Introduction

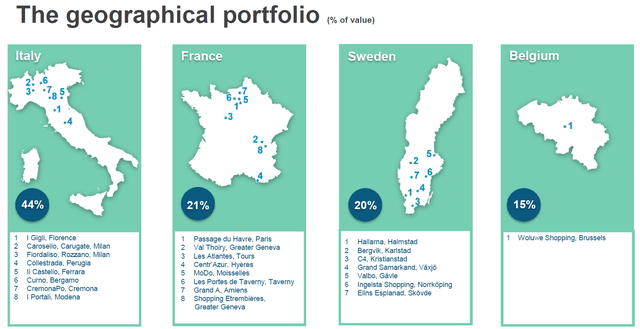

Eurocommercial Properties (OTC:ECMPF) recently released its financial results for the third quarter and as this REIT is a leading commercial REIT in Europe with assets in Italy, France, Sweden and Belgium, it is always interesting to keep an eye on its performance. The REIT has been a loyal dividend payer and I hope the current issues in the REIT sector won’t have too much of an impact on Eurocommercial.

Eurocommercial Investor Relations

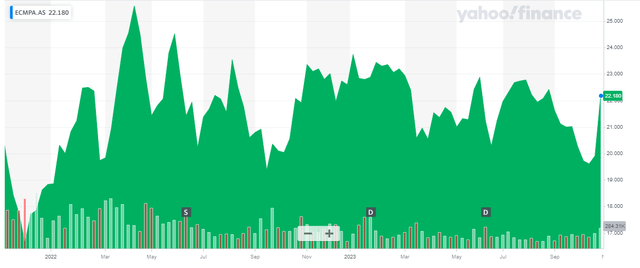

The main listing of Eurocommercial Properties is in Amsterdam where it is trading with ECMPA as its ticker symbol. The average daily volume in Amsterdam is 34,000 shares per day. As there are currently 53.3M shares outstanding, the market cap of Eurocommercial is currently roughly 1.2B EUR. I will use the Euro as base currency throughout this article.

Yahoo Finance

Unfortunately the REIT’s website contains download-only links, but you can find all the relevant information I will be referring to here.

Strong rental growth boosts the results

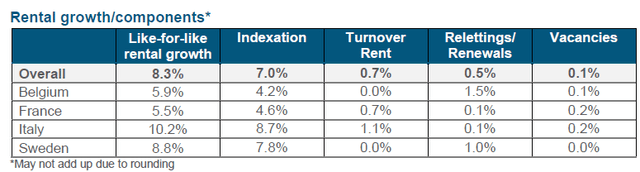

I actually had high hopes for the REIT’s third quarter. Eurocommercial had already posted strong results in the first half of the year and the rental growth numbers just continued to head in the right direction. As you can see below, the like for like rental growth in its asset portfolio was very strong with an average LfL rental growth of 8.3%, mainly thanks to the indexation of existing rental agreements.

Eurocommercial Investor Relations

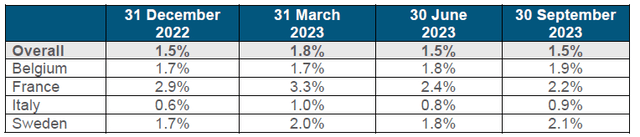

That’s encouraging, especially as the vacancy levels continued to be very low. As you can see below, Eurocommercial’s occupancy ratio is approximately 98.5% with occupancy ranging from 97.9% in Sweden to a very impressive 99.1% in Italy.

Eurocommercial Investor Relations

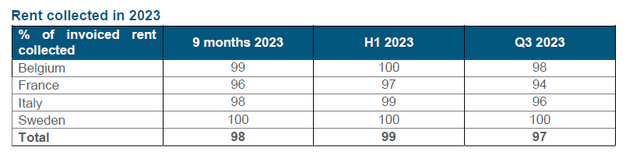

Another important factor is the rent collection level. Although you could argue there was a drop from 99% in H1 2023 to 97% in the third quarter, it is important to realize that even after the corresponding period overdue rents are being paid. That’s also what Eurocommercial is expecting as it mentions the collection rate was 98% in the first nine months of the year and that rate is ‘expected to improve further’. And that’s not necessarily wishful thinking: when Eurocommercial reported its H1 results, its rent collection ratio came in at 98% in the first semester and this has since further increased to 99%.

