirmed that it has seen no sign of check management, a positive divergence from commentary from others like Darden (DRI) that saw an unfavorable mix with slightly less entrée and alcohol attachment. This outperformance suggests that First Watch should weather the industry-wide traffic dip better than its peers in Q3, and reinforces the company’s decision to grow units aggressively, with it clearly benefiting from a loyal customer base vs. some other casual dining brands that have suffered this year.

That said, there’s no investing without valuation as Joel Greenblatt has stated, and while First Watch may rank highly from a growth standpoint, it’s tough to justify paying up for the stock above $17.30 with limited margin of safety in place. Obviously, the stock could head higher and I could be wrong, but I prefer to buy growth stories when they trade at a deep discount to fair value, like where Aritzia (ATZ:CA) trades currently at a 7% free cash flow yield based on next year’s free cash estimates with low double-digit revenue growth. Hence, if I were looking to put new capital to work in small caps currently, I see this as the more attractive opportunity currently.

Read the full article here

Leave a Reply