By Seema Shah, Chief Global Strategist

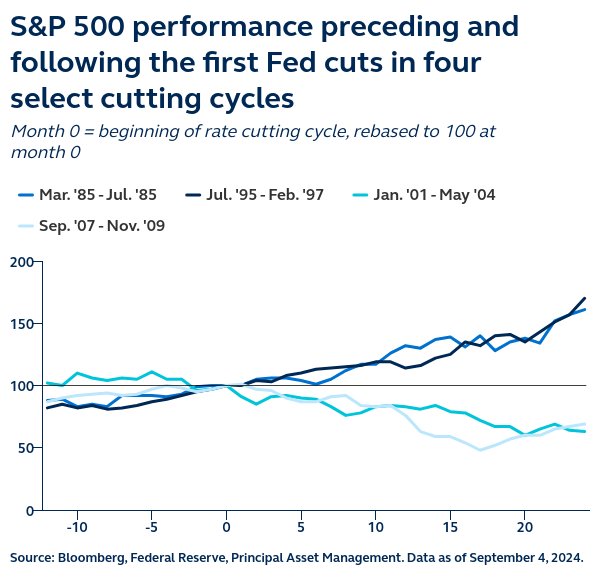

History suggests that the Fed’s success in piloting a soft versus hard landing will play a key role in dictating the path for U.S. equities. For example, in 1985 and 1995, rate cuts supported strong equity gains as recessions were avoided, while in 2001 and 2007, even aggressive easing couldn’t prevent steep market declines amid economic downturns. Today, the absence of glaring household or corporate balance sheet vulnerabilities means Fed easing should be enough to prevent recession, and should provide investors some optimism for the future of the market.

With the Federal Reserve poised to begin a rate-cutting cycle at its September 18 meeting, financial markets are already pricing in 100 basis points of cuts by year-end. While many believe that rate cuts signal trouble for equities, a closer look at past Fed easing cycles reveals a more nuanced picture.

Since 1970, the Fed has embarked on 23 rate-cutting cycles. In 16 of those instances, the market was higher six months after the first cut, with gains often in double digits. Historically, the key determinant of market performance has been whether the U.S. economy avoided recession. In the 1985 and 1995 cycles, when economic slowdowns were moderate and inflation pressures were contained, the Fed’s easing helped steer the economy toward a soft landing. The S&P 500 gained 32% and 14% in these periods, respectively, buoyed by rising corporate earnings and resilient consumer confidence. However, in recessionary periods like 2001 and 2007, even aggressive rate cuts could not prevent sharp market declines, as economic contractions overshadowed any monetary relief.

Today, the markets remain cautiously optimistic, reflecting hopes that rate cuts will avoid a downturn. Yet, if economic conditions worsen sharply, fears of a recession could outweigh the benefits of rate cuts. History shows that rate cuts themselves are not the enemy—it’s the economic context in which they occur that investors should be paying close attention to.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here

Leave a Reply