By Maurice van Sante, Senior Economist Construction & Team Lead Sectors

High interest rates and soaring building costs have drastically reduced the demand for new buildings in Europe. So far, ongoing projects and a heightened focus on sustainability have prevented construction volumes from shrinking, but we’re expecting to see a steep decline begin to emerge in 2024.

Zero growth in 2023

We’re expecting zero growth for EU construction volumes this year, an upgrade of our previous forecast which is mainly due to a better-than-expected first half of the year.

Construction volumes still remain high. In June, EU construction production was at the same level as in the same period last year. Firms still have a healthy backlog of work, with 8.9 months of guaranteed projects at the beginning of the third quarter of this year.

However, there are clear signs that volumes will start to shrink soon as the late cyclical nature of the sector begins taking effect. Home buyers and firms are reluctant to invest in new premises due to the weaker economy, high interest rates and increased building costs. Due to long lead times, it’s likely to take a while before these effects are reflected in construction output volumes.

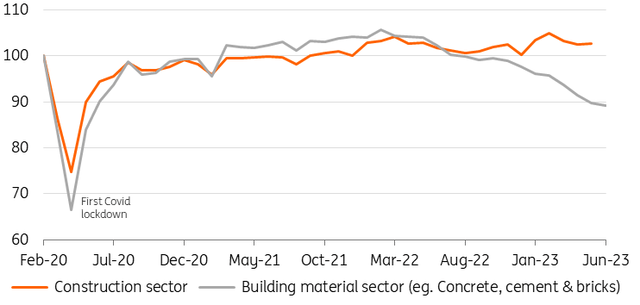

Construction volume still stable but fall in building material production

Development EU Construction sector volume (Index February 2020=100, SA)

Eurostat, ING Research

Looming slowdown on the cards for 2024

Manufacturers of cement, bricks and concrete – those right at the beginning of the value chain – are already facing sharp production declines. Building material suppliers of these materials are registering an average fall in production of 13% in June compared to the same period last year. The highest declines are faced in Austria (-15.0%), Germany (-15.6%), and The Netherlands (-19.5%).

A decline in building permits, confidence and demand are also indicators for lower volumes in the construction sector in the second half of 2023 and into 2024. However, we only expect a modest decline for the EU construction of -1% in 2024.

Renovation market counterbalances decline in new building sector

The construction sector will not see as much of a decline in production volumes as the building materials sector. Building material suppliers mainly deliver to new building projects, which are more susceptible to economic development than the renovation sector. The demand for renovation and maintenance – more than 50% of total construction production – is less affected by economic cycles.

Interestingly, the demand for R&M may even increase during an economic crisis. For instance, homeowners who are unable to sell their houses often opt to enhance their existing living spaces in order to meet their changing housing needs.

As a result, this can lead to an increase or at least sustainment of demand for R&M. In addition, the R&M market will likely show future growth driven by sustainable and energy-related factors.

Many governments support sustainability measures, and high energy prices act as an extra trigger. Since energy prices have started to moderate this year, interest in energy-saving measures has slowed but still remains at a high level.

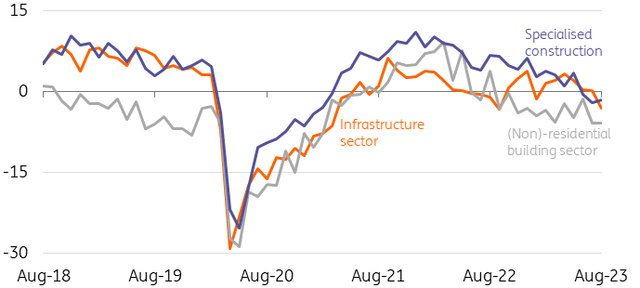

The confidence of the different subsectors is slowly decreasing

Another sign that the decline in the construction sector will be a small one is the slowly abating confidence indicators in different subsectors. Specialised construction companies have been optimistic for a long time, but in June, indicators were marginally negative for the first time in more than two years.

