Enterprise Products Partners L.P. (NYSE:EPD) is one of the largest midstream companies in the world, with a market capitalization of just over $55 billion. The company has a dividend yield of almost 8%, and recently reported Q3 earnings. As we’ll see throughout this article, the company has the ability to drive long-term shareholder returns.

Enterprise Products Partners Capital Allocation

The company has continued to invest heavily as various companies ramp up organic growth from higher opportunity.

Enterprise Products Partners Investor Presentation

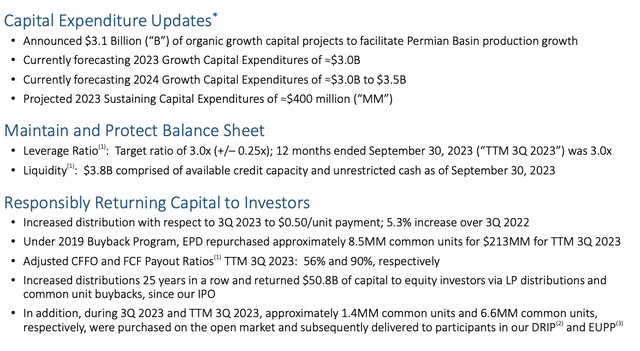

After a slate of major deals involving the Permian Basin, the company is planning to spend $3.1 billion on organic growth capital projects to facilitate its position in the Permian Basin. This is a large ramp-up from before, the company’s annual sustaining capital is $400 million, and it’s planning to spend $3 billion in 2023 growth capital and $3.2 billion in 2024 growth capital.

The company does, however, maintain one of the lowest leverage ratios in the industry, with a target ratio of just 3.0x. It has almost $4 billion in liquidity, which is meaningless at its size, because it really just means the company has the capital to continue operating, as it realistically always should have anyway.

The company is committed to shareholder returns. It’s almost 8% dividend yield was recently increased by 5.3%. Like most midstream companies, the company keeps buybacks incredibly low, which is short-sighted in our view. Still it repurchased $213 million in the TTM which is exciting to see.

Enterprise Products Partners Returns

The company’s financial picture versus a $55 billion company is viewed below.

Enterprise Products Partners Investor Presentation

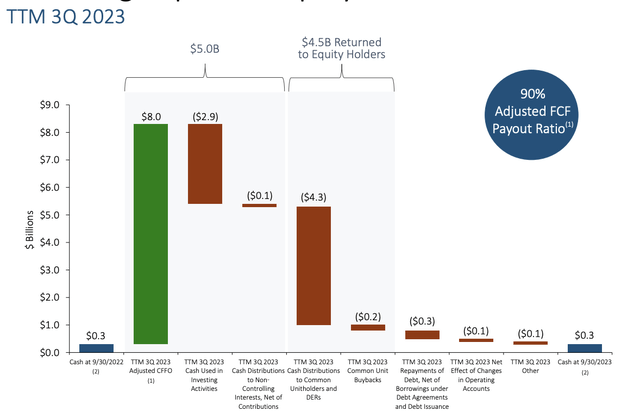

The company earned $8 billion in CFFO from the last 12 months and used $2.9 billion in capital spending (organic and maintenance). Operating and cash distributions to non-controlling entities used up another $0.2 billion. The company paid $4.3 billion in its dividend, which it can comfortably afford, and $0.2 billion with buybacks, ending up with the same amount of cash.

The company’s payout ratio is 90%, which might seem high, but with long-term contracts is something it can comfortably afford. However, there is an important takeaway here that the company cannot grow distributions noticeably without growing CFFO from organic capital spending.

Still, because organic capital spending comes back to shareholder, the company in effect has double-digit shareholder returns that it can provide.

Enterprise Products Partners Growth Capital

The company is ramping up growth capital spending, especially in regards to natural gas.

Enterprise Products Partners Investor Presentation

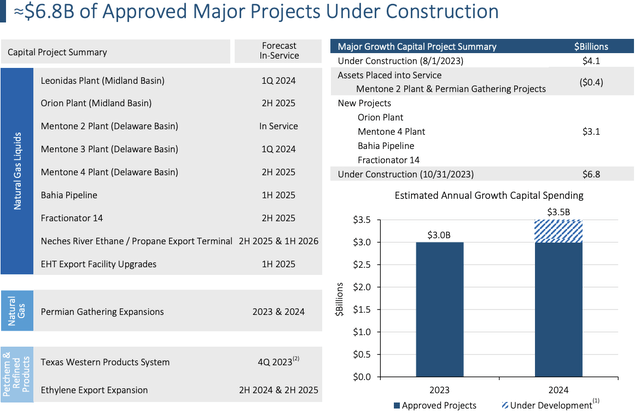

The company has $6.8 billion of approved major projects, with $3.1 billion in new projects, and $4.1 billion that have already been under construction. It recently placed $0.4 billion worth of projects into service. The company is continuing to invest heavily in growth capital and that growth capital is likely to enable strong long-term growth and returns.

Our View

At the end of the day, what matters is Enterprise Products Partners L.P.’s ability to drive long-term shareholder returns.

The company’s basis for its returns is its dividend. It has a dividend yield of almost 8%, utilizing about 90% of its post capital cash flow. The company also uses modest cash flow for debt repurchases but together, net direct shareholder returns are about 8%. The company can continue to afford that and we expect it to modestly increase those returns over time.

However, more important than that for the company, is its continued usage of about 6% of its market capitalization annually for growth capital. The company is especially focused on becoming more relevant in the rapidly booming Permian Basin. This will enable the company’s long-term cash flow to grow even faster, supporting more significant shareholder returns.

Thesis Risk

The largest risk to our thesis is the company doesn’t have an approach to handling climate change. The company is continuing to build up its impressive portfolio of assets, and with natural gas especially, we expect demand to remain strong. However, in the decades to come the market will shift, and when it does Enterprise Products Partners is in a risky position.

Conclusion

Enterprise Products Partners L.P. has seen its share price stagnate, but remains near all-term highs. That’s despite some of the highest interest rates of the industry. The company continues to maintain an incredibly strong business, with one of the lowest debt levels in the industry, a debt level it can comfortably afford.

The company, overall, remains committed to shareholder returns. It has a dividend yield of almost 8% that it can comfortably afford. It’s continuing to modestly increase its dividend. The company’s growth capital spending is ramping up, and we expect it to continue increasing. That will help support overall shareholder returns.

Read the full article here

Leave a Reply