Investment Thesis

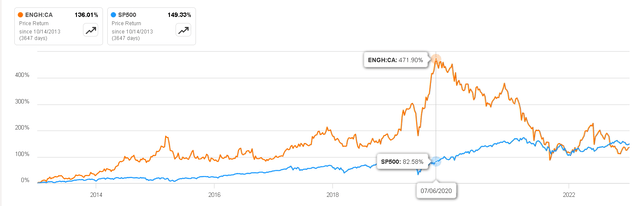

Enghouse Systems (TSX:ENGH:CA) is a vertical software company that, at some point in 2020, emerged as a clear outperformer compared to the S&P 500. However, since that time, the share price has been significantly impacted due to a series of mediocre quarterly results.

These results can be explained by the company’s transition in its business model. It has shifted from selling its software with perpetual licenses to offering it under the Software as a Service (SaaS) business model.

In this article, we will analyze Enghouse’s business model and explore the potential advantages that this radical shift in the business model could bring. Additionally, I will provide a valuation to support my belief that the current share price justifies an investment in the company.

Performance vs S&P500 (Seeking Alpha)

Business Overview

Enghouse Systems is a Canadian software and services company, specializes in providing customer engagement solutions, contact center software, and telecommunications software. They offer a comprehensive range of products and services designed to assist businesses in enhancing customer interactions, streamlining operations, and optimizing communication systems.

Enghouse Systems is widely recognized as a vertical software provider. Vertical software providers excel in creating tailored software solutions for specific industries. Enghouse, in particular, is dedicated to developing software solutions for various sectors, including telecommunications, contact centers, healthcare, financial services, and more. Their suite of products and services is meticulously crafted to address the unique needs and requirements of these diverse industries.

This industry-specific focus fosters strong customer loyalty, as businesses come to rely on Enghouse’s solutions for their operational effectiveness. Consequently, they are less likely to switch to alternative providers. For instance, Enghouse Systems offers telecommunications software designed for service providers, contact center solutions to enhance customer service and engagement, and healthcare software for efficiently managing patient information and communication. By tailoring its offerings to specific vertical markets, Enghouse Systems aims to provide specialized, precisely targeted solutions that effectively meet the distinct challenges and demands of each industry. This specialization is a defining characteristic of vertical software providers.

The company’s services can be divided into four main categories, which we will explain below.

Author’s Representation

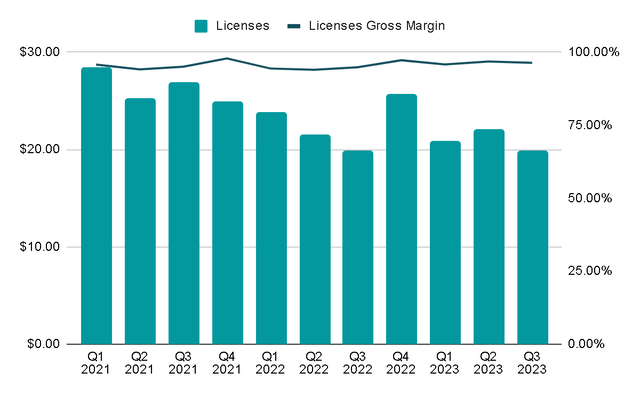

Licenses

The company offers software licenses for sale in two ways: perpetual licenses and term licenses. Perpetual licenses grant customers the right to use the software indefinitely after paying a one-time license fee, typically at the start of the contract. Term licenses, on the other hand, give customers the right to use the software for a specific period in exchange for a fee, which can be paid upfront or in installments over the contract duration.

Although the gross margins of this segment are very high at around 95%, this licensing business model has a great disadvantage: Low recurrence.

This is because the sale implies selling the license only once and not charging the client anything again, consequently, revenue is less predictable and recurring. It is no coincidence that in the last decade businesses such as Adobe, Autodesk or Microsoft have transitioned from selling perpetual licenses to a monthly or annual subscription model where the customer has to pay recurrently to have access to the software.

Author’s Representation

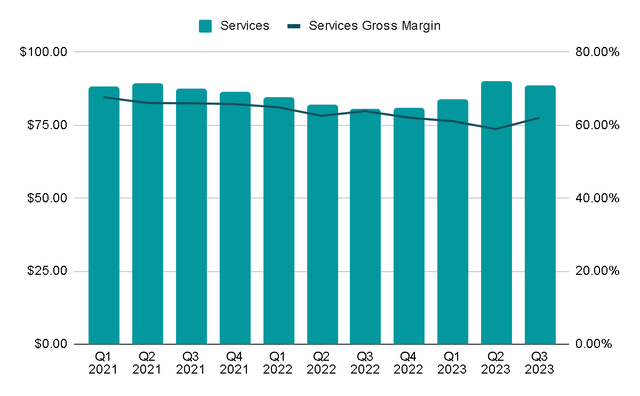

Services

We could divide the Services segment into two: Professional Services, Maintenance and SaaS. It is in this segment where the revenue is found that we are interested in continuing to gain relevance.

- Maintenance revenue primarily includes technical support and the provision of unspecified upgrades and updates. These are provided on an as-available basis and are related to the company’s perpetual and term-based on-premise license agreements.

- Professional services revenue encompasses a range of services, including installation, implementation, configuration, consulting, and training. These services can be offered either bundled with software licenses or as standalone offerings.

- In the Software as a Service (SaaS) arrangements, the end user typically doesn’t physically possess the software, instead, customers acquire the right to access and use the software. This is where highly recurring revenue is generated, since the client who is interested in having access to the software will have to pay monthly or annually, instead of paying once and getting the software forever.

The gross margins of this segment as a whole are around 60%, although the company does not usually reveal the margins for each of the branches that make up the segment.

Author’s Representation

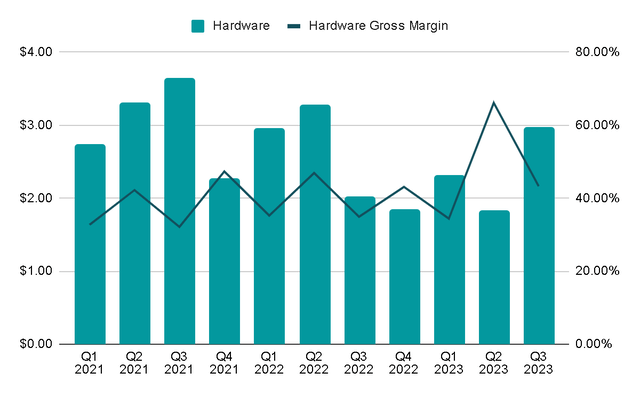

Hardware

This line of business is complementary to having another additional source of income through selling some pieces of hardware that the client requires to be able to use the software designed by Enghouse optimally.

The segment’s revenues represent just 2% of total sales and in general, have worse margins and are more cyclical.

Author’s Representation

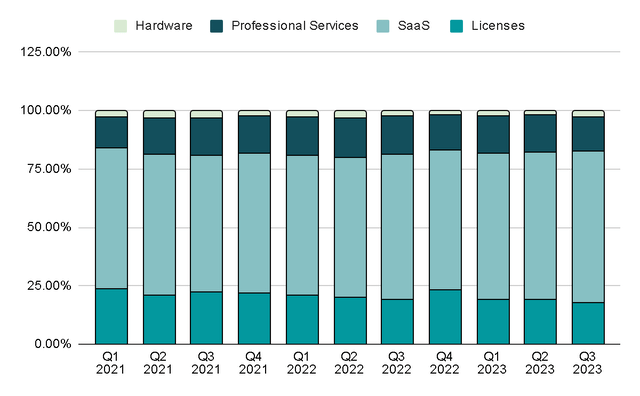

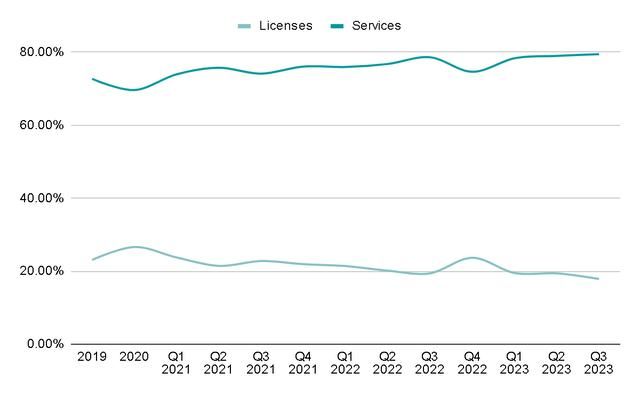

Transition to SaaS

Since 2021, the company has been focused on initiating a transition to a cloud-based model, as SaaS businesses are typically characterized, and has also been focusing on increasing service revenue and reducing perpetual licenses. In 2019, services represented 72% of revenues and now they are around 80%.

To understand the positive implications of this transition I would like to show two examples of businesses that did something similar, after all, Enghouse is not inventing the wheel, it is just copying what has already been proven to be successful.

Author’s Representation

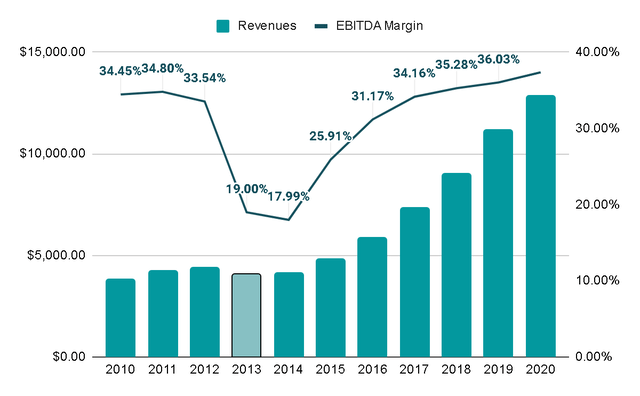

Adobe

In 2013 Adobe went from selling perpetual licenses to offering subscriptions. The following graph shows perfectly how, during this transition, revenues decreased and margins declined a little, however, in the following years it went from completely flat revenues to extraordinary growth year after year in both revenues and margins.

Author’s Representation

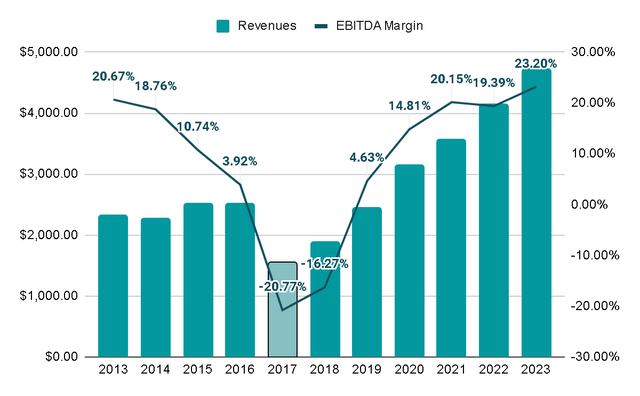

Autodesk

The case of Autodesk is similar. In the years prior to its transition to SaaS, in 2017, revenues were unpredictable and growth was minimal. Once again we see that during the transition year the income decreased and the margins the same, however, this bore fruit in subsequent years and also increased margins and revenues.

