Overview:

Energy Transfer (NYSE:ET) is the largest pipeline in the United States, with more than 100,000 miles of pipelines.

Energy Transfer

Energy transfer is one of the most controversial stocks on Seeking Alpha, and in fact, I have written 15 articles on Energy Transfer, invested in it, and got out of it multiple times over the years.

With its current substantial and what I consider to be a safe dividend equaling 9% makes it an appealing possibility not only for income but also for potential capital gains. But that potential faces multiple hurdles to overcome in the next few years.

In this article, I will discuss four potential problem areas that ET has to deal with and their potential implications on their investment profile.

Please note I use the terms “distributions” and “dividends” to mean the same thing.

1. Regulatory hurdles continue to limit the pipeline business in general and Energy Transfer in particular

Currently in the news is a long-awaited report from the Army Corps of Engineers related to the Dakota Access Pipeline (DAPL). This pipeline was created by ET back in 2014 to allow access to the Bakken oil fields in North Dakota. However, Native Americans in the area claimed that it was improperly run under a lake (Lake Oahe)on their reservation and that the pipeline poses a long-term risk to that lake with potential future leaks.

There are many sides to this story in fact, I have written about it several times, including this one, “Energy Transfer And The Dakota Access Pipeline: Like An Elephant With A Fly On Its Butt” where I explained my take on the DAPL situation. DAPL is not a large part of ET’s revenue and, in fact, it is less than 3%. Still, it is another example of Energy Transfers’ more aggressive approach to expanding their business and, as such, may have many repercussions relative to their investment quality.

More recently, ET has been turned down by the Energy Department for a 2nd extension of ET’s plan to build a LNG facility in Lake Charles, LA. Energy Transfer has appealed the Energy Department’s decision again, but in my opinion, it’s unlikely it will be overturned, especially in this particular political environment.

Dapple and LNG are just two examples of the regulatory hurdles ET and other pipeline companies must overcome to attract more investment interest.

2. The Hubbert curve is upon us and could affect volumes in the future.

Hubbert’s curve is a model for oil reservoir balances first introduced by M. King Hubbert in 1956. Hubbert determined that you can calculate when an oil basin or oil field has reached its peak production capacity and production per well will be downhill from there. To keep production steady or grow, you must drill more wells than you have historically, thus adding to your cost per barrel produced. And because of the curve, at some point in time, drilling becomes unprofitable, and therefore volumes drop considerably. The lower volume production from pipeline companies’ customers means lower revenue and cash flow for those companies that move energy such as Energy Transfer.

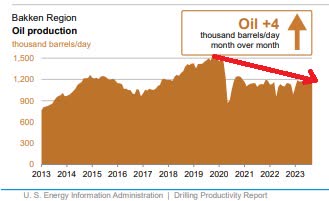

This is perhaps easiest to see by checking the charts from the EIA for the Bakken oil field, which is connected to DAPL by the way, and the largest natural gas production source in the US the Marcellus Shale, mainly in the Appalachians.

EIA

As you can see from the above chart, Bakken oil production peaked in 2019 and it’s been on its way down ever since then. And although it seems rather gradual, you have to understand that as the peak deteriorates, it becomes harder and harder to meet previous production volumes.

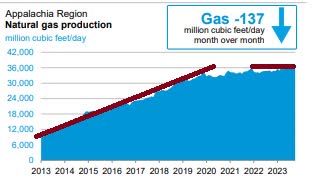

If we look at the natural gas volumes from what is called Appalachia in this chart, which is mainly the Marcellus Shale, we can see that it has also started to slow down and is either at its peak or very close to its peak production.

EIA

The best explanation I have read yet about Hubbard’s curve is in this article by Goehring & Rosencwajg, which I recommend everybody invested in pipelines reads. This article contends that of the US oil shale basins, only the Permian Basin has not yet reached its peak though it is close, probably within a couple of years of reaching its peak.

Obviously, if a production area has ever-decreasing volumes, that will affect the revenue of anybody shipping those volumes out of that basin, including ET and other pipeline companies.

3. MVCs (Minimum Volume Commitments) do not lead to better results

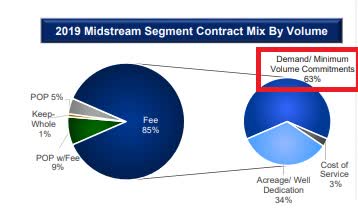

One thing MLPs emphasize in their presentations to investors is that they are protected by MVCs. For example, this is from ET’s most recent year-end presentation.

Energy Transfer

If your customer hits your MVC that means your volume is down from its high point and likely profits are down too. So if you do need to use your MVCs, that indicates business weakness not only currently but also in the future.

This is because customers hitting their MVC also have reduced revenue and profits. This, in turn, could cause two negative things to happen. Number one, your customer may have financial problems that will change their approach to business in general and towards your pipeline business specifically.

Number two, when it comes time to renew the contract, the customer will demand a lower MVC.

Thus, using your MVCs is a negative, not a positive.

4. ET and Pipeline LPs, in general, have been in a downward trend since 2014

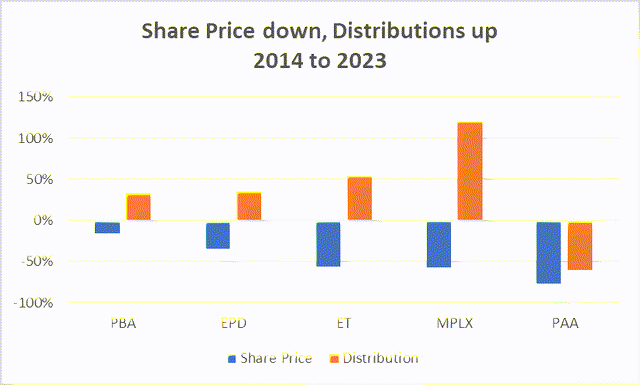

In November 2014, ET’s share price peaked at $31.91. It currently sits at $13.75, a decrease of 57 percent. But over the period 2014 through Q2 2023, ET’s dividend has increased from $.80 to $1.23, an increase of 52%.

So, from an investment standpoint, pipelines, in general, have been a terrible investment over the last nine years despite much improved financial metrics.

Here’s a very ugly chart showing dividends versus price since 2014 for pipeline LP’s:

Seeking Alpha and author

Looking at MPLX, we see that the share price is down by more than 50% despite distributions being up more than 100%. This tells me the market and investors, in general, are leery of buying pipelines in the current economic and political environment.

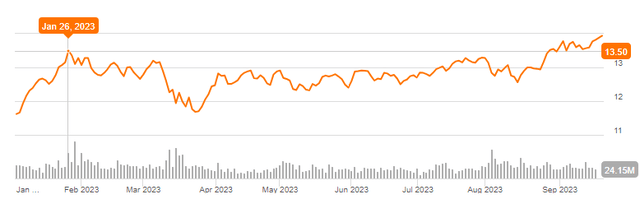

In ET’s case, there has been little share price increase since January when the dividend was raised.

Seeking Alpha

Conclusion:

Why have pipeline stocks had such good financial metrics and such poor share price performance over the past eight years?

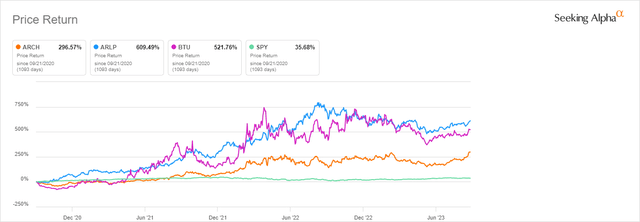

There has to be a large, overarching reason why this is affecting this particular sector of the energy market and not any others. I mean, even coal companies have increased their share price by large amounts as their financials have improved, but not pipelines.

Seeking Alpha

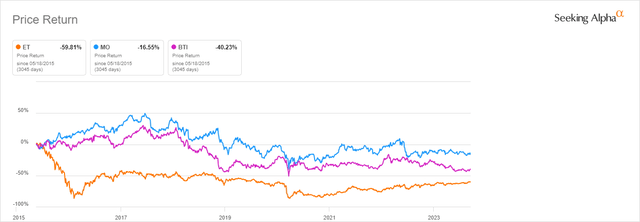

The only other industry I can think of that has a weak share price in spite of huge cash flows and dividend increases is the cigarette business. Here’s a chart showing Altria (MO) and British Tobacco (BTI) versus ET.

Seeking Alpha

What do pipeline companies and cigarette companies have in common? They are both highly regulated, and both deliver products that government agencies want to terminate. The only question is, how long will it take government agencies to do just that?

It has been decades of regulatory burdens that have negatively affected the cigarette business, and it will probably be decades before the pipeline companies are regulated out of business. But in the meantime, investors should be prepared for little in the way of capital gains, although dividends will likely be substantial.

Energy Transfer remains a Hold for dividend investors at least until the regulatory issues surrounding DAPL and the LNG license are resolved.

Read the full article here

Leave a Reply