I’m generally a fan of investing outside the U.S. Aside from broader diversification, international investing can also bring with it outsized returns in the right environment. We all know U.S. equities have been on fire for some time, which makes them vulnerable to weakness should any kind of global mean reversion take place. One region of the world that, I think, is worth considering is Taiwan (this despite concerns over China). If you agree, the iShares MSCI Taiwan ETF (NYSEARCA:EWT) is worth considering.

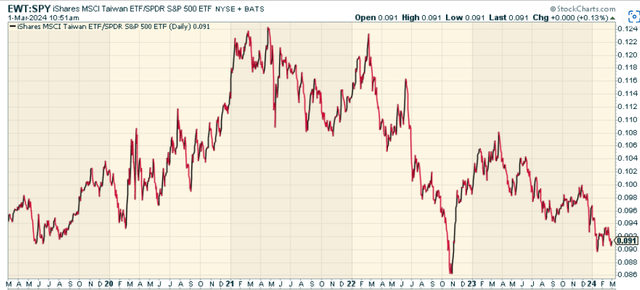

EWT is an exchange-traded fund, or ETF, that tracks the investment results of the MSCI Taiwan 25/50 Index. This index consists of stocks traded primarily on the Taiwan Stock Exchange. When we look at the price ratio of EWT to the SPDR® S&P 500 ETF Trust (SPY), it’s gone roundtrip after having outperformed all the way up until 2022. The trend is still down, but could soon stabilize and reverse.

StockCharts.com

Top Holdings of EWT

The top 10 holdings of EWT make up over 42% of the fund. The vast majority of positions are under a 2% weight. Companies include:

- Taiwan Semiconductor Manufacturing Company Limited (TSM): TSMC, as it is commonly called, is the world’s largest dedicated independent (pure-play) semiconductor foundry, headquartered in Taiwan.

- MediaTek Incorporated (TWSE:2454): MediaTek is a global fabless semiconductor company that enables nearly 2 billion connected devices a year.

- Hon Hai Precision Industry Co., Ltd. (OTCPK:HNHAF): Known as Foxconn, Hon Hai is a major electronics manufacturer.

- United Microelectronics Corporation (UMC): UMC is a global semiconductor foundry that provides advanced technology and manufacturing services for applications.

- China Steel Corp. (OTC:CISEF): As the name suggests, China Steel Corp is a prominent player in the steel industry,

On the surface, this looks pretty diversified, but keep in mind that TSMC makes up over 22% of the fund. This hasn’t been a bad thing necessarily, as Taiwan Semiconductor has been on fire in 2024, clearly benefiting from AI mania and Nvidia’s success. Still, it’s worth considering if you want a fund with such high exposure to a single stock like this.

StockCharts.com

Sector Composition and Weightings

The sector composition and weightings of EWT are diverse. The top three sectors include:

- Information Technology: This sector is heavily weighted in EWT with a significant portion of the fund invested in tech companies like TSMC and MediaTek. It makes up 64% of the fund.

- Financials: The financial sector also forms a noteworthy part of EWT’s portfolio at 17.34%

- Materials: The materials sector, including companies like China Steel Corp, also forms a decent part of EWT’s holdings at 4.91%

Comparison with Peer ETFs

The only other real comp to EWT is the Franklin FTSE Taiwan ETF (FLTW). The holdings look substantially similar (Taiwan Semi top in both with it having a 24% position in FLTW). EWT’s fee is 0.59% while FLTW is quite a bit lower at 0.19%. FLTW has outperformed by about 800 basis points since 2021, mainly due to index composition differences as it tracks the FTSE Taiwan Capped Index. Overall, they both provide good exposure. Performance is better on FLTW yes, and lower fees, but EWT certainly trades with more volume, which might be of importance to some investors.

Pros and Cons of Investing in EWT

Investing in EWT comes with its unique set of pros and cons.

Pros:

- Exposure to Taiwan’s Economy: Taiwan’s bustling economy and its prominence in the tech sector make EWT an attractive choice for investors seeking international diversification.

- Diversification: EWT offers a diversified exposure to Taiwan’s markets, spanning across different sectors.

Cons:

- Currency Risk: As the fund invests in foreign stocks, it is exposed to currency risk. Any significant fluctuation in the Taiwan dollar can impact the fund’s returns.

- Geopolitical Risk: Taiwan’s geopolitical tensions with China can impact the fund’s performance.

Conclusion

Investing in iShares MSCI Taiwan ETF can be a strategic move for investors looking for international diversification, particularly with a focus on Taiwan’s economy. However, it is crucial to consider the associated risks for iShares MSCI Taiwan ETF, including currency and geopolitical risks. The fund’s heavy reliance on the tech sector can also be a potential risk factor. And if China were to invade, all bets are off. Still, I think EWT is a good fund to consider.

Markets aren’t as efficient as conventional wisdom would have you believe. Gaps often appear between market signals and investor reactions that help give an indication of whether we are in a “risk-on” or “risk-off” environment.

The Lead-Lag Report can give you an edge in reading the market so you can make asset allocation decisions based on award winning research. I’ll give you the signals–it’s up to you to decide whether to go on offense (i.e., add exposure to risky assets such as stocks when risk is “on”) or play defense (i.e., lean toward more conservative assets such as bonds/cash when risk is “off”).

Read the full article here

Leave a Reply