Shares of Equitable Holdings (NYSE:EQH) have been a strong performer over recent weeks, which has pushed shares back into positive territory over the past year. Given good progress growing the less risky part of its business and a compelling sum of the part valuation, I see the potential for a mid-teens return over the next year.

Seeking Alpha

In the company’s third quarter, Equitable earned $1.15 in adjusted EPS, coming up $0.15 short of estimates. This was still up 16% from last year. The company’s earnings can be subject to meaningful volatility when there are large rate and equity market movements, which can create noise in annuity results. As the company continues to migrate into less-risky insurance products, this volatility will be moderated. Importantly, these results continued to progress. Further, management reiterated its guidance for $1.3 billion of cash flow generated to the holdco, having already generated $1 billion through three quarters.

Equitable’s primary business is selling annuities. Historically, it sold variable annuities, which became increasingly complex and capital intensive in the lead-up to the financial crisis. In hindsight, the terms offered to investors were too generous, and these products proved difficult to fully hedge. This is why companies with large legacy VA businesses like Jackson (JXN) and Brighthouse (BHF) tend to trade at steep discounts to book value. EQH no longer writes these policies and has been letting this legacy business of pre-2011 policies naturally decline. There is over $2 billion in annual run-off, which has reduced capital assets from $14 billion in 2017 to below $4 billion today. It contributes about $0.2 billion in operating earnings, about 10% of the firm’s earnings, from 30% in 2017. At the rate of asset attrition, this business will be just a footnote within 3-4 years. Importantly, EQH completed its annual reserve review during the last quarter, which required no material adjustments, meaning its existing policies are performing as previously expected.

As this business declines, its new insurance efforts are gaining steam with $1.5 billion of retirement inflows. EQH is focused on selling indexed annuities, which are pegged against an index, like the S&P 500 or a 60/40 blended portfolio and offer some downside protection in exchange for capped upside, providing a smoother return profile for investors. This product is much easier to hedge for the insurer via put options and other derivatives.

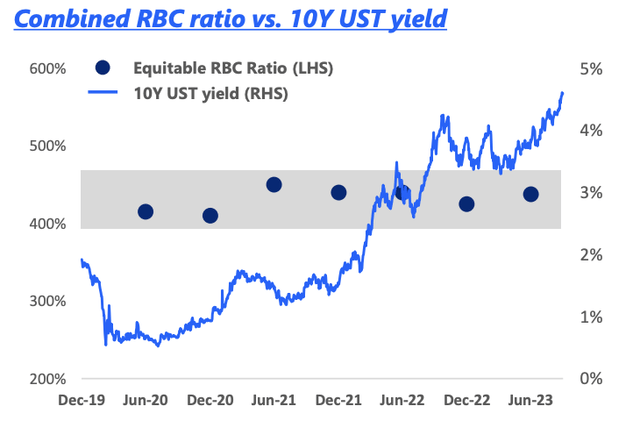

Its flagship indexed annuity accounted for nearly 60% of premiums with 37% growth. This continues to shift the composition of EQH’s insurance liabilities to a less market-sensitive posture. As evidenced by the stock’s fall in Q1, when markets fall, investors still fear that EQH’s hedging program may prove ineffective. As time progresses, this fear should diminish, in part because its hedging is working across market cycles. Over the past four years, we have witnessed both severe market downdrafts (in 2020) and severe rate increases (over the past year). Through this period, EQH’s has maintained a risk-based capital position above 400%, a key demarcation line of a healthy insurance balance sheet and capital position. As its legacy VA assets get smaller and smaller, this should continue to be the case.

Equitable Holdings

Individual retirement reported particularly strong results as it earned $221 million from $193 million last year. These gains were driven by the fact its net interest margin expanded to 247bp from 182bp. Insurance premiums here rose to $3.8 billion from $3 billion last year, a significant increase as higher rates pull more investors into these annuity products that can now offer higher yields.

Group retirement earned $113 million from $107 million as higher rates offset lower premiums, which were down 4% from last year to $817 million. Group activity tends to be less market sensitive, and EQH continues to have a unique franchise, with leading offerings to k-12 school teachers. Given the greater rate-sensitivity of individual sales, I expect that unit to be positioned for greater growth over the next year.

EQH is now able to deploy cash and maturities at an over 6% yield, which is helping to support wider interest margins on its products. Its investment holdings are also fairly conservative. 96% of its portfolio is investment grade rated. Its commercial real estate exposure has just a 62% loan-to-value. While I believe CRE, particularly office, faces significant long-term risk, this low LTV ratio provides meaningful insulation from potential losses. EQH does have a $9.8 billion unrealized loss in accumulated other comprehensive income from buying bonds when rates were lower. As they are bought to offset the duration of its annuities, the economic loss is offset by a theoretical gain on its insurance liability. As such, I believe it best to look at its financials on an ex-AOCI basis.

Aside from insurance, EQH has a wealth management business of financial advisors. This unit reported 8% organic growth with nearly $80 billion in assets under administration. It generated $1.6 billion of inflows, a very strong result, that speaks to ongoing momentum from this franchise. This unit is not capital intensive and drives 7% of operating income. Earnings nearly doubled to $40 million as margins expanded by 5% to 13.6% thanks to 16% growth in assets from last year. As one does not need to grow advisors as quickly as assets, this business has meaningful operating leverage.

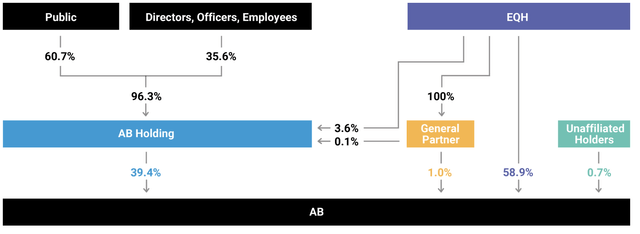

In addition to its insurance and wealth management business, Equitable owns about 62% of the economic interest in AllianceBernstein (AB). It controls AB, one of the largest independent asset managers in the world via 100% ownership of the general partner. EQH receives income through AB’s dividends, and it consolidates its financial results into its own.

AllianceBernstein

In situations where a company owns a stake in another publicly-traded company, I believe it is better to ignore the earnings stream and impact on consolidated financial metrics in favor of valuing the parent (in this case EQH) on a stand-alone basis, and then adding the market value of its stake in the other company (in this case AB). Given where AB shares are trading today, EQH’s stake is worth about $2 billion.

These units dividend cash up to the holding company, which is the entity that buys back stock and pays dividends. The holdco also carries $3.8 billion of long-term debt. Based on capital requirements, regulators have to allow dividends from the insurance operations (as with any insurer) whereas dividends from wealth management and AB do not require regulator oversight. As noted, the company is on track to generate $1.3 billion in cash.

Management also targets a 60-70% payout ratio. Shares offer a 3% yield, and Equitable repurchased $238 million in stock in Q3 for $678 million this year. As a result, the share count is down 7.7% from last year. The holding company also has $2 billion in cash and equivalents, giving it ample capacity to continue to return about $1 billion in capital per year.

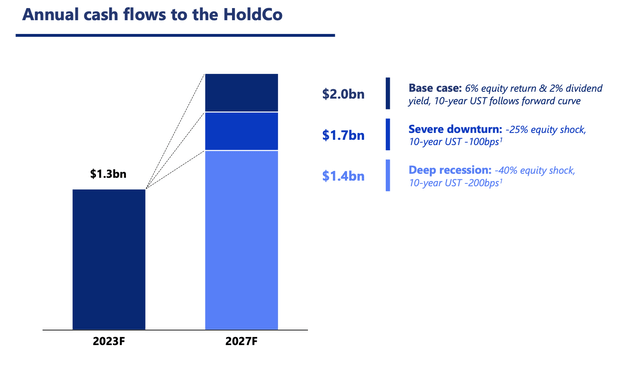

Thanks to less market sensitivity in its new annuities and growth in wealth management, EQH expects to grow annual cash flow to $2 billion in four years. Even in a severe downturn, it expects to grow cash flow over time to $1.4 billion, speaking to the lower cyclicality of its business.

Equitable Holdings

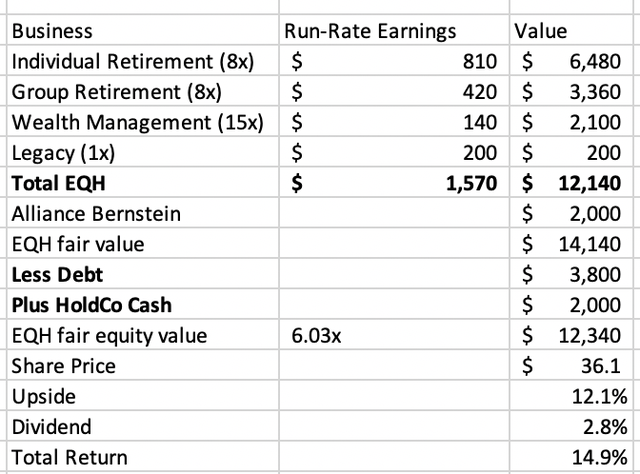

I view the best way of valuing EQH to be a sum of the parts analysis of its various units. I am conservatively valuing its new annuity businesses at 8x earnings. This is still a low multiple, as I believe markets retain some skepticism of annuities after issues with variable annuities last decade. In time, this multiple could expand toward 10x, but I believe assuming a single-digit multiple is more appropriate for now. Given it is less capital intensive and more predictable, wealth management is valued at 15x. I only value legacy profits at 1x, very conservatively, given their run-off status. I then add the equity value of AB and subtract EQH’s net debt.

my own calculation

This gets me a fair value of about $36, about 12% above current levels. This implied equity value of $12.4 billion is above its ex-AOCI book value of $11.4 billion, as wealth management operations typically trade well above their book value, given unaccounted for brand equity value in GAAP financial statements.

Combined with its dividend, there is a 15% total return potential. I would also note that multiples I am using for EQH’s insurance operations are fairly conservative. Moreover, its buyback should continue to reduce the share count and push fair value higher. With a solid dividend, accretive buyback, and depressed multiple, alongside a solid HoldCo cash position, I see further upside in EQH and would stay long shares.

Read the full article here

Leave a Reply