2023 is not an easy year for regional banks, as confidence in them has waned since the failure of SVB. In addition, the Fed’s monetary policy is challenging both loan growth and equity growth due to unrealized losses on fixed-rate securities.

These issues also grip First Commonwealth (NYSE:FCF), yet its YTD performance is not that bad when compared to peers: -11.34%. Last week, there was the release of Q3 2023, and both EPS and revenues slightly disappointed expectations:

- Normalized EPS was $0.39, $0.01 less than expected.

- Revenues were $122.58 million, $1.37 million less than expected.

However, although estimates were missed, overall the quarterly was not bad, in fact, I think it was better than many peers. The net interest margin remained high, the cost of deposits low, and shareholders were rewarded with both buybacks and dividends.

Loan portfolio and investment portfolio

First Commonwealth Financial Corporation (FCF) Q3 2023 Earnings Call

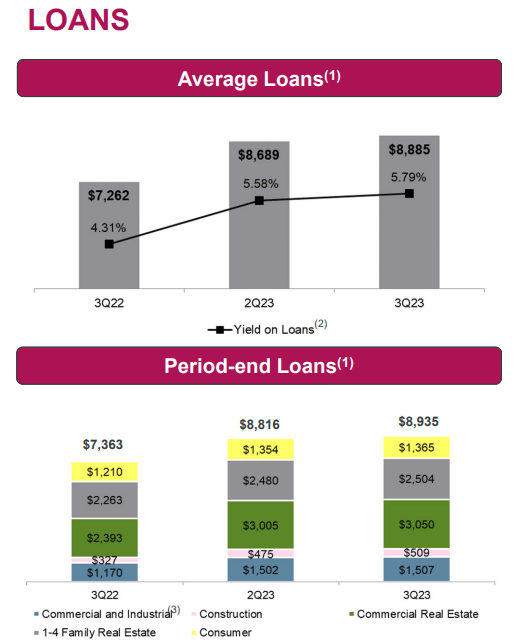

Average loans increased by $195.7 million over the previous quarter and $1,622.9 million over the previous year. The yield on loans continued to increase and reached 5.79 percent, an increase of 21 basis points over the previous quarter and 148 basis points over last year.

Mortgage loans increased by $56.8 million, offset by a $33.4 million decrease in 1-4 family construction loans. Commercial real estate loans and equipment finance loans also increased, by $45.10 million and $36 million, respectively.

First Commonwealth Financial Corporation (FCF) Q3 2023 Earnings Call

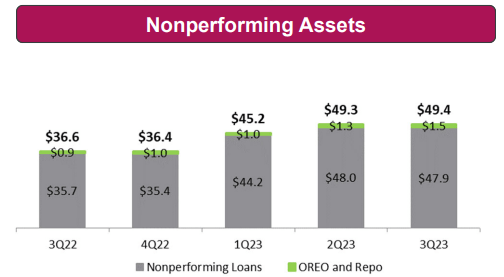

Nonperforming loans remain stable compared to the previous quarter and $12.20 million higher than last year.

In terms of repricing the loan portfolio, as quarters go by, replacement rates are increasing, and this could provide interesting opportunities to increase the net interest margin.

The replacement yields, the differential between the yield on what’s coming on versus what’s coming off has been expanding. And that also gives us confidence in the margin. So in the second quarter that differential was 87 basis points, and new loans are coming on the books is 7.01%, but it was 87 basis points higher than what was running off the books. And this is the differential in the third quarter was 115 basis points.

CFO Jim Reske, conference call Q3 2023.

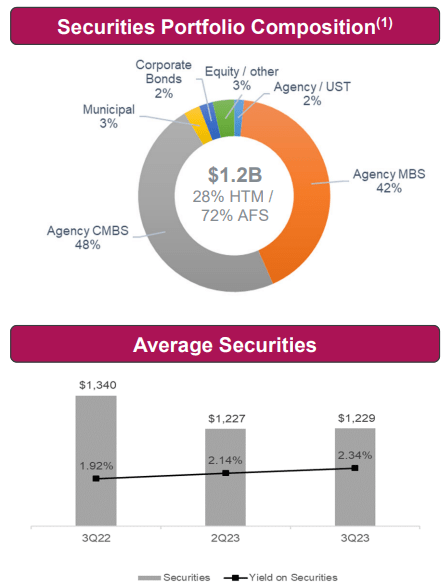

Finally, let us now analyze the situation of the securities portfolio.

First Commonwealth Financial Corporation (FCF) Q3 2023 Earnings Call

This portfolio has a value of $1.20 billion and consists mainly of Agency MBS and Agency CMBS, 42 percent and 48 percent respectively. From last year to the present, the portfolio’s yield has increased by 42 basis points, but in terms of value, it has decreased by $111 million. In other words, management’s strategy has simply been to adopt a passive attitude and let the securities mature without being replaced. In fact, as the unrealized losses were increasing more and more, buying new securities could have aggravated the situation even more. In any case, there will be a change of course in the coming months.

I think our securities portfolio for at least in last year we were doing almost no purchases to let that run off. So that we can redeploy in the loan growth and it was a good profitable strategy, but it’s gotten to a point where it’s a little small in terms of a portion of total assets compared to peers. And so we’d like to get the size of securities portfolio up a bit.

CFO Jim Reske, conference call Q3 2023.

In short, the time has come to buy new securities at current market rates since the investment portfolio has been downsized too much. No detailed figures were given on this, but it is supposed to be about $40 million per month investment. We are certainly not talking about investments in the billions, as well as not even half a billion.

Deposits and net interest margin

First Commonwealth Financial Corporation (FCF) Q3 2023 Earnings Call

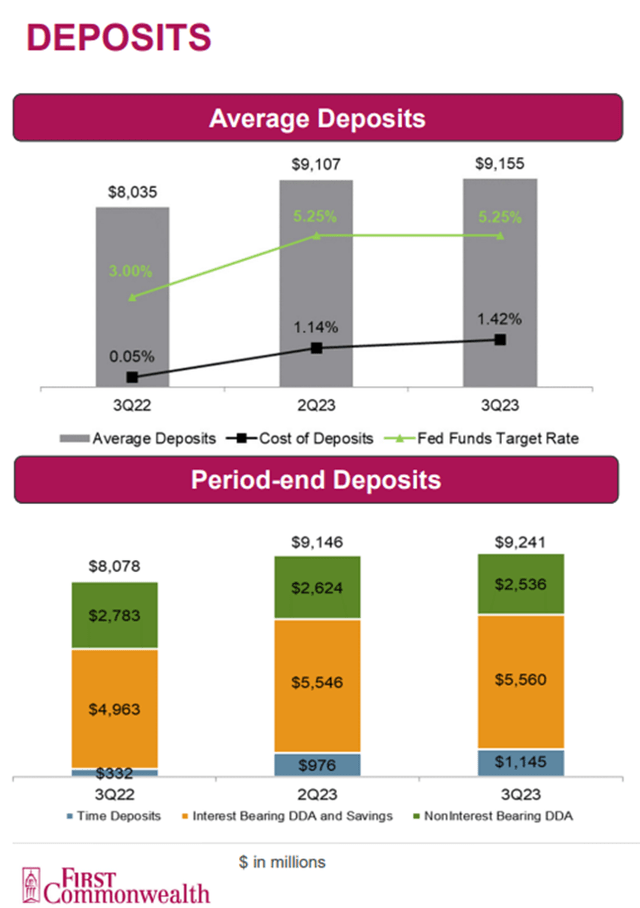

Average deposits increased by $48.40 million, so they were almost unchanged from the previous quarter. What has changed, however, is the cost, which went from 1.14% to 1.42%. In any case, this 28 basis point increase worries me a little since we are talking about a very low cost compared to peers that cannot get below 2-3 percent. Among other things, further evidence of the soundness of First Commonwealth’s deposits is the non-interest-bearing deposits. Compared to last year they have declined by only 9 percent despite all the turmoil of this period and high money market rates.

Let’s see how this is reflected in profitability.

First Commonwealth Financial Corporation (FCF) Q3 2023 Earnings Call

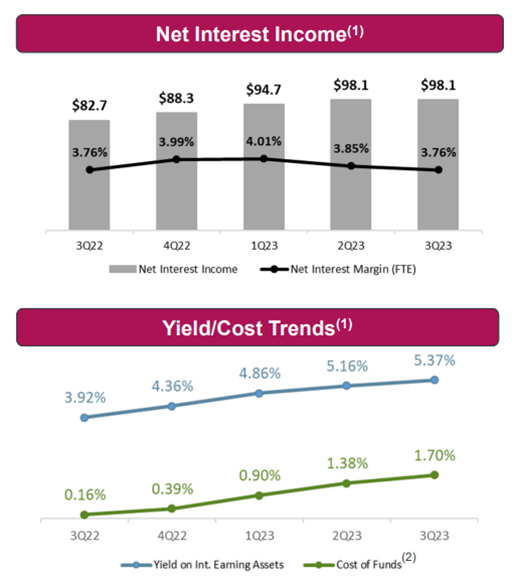

Net interest income for Q3 2023 was the same as the previous quarter and improved by $15.40 million from last year. In contrast, net interest margin decreased to 3.76 percent, 9 basis points lower than the previous quarter. The cause of this decline was mainly due to an increase in the cost of funds faster than the increase in loan yields, and this resulted in a deterioration.

Based on management’s estimates, this quarter could be the bottom of the net interest margin but it is impossible to be certain. The rise in the cost of deposits is unpredictable, and even if the Fed no longer raises interest rates the upward pressure would remain for a while.

The analogy, I don’t think it’s a good analogy but it’s one I came up with is it’s like a motor boat, you shut off the engine it keeps drifting forward. Even if Fed cuts rates next year deposit – overall deposit costs will continue to drift up or just because of this rotation phenomenon that we’ve been talking about.

CFO Jim Reske, conference call Q3 2023.

Conclusion

First Commonwealth is a bank that due to its low cost of funds is able to keep its net interest margin high. For the moment there are no particular problems, in fact nonperforming loans remain low and profitability is expected to recover in the coming quarters. In general, even at the peak of the banking crisis at the beginning of the year, this bank did not experience major weaknesses, which cannot be said of peers. In fact, the stock’s YTD loss is relatively low compared to any ETF that replicates the performance of regional banks.

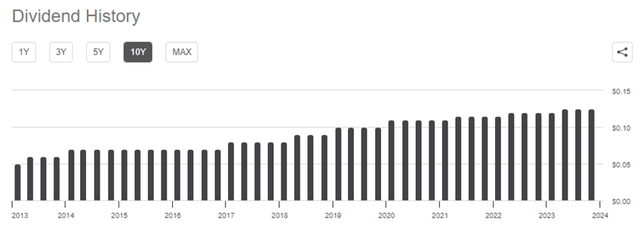

The current dividend yield is 4.08% and the payout ratio is quite low, 33%. The dividend seems sustainable, and over the past 10 years, it has also proven to be growing.

Seeking Alpha

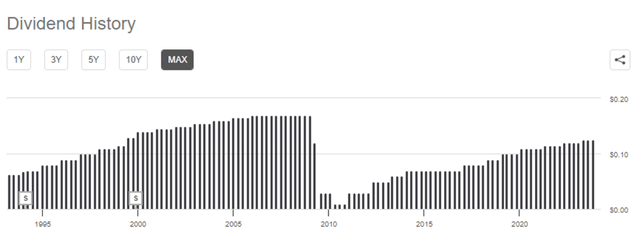

However, throughout the history of this bank, this has not always been the case.

Seeking Alpha

After the 2008 crisis, the dividend was wiped out, and after more than a decade there still has not been a full recovery. In short, the macroeconomic environment in which a bank operates makes all the difference. Regardless, history may not necessarily repeat itself, and First Commonwealth may have learned from its mistakes. Finally, in addition to the dividend, shareholders this quarter also benefited from the buyback. 259,639 shares were purchased at a weighted average price of $12.36; the bank has another $18.3 million available to continue its program.

Read the full article here

Leave a Reply