The iShares MSCI United Kingdom ETF (NYSEARCA:NYSEARCA:EWU) is once again trading at an extreme discount relative to its peers. Even taking into account the long-term trend of weak growth, the EWU still seems attractive on a relative basis. As I argued in a previous article in May, I have reduced my holdings of UK stocks in favor of bonds following the spike in yields. However, for equity investors, the EWU looks likely to outperform over the coming years as the valuation discount and significantly higher dividend yield relative to its peer is likely to more than offset slower earnings growth. While the pound is overvalued and due for another decline, the majority of earnings come from overseas.

The EWU ETF

The EWU tracks the performance of the MSCI U.K. Index and covers approximately the top 85% of investable universe in the UK, with an expense ratio of 0.5%. The ETF sector weightings have more in common with emerging market benchmarks, with higher exposure to commodities and financials. Energy and Materials have a 14% and 9% weighting respectively, while financials also make up a hefty 18% of the index. Meanwhile, Technology stocks represent just 1% of the index which compares to 22% for the MSCI World and 8% for the MSCI World Excluding the US. The EWU’s current distribution yield is 3.2%.

Half Price Relative To The MSCI World

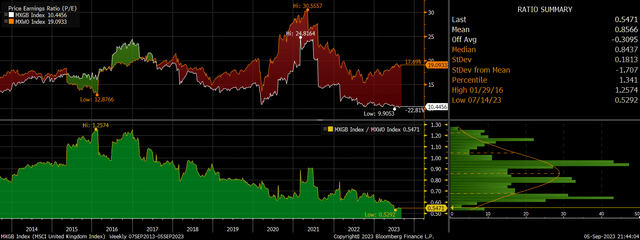

The MSCI UK now trades at a trailing PE ratio of just over 10x, which is a record 45% below that of the MSCI World. On an EV/EBITDA basis, the UK’s discount is even larger, with the 5.6x figure less than half of the MSCI World’s 12.2x.

PE Ratios For MSCI UK and MSCI World (Bloomberg)

In part this PE ratio discount reflects near record profit margins, which are now at 11% compared to its 20-year average of 8%. However, even on a price-to-sales basis UK stocks are cheap, with the ratio relative to the MSCI World now in the bottom 8th percentile of readings going back 30 years.

The EWU is even trading at extreme undervalued levels relative to EM stocks, with the MSCI UK’s PE ratio now almost 30% below that of the MSCI Emerging Markets index, marking its largest discount in over a decade. The MSCI UK’s EV/EBITDA ratio, meanwhile, is a record 37% below the EM benchmark.

PE Ratios For MSCI UK and MSCI EM (Bloomberg)

Valuation Discount Not Justified Despite Weak Country Fundamentals

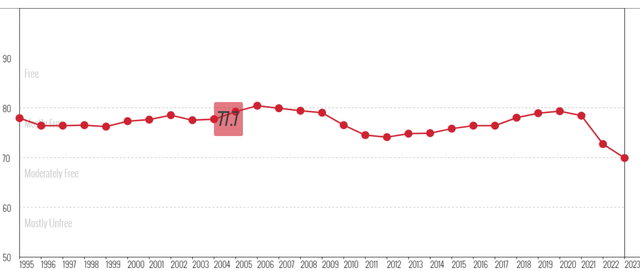

I believe that a certain discount should be applied to UK stocks, in part due to the high weighting of financials and almost non-existent weighting of technology stocks. The UK’s poor external and fiscal position, as well as the accelerating decline in economic freedom also suggest weak long-term growth prospects.

Index Of Economic Freedom (Heritage Foundation)

However, a near 50% discount to its peers seems far too high, particularly as the majority of EWU sales come from overseas therefore insulating companies from domestic economic weakness. The MSCI UK’s dividend yield of 4.2% is now 2.8pp above that of the MSCI World meaning that UK dividend growth would have to underperform by 2.8pp in perpetuity in order to justify its undervaluation. This would mark an acceleration of the underperformance seen over the past two decades. I also think the discount applied to global energy stocks, which have a high weighting in the UK, is unjustified, and rising valuations should help narrow the UK’s discount over time.

Pound Weakness Would Have Limited Impact On Relative Performance

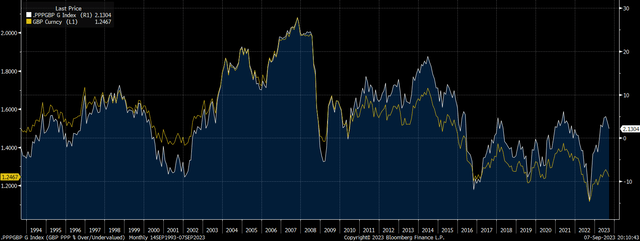

The pound has retreated from its July peak after its real exchange rate against the dollar (which takes into account relative inflation rates) reached its highest level since before Brexit. The currency is now overvalued in purchasing power parity terms as the chart below shows, and the long term bearish trend looks likely to resume along with the economy’s decline.

GBPUSD and GBPUSD Real Exchange Rate (Bloomberg, JPMorgan)

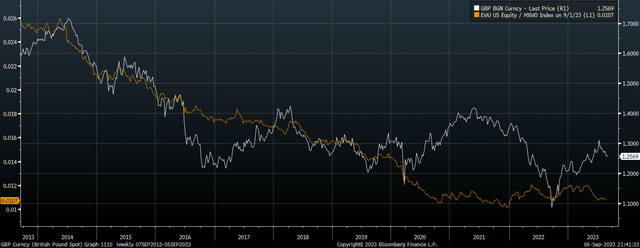

As a dollar based ETF the EWU is theoretically at risk from any sharp drop in the pound. However, over the past few years there has been almost no correlation between the pound and the EWU’s performance relative to the MSCI World. As around two thirds of the MSCI UK’s revenues are derived from overseas, a weaker currency helps increase sales in local currency terms, offsetting the direct impact of the falling pound.

GBP and Ratio Of EWU Over MSCI World (Bloomberg)

Read the full article here

Leave a Reply