The Eaton Vance Tax-Managed Buy-Write Income Fund (NYSE:ETB) is a closed-end fund aka CEF that can be purchased by investors who are seeking to earn a high level of income from the assets in their portfolios. This fund employs a somewhat different strategy than most income-focused funds, however, as it relies heavily on common equities alongside an option strategy to provide income as opposed to investment in fixed-income securities like most other income-focused funds. The strategy works though, as the Eaton Vance Tax-Managed Buy-Write Income Fund boasts an 8.78% yield at the current price and was generally pretty consistent with its distribution until just recently.

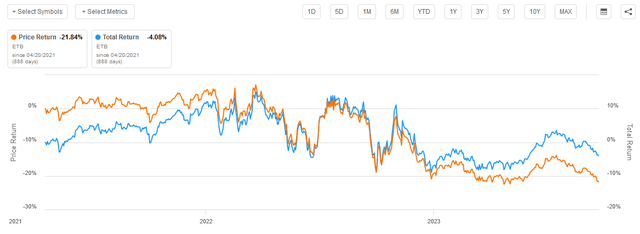

I last discussed this fund in April 2021, so naturally a great deal has changed. The fund has delivered a very poor performance since that time as its market price is down 21.84%. Fortunately, the fund’s fairly high yield saved it and investors in the fund have only lost 4.08% overall:

Seeking Alpha

This poor performance was mostly caused by the Federal Reserve abandoning its quantitative easing policy in 2022 and switching to a monetary policy that involves reining in the money supply in an attempt to reduce inflation. As is the case with most Eaton Vance funds, this one suffered from having a portfolio heavily weighted towards long-duration stocks that performed pretty well over most of the past fifteen years, but which is poorly positioned for a tight monetary policy and high inflation. We will, of course, want to investigate and see if it has made any changes to that portfolio since then.

In addition to discussing changes in the overall economic environment and the fund’s portfolio, this article will provide readers with an update on the fund’s finances. After all, more than two years have passed since we last discussed it so naturally the fund has released some more current information.

About The Fund

According to the fund’s website, the Eaton Vance Tax-Managed Buy-Write Income Fund has the stated objective of providing its investors with a high level of current income and current gains. This is hardly surprising considering the strategy that the fund uses to accomplish its objectives. The website is, unfortunately, silent on that but the fund’s fact sheet provides a pretty good summary of its strategy. Here is what it states:

The Fund invests in a diversified portfolio of common stocks and writes call options on one or more U.S. indices on a substantial portion of the value of its common stock portfolio to seek to generate current earnings from the option premium. The Fund’s portfolio managers use the adviser’s and sub-adviser’s internal research and proprietary modeling techniques in making investment decisions. The Fund evaluates returns on an after tax basis and seeks to minimize and defer federal income taxes incurred by shareholders in connection with their investment in the fund.

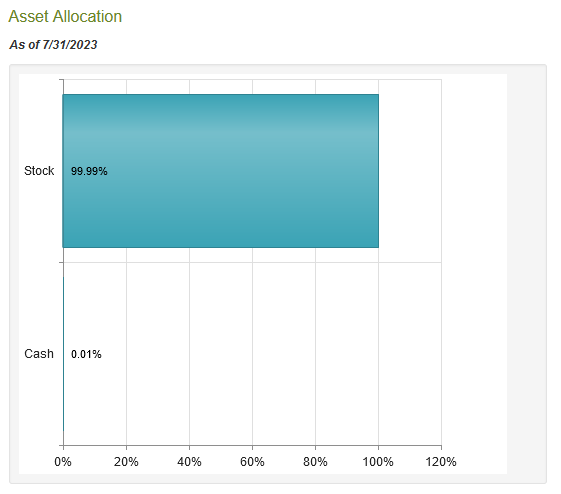

In other words, the Eaton Vance Tax-Managed Buy-Write Income Fund employs an option-income strategy. This requires that the fund would have a significant portion of its assets invested in common stocks, which is exactly what we see:

CEF Connect

As shown here, the fund currently has 99.99% of its assets invested in common stock, while holding only a very small amount of cash. This is, in fact, the largest allocation to common stock that I have ever seen in an unleveraged fund. The majority of common stock funds hold a bit more cash on hand so that they can more easily exploit opportunities in the market and pay their distributions. With that said, it is not really a problem for the fund to be fully invested like this. In fact, this is one of the advantages that closed-end funds have over open-ended mutual funds, as closed-end funds do not need to keep cash on hand to meet shareholder redemptions. Presumably, the fund could borrow money on a temporary basis if it desperately needs cash to pay the distribution, although this low cash position could also be caused by the timing of when the distributions were sent out to the investors.

The fact that the Eaton Vance Tax-Managed Buy-Write Income Fund employs a covered call strategy could be concerning to some investors who are more risk-averse. This is a category that would include many retirees and similar individuals who are dependent on their portfolios for income. After all, it is much more difficult for a retiree to replace lost principal, and we have all heard about the potential for large losses connected to option strategies. In previous articles, I pointed out that a covered call strategy is reasonably safe because the fund owns the asset that would need to be delivered in the event that the option is exercised against it. However, this fund is not using a covered call strategy, as I explained in my previous article on the fund:

The fund writes call options against American indices in order to generate income, but it does not actually own any of the underlying indices. This is critical because it means that the fund is technically writing naked calls. A naked call-writing strategy is one of the most dangerous options strategies because the potential losses are unlimited. This comes into play if the index is trading above the strike price of the option upon expiration as that scenario would force the fund to pay whatever the difference between the index and the option strike price is on that date.

We can think of this as the fund writing call options against the SPDR S&P 500 ETF Trust (SPY) or the Invesco QQQ Trust (QQQ) without actually owning the index fund. Then, it will have to pay whatever price is necessary to obtain it when the option gets exercised. Granted, index options are typically cash-settled, but the basic concept is the same. In short, the fund’s option strategy exposes it to unlimited potential losses because an index can technically go up by an unlimited amount. The fund will normally try to buy back an option that is at risk of expiring in the money, but even that will result in losses. Thus, this strategy is nowhere near as safe as the ones used by actual covered call funds, such as the Eaton Vance Enhanced Equity Income Fund (EOI).

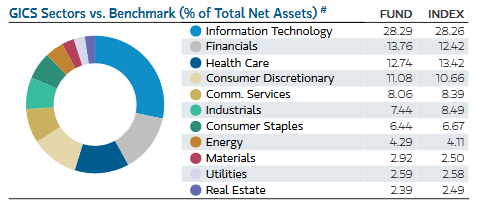

The fund attempts to mitigate the potential risk by investing in a portfolio that it expects to deliver a return that is comparable to the major American indices. As we can see here, its weightings to most sectors are pretty close to that of the S&P 500 Index:

Fund Fact Sheet

The expectation here is that the fund’s portfolio will deliver a performance that is comparable to the S&P 500 Index and offset the risks of the options strategy. Basically, what the fund management expects is that if the index makes any sharp moves upward then the portfolio should too. In a worst-case scenario, the fund’s managers could then realize some of the gains in its portfolio to pay off the counterparty to the option. For the most part, this strategy works pretty well.

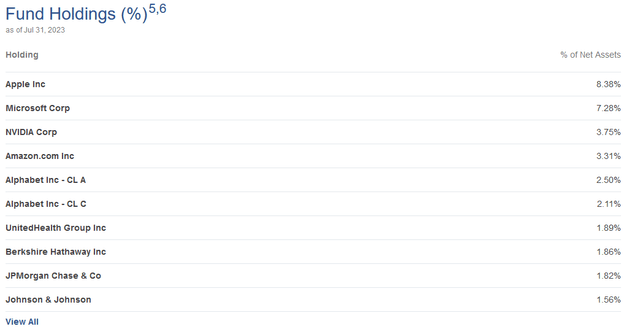

As I pointed out in my previous article on the fund, the Eaton Vance Tax-Managed Buy-Write Fund is very heavily weighted towards long-duration stocks. We can see that by looking at the largest holdings in its portfolio:

Eaton Vance

Apple (AAPL), Microsoft (MSFT), Nvidia (NVDA), Amazon.com (AMZN), and Alphabet (GOOGL, GOOG) account for 24.02% of the fund on their own. These are long-duration stocks because they are not held for what they are today, but for what they could be in twenty or thirty years. Apple’s net income in the past year was $94.760 billion, which is nowhere near enough to justify being valued at higher than Exxon Mobil (XOM), Chevron (CVX), and BP (BP) combined. In fact, the three oil supermajors had higher net income over the trailing twelve-month period than Apple, yet they only have a market capitalization of about $887.54 billion combined, compared to Apple’s $2.75 trillion. Clearly, Apple is not being valued based on its financial performance today, but on what people think will be its financial performance twenty or thirty years from now.

The problem with long-duration stocks is that they do not perform as well in a high-interest-rate environment as they do in a low-interest-rate environment. This is immediately apparent in the fact that Apple has delivered a lower total return than either Exxon Mobil or the S&P 500 Index (SP500) over the past twelve months:

Seeking Alpha

The reason that I am mentioning Apple specifically is not because I have some problem with the company or the stock. As we saw above, Apple is by far the largest position in the Eaton Vance Tax-Managed Buy-Write Income Fund. As we can clearly see, the fund’s large allocation to that stock right now actually reduced its performance compared to the S&P 500 Index over the past year. The fund needs its portfolio to keep up with the S&P 500 Index for the options strategy to work properly and its large allocation to Apple has proven to be a drag on the portfolio. Fortunately, all of the other large technology companies on the above list did beat the S&P 500 Index over the same period.

Recently though, the market has started to turn as investors begin to accept the reality that the Federal Reserve will not be cutting interest rates anytime soon. This has led to a sell-off in the artificial intelligence companies that are heavily represented in the fund’s largest positions. As such, the fund’s portfolio might not be the best for maximizing total return in the current environment. However, the most important thing is that it at least keeps up with the S&P 500 Index due to the risk of the naked options strategy. The fund’s heavy allocation to a small number of technology names could be a risk here, particularly if rates go up more. While its allocation to technology is pretty close to the S&P 500 Index, the index has more companies, so the risk is somewhat lower. This fund only has 160 holdings as of the time of writing and nearly all of its technology exposure is in five companies. Investors should consider that risk before buying the fund.

Distribution Analysis

As mentioned earlier in this article, the primary objective of the Eaton Vance Tax-Managed Buy-Write Income Fund is to provide its investors with a very high level of current income and current gains. It does that primarily through its options strategy, as the dividend income is relatively minimal here. After all, the S&P 500 Index only has a 1.51% current yield, and it is unlikely that the fund’s portfolio will be much above that. After all, it is trying to deliver a return that is comparable to the index.

Basically, what the fund is trying to do here is to sell options against the index and collect the premiums from the option sale. It then wants the option to expire worthless so that it can keep the premium as income. The strategy generally works pretty well as a source of income as long as the index remains relatively flat or declines. The strategy is somewhat less effective during a raging bull market as the fund’s gains are capped and sufficient market appreciation can actually result in losses on the options. Fortunately, we do not have a raging bull market right now, so the strategy should work pretty well to create income that acts much like a synthetic dividend yield from the portfolio.

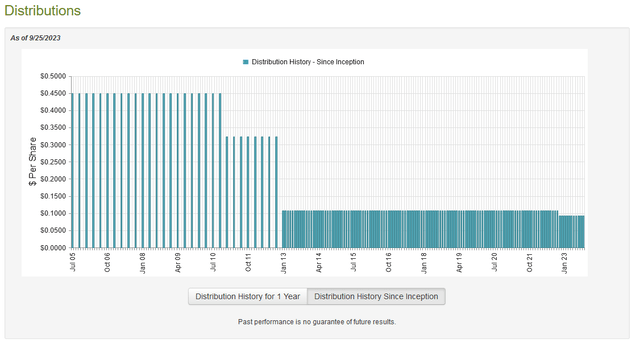

This strategy has, as with most options funds, allowed the fund to provide a fairly high current yield to its investors. The Eaton Vance Tax-Managed Buy-Write Income Fund pays a monthly distribution of $0.0932 per share ($1.1184 per share annually), which gives it an 8.78% yield at the current price. The fund was reasonably consistent with respect to its distribution over the past decade, but it was forced to cut it earlier this year:

CEF Connect

The fund previously would have been very appealing to anyone who was looking for a safe and secure source of income to use to pay their bills or finance their lifestyles. The distribution cut certainly reduced that appeal somewhat, particularly as it came during a time of high inflation in which every dollar counts. The fund was hardly alone in cutting its distribution though, as most of Eaton Vance’s option-income funds cut their distributions around the same time. This was probably due to the heavy losses that the fund took in 2022 due to its technology-heavy portfolio. As I pointed out in a few articles from back around the start of this year, the mega-cap technology stocks all underperformed the S&P 500 Index in 2022 and most of Eaton Vance’s funds had substantial allocations to these companies.

As I have pointed out before though, the fund’s history is not necessarily the most important thing for our purposes today. After all, anyone purchasing the fund today will receive the current distribution at the current yield and will not be adversely affected by those actions that the fund has had to take in the past. The most important thing for them today is its ability to sustain the distribution at the current level. Let us investigate this.

Fortunately, we have a very recent document that we can consult for the purpose of our analysis. As of the time of writing, the fund’s most recent financial report corresponds to the six-month period that ended on June 30, 2023. Obviously, this is a much more recent report than the one that we had available the last time that we discussed this fund. As everyone reading this is likely aware, the market was quite strong during the first half of this year, which is the period of time that is covered by this report. This strength was driven by investors’ optimism that the inflation in the economy would quickly be conquered and allow the Federal Reserve to cut rates. While it now appears that this optimism was unfounded, the period covered by the report would not include the recent weakness that we have seen as investors wake up to the reality of the situation. In fact, the fund probably had the opportunity to generate some capital gains during the period covered here.

During the six-month period, the Eaton Vance Tax-Managed Buy-Write Income Fund received $3,597,012 in dividends and surprisingly nothing in interest. These dividends were the fund’s only source of income, so its total investment income matches that number. It paid its bills out of this amount, which left it with $1,395,741 available for shareholders. Obviously, this was nowhere near enough to cover the fund’s distributions, which totaled $16,425,419 during the period. At first glance, this could be concerning as the fund did not have sufficient net investment income to cover its payouts.

However, the fund does have other methods through which it can obtain the money that is needed to cover the distribution. For example, it may have been able to sell appreciated stocks for capital gains. It also has the option premium income that it received, which is not considered to be investment income for tax purposes but obviously still represents money coming into the fund.

Fortunately, the fund did have some success in this area. It reported net realized gains of $7,512,766 and had another $39,531,283 in net unrealized gains. Overall, the fund’s net assets went up by $32,102,091 during the period after accounting for all inflows and outflows. The fund therefore easily covered its distributions during the period. In fact, it covered them almost three times over, so its distributions should be quite sustainable for quite a while unless those net unrealized gains get erased by a market crash. Overall, we should not have to worry too much about the fund’s distribution right now.

Valuation

As of September 25, 2023 (the most recent date for which data is currently available), the Eaton Vance Tax-Managed Buy-Write Income Fund has a net asset value of $13.80 per share but its shares currently trade for $12.68 each. This gives the fund’s shares an 8.12% discount on net asset value at the current price. This is a very reasonable discount that is quite a bit better than the 5.63% discount that the shares have had on average over the past month. As such, the current price is a very reasonable one to pay for the fund.

Conclusion

In conclusion, the Eaton Vance Tax-Managed Buy-Write Income Fund is a decent option-income closed-end fund if you are comfortable with the risks associated with the high technology allocation. This is perhaps the biggest concern here since those stocks will probably suffer if rates go higher. Jamie Dimon, CEO of JPMorgan (JPM), believes that is a very real possibility and he warned readers of the Times of India to be ready for 7% rates.

The fund delivered a very strong performance in the first half of this year, though, and the distribution appears to be reasonably secure at the current level. The fund’s valuation is quite acceptable, too, so the fund is worth considering if you are comfortable with the risk.

Read the full article here

Leave a Reply