This subsector consists of many construction branches that are active in R&M, such as installation, plasterers, carpenters, painters and glaziers. The confidence of companies in the non-residential building sector as a whole has been in negative territory for almost a year.

Lastly, confidence in the infrastructure sector has remained positive for quite a while and only initially touched negative territory in August. Many infrastructure projects are driven by public investments, the availability of EU funds, the need for upgrading existing roads and required environmental investments such as the extension of electrical grids.

Confidence indicators subsectors are slowly moving into negative territory

Development EU confidence indicator

European Commission, ING Research

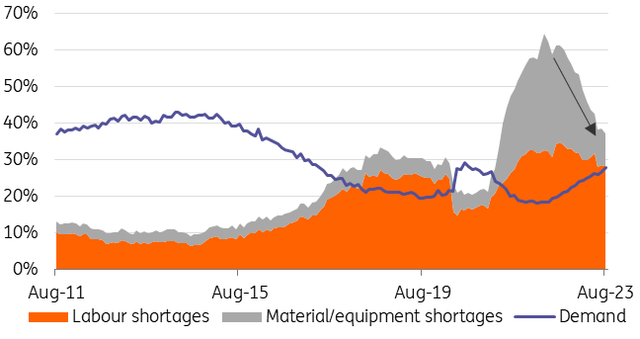

Demand shortages are replacing supply shortages

In August 2023, 9% of all EU contractors indicated lower production due to delayed delivery or lack of building materials. Shortages are now abating due to the easing of supply chain problems in the economy and are almost at the average of the last 10 years.

Another factor limiting production, but with a more structural nature, is the availability of sufficient labour. In a recent European Commission survey, almost 30% of EU contractors cited this as problematic – particularly those in Austria, France and Germany.

While material shortages are easing, a lack of demand is increasingly becoming a new limiting factor for many contractors. 28% of EU building companies are facing a lack of demand as the most significant factor in production limitation, the share of which has been rising over the last year. Belgian and Dutch contractors are experiencing the lowest demand restraints.

Demand restraints are increasing while limiting supply factors level off

% EU construction firms that have to limit the production because of (labour and material shortages cumulative)

European Commission, ING Research

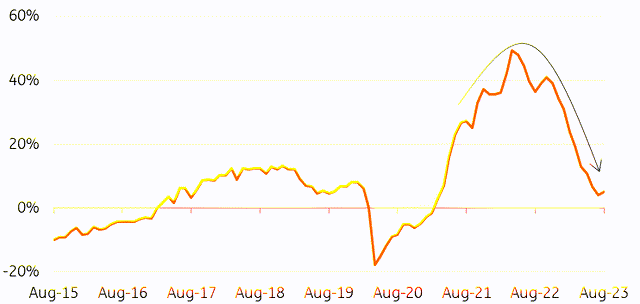

High price increases are over

Fewer contractors are increasing their sales prices due to the lower costs of some building materials. The reasons for these lower price increases are diminished supply chain disruptions and weakening demand.

Contractors no longer have to pass through higher input prices or encounter a higher level of competition – particularly in Austria and the Netherlands. In August 2022, approximately 65% of companies in these countries responded to surveys that they were scheduling sales price increases.

This figure dropped to just 8% in Austria and 20% in The Netherlands in August this year. In Germany, the majority of building firms now plan on decreasing sales prices.

Number of contractors that want to increase prices is diminishing fast

Balance of construction companies in the EU that expect to increase -/- decrease output prices (over next 3 months)

European Commission, ING Research

Residential building permit issuance plunges

The number of approved permits has decreased over the last two years. In the first quarter of this year, there was a decline of almost 8% in issued permits for residential buildings compared to the same period two years earlier. Higher interest rates and a weaker economy are causing home buyers to take a more hesitant approach to purchasing.

While some building material prices have decreased in recent months, higher building costs still remain. This has made new buildings more expensive and new project developments less profitable.

To make matters worse, existing house prices are decreasing in many countries, making newly built residences relatively even more expensive for buyers. As a result, developers are reluctant to start new projects and we’re therefore seeing a lower number of issued permits.

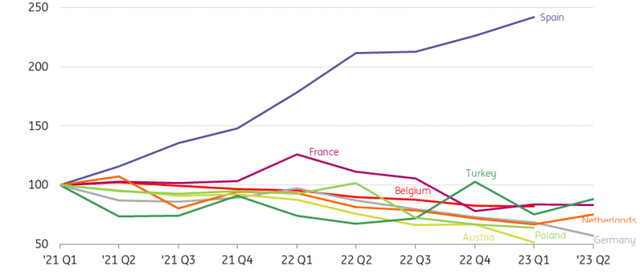

EU permits new homes declining, except for Spain

Building permits, number of new dwellings, (index 2019 Q4 =100, SA)

Eurostat, ING Research (No data available for 2023 Q2 for Belgium, Poland, & Austria)

Highest decrease in Austria

Austria has seen the steepest decline in the number of issued permits for new houses, which has almost halved in the last two years. Alongside higher interest rates and building costs, this is due to the end of housing subsidies for new housing construction. Belgium, Germany, the Netherlands and France all saw a drop in issued permits of between 20% and 50% in the same period.

Enormous permit increase in Spain

Spain is the outlier in this area, with the number of residential building permits skyrocketing over the last couple of years. In the first three months of this year, it was more than 2.5 times higher than two years earlier.

The question is, of course, whether all these projects are going to be accomplished. As the real estate market cools down, the sales of new houses are under pressure as well. However, it remains a positive sign for Spanish construction after years of decline.

A temporary setback but growth ahead

The issuance of permits is a strong indicator for future production, and as the number decreases, we expect declining volumes in the new residential sector this year and next year. However, huge housing shortages in many European cities should ensure sufficient demand in the residential sector in the long run.

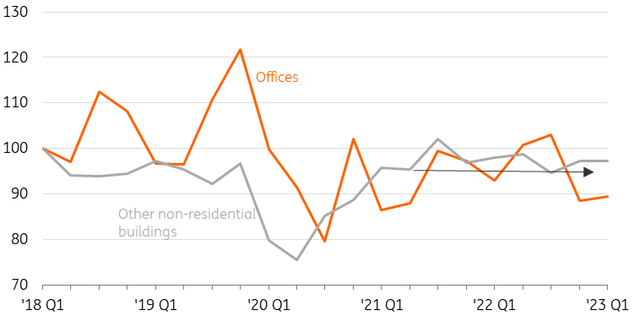

No drop in the non-residential sector

In the non-residential sector (excluding offices) there has been no decline in issued permits. The building permits in square meters even increased slightly in the first quarter of 2023 compared to the same period both one and two years earlier.

This is mainly due to a rise in e-commerce which has increased the demand for new logistics centres and consequently the number of issued permits. Public spending on buildings for education and health also stabilised.

However, the slowdown of economic growth, higher interest rates and both geopolitical and economic uncertainty all contribute to making companies in other sectors more hesitant toward investment in new premises. All in all, the amount of issued permits remains more or less stable.

Remaining uncertainty in the office market

The office building sector is seeing a slight decline in issued permits. Uncertainty still remains over the future of working from home, and that makes current investment in new offices risky. Vacancy rates are also increasing in many European cities.

Office workers favour working from home, but an increasing number of companies are now demanding that employees return to the office for at least a few days out of the week. These requirements are also being seen in the US from companies such as Zoom, Amazon, JPMorgan and Disney.

In the long term, the question now remains to what extent the trend of working from home will be permanent, as well as how much demand there will be for office space.

The increasing trend of hybrid working could result in rising demand for the refurbishment of offices in order to make them suitable for a new way of working, as well as for new office buildings that meet this need.

Stable volume of issued non-residential building permits

New non-residential building permits in m2 (index 2018 Q1 = 100, Seasonally adjusted)

Eurostat, ING Research

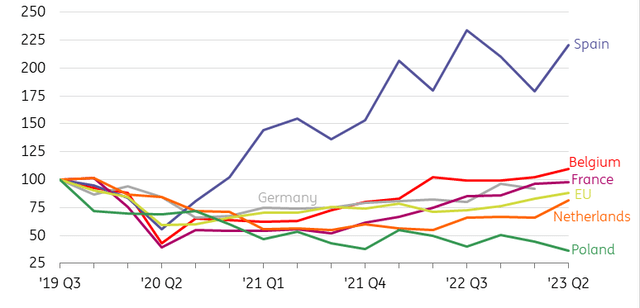

Number of EU contractor bankruptcies picks up speed

The number of insolvencies of contractors is steadily increasing and has almost reached pre-Covid levels in many EU countries. In Belgium, it surpassed this level in the second quarter of 2023. Higher building material costs and declining demand are the leading causes.

Bankruptcies in Spain have followed another path. Throughout the Covid-19 pandemic, more Spanish building companies had to close their doors, likely as a result of the contraction of construction volumes in Spain remaining relatively high from 2020 to 2022.

In September 2022, the new Spanish law on insolvency was finally passed, which also gave creditors more power. Restructuring processes that often got stuck in court in the past can therefore be handled faster and this has resulted in more bankruptcies.

A low number of bankruptcies, except for Spain

Development EU bankruptcies construction sector, (index 2019 Q3 =100, SA)

Eurostat, ING Research (No data available for Austria & Turkey)

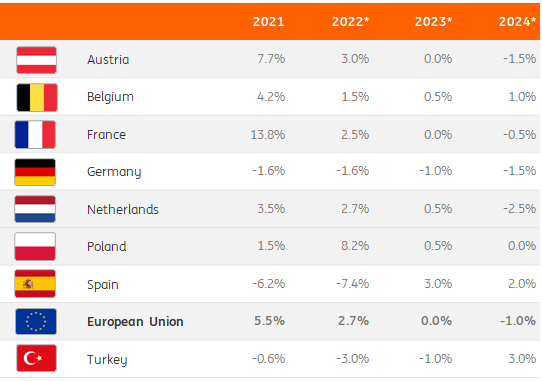

Our view on EU construction markets

Germany: Four years of contracting building volumes

In the first half of this year, German construction activity declined by 1.4% year-on-year after a decline in 2022 of 1.6%. For 2023, we forecast a moderate contraction of the largest construction market in the EU. The building industry continues to suffer under higher interest rates and increased construction costs, which led to three German project developers – Project Immobilien, Development Partner and Euroboden – filing for bankruptcy in August.

Order book assessment of contractors also declined to 3.8 months in the third quarter of 2023 from 4.3 months a year earlier. A sharp decline in building permits for new residential buildings in the first half of this year also signals a further decrease still to come. Along with higher interest rates and construction costs, policy uncertainty regarding sustainability measures in the real estate sector added to the drop in the number of new permits.

Spain: Construction sector at a turning point

By the end of 2022, the production level was almost 25% lower than it was at the end of 2019. Yet, order books are now improving and the EU’s recovery fund investments in the Spanish construction sector should generate a more positive outcome moving forward. The increase in permits will also have a positive effect on building volumes – although the question will remain as to how many approved projects will actually be built as challenging circumstances persist. Nevertheless, we have upgraded our forecast for Spain.

EU construction forecast

Volume output construction sector, % YoY

Eurostat & ING Research *Estimates & Forecasts

The Netherlands: Construction faces sharp decline in 2024

We expect Dutch construction volumes to experience a slight growth of 0.5% this year. A small contraction was previously anticipated, but unexpectedly high growth in the first quarter of this year has led to the possibility of ending 2023 with a small increase.

Signs of cooling are already evident at the beginning of the Dutch construction value chain, with a visible contraction in project development and the production of building materials such as concrete, cement, and bricks. This trend will continue further down the supply chain.

As a result, we expect a contraction of 2.5% in Dutch construction output next year – the largest decline since 2013. This is a relatively large drop compared to other countries. However, the Dutch building sector has performed well in recent years, and production levels should therefore remain at high levels.

Belgium: Low growth for the construction sector in 2023

Belgian construction output rose by 0.3% in the first half of 2023. The Belgian construction confidence index has been hovering around a neutral level for months but reached its lowest point of -5.0 in more than two years in July, despite an increase in building production volumes in 2022.

The issuance of building permits for both residential and non-residential buildings has decreased over the same period, but more moderately than in other countries.

The government’s stimulus plans include funding to improve the energy efficiency of existing buildings and funds to rebuild 38,000 homes damaged by the floods in 2021. Overall, we predict that the Belgian construction sector will still experience a low growth rate of around 0.5% in 2023 and 1% in 2024.

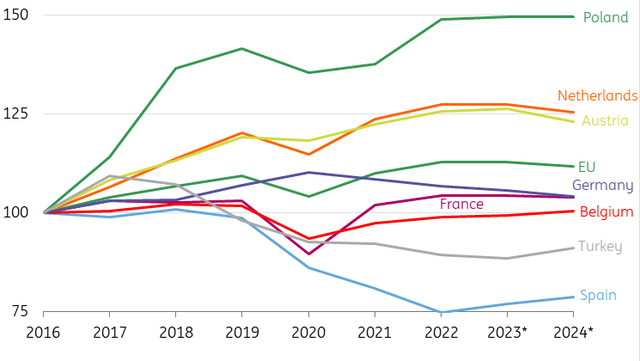

Strong development differences among countries

Development volume construction sector (Index 2016=100)

Eurostat & ING Research *Estimates & Forecasts

Poland: Promising building start in 2023, but contraction ahead

Polish contractors started the first half of 2023 with a growth rate of 1.3% compared to the same period in 2022. Order books are still well filled, with 8.6 months of work and have even increased slightly. The higher volumes are driven by the infrastructure sector, which showed an impressive increase of almost 10% in the first half year.

We expect that the growth rate of the infrastructure sector will decrease as projects under the previous EU financial perspective will end in 2024. The EU Recovery and Resilience Facility has been delayed due to a judiciary dispute, but this should boost the construction industry once implemented.

The building sector is performing less. Building permits for residential buildings decreased by 40% YoY in the first quarter of 2023. Overall, we anticipate that total Polish construction output will still marginally increase by 0.5% in 2023.

France: Zero growth in 2023

After a 2.5% increase in French construction volumes in 2022, growth increased further in the first half of 2023 by 0.5% YoY. However, French contractors are slowly becoming more pessimistic. In August, the French construction confidence index (EC survey) was marginally negative, and order books are slowly becoming less well-filled.

French contractors now have 7.8 months of work on average in their backlogs compared to 8.1 months in the first quarter of last year. The issuing of building permits for new houses is also decreasing, but at a slower pace than in many other countries. Material and labour shortages are less of an issue but are still relatively high.

Government measures such as MaPrimRénov have supported renovation and sustainability activity. For 2023, the budget of this scheme has increased from €2.4 to €2.5 billion but remains lower than the €3.1 billion allocated in 2022. Overall, we expect that the French construction output will stabilise in 2023 and decrease by -0.5% in 2024.

Turkey: uncertainty trumps

In August, the Turkish construction confidence indicator (EC survey) showed a negative reading of -13.0. However, order books recuperated slightly after the lowest level measured since 2011 was recorded in the first quarter of this year. Fewer contractors complain about low demand, and the issuing of building permits is pretty much stable.

The earthquakes at the beginning of this year have caused massive damage to over 300,000 buildings. Our expectation is that reconstruction efforts in the form of higher public investment should generate growth in the construction sector from 2024. This will take place after a further small decline in construction output in 2023, marking six consecutive years of declining building output in Turkey.

Content Disclaimer

This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here

Leave a Reply