Eurocommercial Investor Relations

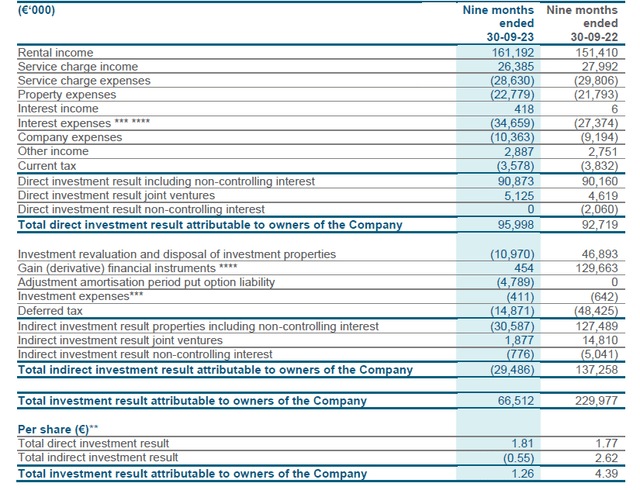

When looking at REITs, the net income isn’t necessarily the best metric to base an investment thesis on. In Western Europe, the ‘direct result per share’ is what really matters. That number, comparable with the FFO result, provides insight into how the REIT is performing excluding certain non-recurring effects like the revaluation of its assets.

As you can see below, the total rental income increased to 161.2M EUR. After deducting the net service expenses and the 22.8M EUR in property expenses, the net rental income in the first nine months of the year was approximately 136.2M EUR. An increase from the 127.8M EUR generated in the first nine months of 2022.

Eurocommercial Investor Relations

Of course some of the other expenses increased as well and the total amount of interest expenses increased by in excess of a quarter to almost 35M EUR. Fortunately, the higher net rental income was sufficient to cover the higher interest expenses and the direct result before taking non-controlling interests into account was 90.9M EUR, almost 1% higher than in the first nine months of the year.

There was some positive news as well as whereas there was a 2.1M EUR tranche of the direct result attributable to non)controlling interests, this was no longer the case in the first nine months of this year and that’s what ultimately helped to increase the direct result from 92.7M EUR to 96M EUR, an increase of just over 3.5%.

As the image above shows, there was a total impact of 29.5M EUR in indirect investment results and this was mainly related to deferred taxes and the lower valuation of some assets. While the total investment result was just 1.26 EUR per share, the direct investment result was 1.81 EUR, which is approximately 2% higher than the 1.77 EUR the REIT generated in the first nine months of last year.

And that is a good result, mainly because it shows Eurocommercial has been able to deal with the higher interest expenses. The total interest expenses during the third quarter were approximately 13M EUR which means the trend is (obviously) still up. And I expect additional pressure on the interest expenses as the current average cost of debt is approximately 3.2%. While the vast majority (81%) has been hedged for the next 4.5 years, the gradual refinancings will obviously weigh on the result and will likely cause the direct result per share to flatline over the next few years. After all, the very strong indexation of the rents this year was a tremendous help but as inflation rates are coming down, we should expect the future indexation level to be a low single digit. This will be sufficient to cover an increase in the cost of debt by 20 bp per year but I think the average cost of debt will increase at a slightly faster pace.

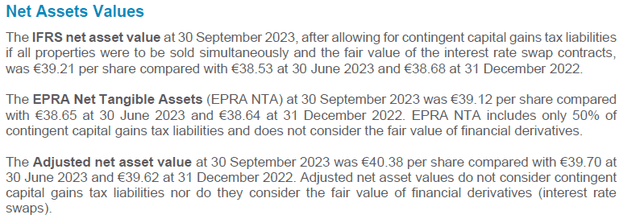

The dividend will likely remain at least stable at 1.60 EUR per share and the REIT has confirmed an interim dividend of 0.64 EUR per share will be payable in January (if this is followed by a 1 EUR final dividend, there will be a small dividend growth compared to last year). Eurocommercial will offer the possibility to take the interim dividend in new shares. Depending on the proposed conversion rate of dividend rights in new shares, that could be a good option. The most recently disclosed Net Tangible Asset calculation showed a fair value of 39.12 EUR per share which means the stock is trading at a 40% discount to the book value.

Eurocommercial Investor Relations

That being said, the NTA/share is based on a rental yield in the mid-5 range. If I would apply a required net rental yield of 6%, the NTA/share would decrease by almost 600M EUR. That would have a negative impact of 11.25 EUR per share which means that even if you would use my more conservative scenario, the NTA/share would still be approximately 28 EUR. And yes, that still is more than 20% above the current share price. In this scenario, the LTV ratio would increase to 53%. Which is indeed high, uncomfortably high, but that LTV ratio should remain pretty comfortably below 60%.

Investment thesis

While it looks like Eurocommercial’s financial results will remain robust (subject to keeping the occupancy rate at a high level), I am not expecting much in terms of earnings growth. While there will be net rental income increases, the increasing interest rates Eurocommercial will have to pay will likely mitigate the entire impact of those rent hikes.

The REIT is now guiding for a full-year direct result of 2.30-2.35 EUR per share which implies a Q4 result of 49-54 cents per share which is another downtick from the 0.59 EUR in Q3. This also means we should likely expect a 2024 result that will be weaker than 2023. While I am now satisfied the existence of Eurocommercial is not threatened, the focus can now move towards keeping the direct result per share as stable as possible. I currently have a small long position in Eurocommercial and would be interested in adding to this position, despite not expecting any substantial growth on a per-share basis.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply