Introduction

The energy sector is presenting an interesting picture right now. On one side of the coin, there are oil companies that are raking in the cash, thanks to the high oil prices. On the other side, there’s a bit of a pickle for some of the North America-focused oilfield service providers. The rig count is on the decline, and that’s putting them in a tight spot. Yet, in the midst of all this uncertainty and contradiction, there’s a beacon of stability: the energy infrastructure companies. These folks are pulling in steady cash flows like clockwork, year after year.

Demand for energy is staying strong, both here at home and on the international stage. That’s music to the ears of midstream companies and MLPs-they’re cashing in on this demand and riding high. Enter the Alerian Energy Infrastructure ETF (NYSEARCA:ENFR). This ETF is like a treasure trove-it’s packed with the biggest and best energy infrastructure companies and MLPs out there.

In my previous article, I laid down a case in favor of investing in the energy infrastructure sector and Alerian Energy Infrastructure ETF specifically, a stance that has only grown stronger since then. In my view, it’s a great option for investors looking to get a piece of the action in high-quality energy assets and definitely worth a spot on your radar.

Inside ENFR: Exploring the ETF

The Alerian Energy Infrastructure ETF comprises 27 of the largest energy infrastructure companies and Master Limited Partnerships [MLPs] in the U.S. and Canada. It’s a moderately sized fund, managing assets worth $124.5 million, and offers a dividend yield of 5.10% (based on the 30-day SEC yield). It is significantly smaller than some of its counterparts, like the Alerian MLP ETF (AMLP), the largest in the energy infrastructure domain, boasting over $7.1 billion in assets under management.

Unlike numerous competing ETFs with a primary focus on MLPs, such as Alerian MLP ETF, ENFR incorporates both c-corporations and MLPs. In my view, this approach provides investors with a more comprehensive exposure to the energy infrastructure sector compared to the larger, MLP-centric ETFs.

This distinction is vital because some of the biggest energy infrastructure players, like Kinder Morgan (KMI) and Enbridge Inc (ENB), operate as c-corporations. These major companies are often overlooked by MLP-centric ETFs. I believe this is a significant oversight, as it denies investors access to companies that are pivotal to North America’s energy infrastructure. For instance, Enbridge plays a crucial role, transporting about a third of all North American crude oil production, while Kinder Morgan’s pipelines handle nearly 40% of the region’s natural gas production. For those seeking comprehensive sector exposure, I consider ENFR to be the superior option over MLP-focused ETFs.

Favorable Environment

Those familiar with my work know I’ve extensively discussed the U.S. rig count’s decline and its impact on certain oilfield service providers, as highlighted in my last piece on Ranger Energy (RNGR). Drilling activities have indeed decelerated in the U.S. throughout 2023, with a reduction of 150 rigs since the year’s commencement, according to Baker Hughes (BKR). By last week’s close, 622 rigs were operational in the U.S., comprising 501 oil and 117 gas rigs-down from 618 oil rigs and 152 gas rigs at the year’s onset.

While this situation poses challenges for oilfield services companies facing diminished demand, it actually hasn’t translated into a drop in oil and gas production. In fact, U.S. production levels have risen. Despite a slowdown from the shale boom era, this year has seen an increase in production volumes, showcasing enhanced efficiency from oil and gas producers, enabling them to extract more with fewer resources. U.S. oil production climbed to 12.99 million bpd by July, an increase from 12.57 million bpd at the start of the year, as per U.S. Energy Information Administration data. Concurrently, gas production also rose to 3.22 trillion cf in July, up from January’s 3.16 trillion cf.

Should oil prices maintain their strength, we could witness a revival in rig counts as U.S. producers potentially increase drilling activities to meet rising energy demands and compensate for OPEC+ supply gaps. This scenario might boost U.S. oil and gas production growth.

Oil prices have seen nearly a 10% surge over the past three months, with WTI hitting $86 a barrel at the time of this writing. This uptrend is partly attributable to OPEC+’s supply restrictions. Just last month, Saudi Arabia-the group’s powerhouse-committed to extending its one-million-barrel-per-day output reduction until the end of 2023, a stance echoed by Russia in its decision to keep its crude oil exports down by 300,000 bpd during the same period. The International Energy Agency has highlighted the potential for these actions to push the oil market into a deficit in Q4-2023.

Compounding this are the escalated geopolitical tensions following the Israel-Hamas conflict. While Israel is not a significant player in the global oil market, the conflict’s potential to spread, particularly to the Persian Gulf region, cannot be overlooked, as it may disrupt oil supplies. A potential tightening of U.S. sanctions on Iran could withdraw 500,000 bpd of Iranian oil from the market, further constricting supply and potentially elevating prices.

Nonetheless, the current production lull from OPEC and its allies presents a unique opportunity for U.S. oil and gas producers to step in, bridge the gap, and expand their market share. This scenario would ensure a steady flow of oil and gas through pipelines, guaranteeing sustained demand for energy infrastructure assets, which is a positive development for the midstream sector.

Positioned to Benefit

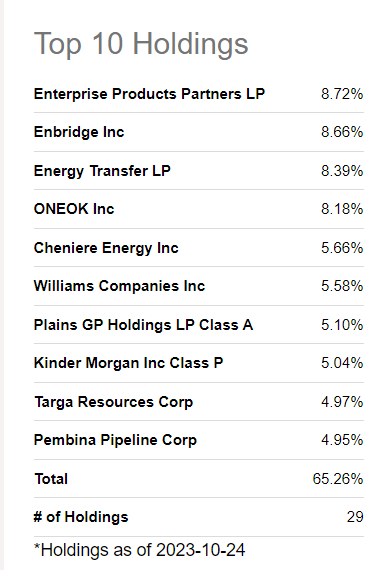

The energy infrastructure companies and MLPs within the ENFR portfolio are poised to reap benefits from the current business climate, displaying promising potential for earnings growth. Note that ENFR is top-heavy ETF, predominantly influenced by the largest players in the energy infrastructure arena. The ETF’s top-10 holdings encapsulate the industry’s giants, including Enterprise Products Partners (EPD) and Enbridge. Collectively, its leading 10 holdings represent a substantial 65% of the ETF’s total assets.

Amongst these, the top two holdings-Enterprise Products and Enbridge-exemplify ENFR’s strength in diversification, blending both MLPs and C-corporations in its asset pool. Enterprise Products, an MLP, and Enbridge, a C-corporation, highlight the ETF’s capacity to fairly represent the energy infrastructure industry.

Seeking Alpha

Exploring ENFR’s top holding, Enterprise Products stands out as one of the world’s biggest midstream companies. It boasts an impressive assortment of midstream assets, notably within the Natural Gas Liquids [NGL] value chain. Enterprise Products’ reach extends over 50,000 miles of pipelines, augmented by an array of natural gas processing plants, fractionators, and PDH and iBDH facilities. This extensive asset base is matched by strong demand, as evident in its second quarter results in which its pipelines achieved record oil equivalent volumes of 11.9 million barrels.

Furthermore, Enterprise Products exhibits stellar performance in generating Distributable Cash Flows [DCF], consistently surpassing cash distributions and resulting in a robust coverage ratio. A case in point: the second quarter saw the firm generating $1.7 billion in DCF, translating to a solid 1.6x coverage ratio. With a proven track record of converting high-quality assets into steady cash flows year after year, Enterprise Products has maintained an upward trajectory in dividend growth for over 25 consecutive years, affirming its commitment to unitholder value.

Currently, Enterprise Products is channeling its efforts into numerous growth initiatives aimed at capturing the expanding U.S. oil and gas production volumes. The completion of four major projects, including a cryogenic natural gas processing plant, an NGL fractionator, and a propane dehydrogenation [PDH] plant marks significant progress. Alongside these completed projects, an additional capital commitment of $4.1 billion has been earmarked for upcoming projects that will come online in the coming quarters and are poised to boost earnings and cash flow, which ensures sustained distribution growth. This ongoing development bodes well for ENFR’s performance.

Switching focus to Enbridge, ENFR’s second-largest holding, we observe a formidable asset base comprising liquid pipelines, and natural gas transmission and distribution facilities. Additionally, Enbridge’s portfolio extends into renewable energy, featuring wind farms in Europe and solar energy projects across North America. Much like Enterprise Products, Enbridge stands out for its consistent cash flow generation and a stellar record of dividend growth spanning over 28 years.

Enbridge is working on a sizeable suite of 17 growth projects, representing a cumulative investment of CAD $19 billion (approximately $13.8 billion USD). Notable projects include the 137-mile Rio Bravo pipeline, poised to supply natural gas to the Rio Grande LNG export facility in Texas, and the Woodfibre LNG export project in British Columbia, boasting a production capacity of 2.1 million tons per annum. Additionally, a significant expansion of its British Columbia natural gas pipeline system is also underway. These initiatives, set to materialize over the next five years, are expected to fuel Enbridge’s growth trajectory, subsequently enriching ENFR’s potential for returns.

Takeaway & Risks

ENFR’s biggest holdings have consistently demonstrated their capacity to reward shareholders through dividends while generating strong cash flows. They appear to be strategically positioned to reap the rewards of the strong business environment, investing significantly to maximize the advantages of the favorable market conditions. As they bring their new projects to fruition, we can expect their earnings and cash flows to continue growing. This, in turn, should enable them to sustain and potentially increase their dividends and distributions, positively influencing ENFR’s overall performance.

When we delve into the valuation aspect of ENFR’s holdings, the findings are intriguing. Approximately 37% of the holdings, constituting a combined weight of 36%, have garnered attractive valuation grades ranging from A+ to B- on Seeking Alpha’s Factor Grades. Meanwhile, an equivalent number of holdings, representing a slightly higher weight of 38%, have been assigned valuation grades varying from C+ to C-. Focusing on the ETF’s top two holdings, Enterprise Products and Enbridge have been assigned valuation grades of C+ and B- respectively. However, it is noteworthy that within the top-10 holdings, four companies-Cheniere Energy (LNG), Kinder Morgan, Williams Companies (WMB), and Targa Resources (TRGP)-collectively accounting for 21% of the total weight, present less attractive investment opportunities with valuation grades ranging from D to F.

Given this assortment of valuation grades, creating a diverse landscape with no clear inclination towards higher attractiveness in terms of valuation, my assessment leads me to categorize ENFR as a ‘hold’.

It is also important to address the potential risks when evaluating investment opportunities. Although ENFR presents a promising outlook, navigating the current high interest rate environment remains a formidable challenge for energy infrastructure companies and MLPs. Rising interest rates directly impact borrowing costs, potentially hindering the development of new projects and limiting future growth prospects. For energy infrastructure companies burdened by substantial debt, the current financial landscape is particularly challenging. Refinancing in such conditions escalates costs, potentially straining their financial resources. This, in turn, could lead to reduced profits, leaving less capital available for shareholder payouts.

Additionally, the high borrowing costs do not operate in isolation. The high interest rate environment also contributes to a broader economic slowdown, with potential repercussions for energy demand. A contraction in energy consumption could place further pressure on the energy infrastructure sector. This scenario is not without precedent; the industry faced significant headwinds during the pandemic as energy demand plummeted. While it’s critical to acknowledge that the severity of the pandemic’s impact represents an extreme case, it serves as a stark reminder of the industry’s vulnerability to demand fluctuations.

Read the full article here

Leave a Reply