Author’s Representation

Enghouse

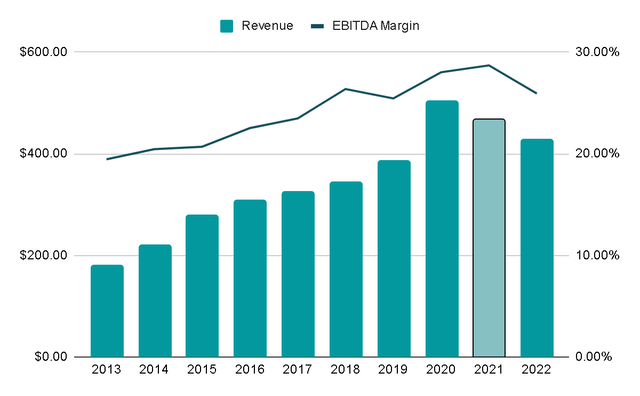

Now, the case of Enghouse has a nuance and that is that the company has been growing in recent years thanks to the fact that its business model did not depend solely on perpetual licenses. However, it can also be noted how during 2022, a year after the board began to mention that it wanted to transition its business model, revenues also decreased, in this case 8.5% and EBITDA margins went from 29% to 26%.

Although the company has a more solid and diversified revenue base, it seems that the pattern we saw before with Adobe and Autodesk is repeating itself, which could suggest that if the transition is successful, we could expect more predictable revenues and a slight margin expansion.

Author’s Representation

Valuation

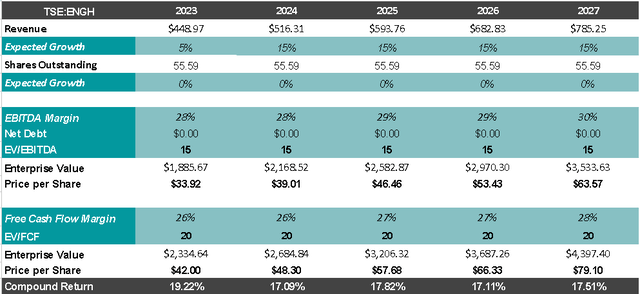

For the valuation, we will begin with the expectation that margins will increase each year due to the transition in the business model. This is based on examples mentioned above, such as Adobe and Autodesk.

Furthermore, I believe that, thanks to these more predictable revenues, consistent growth can be maintained at around 15% annually. However, during FY2023, growth is expected to be only 5%. This is due to the fact that, in the first nine months of the fiscal year, revenues grew by 4% YoY, although in the last quarter, this growth accelerated to almost 9% YoY. Additionally, the FCF margin for the third quarter was 26% and the Adjusted EBITDA was 29%, quite positive.

This implies that by FY2027, Enghouse would be generating approximately $785 million CAD in revenue and $220 million in Free Cash Flow. If we apply valuation multiples of 15x EBITDA and 20x FCF, we would have an Enterprise Value ranging from $3.5 billion to $4.5 billion CAD. In other words, a price per share of approximately $70 CAD. This would represent a return of 17.6% per year from current prices.

Author’s Representation

In a less favorable scenario where revenues grow at a rate of only 10%, and the market does not assign higher multiples, the company would be trading at 12x EBITDA and 15x FCF. This suggests a price per share of approximately $45 CAD. In such a scenario, the return would be around 8%.

Final Thoughts

The management team has been leading the company for many years, and it’s clear how they have known when to pivot in their decisions. For example, during 2020 and 2021, they made few acquisitions because market valuations were quite expensive. However, in 2022 and 2023, they have returned to M&A activity. The same applies to the change of the business model and the transition to SaaS.

While this transition holds significant promise, it also carries inherent risks. One major risk is the possibility of a failed transition. If the transition to SaaS is not successful, the company will find itself in a more vulnerable position, as it would entail a loss of resources at a time when revenues are fluctuating, and growth is slower. So far, the process seems to be going well, but this risk must be taken into account.

Considering all of this and the current valuation, I believe that even if this change does not go entirely as expected, Enghouse could still be a good investment after the punishment that the share price has endured. That’s why I have decided to give it a ‘buy’ rating.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply