In the world of investing, big moves by renowned investors are worth watching. Michael Burry, known for “The Big Short,” purchased 100,000 shares of Expedia Group (NASDAQ:EXPE), shining the spotlight on this travel stock and prompting a deeper exploration. With a current market cap of $14.5 billion and ownership of more than 20 travel brands, Expedia stands as a global connector of travelers. While many travel stocks have been on fire recently, Expedia stock has languished in comparison. We agree with Michael Burry that the current valuation offers a good opportunity for medium-term investors.

Financial Health and Performance

Currently, Expedia boasts a robust financial position, with $6.3 billion in cash and investments, $6.6 billion in long-term debt, and $1.5 billion of minority interest, leading to an enterprise value of $15.5 billion. The company’s gross margins are excellent at 86%, highlighting its asset-light business model.

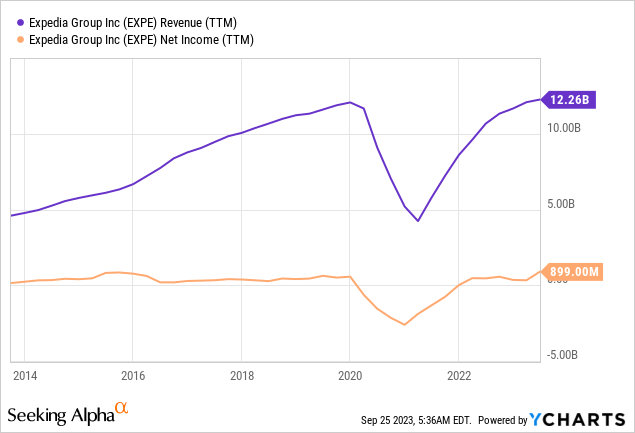

Over the last 12 months, Expedia has generated $12.3 billion in revenue, $900 million in net income, and $2.3 billion in free cash flow. This performance positions the company at 1.3 times revenue, 16 times earnings, and just 6.7 times free cash flow. That’s a good valuation for what has been a pretty consistent business over the years.

Pandemic Impact and Recovery

Like many businesses, Expedia was not immune to the impacts of the pandemic. However, the company has showcased resilience, with both revenue and earnings fully recovering and hitting new highs. Despite this, the stock price has yet to mirror the financial rebound, remaining approximately 15% lower compared to five years ago.

The dip in stock price is partially attributed to the increased debt undertaken by Expedia during the pandemic. Much of this has been utilized to acquire various brands such as Vrbo, Trivago, and Hotels.com. Those acquisitions strike me as reasonably solid even if the timing may not have been ideal. Furthermore, the subsequent paydown of part of this debt, facilitated by healthy free cash flow, has put the company on a more stable footing, setting the stage for future growth.

Brand Portfolio and Global Presence

Expedia’s diverse portfolio now encompasses more than 20 brands and 200 websites, establishing a global network in 70 countries. The company collaborates with over 600,000 hotels, airlines, and other travel providers, offering comprehensive travel arrangements and advertising solutions. Expedia’s websites are far from simple but they remain easy to use and have a good reputation among customers.

Skift

Revenue Streams and Growth

Revenue generation for Expedia is segmented into Retail ($8.9 billion), B2B ($3 billion), and Trivago ($350 million), representing 73%, 24%, and 3% of Last Twelve Months (LTM) revenue, respectively.

Examining Expedia’s revenue streams reveals modest growth, with a 22% increase from $10 billion in FY 2017 to $12 billion in LTM ending June 30th, 2023. A closer look at revenue segregation uncovers:

– Lodging business showcasing a 40% growth.- Merchant and Agency Air experiencing a 47% decrease.- Advertising and media business seeing a 28% reduction.- Other revenue streams, including car rental and insurance, growing by 7%.

Despite varying growth rates across segments, Expedia’s high gross margin of 86%, up from 82% in 2017, sufficiently covers all operating expenses, leading to an operating margin of 10%.

Operating Expenses and Shareholder Value

Expedia’s largest operating expense emanates from Selling & Marketing, accounting for $6.5 billion or 53% of revenue. This expenditure is integral for Expedia to remain competitive, as reaching and pitching to travelers is crucial in the crowded travel industry.

Expedia’s commitment to shareholder value is evident through its share buybacks and dividends. The company generates over $2 billion in free cash flow, a portion of which is returned to shareholders. Although dividends were halted during the pandemic, they are expected to resume as early as 2024, once the company’s debt position improves.

Investment Risks

The travel industry is fiercely competitive, with Expedia facing rivals like Booking.com, Airbnb, hotel chains, airlines, and even tech giant Google. The high competition necessitates substantial spending on sales and marketing, amounting to roughly 53% of Expedia’s total revenue.

Additionally, the advent of AI poses a potential disruption risk to various travel services and agencies. Numerous startups have popped up promising easy AI-driven itineraries and travel plans. These developments are a threat but could also be regarded as gimmicky. Expedia’s management has successfully navigated challenges in the past, projecting confidence in continued growth.

Another key risk is the economy. While many consumer stocks this year have been hurt by higher inflation, travel has been largely immune due to lingering effects from the pandemic. While travel has good long-term prospects, at some point, the current enthusiasm will wear off.

The most likely catalyst for this is already happening: higher prices. Travel companies across the board have ramped up prices this year so much that it is putting some people off. The higher price of oil and potential for a recession moving into next year means that these higher costs are not going to be easily reversed. As a result, investors should be prepared for some volatility, particularly if the economy worsens from here.

Investment Perspective

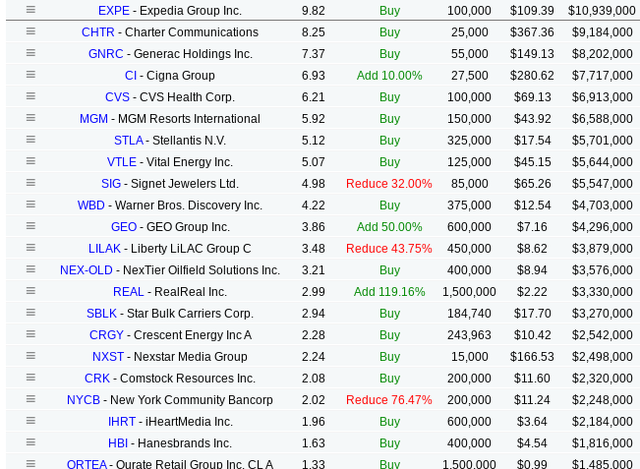

Prominent investor Michael Burry’s acquisition of Expedia shares at $109, totaling $10 million, underscores the potential he sees in the company. According to recent filings, Expedia is now Mr. Burry’s largest equity position. In our view, Burry’s trade is predicated on three things. Tailwinds in global travel, the reasonable valuation of the stock, and Expedia’s reliable history of earnings.

Dataroma

Looking ahead, if you project revenue growth of 10% per year and a similar net income margin of 7%, that would potentially result in earnings of $1.2 billion in three years. That roughly translates to an investment return of 14% a year at a 20 times exit multiple. That seems like a conservative estimate. It wouldn’t necessarily be a surprise for Expedia to outperform those expectations for two reasons.

First, Expedia’s revenue growth rate over the last 10 years is already above this marker at 10.8%. And its net income growth rate over the same period is 19.98%. Most importantly, these growth rates include the pandemic which obviously caused huge volatility to Expedia’s earnings.

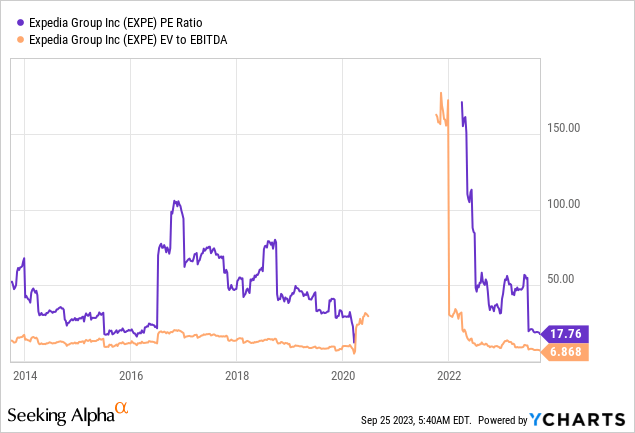

Second, Expedia appears undervalued by almost all historical averages. As shown by the chart below, Expedia’s current P/E sits well below its historical average and its EV/EBITDA is essentially at an all-time low:

Conclusion

Expedia’s performance over the years has been consistent and in line with shareholders’ interests. That speaks to the management team which has made a number of good moves to keep Expedia in the running. It also speaks to the inherent positive characteristics of the business model. Expedia’s strong performance and strategic positioning in the travel industry present a compelling investment case.

Read the full article here

Leave a Reply