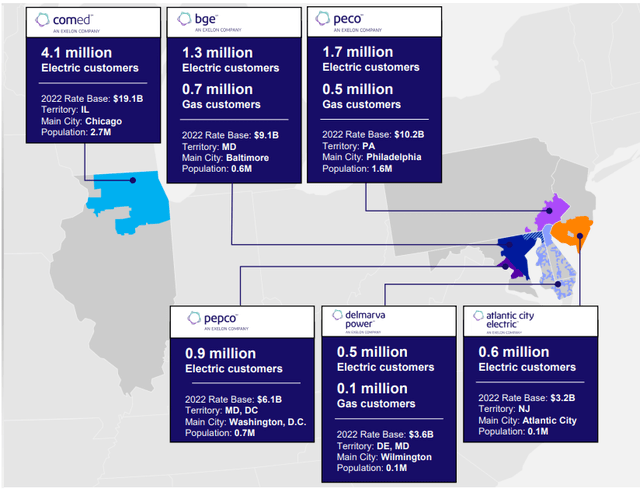

Exelon Corporation (NASDAQ:EXC) is a large regulated electric and natural gas utility that serves the cities of Chicago, IL, and Philadelphia, PA, as well as the surrounding regions. These are two of the largest cities in the United States, which means that Exelon Corporation has an enormous customer base. We can certainly see this here:

Exelon Corporation

This makes Exelon one of the biggest utility companies in the nation, despite the fact that its service territory is not nearly as large geographically as some of the other companies that we have discussed over the past year or two. Exelon’s size does not really affect its characteristics though, as the company is a very stable entity that should be relatively immune to any economic fluctuations or shocks. That could be important considering that we are seeing a number of signs that America’s consumer-driven economy is beginning to collapse.

As regular readers may recall, we last discussed Exelon Corporation in the middle of June of this year. The company’s stock has unfortunately delivered a poor performance since then, as the share price is down 3.96% compared to a 0.61% decline in the S&P 500 Index (SP500) over the same period:

Seeking Alpha

With that said, though, pretty much the entire utility sector has delivered a very poor performance over the period. The iShares U.S. Utilities ETF (IDU) is down 8.11% since the date that my prior article was published, so Exelon has overall beaten the American utility sector as a whole. This is something that could make potential investors optimistic, although the company’s share price could decline further if the current conditions in the market change and interest rates go up once again. Exelon does have a reasonably attractive valuation and a 3.64% yield at the current price, though, so anyone who buys today should be getting a decent deal no matter which way the market goes.

About Exelon Corporation

As stated in the introduction, Exelon Corporation is one of the largest utilities in the United States, as it serves the cities of Chicago, Illinois and Philadelphia, PA. These are two of the largest cities in the nation, especially when combined with their surrounding suburbs. Exelon Corporation serves the suburbs of each of these cities as well, which gives it a total customer base of approximately 10.6 million.

However, as I have pointed out in various previous articles, the fact that Exelon Corporation is one of the largest utilities in the nation has little bearing on its characteristics or ability to be a good investment. After all, as investors, we tend to look at everything on a per-share basis. That is, unless you are wealthy enough to purchase an entire $39.56 billion market capitalization company all by yourself.

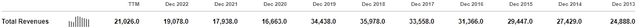

All kidding aside, one of the most important characteristics that Exelon Corporation enjoys is that its revenues and cash flows tend to be very stable and unaffected by most economic events. We can see this by looking at the company’s revenues over time. Here they are over the past ten years, including the most recent trailing twelve-month period:

Seeking Alpha

We do see a substantial decline in the company’s revenues back in 2020, but other than that they showed general growth over the 2013 to 2019 period as well as the 2020 to present period. The reason for the substantial drop in revenues was because of Constellation Energy (CEG) being spun-off of Exelon during the 2021 to 2022 period, and not due to any problems that the company has been having since 2020. The timing of this was admittedly not too good, though, since it gives the impression that Exelon Corporation was affected by the pandemic-driven lockdowns to a greater extent than it actually was. There were a number of news headlines and reports that came out in late 2020 and early 2021 that stated how an enormous number of families nationwide had fallen behind on their utility bills due to being out of work during the pandemic-related lockdowns, but most of these bills were ultimately paid and overall utilities like Exelon were much less impacted by the financial shock than companies in many other industries.

This will normally be the case for Exelon. The company will, as a general rule, not be affected by economic downturns to nearly the same extent as companies in most other industries. I explained the reason for this in my previous article on this company:

The reason for this overall stability is that Exelon Corporation provides a service that is typically considered to be a necessity for our modern way of life. After all, how many people do not have electric service going to their homes and businesses? As such, most people will prioritize paying their utility bills ahead of making discretionary expenditures during periods in which money gets tight.

As such, Exelon’s customers are likely to prioritize making their payments to the company as opposed to doing things such as going out to eat, going on a vacation, or buying some new tech gadget. After all, what good is owning the newest Apple (AAPL) iPhone or Samsung (OTCPK:SSNLF) Galaxy when there is no electricity in your home to charge it? As Exelon Corporation’s revenues come from people and businesses paying their monthly utility bills, this results in the company weathering difficult economic conditions with ease.

This general stability extends to the company’s cash flows as well. Here are the company’s operating cash flows for each of the periods mentioned above:

Seeking Alpha

We can see the same general pattern that we saw earlier with revenues. This is a positive sign as it does partly show us that the company’s expenses are not growing more rapidly than its revenues. In some ways though, this is more important because operating cash flows ultimately is what Exelon uses to pay its dividends. We discussed this in the previous article on this company and will likewise discuss it in this one.

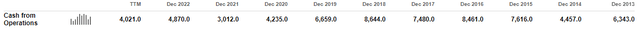

The point though is that Exelon Corporation is generally unaffected by any changes in economic conditions, whether for better or for worse. This could be critical right now as it is uncertain what is going to happen to the economy over the next six months. Many economists are predicting a recession, and indeed most economic indicators have been pointing that way for the past year or so. However, thus far most reports say that the gross domestic product continues to climb:

Trading Economics

It is certainly possible that this is misleading, as government spending is a major component of gross domestic product so rising government spending could be offsetting weakness in the private sector. In addition, inflation in food and fuel could be pushing up the gross domestic product even though the actual productive output of the economy is declining. Nevertheless, the definition of a recession is that gross domestic product declines for two consecutive quarters and we have not seen that happen yet. Indeed, the growth number for the most recent quarter could suggest that a recession has become unlikely in the near future. The market itself seems to be predicting a recession however, as it has been pushing up the prices of both stocks and bonds over the past two weeks and the only reason that it would do that is if investors expect that the Federal Reserve will cut rates. That will require a very severe recession.

Thus, the economic outlook appears to be a bit uncertain right now, although the private sector is expressing a great deal of concern about the strength of American consumers. One thing that we can count on though is that Exelon’s customers will continue to pay their electric and natural gas bills as they will want to maintain service in their homes. This is something that owners of this company can take comfort in and in that respect, it can certainly help you sleep at night no matter what happens over the next six to eight months.

Growth Prospects

Naturally, as investors, we are unlikely to be satisfied with mere stability. After all, if all Exelon could give us was mere stability, then its 3.64% current yield would be incredibly unattractive in today’s environment. We want to see the company grow and prosper with the passage of time. Fortunately, Exelon is well-positioned to accomplish this growth.

The primary way in which the company will deliver earnings growth is by expanding its rate base. I explained the concept of rate base in my previous article on this company:

The rate base is the value of the company’s assets upon which regulators allow it to earn a specified rate of return. As this rate of return is a percentage, any increase to the rate base allows the company to increase the prices that it charges its customers in order to earn the regulatory-allowed rate of return. The normal way to increase the rate base is by investing capital into upgrading, modernizing, and perhaps even expanding the company’s utility-grade infrastructure.

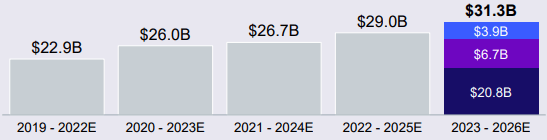

Exelon is currently engaging in a $31.3 billion capital investment program that runs from 2023 until 2026. This is a larger program than the company has employed in the past. In fact, as we can see here, Exelon has a history of generally increasing its capital spending over time:

Exelon Corporation

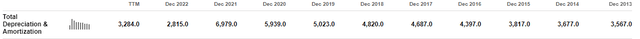

This is unfortunately something that is necessary due to the way depreciation works. In short, depreciation is constantly reducing the value of the company’s assets, so it needs to spend money every year just to keep its rate base stable. If Exelon wants to grow its rate base, then it needs to spend in excess of its depreciation. That actually makes its depreciation expense higher next year, which means that the company has to keep increasing its capital expenditure just to remain stable, let alone grow. We can see this here:

Seeking Alpha

We once again see the drop in depreciation expenses related to the Constellation Energy spinoff, but otherwise, the trend is that its depreciation expenses tend to rise over time.

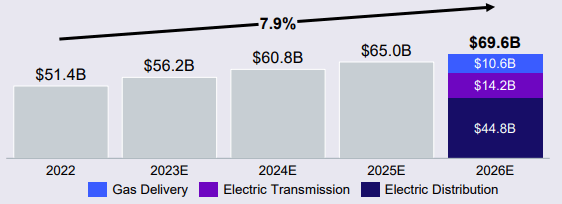

The company’s capital spending plan as presented should allow it to grow its rate base at a 7.9% compound annual growth rate, which is higher than many of its peers are able to deliver.

Exelon Corporation

However, Exelon is only projecting that its operating earnings per share will grow at a 6% to 8% compound annual growth rate over the period. Thus, the rate base will be growing faster than the company’s per-share earnings. This makes sense because the company will need to either borrow money or issue new common shares to fund this capital spending program. Either of these options will create a drag on earnings per share growth.

When combined with the current 3.64% yield though, shareholders in the company should still be able to expect a 10% to 12% total average annual return, which is in line with most of the company’s peers.

Financial Considerations

As I pointed out in my previous article on Exelon Corporation:

It is always important to investigate the way that a company finances its operations prior to investing money in it. This is because debt is a riskier way to finance a company than equity, due to the fact that debt must be repaid at maturity. That is normally accomplished by issuing new debt and using the proceeds to repay the existing debt. As new debt is issued with an interest rate that corresponds to the market interest rate, this process of rolling over debt can cause a company’s interest expenses to increase depending on the conditions in the market.

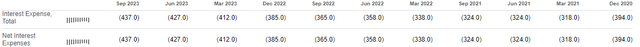

As I have pointed out in a few recent articles on some of Exelon’s peers, interest rates are currently at a higher level than we have seen since early 2001. This has caused many utilities to suffer from rising interest expenses over the past few quarters. We can see that this is the case with Exelon Corporation too:

Seeking Alpha

This acts as a headwind to the company’s financial performance. After all, the more money that it has to pay to service its debt, the less that is available to make its way down to the shareholders. This is disappointing, but it is something that most companies across the industry are experiencing so it is not really the end of the world. We just have to put up with it if we invest in companies that are heavily dependent on debt, such as utilities.

With that said, we still want to ensure that Exelon Corporation is not relying too heavily on debt to finance its operations. One method that we can use to determine this is to compare the company’s net debt-to-equity ratio against that of its peers.

As of September 30, 2023, Exelon Corporation has a net debt of $42.895 billion compared to $25.470 billion of shareholders’ equity. This gives the company a net debt-to-equity ratio of 1.68 today. Here is how that compares to some of Exelon’s peers:

|

Company |

Net Debt-to-Equity Ratio |

|

Exelon Corporation |

1.68 |

|

Entergy Corporation (ETR) |

1.85 |

|

DTE Energy (DTE) |

1.88 |

|

FirstEnergy Corporation (FE) |

2.22 |

|

American Electric Power Company (AEP) |

1.67 |

As we can see, Exelon Corporation’s debt load appears to compare reasonably well to that of its peers. It is in line with American Electric Power and better than all of the other companies that are represented here. As such, we probably do not have to worry too much about the company’s debt load as it does not appear to be overly reliant on debt to finance its operations.

Dividend Analysis

One of the biggest reasons why investors purchase shares of utility companies such as Exelon Corporation is the high dividend yields that they typically possess. Exelon itself certainly qualifies here as the company’s 3.64% yield is substantially above the 1.49% current yield of the S&P 500 Index (SPY). Its yield is also above the 2.89% current yield of the iShares U.S. Utilities ETF. This latter one is surprising since Exelon has outperformed this index fund since we last discussed the company in June.

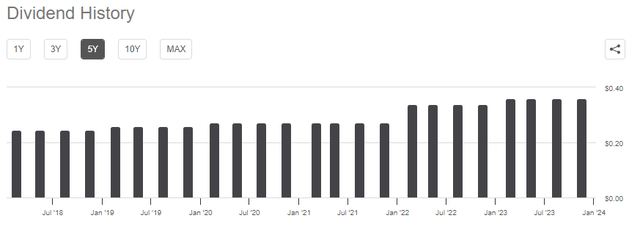

One of Exelon’s most endearing characteristics though is the fact that the company has a history of regularly increasing its dividend over time:

Seeking Alpha

This is particularly nice during today’s inflationary environment because the rising costs of everything that we buy are quickly reducing the number of goods and services that we can purchase with the dividend that the company pays out. This is a particularly big problem for retirees or anyone else who is dependent on the dividends that they receive to cover their bills or finance their lifestyles. The fact that Exelon’s dividend typically increases annually helps to offset this problem and ensures that the dividend retains its purchasing power over time.

As is always the case though, it is critical that we ensure that the company can actually afford the dividend that it pays out. This is because we do not want to be the victims of a dividend cut since that would reduce our incomes and almost certainly cause the share price to decline.

The usual way that we determine a company’s ability to carry its dividend is by looking at its free cash flow. During the twelve-month period that ended on September 30, 2023, Exelon Corporation reported a negative levered free cash flow of $3.6449 billion. That is obviously not enough to cover any dividend, yet Exelon still paid out $1.409 billion to its shareholders over the period. At first glance, this is likely to be concerning as it clearly indicates that Exelon is failing to generate sufficient cash to cover all of its bills and capital expenditures, let alone pay a dividend.

With that said, it is not uncommon for utilities to finance their capital expenditures through the issuance of debt and equity. These companies will then pay their dividends out of operating cash flow. This is due to the incredibly high costs of constructing and maintaining a utility-grade network over a wide geographic area.

During the trailing twelve-month period that ended on September 30, 2023, Exelon Corporation reported an operating cash flow of $4.021 billion. That was clearly sufficient to cover the $1.409 billion that was paid out in dividends while still leaving the company with a substantial amount of money left over for other purposes. Thus, it does appear that the dividend is reasonably safe right now and Exelon is on track to increase it early next year.

Valuation

According to Zacks Investment Research, Exelon Corporation will grow its earnings per share at a 6.30% rate over the next three to five years. That is in line with the earnings per share growth that the company should be able to deliver based on its rate base growth, so it certainly seems like a reasonable projection. This gives the company a price-to-earnings growth ratio of 2.67 at the current share price.

Here is how Exelon Corporation’s current valuation compares to its peers:

|

Company |

PEG Ratio |

|

Exelon Corporation |

2.67 |

|

Entergy Corporation |

2.48 |

|

DTE Energy |

2.71 |

|

FirstEnergy Corporation |

N/A |

|

American Electric Power Company |

3.07 |

As we can see here, Exelon appears to represent the median of its peers in terms of valuation. This company is certainly not the cheapest that is represented here, but it is certainly not the most expensive either. However, the only company that has a lower valuation also has a higher amount of leverage, so there appears to be a risk-reward trade-off here. Exelon Corporation does appear to represent a reasonable balance between the two, all things considered.

Conclusion

In conclusion, Exelon Corporation appears to offer a lot to investors in the current climate. The firm enjoys remarkably stable cash flows over time that should be relatively resistant to anything that happens in the macroeconomic environment. This is a very positive thing right now as there is a great deal of uncertainty about what may come in the near future. Exelon Corporation appears to have a manageable level of debt relative to its peers and a respectable valuation. The total return is also reasonable, although it is certainly not the best in the sector. Overall though, Exelon Corporation might be worth considering right now.

Read the full article here

Leave a Reply