Earnings of First National Bank Alaska (OTCQX:FBAK) will likely remain rangebound in the upcoming quarters. Moderate loan growth will likely push up earnings while a growth in operating expenses will restrict earnings growth. Meanwhile, the margin will likely remain stable. Overall, I’m expecting the company to report earnings of $17.85 per share for 2023 and $18.34 per share for 2024. First National Bank Alaska is offering a forward dividend yield of around 8.4% (including the special dividend). Further, the stock offers a moderately high upside from the current market price. As a result, I’m maintaining a buy rating on First National Bank Alaska.

Alaskan Economy and Oil Prices Present a Mixed Outlook for Loan Growth

First National Bank Alaska’s loan growth has been above average so far this year. The loan portfolio grew by 5.0% in the first nine months of 2023, or 6.7% annualized. This is higher than the 5-year compounded annual growth rate of 4.2% from 2017 to 2022. Going forward, I’m expecting loan growth to come closer to the historical average.

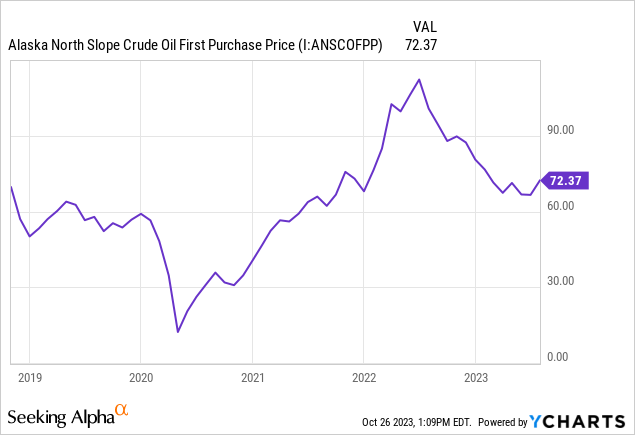

Alaska’s economy is heavily dependent on oil prices as oil revenues supply nearly 85% of the state’s budget, according to official sources. Therefore, oil prices are an important indicator of the health of FBAK’s markets, and consequently loan demand. As shown below, Alaskan crude oil prices inched upward in September after a prolonged mostly downward trend.

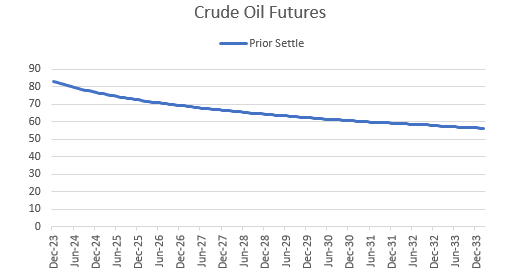

I think oil prices can remain elevated in the fourth quarter of this year due to geopolitical factors. However, the oil futures curve is still in sharp backwardation. Therefore, my longer-term outlook isn’t bullish.

CME Group

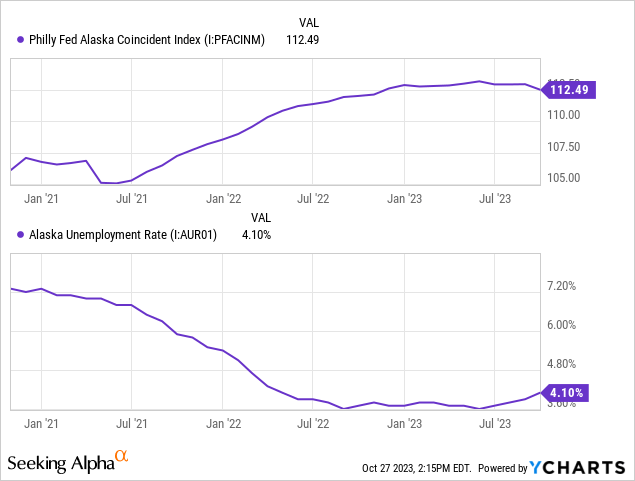

Unfortunately, some macroeconomic indicators are signaling that the upcoming quarters may be worse than the earlier part of this year. Alaska’s unemployment rate has worsened, and the coincident economic index has dipped. This means that the state’s economic activity is slowing down, which bodes ill for loan growth.

Considering these factors, I’m expecting the loan portfolio to grow by 1.25% in the last quarter of 2023, leading to a full-year growth of 6.3%. For 2024, I’m expecting loan growth to fall to 5.1%.

Loan growth was positive while deposit growth was negative in the first half of this year as depositors tried to chase yields and moved their funds. The gap between loan and deposit growth rates became smaller in the third quarter as deposit growth turned positive. Going forward, the difference between loan and deposit growth rates will likely continue to diminish as the up-rate cycle ends and the operating environment normalizes. Therefore, I’m expecting most balance sheet line items to grow in line with loans. The following table shows my balance sheet estimates.

| Financial Position | FY19 | FY20 | FY21 | FY22 | FY23E | FY24E |

| Net Loans | 1,992 | 2,190 | 2,104 | 2,208 | 2,347 | 2,467 |

| Growth of Net Loans | 2.9% | 9.9% | (3.9)% | 4.9% | 6.3% | 5.1% |

| Other Earning Assets | 1,589 | 2,391 | 3,356 | 2,886 | 3,064 | 3,125 |

| Deposits | 2,388 | 3,113 | 4,217 | 4,225 | 3,960 | 4,162 |

| Total Liabilities | 3,261 | 4,109 | 5,027 | 4,930 | 5,142 | 5,367 |

| Common equity | 548 | 587 | 555 | 408 | 416 | 424 |

| Book Value Per Share ($) | 172.8 | 185.2 | 175.1 | 128.7 | 131.5 | 133.9 |

| Tangible BVPS ($) | 172.8 | 185.2 | 174.1 | 127.8 | 130.8 | 133.1 |

| Source: FDIC Call Reports, Annual Financial Reports, Author’s Estimates(In USD million unless otherwise specified) | ||||||

Expecting the Margin to Stabilize

Despite the growth in the third quarter, FBAK’s deposits shrank significantly by around 7.4% in the first nine months of this year. At the same time, the loan portfolio grew by an impressive 5.0%. This discrepancy between the growth rates hurt the margin because the company had to resort to expensive borrowing to fund its loan growth.

The re-pricing of deposits also pressurized the margin. As mentioned in the earnings release, the cost of interest-bearing deposits increased to 0.92% in the third quarter of 2023 from 0.13% in the third quarter of 2022.

On the other hand, the upward re-pricing of loans boosted the margin. Overall, the margin grew by 18 basis points in the first quarter before declining by 7 basis points in the second quarter and then growing by just a single basis point in the third quarter of the year.

Going forward, I’m expecting the margin to be somewhat stable. This is because I’m expecting interest rates to stabilize from now onwards till at least the middle of 2024. Further, as mentioned above, I’m expecting balance sheet items to move in tandem with loans because I’m expecting normalization, or in other words, I’m expecting mean reversal. Therefore, I’m not expecting any further deterioration of the funding mix.

Expecting Earnings to be Rangebound

I’m expecting the earnings for upcoming quarters to not change much from the earnings in previous quarters. This is because I’m expecting operating expenses to grow on the back of inflation, which will counter the impact of loan growth. Further, I’m expecting the margin to be somewhat stable. Overall, I’m expecting First National Bank Alaska to report earnings of $17.85 per share for 2023 and $18.34 per share for 2024, as shown below.

| Income Statement | FY19 | FY20 | FY21 | FY22 | FY23E | FY24E |

| Net interest income | 137 | 145 | 146 | 145 | 150 | 154 |

| Provision for loan losses | 0 | 2 | 2 | (1) | 0 | 2 |

| Non-interest income | 23 | 26 | 27 | 24 | 26 | 28 |

| Non-interest expense | 86 | 91 | 92 | 93 | 98 | 101 |

| Net income – Common Sh. | 56 | 58 | 58 | 58 | 56 | 58 |

| EPS – Diluted ($) | 17.56 | 18.17 | 18.45 | 18.39 | 17.85 | 18.34 |

| Source: FDIC Call Reports, Annual Financial Reports, Author’s Estimates(In USD million unless otherwise specified) | ||||||

In my last report, which was issued before the first quarter’s results, I estimated earnings of $18.23 per share for 2023. My updated earnings estimate is slightly lower because the tax rate so far this year has been slightly higher than what I previously anticipated. Other than the tax rate, I haven’t made any significant changes in my estimates.

Risks Appear Moderately High

I believe First National Bank Alaska’s risk level is moderately high due to the following two factors.

- Oil and Gas Concentration. As discussed above, the oil and gas market has a direct bearing on FBAK’s bottom line because of the Alaskan economy’s heavy reliance on oil production. Due to the current geopolitical problems, there is presently a lot of uncertainty in the oil and gas market.

- Unrealized Losses. The unrealized losses on the Available-for-Sale securities portfolio amounted to $143.5 million at the end of September 2023, as mentioned in the earnings release. To put this number in perspective, $143.5 million is 34% of the total equity book value at the end of September 2023 and 2.5 times the net income for 2022. There is a high chance that FBAK will reverse these losses when rates start to decline next year. However, until these losses are reversed, the risk of these unrealized losses turning into realized losses will remain.

One factor that ameliorates FBAK’s risk position is its high capitalization. The company reported a tier I leverage ratio of 9.98% for the end of September 2023, which is much higher than the minimum regulatory requirement of 5.0%.

Dividend Yield of 6.7%, Excluding the Special Dividend

The most attractive point about FBAK is its high dividend yield. The current quarterly dividend of $3.2 per share implies a dividend yield of 6.7%. The company also pays out an annual special dividend of $3.2 per share. Including the special dividend, FBAK is offering a massive dividend yield of 8.4%.

The dividend appears secure due to the following two factors.

- Based on my earnings estimate, the 2024 payout ratio for First National Bank Alaska is around 87%, including the special dividend. For most other companies, such a high payout ratio would worry me, but FBAK normally maintains a high payout. The company has in fact maintained an average payout ratio of 82% over the last five years.

- The company is very well capitalized; therefore, there is no pressure from regulatory requirements to cut dividends. FBAK reported a total capital ratio of 19.91% for the end of June 2023 (the September figure hasn’t been released as of the writing of this report), which is far higher than the minimum regulatory requirement of 10.50%.

Maintaining a Buy Rating

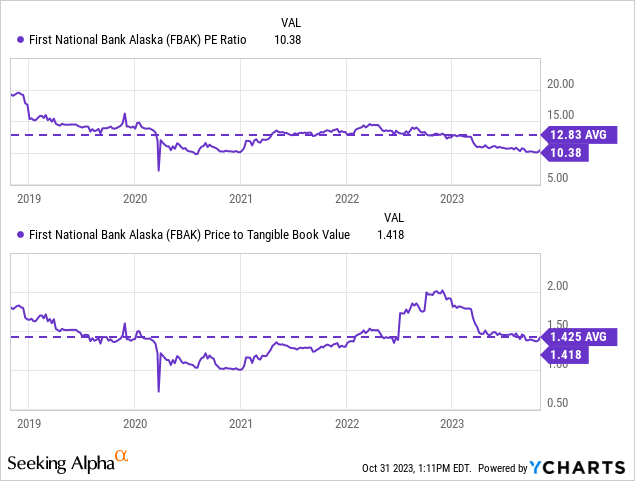

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value First National Bank Alaska. FBAK stock has traded at an average P/TB ratio of 1.43x and an average P/E multiple of 12.83x in the past, as shown below.

Multiplying the average P/TB multiple with the forecast tangible book value per share of $130.8 gives a target price of $186.4 for the end of 2023. This price target implies a 1.9% downside from the October 31 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 1.23x | 1.33x | 1.43x | 1.53x | 1.63x |

| TBVPS – Dec 2023 ($) | 130.8 | 130.8 | 130.8 | 130.8 | 130.8 |

| Target Price ($) | 160.2 | 173.3 | 186.4 | 199.5 | 212.6 |

| Market Price ($) | 190.0 | 190.0 | 190.0 | 190.0 | 190.0 |

| Upside/(Downside) | (15.7)% | (8.8)% | (1.9)% | 5.0% | 11.9% |

| Source: Author’s Estimates |

Multiplying the average P/E multiple with the forecast earnings per share of $17.9 gives a target price of $229.0 for the end of 2023. This price target implies a 20.6% upside from the October 31 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 10.83x | 11.83x | 12.83x | 13.83x | 14.83x |

| EPS 2023 ($) | 17.9 | 17.9 | 17.9 | 17.9 | 17.9 |

| Target Price ($) | 193.3 | 211.2 | 229.0 | 246.9 | 264.7 |

| Market Price ($) | 190.0 | 190.0 | 190.0 | 190.0 | 190.0 |

| Upside/(Downside) | 1.8% | 11.2% | 20.6% | 30.0% | 39.4% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $207.7, which implies a 9.3% upside from the current market price. Adding the forward dividend yield gives a total expected return of 17.8%. Hence, I’m maintaining a buy rating on First National Bank Alaska.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply