Thesis

Our thesis is that investors are not appreciating the underlying earnings power of Fairfax because they are fixated on certain historical issues.

The company is in an environment in which it should thrive – the insurance business has grown 3x, the investment portfolio is mostly short duration fixed income while interest rates have increased dramatically, and the remainder of the portfolio needs to simply do fine to produce a rewarding ROE.

If the company consistently executes over 12-18 months, we think the multiple is likely to rerate closer to peers trading over 1.5x P/B vs where Fairfax is today at 1.0x. This would produce gross investment returns of 2x – 3x over 5 years.

If the multiple does not re-rate, we expect management will continue to buy back stock (share count is down by ~16% over the last 5 years), resulting in faster EPS and BVPS growth.

Introduction

We last wrote about Fairfax in June 2016. Our conclusion at that time was that if bad things were to happen the company would do very well and, if not, then they would likely produce reasonable profits.

The stock has produced around an 8% – 9% CAGR (~80% total return) since then. Not an awful result but underperformed the S&P500. Despite the underperformance in the stock price, the performance of the business has exceeded our hurdle. We continue to be long-term owners.

To give readers an understanding of our context, we work towards buying equities that we don’t expect to have to sell for many years and for those businesses to generate a return to common equity of at least 10%. Our premise is that long-term stock returns track long-term business results. In essence, we try to ride the business, not the share price, and expect that over time one follows the other. We analyze and buy as if we are buying the whole company. It is through this lens that we view the business of Fairfax.

Overview

Fairfax Financial (OTCPK:FRFHF, FFH) is an insurance and investment conglomerate. The company has three main sources of earnings:

- Insurance underwriting.

- Fixed income investing.

- Partially owned businesses (includes traded common stocks, investments in Associates and consolidated non-insurance businesses).

Before discussing each, we want to provide our view on the issues we think investors have anchored themselves to as a reason not to invest in Fairfax.

These issues would be the losses on hedges historically and what we dub as the ‘BlackBerry Problem’.

Losses on Hedges

Back in 2010 Fairfax implemented an equity and deflation hedging program. It lost big money. Based on reported results, cumulative pre-tax losses on equity short positions and CPI-linked derivatives were ~$6.1B from 2010-2020 (Note 5, Fairfax financial statements 2010-2020). For comparison, shareholders equity in 2010 was around $7B – $8B. From that starting point, losing $6B really slows you down. Management made it very clear that they were worried about significant deflation and equity market corrections. The opposite happened.

Management made a huge bet, and it went against them. How should investors think about this?

We like the analogy of a race car. If the car isn’t going fast enough check three things first – is there a problem with the engine (business fundamentals), is the driver giving it enough gas (earnings produced) or is the driver standing on the brake.

In this case, Fairfax had been standing on the brake.

If you back out hedging losses and control for capital flows, we estimate the company would have compounded book equity ~12% from 2016-2022. Management targets a 15% CAGR in book value per share.

Our analysis does not consider any earnings that may have resulted from investment of capital that was lost on the hedges. Moreover, as an investor, if you have such a cautious stance to place a large bet on general market decline and deflation, this most likely causes you to be more cautious in the rest of your portfolio, also hampering returns.

Regardless, management missed its 15% bogey. That’s what happened.

For investors, does producing underlying ROEs of 12% warrant a 0.8x – 1.0x P/B multiple which is where the company has been largely trading? Not in our view.

Even if investors are unwilling to look past the hedging losses, we estimate Fairfax compounded book equity ~10% in the same period. Not a disaster.

We think investors need to appreciate the implications of these results. Despite losing billions on hedges, despite a ‘risk off’ investing stance, despite terrible bond yields for years, Fairfax was able to muscle out a 10% ROE.

We see this as opportunity. A company that powers through bad times and its own mistakes is a sign of underlying strength, not weakness.

Fairfax is no longer hedging. They’re back to their knitting – selling insurance, owning bonds and buying value stocks.

The ‘BlackBerry Problem’

When we say the ‘BlackBerry Problem’, we aren’t referring to the company’s position in BlackBerry itself (although, technically, it is part of the problem).

Here’s the BlackBerry Problem – investors don’t like the companies that Fairfax buys.

That’s it. That’s the BlackBerry Problem.

Resolute Forest Products is an example and one that concluded in Mar-23. In the case of Resolute, between common shares and bonds, the company’s net investment after dividends was $715M. With the interest income on the bonds, sale proceeds of $622M and possibly some money from a contingent value right (connected to duty deposit refunds on lumber), Fairfax might break even on Resolute (2022 annual, pg.10). They have been in Resolute for 14 years. Effectively, dead money.

BlackBerry (BB) (the company) is another example, and one Fairfax still has a position in stock and bonds. BlackBerry’s stock price has recently shot up on the announcement of an offer from private equity firm Veritas. We expect management will provide a full accounting of the results if a deal goes through and they exit. Either way, Fairfax has been invested in BlackBerry for about 10 years. Fairfax might be in for another dead money trade on this ‘decade-r’ investment.

Investors should note that it is often difficult to cleanly track returns on specific positions over time as Fairfax often has various securities in the same name. The common equity may not be reflective of the company’s overall investment exposure or returns.

Our view is that the BlackBerry Problem is a function of Fairfax’s investment playbook (discussed later). In short, Fairfax tries to buy assets very cheap and then wait/work until earnings return. Should earnings not appear, Fairfax tries to get its money back or mitigate losses. Heads-you-win-tails-you-don’t-lose. Buy the assets, sell the earnings. This appears to be the approach. Patience is key to the execution.

Why would investors want a management team that buys ugly positions and stubbornly holds on for a decade?

Because when it works, it works great. For example, Fairfax bought Bank of Ireland stock for €0.10 in late 2011 (2016 annual, pg. 13) and sold 85% in 2016 for €0.32 (gain of $806M) and the rest in 2017. They made ~$1B on the Bank of Ireland trade.

It’s important for investors to realize that homerun performance on its common stocks is not required. Insurance companies are naturally levered because of the insurance float. At the end of 2022, Fairfax total assets were ~$92B and total equity ~$20B.

We often get the sense that investors are waiting for Fairfax to magically turn into Berkshire Hathaway. That management will start buying wonderful companies at fair prices (like Apple) rather than fair companies at wonderful prices (like European banks).

Just remember – If the portfolio does fine, Fairfax will do great.

Looking Forward

Insurance

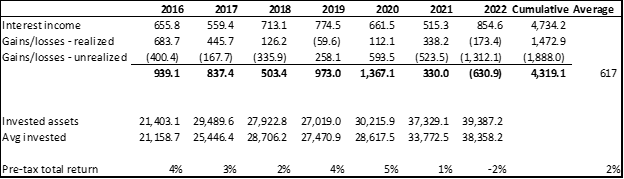

Fairfax Financial Statements

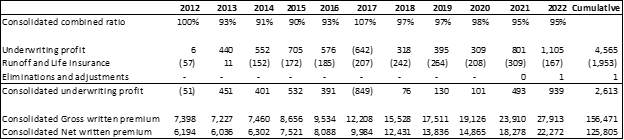

Fairfax’s insurance business has been a growth business. Premiums written have grown ~14% compounded over the last 10 years. Cumulative pre-tax underwriting profits (including runoff) was ~$2.6B. Average combined ratio for the P&C insurance companies was ~ 96% (note that the combined ratio is based on net premiums earned ex-Runoff and Life).

Company financial statements, Yahoo Finance

To put the scale of Fairfax’s operation in context, see the above table. We’ve summarized 2022 premium volume written and combined ratios for some of the largest North American-based insurers along with their current price-to-book trading multiples.

Markel (MKL) and Berkshire (BRK) are the most comparable in terms of an insurance/investment operation. Markel is more comparable in our opinion just given size and relative development of the non-insurance operations.

Markel had net written premium in 2022 of ~$8B and a combined ratio of ~92%. Markel reported a 5-year CAGR in book value per common share of 6% in 2022 (50% below Fairfax) but MKL trades at a P/B of 1.5x vs Fairfax’s 1.0x (50% above Fairfax).

In our view, investors have been so dejectedly focused on historical issues that they have ignored what is being built in plain sight. Fairfax owns one of the largest insurance operations in the world. It is profitable, and it is trading for 50% less than comparable companies.

Insurance companies are currently experiencing favorable market conditions as premium rates are rising. Management said this about insurance market conditions, which we think is a very clear summary.

Favourable underwriting conditions are expected to continue into 2023, albeit more modestly after very healthy rate increases in both 2021 and 2022. As inflationary pressures continue to impact all components of the economy, the risks associated with climate change become more prominent with above average catastrophe losses and reinsurance costs increasing significantly, and insurers keeping prices in line with loss costs. Although the industry is well capitalized from an economic capital standpoint heading into 2023, the industry is feeling the effects of significant increases in interest rates during 2022, with many insurers’ shareholders’ equity decreasing well in excess of 10%. Should interest rates remain higher for longer, the unrealized investment losses will take many years to unwind and could prolong the hard market for a few years. (Fairfax 2022 annual, pg. 129)

In essence, the combination of cost inflation combined with unrealized losses on bond portfolios is leading the insurance industry to compensate by raising prices. Fairfax is able to take advantage of the substantial rise in insurance pricing and the rise in interest rates, because it didn’t reach for yield historically.

In the first 6 months of 2023, Fairfax net premiums written increased just over 7% from prior year (Q2-23, pg. 50).

In April 2023, Fairfax bought a 90% controlling interest in one of its remaining insurance associates, Gulf Insurance, which has around $2.7B in gross written premiums. This is going to fuel continued growth in 2023.

YTD Jun-23 underwriting profit was ~$650M and combined ratio was ~94%. With the purchase of Gulf and the prospects for a continuing hard market into 2024, it seems reasonable for Fairfax to sustain $1B+ in underwriting profit, depending on catastrophe experience.

Insurance Accounting Change – IFRS 17

One thing for investors to be aware of going forward is that insurance accounting has been complicated by a new accounting standard (IFRS 17). The biggest change seems to be around the discounting of losses and a specific adjustment for non-financial risk. Fairfax does provide a reconciliation to underwriting profit which we think is still the proper way to consider insurance underwriting. The reported financial statements have been significantly impacted by this accounting change, including a material increase in common shareholders’ equity since loss reserves were previously undiscounted (i.e. liabilities were higher).

Fixed Income

Fairfax financial statements

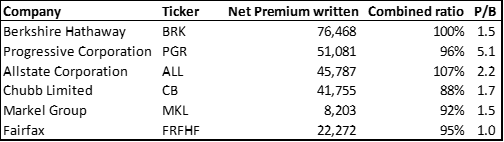

We discussed how Fairfax did not achieve its 15% target in recent years. One of the big reasons for our optimism is the change in the interest rate environment. From the table above, Fairfax averaged ~2% on its fixed income portfolio (for reference, we count cash, short-term investments and bonds all within ‘fixed income’). If you exclude the large unrealized losses during the end of 2022, Fairfax earned ~3%. That is total return, including gains.

Given the short duration, high quality nature of the portfolio combined with the very steep rise in interest rates, we think that the unrealized losses on bonds in 2022 will be largely transient.

Interest income is now increasing substantially. The fixed income portfolio was ~$41B at Jun-23, up nearly $20B since 2016. The company reported that duration increased slightly from 1.6 years to 2.4 years between Dec-22 and Jun-23 as Fairfax invested in more medium-term securities. This allows the company to benefit from continued higher interest rates. At least one big name investor (Bill Ackman) announced recently he’s shorting 30-year treasuries and that yields could hit 5.5% ‘soon’.

If the long end of the yield curve picks up, Fairfax will have the opportunity (all else equal) to extend duration thereby earning higher income for longer.

In Jun-23 Fairfax announced it purchased ~$2B in loans from the Pacific Western Bank situation. The expected return on capital is 10%+. These are quicker burning (~1.7 years) but there is a marked difference between earning 2% – 3% and earning 10%.

Fairfax has made most of its money on credit. Fixed income dominates the portfolio (typically 70% – 75%). For years credit paid little. Yet Fairfax bided its time, unlike others who reached for yield. This discipline restrained earnings but it was the right decision.

Now credit is back.

It is easy to point to the losses the company did take historically (hedges). What is harder to see (but more important due to the magnitude) is the losses the company didn’t take by avoiding the reach for yield.

Don’t knock them for one if you aren’t prepared to give them credit (pun intended) for the other.

On the Jun-23 earnings call management stated that interest and dividend income is currently at a run rate of around $1.5B. This could be a touch conservative and it might be floating closer to $2.0B run rate.

On a reported basis, Fairfax interest and dividend income was ~$850M at the 6-mo ended Jun-23.

In summary, Fairfax has a cash and fixed income portfolio of ~$41B, treasury yields are in the 4% – 5% range and the company is able to get access to premium deals like the Pacific Western portfolio at over 10% returns.

We think pricing in interest income between $1.5B and $2.0B is a reasonable input. Historically, gains on the fixed income portfolio have amounted to around 1%. If investors model in gains on bonds (in addition to interest income) of 1% – 2%, that would amount to roughly another $300 – $600 million in gains.

Partially Owned Businesses

Fairfax’s portfolio of partially owned businesses is accounted for in three categories – mark-to-market common stocks, Investments in Associates and consolidated businesses. In the 2022 annual report, Fairfax provides a summary of its holdings.

Common Stocks

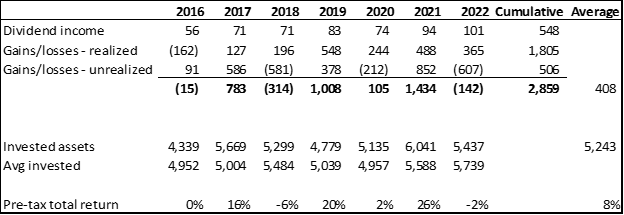

Fairfax financial statements

The table above presents returns on common stocks for Fairfax from 2016 to 2022. Annual total returns have averaged ~8% over the last 6 years.

Remember – Fairfax doesn’t need to shoot the lights out to do well, thanks to the insurance float leverage.

Obviously, the company can allocate its portfolio in different ways over time so the mark-to-market stock portfolio will change in size and composition. Those earnings are not only dictated by market movements but also by portfolio allocation.

Based on the current portfolio, if Fairfax can earn an average of at least 7.5% on its common stock portfolio, that will be a sufficient contribution from this component (~$500M+ in total gains/income per year).

Investment in Associates

Fairfax financial statements

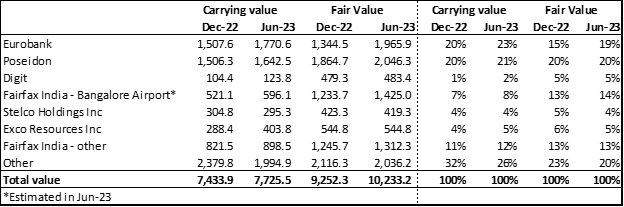

Investment in Associates are large common stock ownership positions that are equity accounted. Nearly 70% (by fair value) at Jun-23 is invested in 6 companies – Eurobank, Poseidon, Digit, Bangalore Airport (BIAL), Stelco and Exco.

At Jun-23 on a reported basis, Fairfax has ~$7.7B invested at carrying value and ~$10.2B at fair value in Associates. In our view, investors should consider it higher to account for the compulsory convertible preferred shares in Digit (discussed later). The breadth of industries and geography over which Fairfax has invested is wide – Greek banking, containership leasing, Indian airports, steel production, etc.

Management said on its Q4-22 earnings call that around $500M in earnings from Associates is conservative. In 2022, earnings from Associates squeaked over the line at $1.015B and in the first 6 months of 2023, earnings from associates are ~$600M, seemingly on target for another $1B+ year.

Before the following discussion, let us be clear – we don’t think looking at share of profit from Associates is a bad approach.

Investors in Fairfax are looking at annual return on equity for valuation purposes. Targeting a share of profit is straightforward, it addresses investor need for periodic return considerations and is grounded in reality. If you own a 1/3 stake in a business, 1/3 of the earnings belong to you. That’s true.

That being said, this approach has the ability to lead investors to the wrong conclusion in either direction. Let us try to illustrate with some examples.

Take Resolute Forest Products. As discussed earlier, Management noted in its 2022 annual report Fairfax might break even on Resolute. However, in 2022 alone, share of profit from Resolute was $159M. Did Fairfax make money? Clearly not. Investors only considering share of profit in associate might miss this nuance, detrimentally.

The opposite can also happen. Consider Digit, Fairfax’s Indian insurance Associate.

Fairfax noted in 2022 that Digit, after only 5 years since inception, is now around $935M in annual gross premiums written. Think how incredible that is. They basically created a billion-dollar insurance business in 5 years.

Ordinarily, fast-growing insurers are a bad idea. It usually means you’re taking the risky business no one else wants, leading to losses. Despite Digit’s 2022 combined ratio of 108%, we look at Fairfax’s overall track record in insurance as giving comfort around underwriting standards for Digit.

A word on Digit – the fair value in Associates is only ~$480M however Fairfax also holds compulsory convertible preferred shares on which they recognized a ~$1.5B gain in 2021 meaning Digit is a significant holding, perhaps around $2.0B in fair value. In 2021, Digit entered agreements with third-party investors to raise $200M in new equity at a valuation of $3.5B. The gain was estimated “using the transaction fair value, which was supported by an internal discounted cash flow analysis” (Fairfax 2022 annual, pg. 65). So ‘mark-to-model’. We traditionally look askance at gains of this nature. That said, we’re happy to allow management their continued optimism, so long as they don’t begrudge us our natural conservatism (skepticism? cynicism?). Frankly, we are also encouraged by Digit’s performance to date.

If investors want (tenuous) reference points for comparative ‘digital’ insurance companies, they can look at Lemonade Inc. (LMND) or Root, Inc. (ROOT) in the US, both of which are public. Lemonade has describe their business as “rebuilding insurance from the ground up on a digital substrate and an innovative business model” (Lemonade Inc 10-Q Jun-23, pg.26).

In 2022, Lemonade generated ~$556M in gross written premium and lost ~$300M in earnings (Lemonade Inc. 2022 annual report, pg. 80). In 2022, Root generated $600M in gross premiums written and also lost ~$300M (Root Inc. 2022 annual report, pg. 69/70). Lemonade’s current market cap is around $800M – $900M and the stock has declined from over $160 to around $12. Root has had an even more spectacular trip from at one point over $400 to now around $10 (market cap is ~$150M).

Digit did $935M in gross written premiums in 2022 and had a total net loss of maybe -$20M to -$30M. Nearly twice the premiums, operating close to breakeven, growing at breakneck speed.

Investors (including ourselves) are free to be skeptical of the $3.5B model valuation but, considering the comparative businesses, we think the bias is clear — Give us insurance geeks doing tech things than the opposite. Thumbs up to Fairfax and the Digit team.

Because Digit is rapidly growing, if earnings remain elusive and there are no additional mark-ups on the securities Fairfax owns in the near term, investors only looking at share of profit in Associates are going to completely miss the value of this business. Moreover, if Digit is able to continue to execute in the vast Indian insurance market, the growth is going to generate new investment assets (via insurance float) for Fairfax, fueling further investments. Between Fairfax India and Digit’s growing investment portfolio ($1.4B in 2022), Fairfax probably has $4B – $5B in assets in India already.

Despite recent (and fairly serious) Canada/India political tensions, we think Fairfax has a solid platform on which to build a very large Indian business, long-term.

The Bangalore Airport (BIAL) investment is another example where it appears the growth in the value of the asset is likely to diverge from reported current share of profit. Based on recent transactions, the fair value of the whole asset appears to be around $2.5B and Fairfax has a 57% stake (which might rise to 64%). Share of profit in 2022 – minus $5.7M.

Again, the fair value is model driven. Per management “a significant amount of its fair value is driven by expected growth in passenger traffic in the later years of the forecasting period once various capital projects are complete” [emphasis added] (Fairfax India 2022, pg. 44). However, Fairfax was able to transact with third parties on such basis and airports do have a fairly infrastructure like consistency to their revenue and earnings. Covid was obviously a bombshell.

However, Fairfax India’s 2022 report also importantly noted “BIAL’s aeronautical revenues are primarily driven by UDFs charged to airlines and passengers, which are set by the Airports Economic Regulatory Authority of India (“AERA”) in five-year control periods and are fixed in a manner to generate a 16.0% per annum return on invested equity for the airport operator.” [emphasis added] (Fairfax India 2022, pg. 44)

It looks like BIAL served ~32M passengers in the 12 months ended April 2023, roughly double the prior period. The recovery was primarily led by domestic travel of ~28M passengers. The city of Bangalore isn’t going anywhere. India has a substantial population that is getting wealthier. Families will travel home for holidays, businessmen will travel for business, tourists will come to see the sights. Life goes on. The airport has around 460 acres of land adjoining the airport that can be developed into income earning real estate.

The story of the BIAL investment is still early. In our view, continued patience from shareholders would be wise.

Investors are probably wondering – When does it make sense for investors to use share of profit?

We think Eurobank and Poseidon are good examples.

Eurobank was purchased in 2014 and later combined with the company’s stake in Grivalia. Eurobank is now one of the largest positions with a carrying value of ~$1.8B at Jun-23 and is producing around $250M to $300M in share of profit.

Eurobank is publicly traded and they have English financial statements for investors to do their own diligence. Here is where the bank stands now:

- Assets: €81.5B (2022), €81.5B (Jun-23).

- Total equity: €6.7B (2022), €7.5B (Jun-23).

- Net Revenue: €3.1B (2022), €1.4B (6mo-Jun-23).

- Net profit: €1.3B (2022), €684M (6mo-Jun-23).

- EPS: €0.36 (2022), €0.18 (6mo-Jun-23).

Eurobank has ~10,000 employees, ROE is over 15%, the stock is trading below book value and Fairfax owns about 1/3 of the company.

It’s a real operating bank that is producing regular earnings and appears to have recovered.

In the case of Poseidon, the business is significant. In 2022, revenue was $1.7B with net earnings of $622M. It is also in growth mode (2022 – CFO ~$856M, Capex ~$1.2B) (Atlas Corp 2022 Annual Report). Poseidon has contracted to purchase 58 new containerships with delivery dates through 2024 with a total purchase price of $6.1B.

Shipping is notoriously cyclical. Currently there appears to be excess capacity in the container ship market and the ship orderbook for newbuilds represents ~30% of existing global fleet capacity (See here and here). Historically, not an awesome scenario for the price of renting out boats. Earnings over the next 12-24 months may decline for Poseidon.

The other two larger investments where current earnings are useful yard sticks are probably Stelco and Exco, which are ~$1.0B in combined fair value. It’s a little tongue in cheek but, basically – if steel prices and oil prices go up, earnings go up. If down, down. These are commodity businesses and earnings follow those cycles (usually why investors hate them). For example, Stelco’s YTD-23 earnings are down almost 90% from prior period. Tonnage shipped was up 6%, average price is down -26%. Oil prices are high and Exco’s earnings have increased significantly.

Let’s sum up.

As long as investors take into account nuances where current earnings might not be indicative of the value accruing to Fairfax shareholders, then using share of profit in Associates to assess Fairfax’s periodic return on equity should be fine.

Management has said $500M in earnings is conservative for this segment and has already exceeded it for 2023. Investors would be wise to not model that out too far. A meaningful portion of earnings is being derived from businesses with strong cyclicality to their revenue profiles.

The fair value on Fairfax’s share of this group of assets is ~$10B. Projecting $750M – $1.0B in share of profit is basically a 10x – 13x P/E ratio on this portfolio. Something for investors to consider.

Investment in Associates – Afterword

We want to share our view on Fairfax’s strategic intent and approach around partially owned businesses. We think it will help investors cultivate the correct frame of mind by which they can judge the company’s investments.

We view Fairfax’s strategic intent as being to gain full ownership in these businesses. The playbook seems straight forward – buy a meaningful stake to have influence, nudge it up over time if practicable and then complete the purchase or, if it’s a bust, get your money back. This approach has a number of benefits.

First, it allows Fairfax to learn the industry, management and business landscape from the inside. This increases the accuracy of subsequent investment decisions. Once you do Greek banking or lumber or shipping for a decade, you should be better at the next one or you avoid it like the plague thanks to long, painful experience. This should increase returns via accumulated institutional knowledge.

Second, the company doesn’t have to commit to the full purchase right away. This lets Fairfax maximize its opportunity set for a given level of capital which, at any time, is largely fixed. This is important because it gives Fairfax a roadmap for capital placement in the future and follow on opportunities. This helps maximize the productivity of the company’s deal team.

And while we hate talking about overused concepts like ‘institutional knowledge’, we think the value in Fairfax’s approach is underappreciated by investors. The company is building a network of long-term business relationships, industry knowledge and market knowledge. These are real.

The results of this relationship and institutional knowledge building, we think, benefits Fairfax financially in concrete and clear ways.

For example, Fairfax acquired an interest in Eurolife (a Greek life insurer) back in 2016 from Eurobank and commenced consolidating it in 2021 after increasing their ownership stake (5 years later) to 80%. The remaining 20% is owned by Eurobank. In 2022, Eurolife did ~$344M in net premium, ~$50M in underwriting profit and had shareholders equity of ~$393M. That deal probably doesn’t happen without a relationship with Eurobank being built earlier.

To further the point (possibly ad nauseum), Fairfax noted in its Q2-23 report that its BB/Ba bond holdings had increased “primarily due to net purchases of Greek government bonds” (Q2-23, pg. 31). In Sept-23, Greece’s credit rating was raised to investment grade for the first time since the debt crises by DBRS Morningstar. About a week later Moody’s raised Greece’s credit rating to Ba1 with stable outlook, just one step away from investment grade after 13 years (hard fought for the Greeks) (Bloomberg). The Greek government bonds Fairfax bought in H1-23 are probably going to see nice gains, if they haven’t already.

This isn’t random. After a decade working in Greek banking, opportunities like these to make money are clearly the additional fruits of long labor.

We would summarize Fairfax’s playbook as:

- Start with a small stake. It’s going to look ugly.

- Have the downside protected with asset value.

- Work with company management to get earnings going.

- If parts of the investment aren’t working, carve out the stuff that does.

- If it looks like a bust, get your money back or mitigate losses.

- If it’s working, sell out for a nice gain or buy the rest.

- Be extraordinarily patient.

The key component in all of this is patience. Many of the most important positions were started over a decade ago.

If investors look through this lens at the deals Fairfax does, we think they might feel a bit more optimistic about the long term.

Consolidated

The consolidated non-insurance businesses are a smaller portfolio and, although consolidated, are still partially owned.

Fairfax reported that at the end of 2022 the carrying value for this group was ~$2.1B. If investors exclude Fairfax India, the remaining businesses have a carrying value of ~$1.6B. The most significant are Recipe (~$600M) and Grivalia Hospitality (~$400M). Recipe is a Canadian restaurants company and Grivalia Hospitality acquires, develops and manages luxury hospitality real estate in Panama, Cyprus and Greece.

Grivalia sounds to be in growth mode with 3 operating assets and 7 under development. We suspect current earnings are modest. Incidentally, the Grivalia Hospitality deal came by way of the Vice Chair of Eurobank. So much for the cautionary tales of Greeks and gifts.

In total, consolidated partially owned businesses produced ~$190M in pre-tax income before interest expense, other and excluding the impairment of Farmers Edge of $133.4M in 2022 on revenue of ~$5.6B. Not overly inspiring.

A quick word on Farmers Edge (OTCPK:FMEGF) – it IPO’d in 2021 and, to put it delicately, it hasn’t gone well. While we appreciate backing out items of this nature to assess the potential for prospective performance, owners of Fairfax are required to live with actual performance, the wins and the losses.

The most significant contributor to earnings is the restaurants and retail segment, most of which is likely coming from Recipe (taken private in 2022). In 2022, this segment produced revenue of $1.7B and ~$128M in pre-tax income before interest expense and other. The restaurant business has been recovering from Covid and management noted that system sales (they have franchisees) increased to CDN$3.4B.

The other businesses within restaurants and retail segment include Golf Town and Sporting Life, after the deconsolidation of Toys “R” Us in 2021. Fairfax bought Toys “R” Us in 2018 for CDN$300M. With the Toys “R” Us sale, Fairfax keeps the real estate and a monthly royalty stream on revenue. They sold the operations for ~C$116M and recorded ~$86M in gain on sale of investment. Another example of the Fairfax playbook in action.

Recipe is a mixed bag by our assessment. There are some clear gems (The Keg), some very old brands (Swiss Chalet/St. Hubert are from the 1950s), and some that are probably struggling. Per the Recipe website there are over 1,200 locations, over 1,000 franchisees and 134M guests served in 2022.

The restaurant industry is difficult. Case in point – Recipe (then called Cara) system sales in 2017 were C$3.5B and EBITDA was C$200M. In 2022, system sales were still C$3.5B and Recipe management is working to get profitability back “to pre-Covid level”, which we interpret as EBITDA being under C$200M. The pandemic was brutal on restaurants and inflation has hampered the return to profitability.

We think there is good option value in the Recipe platform. Outside the individual mega restaurant brands (McDonalds, Chipotle, Chik-fil-A, etc.), there is a large swath of individual restaurants and smaller chains (5-100ish stores) that dominate niches within local markets. The Keg is a good example in our opinion.

Per the Keg Royalties Income Fund 2022 AIF, there are about 107 restaurants in operation, 97 of which are in Canada (about half in Ontario) and 10 in the USA and 56 are franchised. Keg system sales in 2022 were ~C$700M (~20% of Recipe system sales).

For the astute observer, that means the average Keg restaurant is generating over $6.5M/year in sales. These are gems.

Now consider the potential of assembling a constellation of ‘local’ chains that do well in their niche.

First, there are probably opportunities to gain leverage in lots of little ways on certain supplier and operating costs through buying power/scale efficiencies relative to the same business in the hands of a local operator. This has the potential to create value through change in ownership.

Second, is the prospect for growth. Growth in restaurants usually means more stores. With Recipe as a platform there will be a few main ways to get growth – build more stores of current brands in current markets, buy into new markets via acquisition, introduce existing brands into new markets.

None of this is to suggest it is easy or certain. Restaurants have a high failure rate for good reason – labour cost inflation, food cost inflation, rent increases, Covid, consumer spending cycles.

We think Recipe’s structure affords it the opportunity to grow. Franchising is capital light once infrastructure is in place and produces good cash flow. New markets can be tested for potential demand of existing brands. It may cost some capex, time or brand tailoring to do so, but Recipe already has winning formulas, they have winning cards. And if for some reason nothing in Recipe’s ‘hand’ is judged to work in a given market, acquisitions can still be made. How many 30, 50 or 100 store Keg-type chains are out there in North America?

Covid sent the industry for a loop, but we think Recipe as a platform has good chances. We’re willing to remain patient.

And if it doesn’t? Carrying value for Recipe at Dec-22 was ~$600M and EBITDA might be in the $100M range. Odds are reasonable Fairfax can walk away without too much of a dent if it had to.

Investment Return Potential

We see the potential for Fairfax to provide investors 2x – 3x on their money over the next 5 years. We are skeptical the company will be able to hit its 15% BVPS target. It could happen, but the equity portfolio is going to need to carry some very heavy freight. We see 13% – 14% ROEs as being achievable. The key pre-tax earnings components include:

- Insurance underwriting: $1.0B.

- Fixed income investing: $1.8B – $2.3B total return.

- Share of profit of associate: $750M – $1.0B.

- Common stock: $500M total returns.

- Other income: $100M – $200M.

- Interest and other expense: ~$1.0.

- Non-controlling interest share of earnings: 10%.

If the company generates 13%+ ROEs to common shareholders equity over the next 12 – 18 months, the market should start to take notice. Considering where peers are trading relative to Fairfax, the multiple should re-rate higher to the 1.2x – 1.5x P/B range. Even that would still be cheaper than peers.

In the event the market remains sullen on Fairfax, we are fine to keep owning. Management has clearly shown shareholder friendly capital allocation in buying back shares. Over the last 5 years management has bought back nearly 20% of shares outstanding.

Risks

Insurance – The big risks we see in insurance are catastrophes and the market for insurance pricing softening too soon. Pricing is the cyclical nature of the industry. Pricing will soften at some point. In terms of catastrophe risk, Fairfax has a globally diversified business but will still take losses from a single large event or a higher frequency of events. It appears weather events are increasing in frequency and severity due to changing climate (at least that sounds like one of the reasons for price increases). Who knows. We can’t predict the weather.

Fixed income – If rates decline sharply (say due to a recession), it will crimp future income but generate gains on the bonds which can probably be reinvested in cheaper assets elsewhere.

Partially owned businesses – There are a variety of risks given the different positions, but the current portfolio is dominated by four companies (Poseidon, Eurobank, Digit and BIAL). Each has its own circumstances (discussed a little in this article). The other big risk is more ‘decade-rs’. Investments that generate losses or poor returns and take a long time to do so. Given the Fairfax playbook and historical activity, investors are virtually certain to see more of these. Don’t be overly despondent when you do. Tigers are not known for changing their stripes, even if we’d like to hope old dogs can learn new tricks.

Debt – We’d like to see less debt or more cash on the balance sheet (as is our way) but we understand why it isn’t and it is one of those rare moments when we aren’t going to raise our hand. Management is taking advantage of clear opportunities – Pacific West deal, Gulf Insurance, share buybacks, substantially higher interest rates, great insurance markets. This plethora of opportunity all puts demand on capital. Management has options to raise capital like selling minority stakes in existing holdings as they’ve done in the past with OMERS and CPPIB (large Canadian pension funds). It would be ideal to fund everything internally but, as Warren Buffett has said, “Big opportunities come infrequently. When it’s raining gold, reach for a bucket, not a thimble.” We’d rather have a portion of a bucket, than all our own thimble. Still, leverage always bears watching.

Conclusion

We’ve tried to make the case that Fairfax represents a strong opportunity for investors and lay out the key factors. Fairfax has a globally diversified insurance business, a significant fixed income portfolio and about 7 or 8 really important non-insurance businesses in which it owns a big stake. The remainder is largely a wide portfolio of other equity holdings and some debt.

We think the fact that the market has its mind fixed on historical issues vs the actual growth of the business is the reason this opportunity exists. If investors weren’t sour on Fairfax, it would probably be trading 50% higher today.

Since it isn’t, we see the potential to double or triple your money in Fairfax over the next 5 years.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply