By James Knightley, Chief International Economist; Padhraic Garvey, CFA, Regional Head of Research, Americas; and Chris Turner, Global Head of Markets and Regional Head of Research for UK & CEE

The Fed has left the Fed funds target range at 5.25-5.5% and continues to indicate the prospect of another 25bp hike this year. Longer term, the Fed is signalling less prospects of rate cuts and a diminishing chance of a recession as it guides inflation back to 2%. Given the challenges the economy faces, the market is understandably sceptical.

No change from the Fed, but higher for longer is the clear message

The Federal Reserve certainly delivered a hawkish pause today with the message clearly being that policymakers believe interest rates will be staying higher for longer.

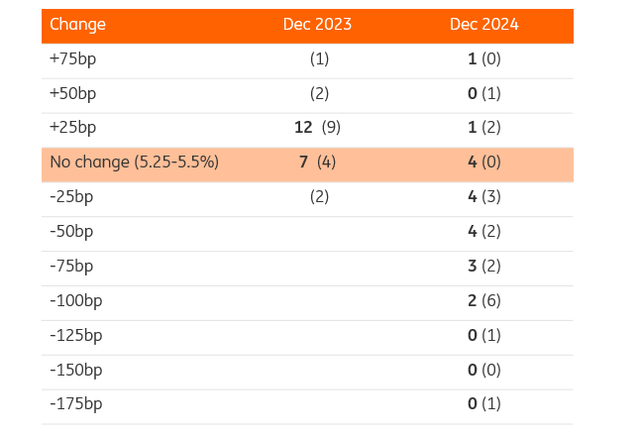

The Fed still have one 25bp hike in their summary of economic projections for this year, with 12 FOMC members backing the move while seven look for stable policy rates through to year-end.

However, they have upped the view for next year, so there are only 50bp of rate cuts pencilled in rather than the 100bp that was viewed as the most likely outcome back in June.

Individual Fed member forecasts for changes to Fed funds target range from current 5.25-5.5%

June predictions in parentheses

Federal Reserve, ING

Fed expects inflation to return to target with recession avoided

Text changes include the description for activity as “expanding at a solid pace” reflecting the recent strength in activity data, having described it as expanding at a “modest pace” in July.

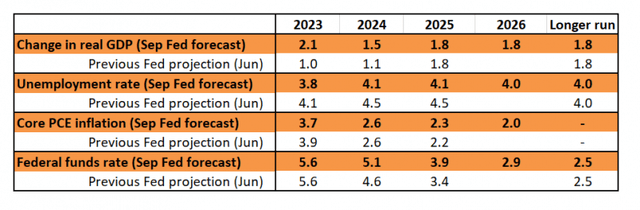

Fourth quarter year-on-year growth has been revised up for this year to 2.1% from 1% while for next year it is up to 1.5% from 1.1%.

The unemployment rate has also been forecast lower to 3.8% from 4.1% for year-end, while for next year it is 4.1% from 4.5%.

As the table below shows, there is little change to their view that inflation will gradually return to target.

Fed official central projection versus their June predictions

Federal Reserve, ING

These are major changes, suggesting that officials are firmly of the view they can generate a soft landing/no recession while guiding inflation towards the 2% target over time.

This is a bold call given all the uncertainties out there and makes it appear more likely that the Fed will indeed carry through with another hike even though we don’t think it is necessary.

Markets appear to be somewhat sceptical as well, only pricing 8bp of a 25bp hike in November and a cumulative 13bp by December versus 7bp and 11bp ahead of the meeting.

Intensifying headwinds means a lower profile for Fed funds remains our call

The Fed is indicating it thinks it needs to do more and will have to keep policy tighter for longer to ensure inflation returns to 2% on a sustainable basis. However, this will be contingent on ongoing strength in activity, inflation and jobs.

The third quarter has been a strong one for activity and rising energy prices will keep upward pressure on headline inflation.

However, we feel that the combination of higher borrowing costs and less credit availability plus pandemic-era savings being exhausted and student loan repayments restarting should mean that households feel more of a financial squeeze in the fourth quarter and beyond.

Higher gasoline prices, while pushing up inflation, will also erode spending power and likely weaken economic activity.

Rising credit card and auto loan delinquencies also hint at more pain with the Federal Reserve’s Beige Book warning that we may be in “the last stage of pent-up demand for leisure travel from the pandemic era”.

Add in auto worker strikes and a potential government shutdown and we remain of the view that the economy will lose the strong momentum from the third quarter.

The concern is that economic softness could go too far (as highlighted by some officials in the July FOMC minutes) and heighten the chances of recession.

Given this risk and the encouraging signs seen on core inflation and labour costs, we think the data flow gradually weaken the case for a November or December rate hike – which the market itself prices at only a 50% probability.

Our base case continues to be more aggressive interest rate cuts through 2024 than the 50bp suggested by FOMC members today and 75-100bp priced by financial markets.

The 10yr still has upside

The Fed will be content that the market is sitting up and listening to its hawkish tilt. Even with unchanged rates today, the 10yr at 4.3% is suitably more restrictive than it was at the last FOMC meeting when it was below 4%. And it still has upside.

The market discount for the bottom of the rate cycle has the funds rate at around 4%, and it has been drifting higher. That places fair value for the 10yr in the region of 4.5%.

The 2yr story is different. Today’s Fed update has seen the 2yr briefly nudge up to 5.15%. It probably does not need to be much higher. The bigger picture in the coming two years will be for the funds rate to be much lower than it is today.

That does not need to break even versus a 2yr much above 5%. In fact, this is an area of the curve that can crash lower once it is confirmed that the Fed has peaked. Bottom line, a curve steepening (dis-inversion) impulse is probable in the months ahead.

Bearish flattening of the curve hits activity currencies

The FX market has reacted to the Fed’s hawkish pause by taking the dollar a little stronger across the board.

News that the Fed is still threatening a final hike and has taken 50bp of its forecast easing cycle in 2024 has triggered a 5bp bearish flattening of the 2-10 year Treasury curve – normally a positive for the dollar against the activity currencies.

The rationale here being that the Fed keeping its foot firmly on the monetary brakes for longer will weigh on global growth.

Though the market reaction has been modest so far, today’s update from the Fed could see pressure on commodity currencies and what we call ‘growth’ currencies – or those currencies, like growth stocks, underperforming in a high interest rate environment. We would put the Swedish krona in this category.

Perhaps some of the modest reaction in FX markets may be a function of the plethora of central bank meetings in Europe tomorrow, where 25bp hikes are expected in Switzerland, Norway, Sweden and perhaps even the UK too.

With oil prices up here and US rates likely to stay firm(er), it is hard to see any reprieve for the beleaguered euro and yen. A recent ING customer poll saw 36% of respondents expecting EUR/USD to end the year at 1.05 or lower.

Today’s Fed news will support that view. For USD/JPY, US 10yr yields look biased towards the 4.50% area. This should see USD/JPY and EUR/JPY push to the sensitive 150 and 160 areas respectively and likely trigger for the first FX intervention of the year from Tokyo.

Content Disclaimer

This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply