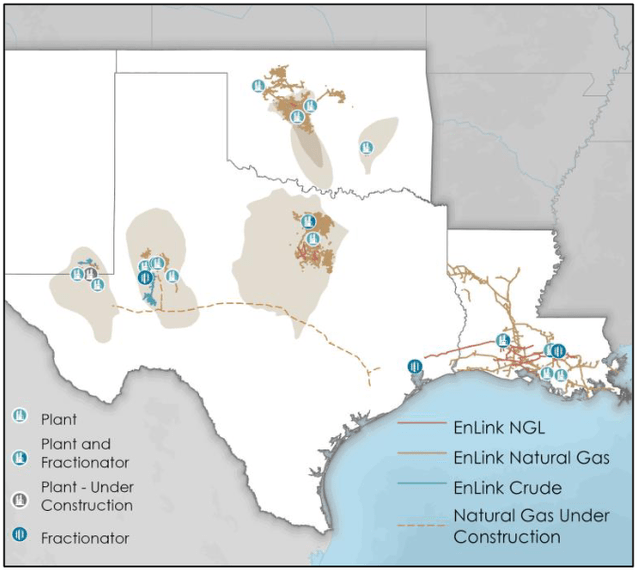

EnLink Midstream, LLC (NYSE:ENLC) is a midsized midstream company that operates in a few hydrocarbon-rich basins in the southcentral part of the United States.

EnLink Midstream

There are a few basins in which this company operates that we do not frequently see midstream companies operating gathering and processing networks. In particular, we see the Anadarko basin represented here, which is not a region that we hear about very often. The fact that the company operates in a few areas that other midstream companies do not could give it some diversity benefits, as each of the different hydrocarbon basins in the United States possesses somewhat different fundamentals. For the most part though, EnLink Midstream enjoys most of the characteristics that we usually appreciate with midstream companies, such as stable cash flows and a high yield.

Unfortunately, EnLink Midstream only yields 4.00% at the current price, so it does not have the same impressive yield that many of its peers possess. In fact, this is one of the only midstream companies with a current yield that is less than that of a money market fund. This was my biggest complaint about this company the last time that we discussed it. The company could make up for its low yield with growth potential though, particularly in the area of carbon capture and storage, which the U.S. government is actively promoting via the Inflation Reduction Act. Indeed, this aspect of the company’s business is probably the reason why its unit price performance has been so strong over the past few months. EnLink Midstream is much more than just this business though, as already mentioned. Let us investigate and see if this company could be a good addition to a portfolio today.

About EnLink Midstream

As stated in the introduction, EnLink Midstream is a midsized midstream company that operates in a few different basins throughout the southcentral region of the United States. These basins include:

- Permian Basin.

- Anadarko Basin.

- Barnett Shale.

- Haynesville Shale.

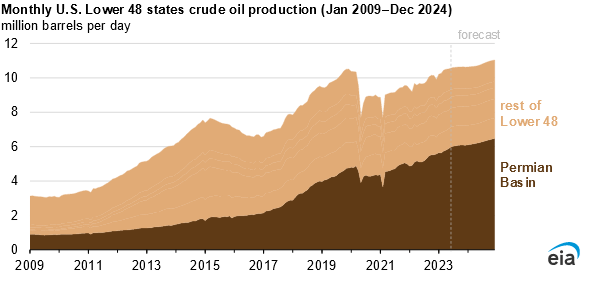

A few of these are areas that we do not hear about very much in the media. In fact, the only one that I commonly hear discussed is the Permian Basin, which is the largest source of hydrocarbons in the United States. It is also the area that has been the focal point for much of the American energy renaissance over the past decade or so. As we can see here, the Permian Basin alone accounts for much of the production growth in the lower 48 states and is expected to continue its dominance going forward:

U.S. Energy Information Administration

The Permian Basin has become even more important to the American energy industry ever since the 2020 price and production crash as it is seemingly the only place that upstream producers want to operate.

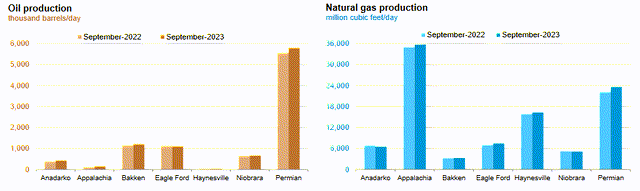

However, we should not discount the other basins in which EnLink Midstream operates. After all, they have all delivered production growth over the past twelve months:

U.S. Energy Information Administration

At this point, some may dispute the previous statement as the Anadarko Basin’s natural gas production has slightly declined year-over-year. However, the basin’s oil production is up during the period and crude oil is a much denser fuel than natural gas. For the most part, we are seeing production increases across the board, although they are generally fairly weak. Even the venerable Permian Basin is no longer seeing production growth as strong as it once did. We can speculate on the reasons for this all day long, but in short, the market and overall business environment is much harsher for energy producers now than it was prior to the COVID-19 pandemic. As such, it makes more sense for upstream energy companies to keep production steady and pay out a large portion of their cash flow to the investors than it does to reinvest cash to try to grow the business. This is certainly a good thing for us as income investors, but it is not a particularly good thing for people who are desperate for low gasoline prices.

The reason that all of this is important is because of the business model that EnLink Midstream employs. I described this business model in my last article on the company:

“In short, the company enters into long-term (typically five to ten years in length) contracts with its customers. Under the terms of these contracts, EnLink Midstream moves a customer’s natural gas, natural gas liquids, and crude oil through its network of pipelines and other infrastructure. In exchange, the customer compensates EnLink Midstream based on the volumes of resources that are transported. This provides the company with a great deal of insulation against volatile energy prices.”

The company’s revenue and cash flow are therefore dependent on resource production, at least to a certain degree. Its contracts with its customers typically include minimum volume commitments that provide a certain baseline amount of revenue, but the company will still generally do better in an environment in which the production of resources is rising. This is because higher production means that more resources need to be transported to the market, which obviously benefits the company in the form of higher cash flows. The fact that energy production in the United States has not been growing very much over the past year has thus been something of a drag on the company’s financial performance.

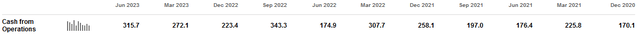

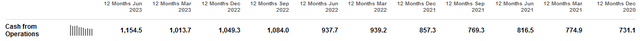

In fact, we can see that the company’s cash flow has not been growing very rapidly as of late by looking at its historical operating cash flow. Here are the company’s quarterly operating cash flows since the end of 2020:

Seeking Alpha

We can see a great deal of volatility here, which is not what we expect from a midstream company. After all, these companies are well regarded for their financial stability. Indeed, this is one of the reasons why risk-averse investors tend to like them. Fortunately, most of the volatility is due to the timing of when money is received and spent. These things tend to even out over the course of a year. This chart shows the same time periods, but shows the company’s trailing twelve-month operating cash flow during each of the given periods:

Seeking Alpha

Here we can see that the company’s operating cash flows exhibit much more stability, as well as generally growing over time. This is exactly what we would expect based on EnLink Midstream’s business model and the production growth in each of the basins in which it operates. However, we do see that the company’s growth seems to be slowing down in more recent periods, which is also what we would expect as upstream companies have not been exhibiting much interest in boosting their drilling activity or overall production levels.

We can therefore clearly see that the company will not be able to generate much growth by depending on upstream production growth, at least for a while.

Carbon Capture And Storage Technology

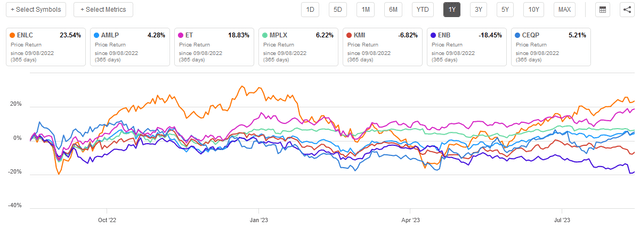

This does not mean that EnLink Midstream is completely lacking any growth opportunities. After all, the company has been one of the better-performing midstream companies in the market over the past year. Here is EnLink’s price performance against the Alerian MLP Index (AMLP) and a number of popular large-cap and mid-cap midstream companies:

Seeking Alpha

As we can clearly see, EnLink Midstream has significantly outperformed its peers in terms of price performance over the past year. In fact, only Energy Transfer (ET) comes anywhere close. This happened despite the fact that the company’s volume growth has been fairly minimal over the period:

|

Q2 2023 |

Q2 2022 |

|

|

Gathering & Transportation (mmBTU/d) |

6,925,200 |

6,636,900 |

|

Processing (mmBTU/d) |

3,562,000 |

3,141,700 |

The volume growth that the company did see was almost entirely due to the Permian Basin, which is an area in which just about every midstream company in the United States, including all of the ones on the chart above, have operations. Thus, they would all benefit from the growth that occurred in that area. The only realistic explanation for the performance difference is that EnLink Midstream has something that the other companies in the industry do not.

As I discussed in my previous article, the catalyst that has been driving EnLink Midstream’s recent market performance is its carbon capture and storage technology. This is a group of technologies and functions that allow the company to capture carbon emissions at the source of production and transport that carbon to a place where it can be stored. The basic idea is to prevent carbon from being emitted into the atmosphere. The energy industry has actually been doing this for decades, but it has gotten new attention now that various activist groups have taken an interest in it as a means to reduce carbon dioxide emissions. The government has too, as the Inflation Reduction Act that was passed back in 2022 provides funding for the development and deployment of carbon capture and storage technologies.

EnLink Midstream is actively attempting to deploy its carbon capture and storage technologies along the Mississippi River Corridor in Louisiana. In that area, there are numerous industrial sources that emit approximately eighty million tons of carbon emissions annually. That is double the amount of carbon that was captured by all carbon capture technologies in 2020.

In my previous article on EnLink Midstream, I pointed out that the company was in discussions with customers to collect twenty million tons of carbon dioxide from industrial customers in the area. The company appears to have had some success with this, as it recently announced a 25-year contract with Exxon Mobil (XOM). Under this contract, EnLink Midstream will collect and remove 3.2 million tons of carbon dioxide emissions from the company’s operations in Louisiana. EnLink Midstream did not name any specific facility that is covered by this contract, but Exxon Mobil has a few refineries, chemical plants, and other industrial operations along the Mississippi River in Louisiana, so the contract most likely covers one of those facilities. As some readers might note, this is a far cry from the twenty million tons of carbon removal that the company was hoping to secure contracts for. However, the announced contract does have the potential to be increased to a total of ten million tons of carbon per year, so it is certainly possible that there will be the opportunity for this deal to eventually be far more profitable than it will be at its inception. In addition, this is just the first contract of several that EnLink Midstream hopes to secure. As such, we could be seeing the initial stage of a growth spurt for the company.

As I have pointed out in numerous previous articles, one of the nicest things about midstream contracts is that we can project the impact that they will have on a company’s financial condition. In this case, the exact impact depends on just how much carbon ends up being captured and stored by EnLink Midstream. The company states that it will have a high single-digit adjusted EBITDA multiple if it only handles the initial 3.2 million tons of carbon but this transforms to a low single-digit adjusted EBITDA multiple if it ends up handling the full ten million tons. As this project is expected to require an initial upfront investment of approximately $200 million, this should mean that it will boost EnLink Midstream’s adjusted EBITDA by $20 million to $50 million annually once the project is complete and begins generating revenue for the company. The company will begin collecting carbon under the agreement in 2025, so we should expect to see its adjusted EBITDA increase by approximately that amount in about two years.

Financial Considerations

It is always important that we investigate the way that a company finances its operations before making an investment in it. I explained the reason for this in my previous article on this company:

“It is always critical that we analyze the way that a company is financing its operations before making an investment in it. This is because debt is a riskier way to finance a company than equity because debt must be repaid at maturity. That is typically accomplished by issuing new debt and then using the money to repay the maturing debt. This can cause a company’s interest expenses to increase following the rollover depending on conditions in the market. As of the time of writing, interest rates are at the highest level that we have seen since 2001 so that could be a very real concern today. In addition to this, a company must make regular payments on its debt if it is to remain solvent. Thus, an event that causes its cash flows to decline could push it into financial distress if it has too much debt. Although midstream companies like EnLink Midstream tend to have remarkably stable cash flows, this is still a risk that we should not ignore.”

The usual way that we judge a midstream company’s ability to carry its debt is by looking at its leverage ratio, which is also known as the debt-to-adjusted EBITDA ratio. This ratio basically tells us how long it would take a company to completely repay its debt if it were to devote all of its pre-tax cash flow to that task. As of June 30, 2023, EnLink Midstream had a total debt of $4.7654 billion and a net debt of $4.7051 billion. The company’s trailing twelve-month adjusted EBITDA is $1.3379 billion as of the same date. This gives EnLink Midstream a leverage ratio of 3.56x or 3.52x depending on whether we use total debt or net debt as a point of comparison (both are frequently used by companies in the sector). This company overall has a very reasonable leverage ratio. As I have pointed out numerous times in the past, Wall Street analysts usually consider anything below 5.0x to be acceptable. However, I am more conservative and would like this ratio to be under 4.0x, which is the level that most of our recommended companies possess. EnLink Midstream clearly meets even this more stringent requirement so we can conclude that its debt is unlikely to be a problem going forward.

Distribution Analysis

One of the biggest reasons why many investors purchase the common equity of midstream companies is because of the high yields that they pay out. Unfortunately, EnLink Midstream is rather disappointing in this respect. As of the time of writing, the company’s common equity only yields 4.00%. This is quite a bit lower than many other companies in the sector. For example, here is how it compares to the list of large-cap and mid-cap midstream companies that we used as a peer comparison of its price performance:

|

Company |

Current Distribution Yield |

|

EnLink Midstream |

4.00% |

|

Energy Transfer |

9.01% |

|

MPLX (MPLX) |

8.94% |

|

Kinder Morgan (KMI) |

6.73% |

|

Enbridge (ENB) |

7.82% |

|

Crestwood Equity Partners (CEQP) |

9.01% |

The Alerian MLP Index yields 8.06% right now, so EnLink Midstream does not compare particularly favorably to the sector in terms of yield. In fact, the company is one of the only midstream companies that has a current yield that is less than a money market fund. This is a direct result of the strong market appreciation that the stock has benefited from over the past year, which we already discussed. Despite this, it may still reduce the company’s appeal in the eyes of those who are looking for a very high level of income from their portfolios. This is particularly true for new investors who have not benefited from the capital appreciation over the past several months.

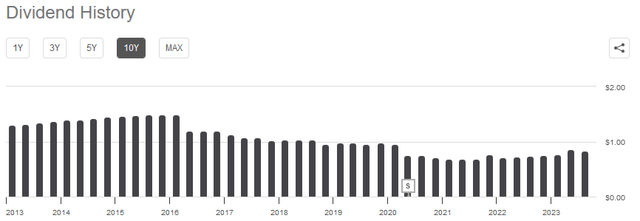

EnLink Midstream’s distribution history has also been rather disappointing:

EnLink Midstream

We can quickly see that this was one of the companies that cut its distribution in reaction to the COVID-19 lockdowns. However, its history of reducing the distribution with the passage of time did not start there. In fact, we see that the general trend has been down ever since 2016. That is not something that we want to see right now, especially with inflation reducing the purchasing power of the company’s distributions.

With that said, the most important thing for anyone who is considering purchasing the company today is its ability to sustain its distribution going forward. After all, anyone buying today will not be adversely impacted by the company’s actions or challenges in the past.

The usual way that we determine a company’s ability to pay its distribution is by looking at its free cash flow. During the twelve-month period that ended on June 30, 2023, EnLink Midstream had a leveraged free cash flow of $584.7 million. That was more than sufficient to cover the $229.9 million that the company paid out in distributions over the period. In fact, it was sufficient to cover the distributions 2.54 times over. That allowed the company to cover its distribution and still retain a substantial amount of money to use for other purposes. Overall, we should not need to worry about the distribution today. EnLink Midstream can easily sustain it.

Conclusion

In conclusion, EnLink Midstream exhibits the stability that we usually expect from a midstream company. Some of the areas in which it operates have not been experiencing much in the way of production growth though, which has been slowing down the company’s cash flow growth. The real opportunity here comes from the company’s carbon capture and storage unit, which could have some real potential given that the Federal government is spending a great deal of money to promote this technology. That has pushed the company’s market price up and its yield down, which is very unfortunate. The company has actually started to sign some contracts that could drive its growth and justify the current price, though.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply